This article is part of our ongoing series of crypto research content, produced by the Bitcoin Magazine team and sponsored by BitMEX. To learn more about our wide-ranging partnership with Bitcoin Magazine, click here.

This article is part of our ongoing series of crypto research content, produced by the Bitcoin Magazine team and sponsored by BitMEX. To learn more about our wide-ranging partnership with Bitcoin Magazine, click here.

Ethereum and the Merge

Last week, it was announced that the Ethereum merge, from a PoW (proof-of-work) consensus mechanism to a PoS (proof-of-stake) consensus mechanism, is in its final stages. The long-promised and continuously delayed event finally looks to be on the near horizon. (For an in-depth look at ETHPoW vs ETH2, check out this BitMEX Research piece.)

Here are the implications, and potentially a useful framework for thinking about Ethereum and the broader crypto ecosystem as a bitcoin supporter.

Although often compared against each other, the so-called intellectual debate between Bitcoin and Ethereum is in Bitcoin Magazine’s view rather nonsensical given the different characteristics of both protocols.

Next week, Bitcoin Magazine will be publishing an in-depth breakdown of the technical elements of the merge and proof-of-stake, its risk factors, and its claims of making ETH “ultra-sound.”

While Bitcoin Magazine is a bitcoin-first and bitcoin-focused publication, as analysts they like to take an objective look at markets and constantly evaluate all predetermined assumptions.

With that being said, let’s dive into some of the latest developments in markets around Bitcoin and Ethereum, with a special eye on the recent surge in interest in ether derivatives.

If you haven’t yet signed up for a BitMEX account, you can do so here.

Bitcoin and Ethereum Derivative Landscape

The terminal total difficulty has been set to 58750000000000000000000.

This means the ethereum PoW network now has a (roughly) fixed number of hashes left to mine.https://t.co/3um744WkxZ predicts the merge will happen around Sep 15, though the exact date depends on hashrate. pic.twitter.com/9YnloTWSi1

— vitalik.eth (@VitalikButerin) August 12, 2022

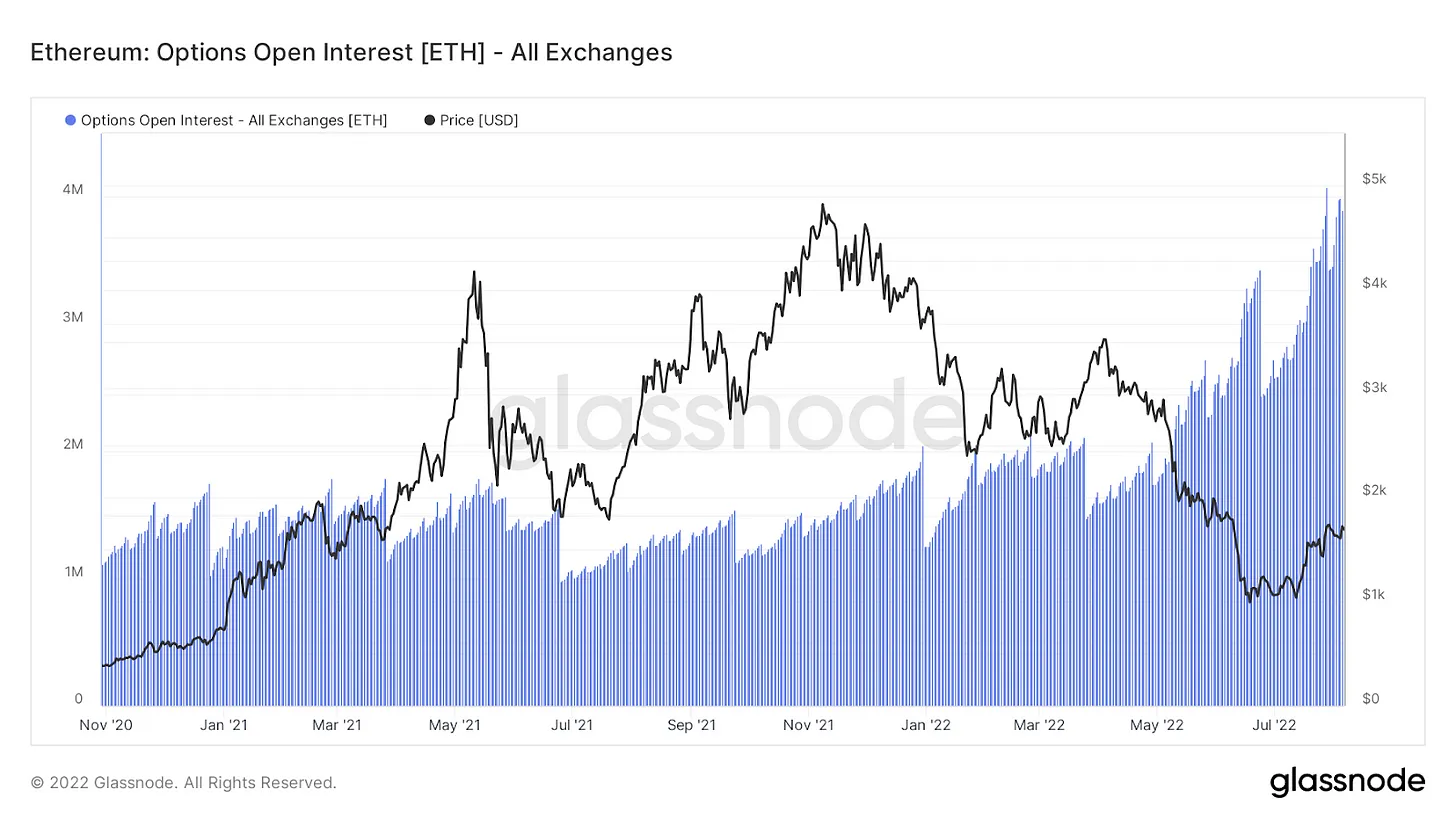

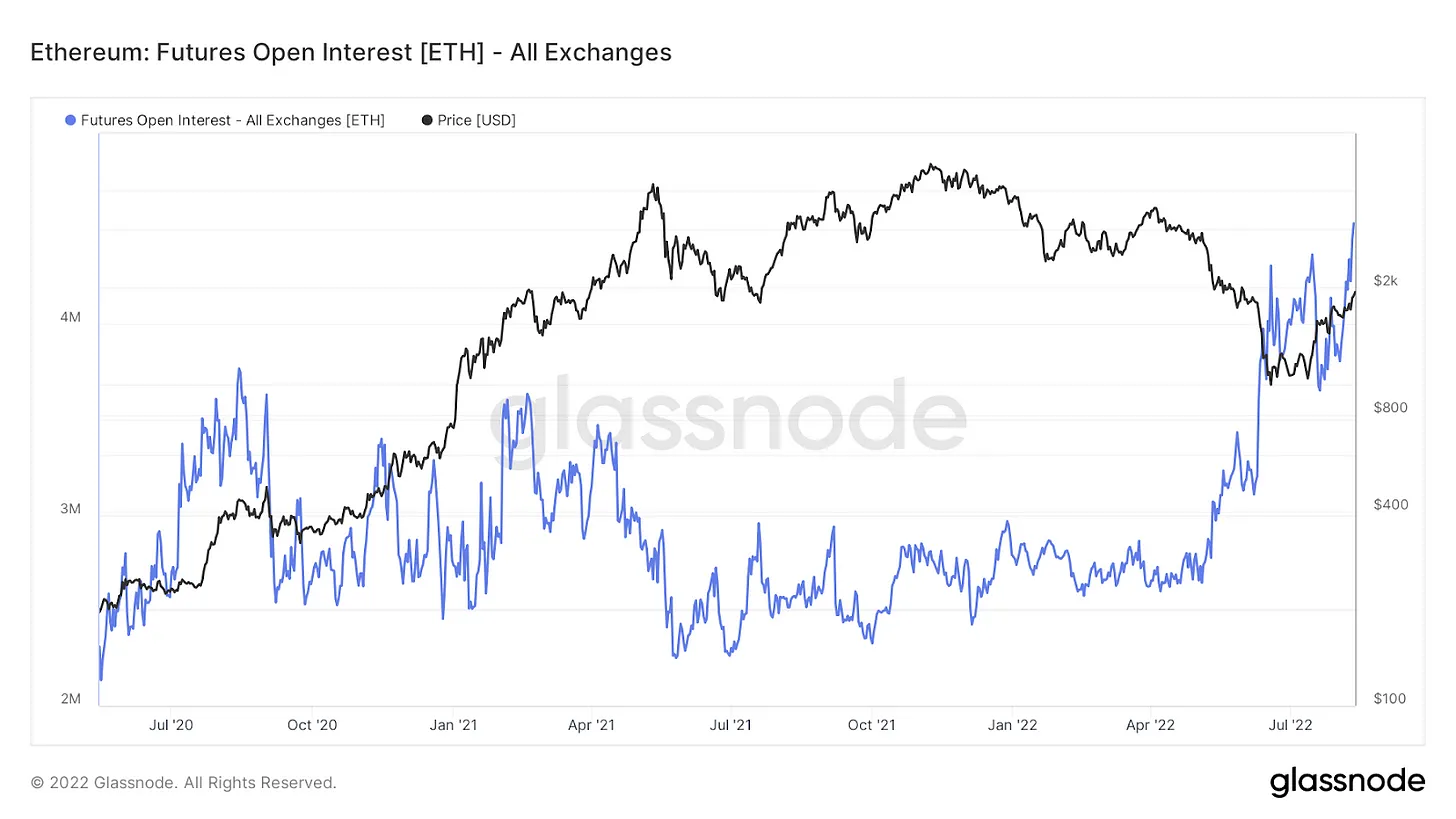

With the Merge estimated to take place on September 15, derivative bets on ether have gone exponential, with both aggregate futures and options open interest soaring to new highs in ETH terms — but there is more than meets the eye.

With the hard fork to proof-of-stake occurring, there is an increasingly likely chance that a fork occurs, where miners and other interested stakeholders (no pun intended) continue to build and foster the Ethereum protocol using proof-of-work.

For readers interested in exploring more of this potential outcome, this discussion with Kevin Zhou on the Unchained Podcast with Laura Shin is useful.

Similar to the 2017 Bitcoin Cash hard fork, where Bitcoin was formed by supporters of larger blocks to increase transactional throughput, holders of ether would get airdropped the forked PoW asset as the protocol shifts to a PoS consensus.

The key difference between these two forks is that the Bitcoin fork war in 2017 was a battle between incumbents in favor of the status quo (small-blockers) versus a group of powerful dissidents who wished to alter consensus. In regards to the current fork proposals for Ethereum, what you have is a community that has “agreed” upon an alteration of the core consensus mechanism via “social governance.”

A bottom-up defense against consensus changes versus a top-down approach towards them.

A Key Difference

Relatedly, for readers interested in a discussion on the history of Bitcoin hard forks, a recent discussion hosted by Aaron van Wirdum for Bitcoin Magazine is very educational.

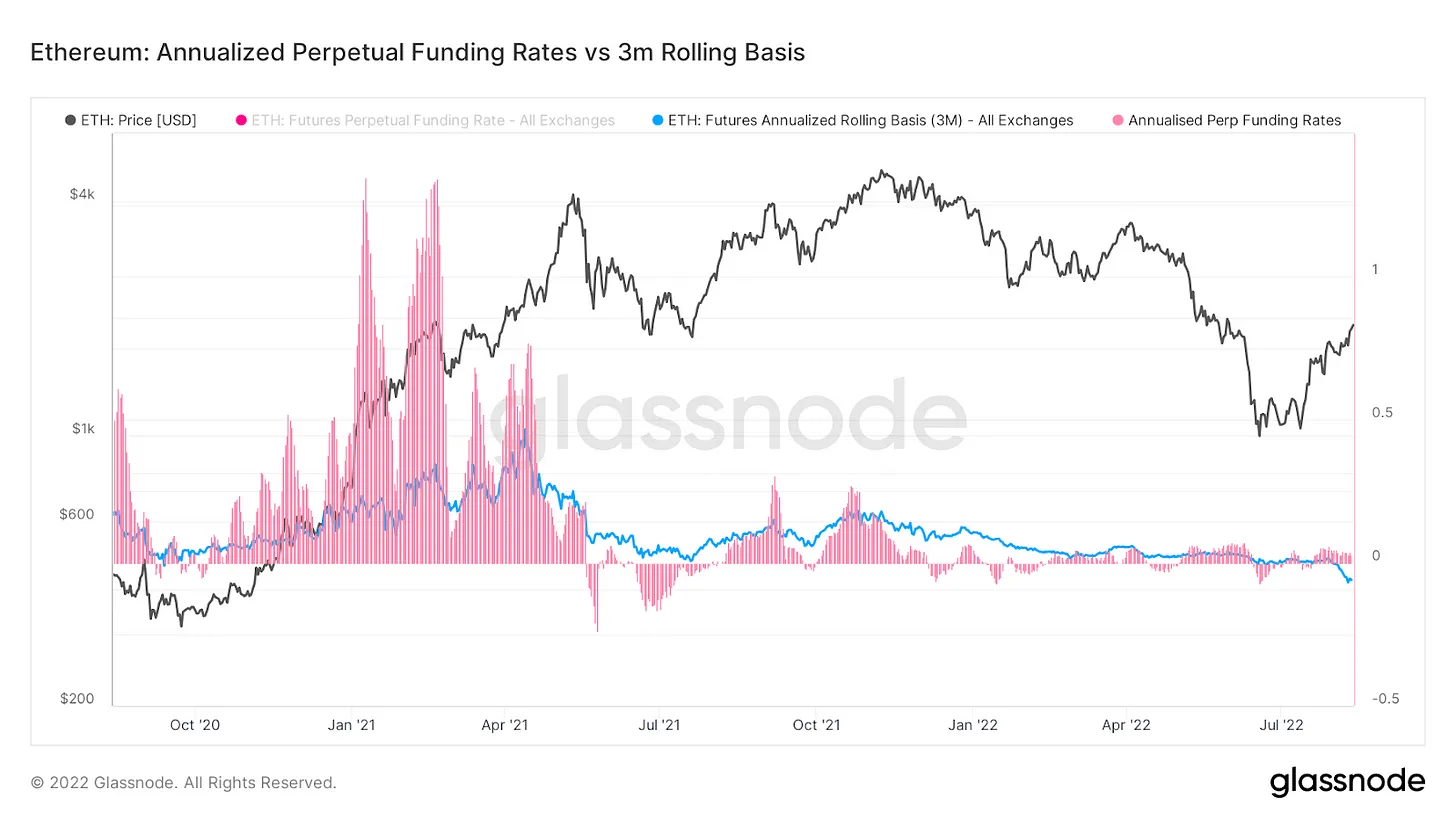

Moving on, this dynamic of a potential fork has caused speculators to begin to position themselves in the futures market to capture this “free airdrop” by buying spot ether, withdrawing coins to personal custody and then shorting futures to hedge exposure (although many market participants are outright directionally long into the merge).

This has led perpetual futures funding and the quarterly future basis to be notably lower than it was during the bull run (or whenever the market was trading at a similar market price). With the market currently in backwardation (futures prices below spot), the annualized basis is at -6% due to demand to remain market neutral while holding spot market inventory (to receive the fork airdrop).

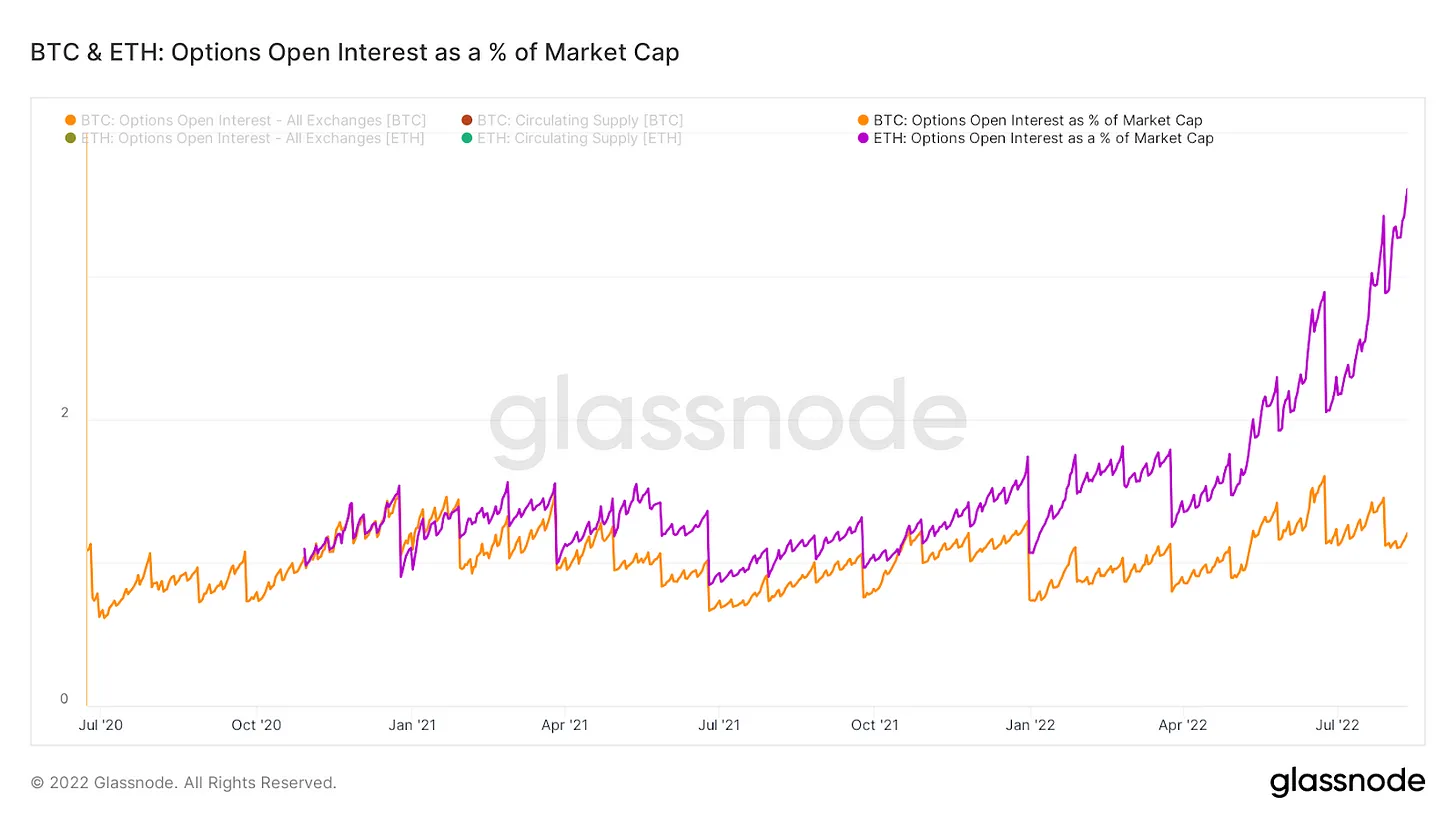

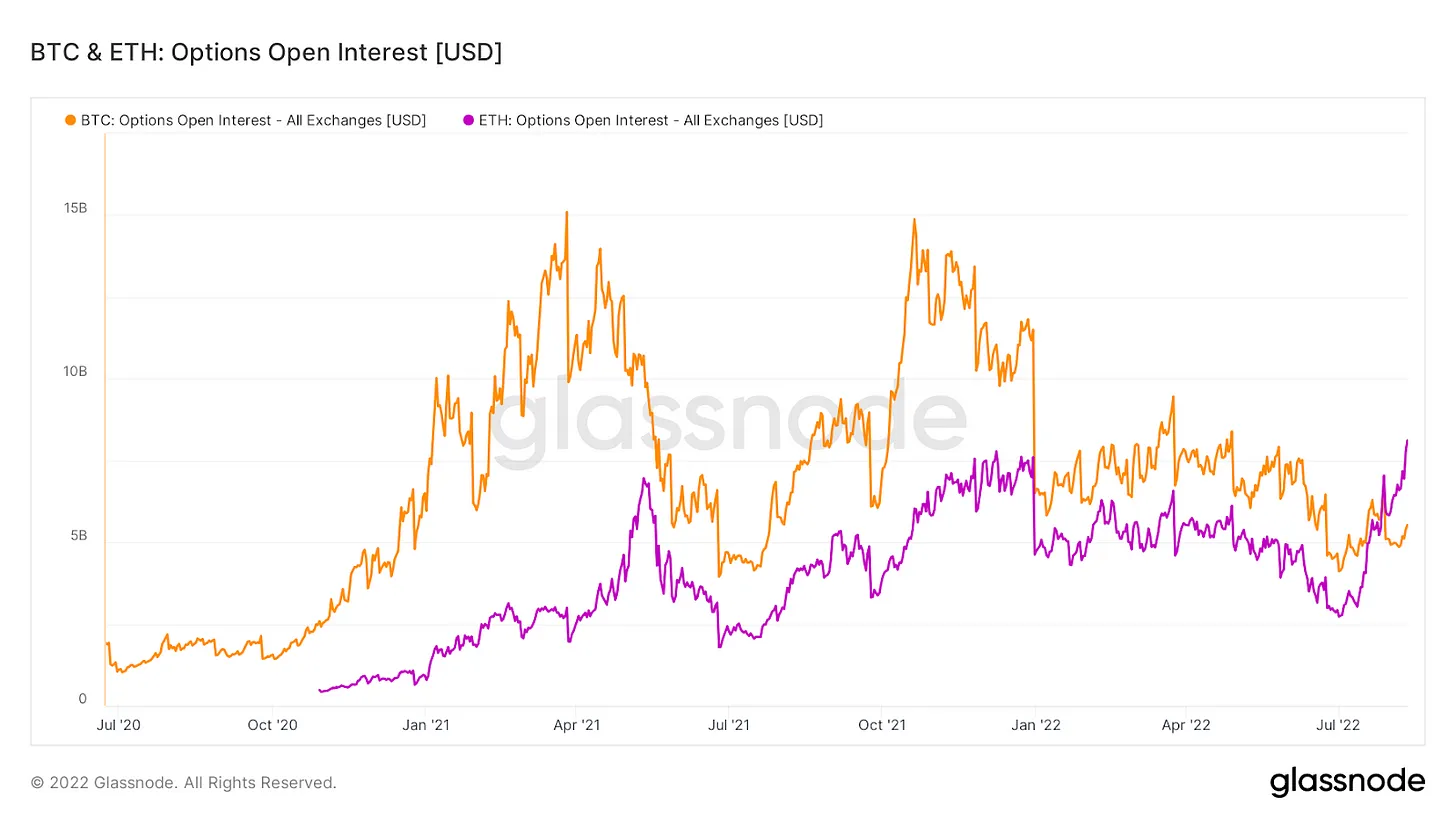

Similar to the large amount of activity that can be seen in the futures market, the options market is also exploding in interest. As a percentage of total market capitalization, options open interest for ether has risen above 3.6% of its total market cap, while options open interest for bitcoin is hovering around 1.2% of its market value.

Surprisingly, this rapid rise in options market open interest for ether has seen it surpass that of bitcoin in notional USD terms.

