This blog presents an overview of our report, entitled ‘Five Ways the World of Crypto Will Change in 2022.’ You’ll find the full report here.

To say that 2021 was a wild year for crypto would be an understatement. Consider some of the top events of 2021:

1. El Salvador became the first country to accept Bitcoin as legal tender.

2. An internet collective called ConstitutionDAO almost bought the US Constitution.

3. The term ‘metaverse’ went mainstream following Facebook’s rebrand to Meta.

4. The world’s first Bitcoin-linked ETF debuted on the New York Stock Exchange.

Changes in the crypto world happen a mile a minute – and that’s exactly what we love about this space. And if the first few weeks of 2022 were any indicator, we’re in for another whirlwind year.

For an idea of what the future holds for crypto in 2022, be sure to read our newly published report, titled Five Ways the World of Crypto Will Change in 2022.

Five Ways the World of Crypto Will Change in 2022

We believe that it’s always a worthwhile experiment to put our knowledge to the test and predict what the future holds for crypto traders and hodlers. So we surveyed our colleagues to find out what we think will come next for crypto in 2022:

1. More Women Than Ever Will Embrace Crypto in 2022

Designed to solve one of the biggest problems of the TradFi system – a lack of inclusion – the crypto revolution has the potential to create a more open and accessible financial ecosystem. But there’s one major obstacle standing in the way of that revolution: the colossal crypto gender gap that’s even wider than in the TradFi space.

As the industry continues its journey into the mainstream and garners a more diverse user base, the next influx of adopters will likely come from women – more than half of which identify themselves as “crypto-curious” – meaning they don’t yet own crypto, but are eager to learn more.

And let’s not forget that much of crypto’s spread will come from its adoption as a medium for cheap international remittances, and its potential to be accepted as a legal mode of payment by at least five developing countries by the end of this year. This could further narrow the crypto gender gap, especially in developing countries where women face greater barriers to financial freedom and security.

Although a wide range of factors driving mass adoption will help turn the tide in 2022, we can’t just rely on the weight of demographic trends to solve the issue. Closing the gender gap will also require a concerted effort by our community. And we think the best way to start is by admitting that certain aspects of crypto culture and language have an exclusionary nature and need to be reconsidered.

2. Solana Will Give Ethereum a Run For its Money

We all love the underdog stories. Whether in sports or crypto, investing in successful underdogs can pay off. Solana is such one story, and despite its rise by over 11,400 percent in 2021, we think that Solana still has room to run. And it may not be long before Solana makes a dent in Ethereum’s dominance.

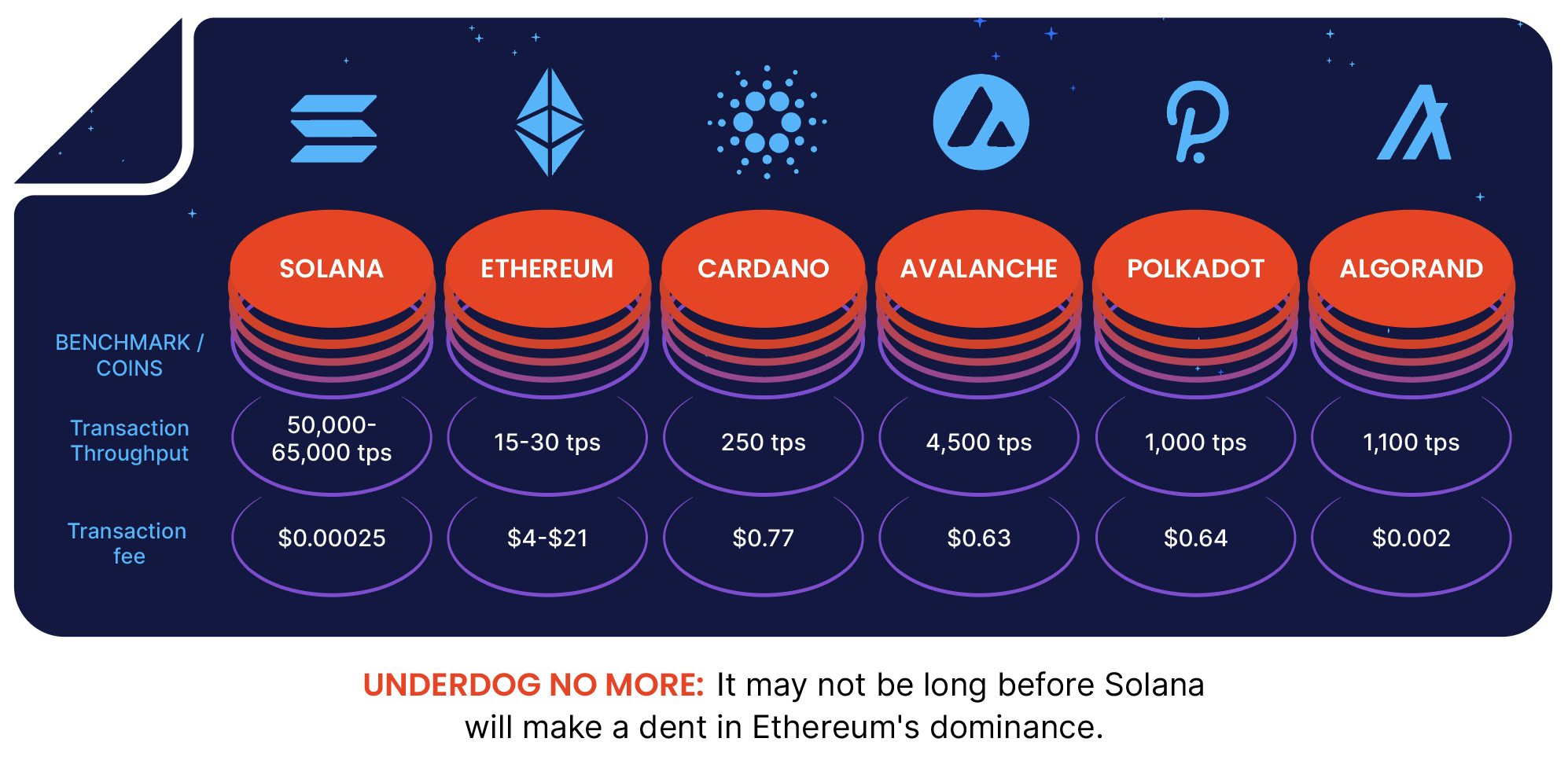

Solana’s advantages over its rivals are widely known. As illustrated below, Solana’s major advantage is that it enables faster and cheaper transactions than all other leading layer-one protocols supporting smart contracts, including Ethereum, Cardono, Avalanche, Polkadot, and Algorand.

While Ethereum is already a household name, Solana has yet to gain widespread recognition beyond the crypto community – but this is set to change. The next impetus for Solana’s growth will come from the hundreds and millions of crypto-curious investors set to dive into the crypto space in the coming months, who will likely be eager to seek exposure in more than just Bitcoin and Ethereum.

3. Crypto Gaming Will Explode

With an estimated 3.2 billion gamers worldwide and mainstream game developers having made clear their intention to adopt blockchain and NFTs, gaming will likely be the entry point to crypto for hundreds of millions of new users in 2022 and the years to come.

A combination of NFTs and fungible native tokens power the in-game economies of play-to-earn games like Decentraland, Axie Infinity, and The Sandbox, where players can buy and sell items they build or accumulate while playing. The market caps of native tokens that form the backbone of in-game economies have skyrocketed in 2021 and now stand in billions.

We predict that as the Fed tightens monetary conditions to control inflation in 2022, coins that power play-to-earn games, along with NFTs and metaverse themes, will likely prove more resilient than other coins because their success is derived from an actual change in consumer behaviour. And by the looks of it, this change will likely become even more entrenched in 2022.

4. Demand For High-Yield Crypto Savings Products Will Surge

With the S&P 500 coming into 2022 at an all-time high, and a distinct possibility of a Fed hike in either March or June, seeking further upside from risky assets like stocks may be a tad optimistic. As such, many will likely wait until the dust settles after the rate hike. And in the meantime, investors will find ways to secure safe and steady returns.

An increasingly popular option is high-yield savings products from established crypto companies. Unlike bonds, which fall in price when interest rates go up, interest-earning crypto products – like BitMEX EARN – usually pay a fixed interest rate and return the original amount deposited after a specified period.

Further guaranteeing payback on the original principal, BitMEX EARN is the only product of its type in the market that’s fully backed by an insurance fund. Given the current macroeconomic conditions, demand for safe and high-yield crypto savings products could surge this year. These easy-to-use products will help investors keep their powder dry in anticipation of opportunities that arise from market dislocation following the Fed’s decisions over the coming months.

5. Crypto Firms Will Look to Acquire TradFi Companies

2021 saw a flurry of M&A activity, with the number of deals increasing by 131 percent compared to the year prior. The combined value of these M&A deals soared by 730 percent to 6.1 billion in 2021 – another milestone in a year that saw crypto enter the mainstream.

To date, the targets of the largest crypto-related M&A deals are crypto firms. But in 2022, the tables could turn, spearheaded by BXM Operations’ intention to purchase German Bank Bankhaus von der Heydt. And this is only the beginning. The crypto bull market bestowed many crypto firms with sufficient valuations to make sizable purchases, and it is likely that M&A activity will smash records again in 2022.

The majority of M&A deals in 2022 will likely continue to consist of crypto firms acquiring their peers. But with the next phase of crypto adoption set to usher in an unprecedented era of inclusiveness, when it comes to M&A, you may well see some new and unexpected partnerships.

Read the Full Report

Want to read our full analysis? Click here to download our report, or stay tuned to our blog for the latest updates.

The views shared in this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Related

The post appeared first on Blog BitMex