Legislation to prohibit payments using crypto-assets sponsored by the Financial Markets Committee of the State Duma Anatoly Aksakov has passed through the first reading.

Inconsistencies in the Bill

According to a report by the state media, the official document recommends an obligation for digital asset exchanges, referred to as “DFA exchange operators,” to decline transactions where crypto is used as a “monetary surrogate.”

The explanatory note of the bill states,

“The amendments establish a direct ban on the transfer or acceptance of DFA and UCP as a counter provision for transferred goods, work performed, services rendered, as well as in another way that allows one to assume payment for DFA of goods (works, services).”

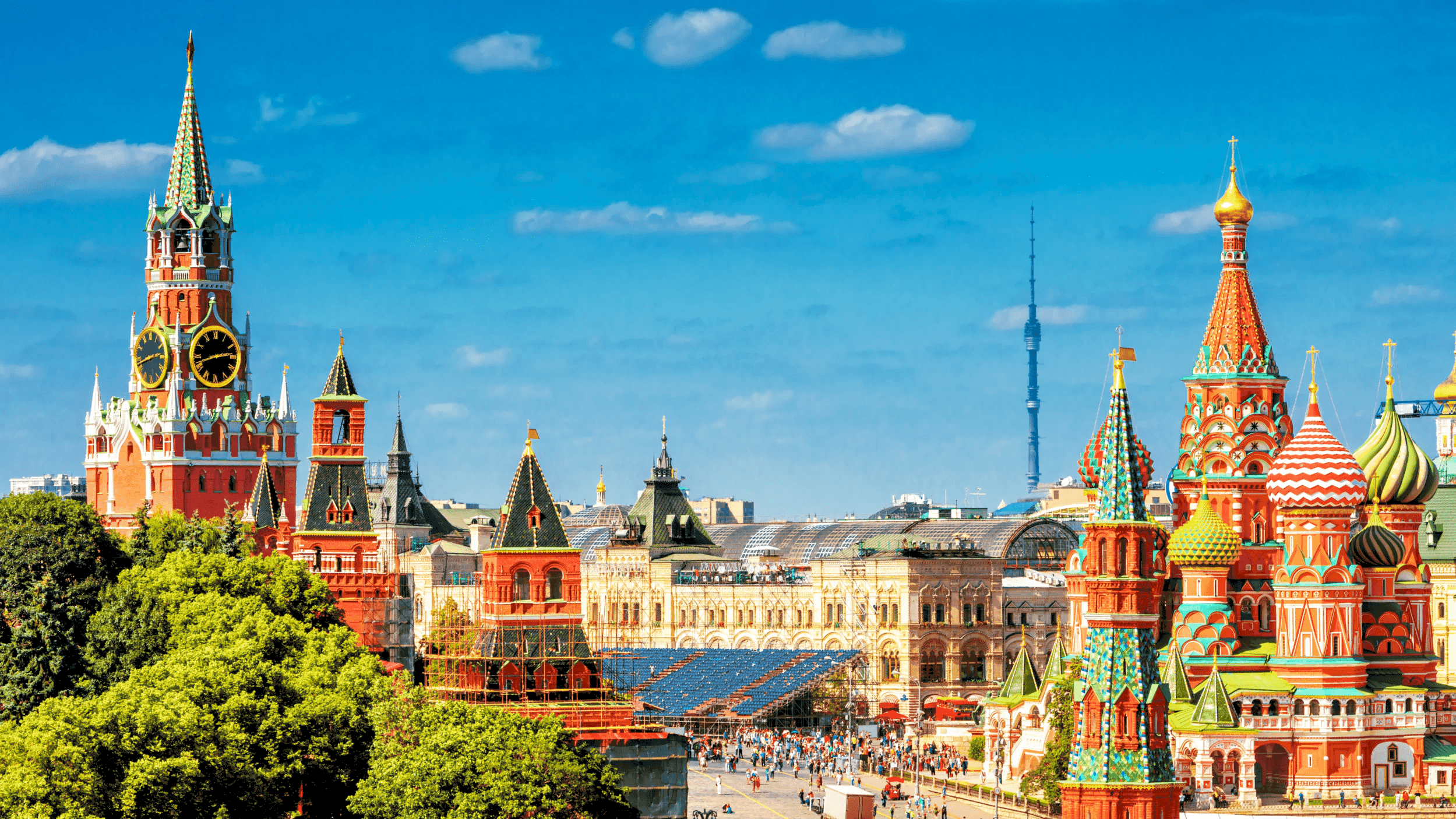

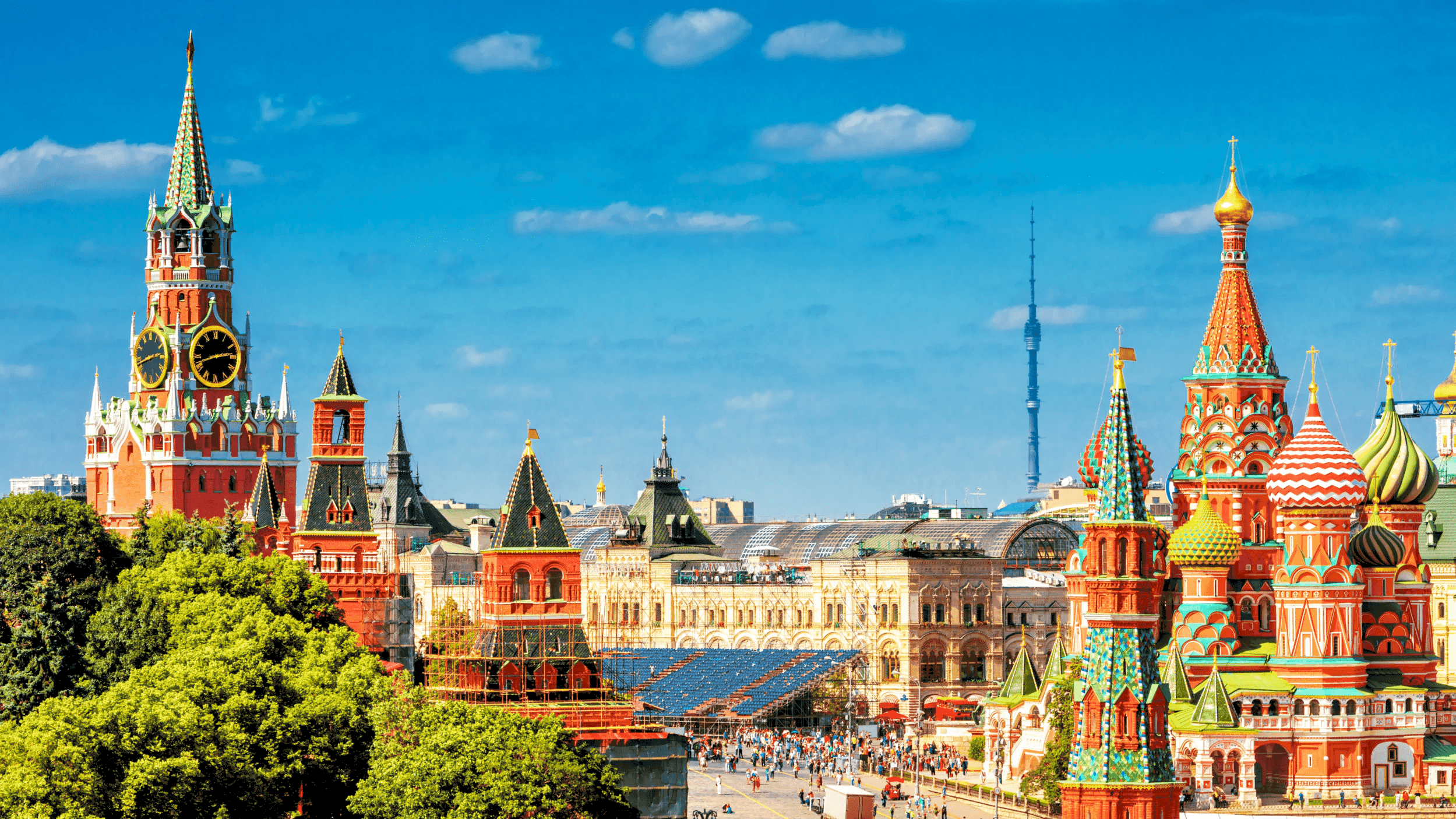

If the bill is approved by the Federal Council and President Vladimir Putin, “digital financial actives” (DFA) will be banned from paying for goods or services. But the country’s authorities remain divided. Roman Yankovsky, a Moscow Digital School teacher, explained that the category “means of payment” refers to money and near-money phenomena.

Since digital assets are property, in principle, they cannot be used as a payment means, but they still can be exchanged, similar to a barter system. Pointing out the term “money surrogates” used in the note, critics have noted that there appears to be no definition to explain what it really means in the existing Russian laws.

ADVERTISEMENT

The bill was filed with the State Duma, the lower house of Russia’s parliament last week, but the proposed prohibition on the use of only cryptocurrencies as a means of payment did not sit right with those opposing it. While the central bank is keen on an outright ban, the Finance Ministry believes regulation may be the way to go.

Crypto Crimes

The latest development comes as crypto-related crimes have become rampant in Russia. A cybersecurity firm – RTM Group – revealed that the number of lawsuits related to cryptocurrencies, digital asset trading, and minting in the country had increased sharply over the course of last year, reaching a total of 1,531.

While the vast bulk of cases (around two-thirds) come under Russia’s Criminal Code but civil cases launched also represent a significant share as well. Most civil legal disputes are comprised of small-scale fraud, such as allegations of brokers overcharging their clients for conducting crypto purchases on their behalf. Additionally, the number of bankruptcy cases related to crypto ownership also doubled in 2021.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato