Merchants’ consumer survey found out that 53% of the South African participants have little to no knowledge of cryptocurrencies. Interestingly, almost half of the respondents said they would be more open to the digital asset realm if local banks provided such services.

South Africans Need More Education

The Johannesburg-based management company – Merchants – determined that only 14% of South Africans have considerable knowledge of the cryptocurrency industry. 23% of the participants remained neutral, while the vast majority (53%) said they had limited or no understanding of the matter.

Unsurprisingly, youngsters are more aware of digital assets than the older generations. Those aged 18 to 24 have better knowledge than any other demographic group.

According to the survey, crypto adoption in South Africa could be boosted if domestic banks embrace the asset class and provide educational programs to users. Almost every second participant said they will be more likely to invest in bitcoin or altcoins if local financial institutions offer such services. Explaining the effects of the possible move was Mat Conn – Group GRO at Merchants:

“There is a real opportunity for banks to get involved in cryptocurrency as it begins to really take off on the continent, rather than waiting until it is more established – by when consumers are likely to have a preferred platform or partner who they have built that trust with.”

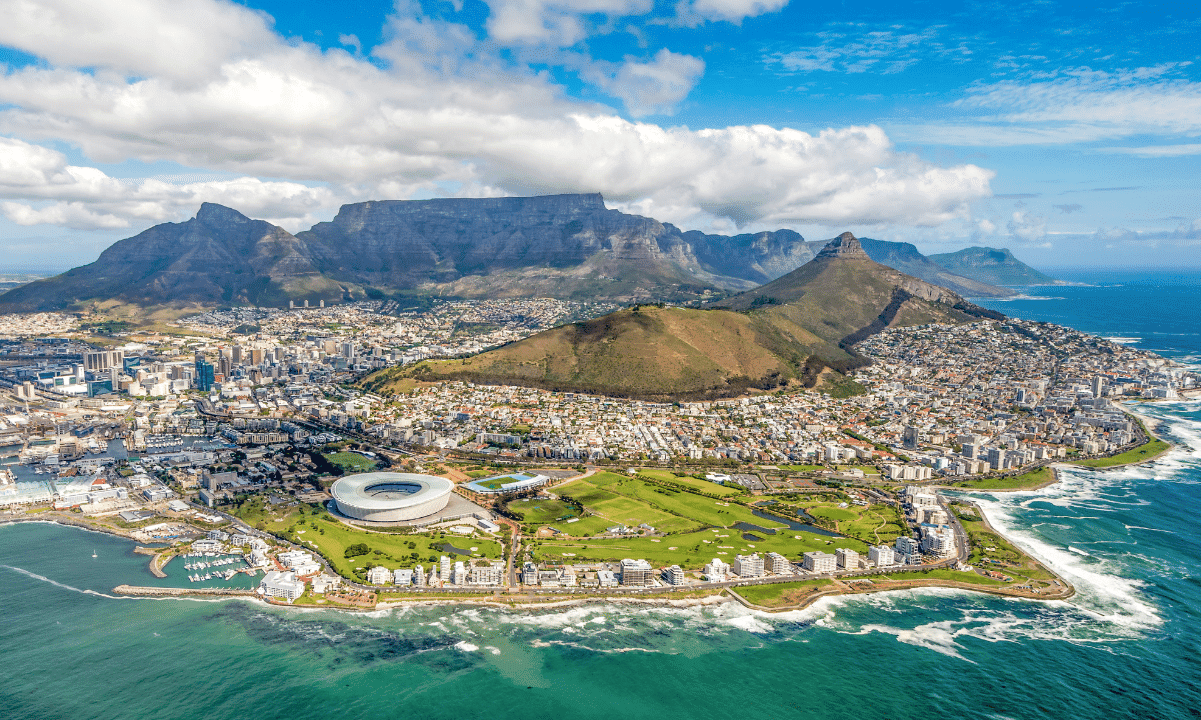

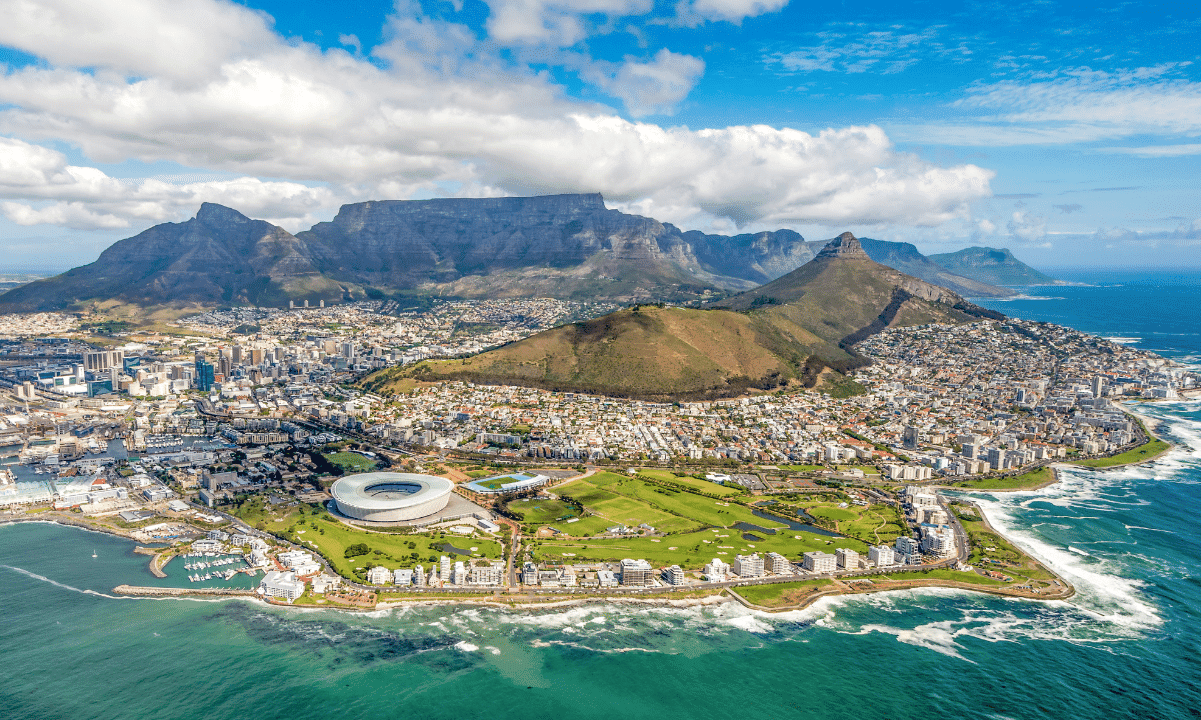

South Africa’s Crypto Adoption Ranks Second in Africa

Despite having insufficient knowledge on the matter, a considerable proportion of the locals have already distributed some of their wealth in crypto.

ADVERTISEMENT

A recent study carried out by the United Nations revealed that 7.1% of the county’s population, or approximately 4.2 million people, are HODLers. Thus, South Africa ranked second on the continent, falling behind Kenya, where the cryptocurrency adoption rate is 8.5%.

Earlier this month, Kuben Naidoo – Deputy Governor of the nation’s central bank – stated that digital assets, specifically bitcoin, could provide numerous advantages to the monetary system. Nonetheless, he argued that there is a lot of hype in the space, urging for the implementation of appropriate regulation.

Such rules are expected to become live in the next year, following which cryptocurrencies will classify as financial assets.

“We are not intent on regulating it as a currency as you can’t walk into a shop and use it to buy something. Instead, our view has changed to regulating (cryptocurrencies) as financial assets. There is a need to regulate it and bring it into the mainstream, but in a way that balances the hype and with the investor protection that is critical,” the executive said.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato