Abstract: In this report we look at address re-use in Bitcoin. Address re-use is generally considered as a bad privacy practice and unfortunately it remains at an elevated level. Currently around 50% of transaction outputs are sent to previously used addresses. Although the situation has improved somewhat since 2013, when the 75% level was breached. In our report we break down address re-use, analysing how much of the re-use has occurred within the same transaction. Our analysis has identified that in the last few months, over 80% of all Bitcoin spend didn’t really move at all and was sent back to the address it came from. This metric has grown continuously since around 2016.

Figure 1 – Bitcoin output count – 4,000 block windows

Source: BitMEX Research, https://oxt.me/charts

Overview

In this piece, we examine the prevalence of address re-use throughout Bitcoin’s history. Address re-use is when Bitcoin is sent on the blockchain to an address which has previously received Bitcoin in the past. In principle, address re-use is not necessary at all and is considered bad from a privacy and security perspective. A new address can just be created for each payment, thereby avoiding re-use all together, although it may be convenient to re-use addresses, so that new payment details do not need to be sent to the payer for each payment. Address re-use can also be useful for exchanges, as for security reasons an exchange may want staff to be familiar with addresses which hold large balances. One can read more about address re-use here.

Unfortunately, address re-use is a very common practice in Bitcoin, much more common than it needs to be, due to the way many wallets are implemented. Re-using addresses is a heuristic that enables analysts to link individual users to multiple payments with a high degree of certainty (If you use the same address again, it can be assumed you are the same person or entity). Therefore, from a privacy perspective, it is considered critical to keep address re-use as low as possible. In Ethereum, address re-use is unfortunately even more common and more revealing, although we will not address that in this report.

Address re-use by transaction output volume

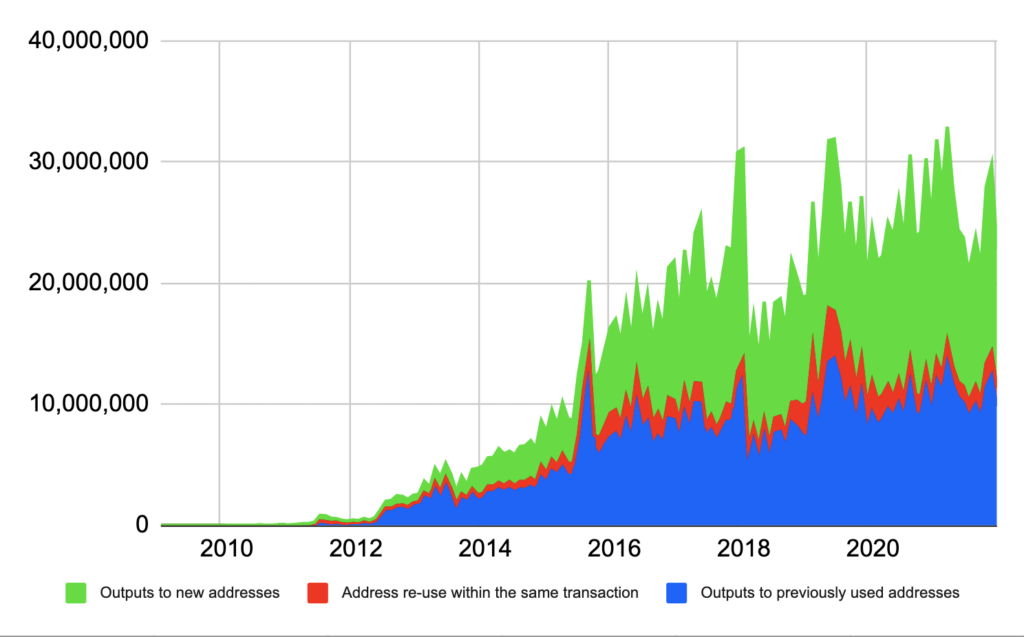

Figure 1 below is a chart which counts all the transaction outputs in Bitcoin’s history, all two billion of them up until January 2022. We broke the transaction outputs into three categories:

- Transaction outputs to new Bitcoin addresses – green

- Transaction outputs to previously used addresses in a previous transaction – blue, and

- Transaction outputs where the address is re-used in the same transaction (i.e. no economic movement of funds) – red

Figure 1 – Bitcoin output count – 4,000 block windows

Source: BitMEX Research, https://oxt.me/charts

The data shows that address re-use is worryingly high and has continued to grow as the Bitcoin output count increased over time. Figure 2 below illustrates the proportion of total outputs that re-use addresses. Address re-use grew to around 75% of all transaction outputs in 2013, before starting a gradual decline to around the 50% level today. However, there did appear to be a small temporary pickup in address re-use in the 2019 era, before improving again in 2020.

Figure 2 – Bitcoin address re-use by output count – 4,000 block windows

Source: BitMEX Research, https://oxt.me/charts

Address re-use in the same transaction, broadly speaking, followed a similar pattern as total address re-use, perhaps around 6x lower in volume. The exception is the 2011 period, where this type of address re-use took longer to emerge, however transaction volume was low in this period and this may be before the emergence of wallets which started sending change back to the same address by default.

Address re-use by output value

We also analysed the value of outputs sent to addresses which were re-used. In particular, address re-use within the same transaction, which seems to account for most of the address re-use by value. The data here is more volatile, as one would expect when using value, however, there is a clear trend. There has been very strong growth in address re-use by transaction value since Bitcoin launched. Growth has accelerated sharply since 2016 and by 2022, over 80% of Bitcoin spend, was sent back to the same address it came from in the same transaction. This means that for over 80% of the spend by value, there was no economic transfer of value and the spend either related to change back to the sender or some form of output consolidation.

Figure 3 – Bitcoin spend (Output address re-use in the same transaction) – 1,000 block windows

Source: BitMEX Research

The chart shown in Figure 4 is quite remarkable, in our view. It shows growth in address re-use in the same transaction, even continuing into 2021, right up to over 80%. This may be partly driven by the wallet behaviours of large exchanges, who may be quite dominant in terms of transaction value and have little concern for privacy. These exchanges could be consolidating their coins into one output or conducting withdrawals with large amounts of change going back to the exchange.

Figure 4 – Bitcoin spend (Output value address re-use in the same transaction)

Source: BitMEX Research

Note: Linear trendline in red

Conclusion

While the large amount of address re-use, by value, could be considered bad news for privacy, it may relate to the activity of a small number of large wallets, such as exchanges. In contrast, the situation by transaction volume looks more favourable and this may be more indicative of real users. However, there is still considerable room for improvement here and we would characterise the extent of address re-use as high. A situation has remained broadly unchained since 2012. This is an area that requires more research and we intend to try and break the data down further in the coming weeks.

Related

The post appeared first on Blog BitMex