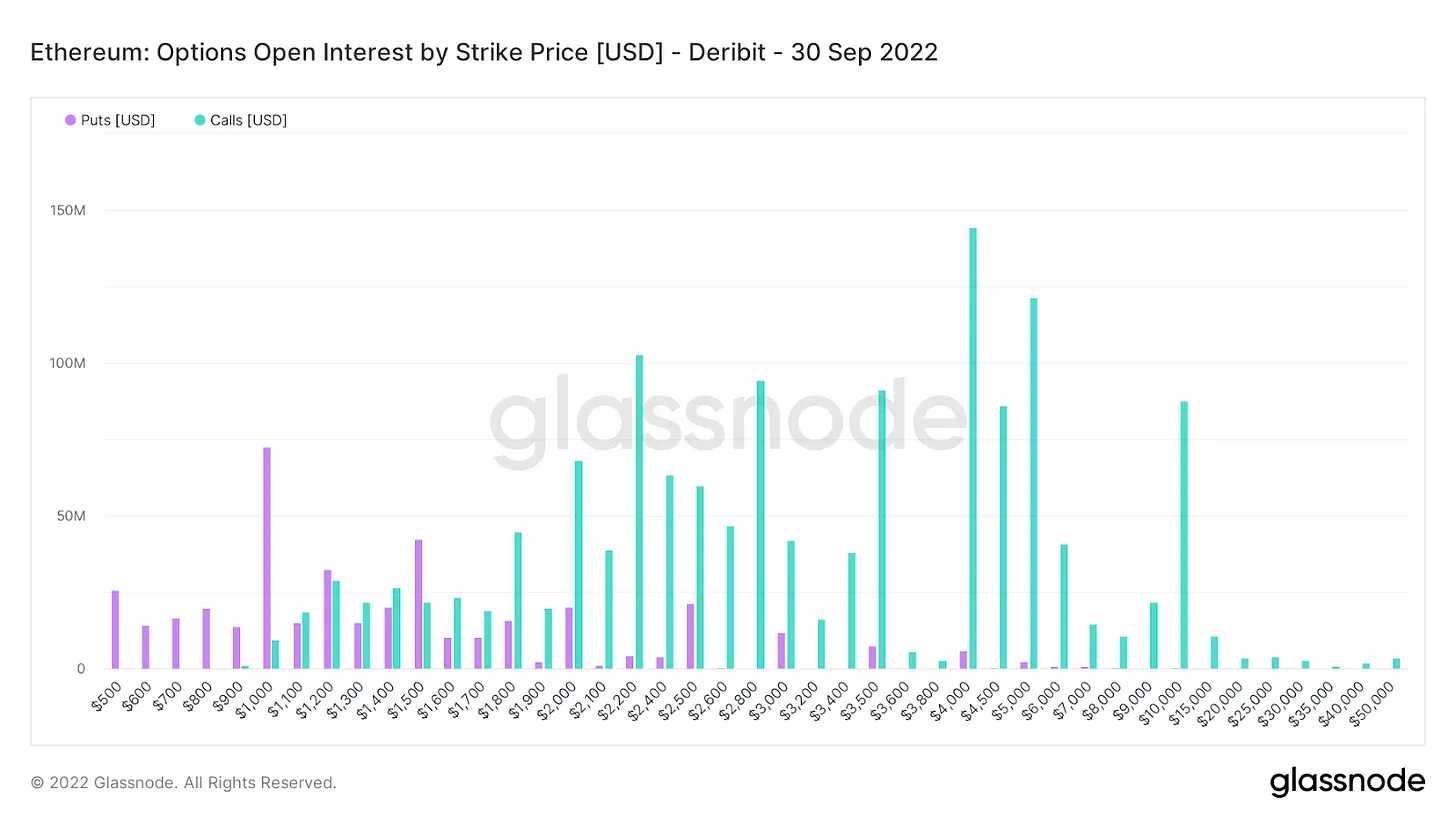

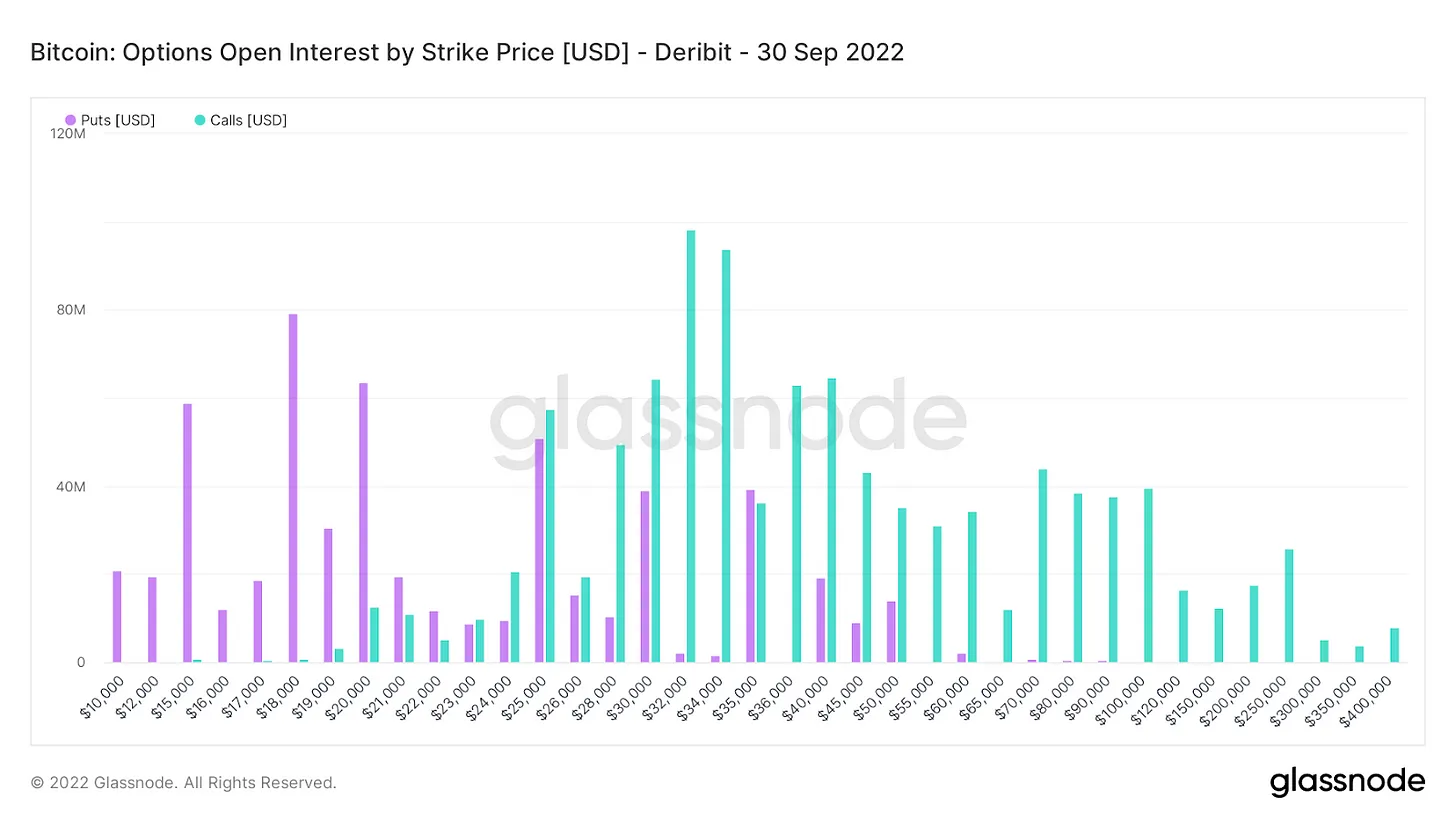

In particular, there is a large amount of bullish speculation around ETH for the September expiration (which should occur after the merge). Shown below are the options open interest by strike price in both ETH and USD terms.

With the largest strike prices for call options above $4,000 ETH (more than 100% above the current market price), there are three separate strike prices above $100 million in national open interest. Bitcoin on the other hand, has no strikes with notional call option value above $100 million, despite Ethereum being just 50.8% of its market cap.

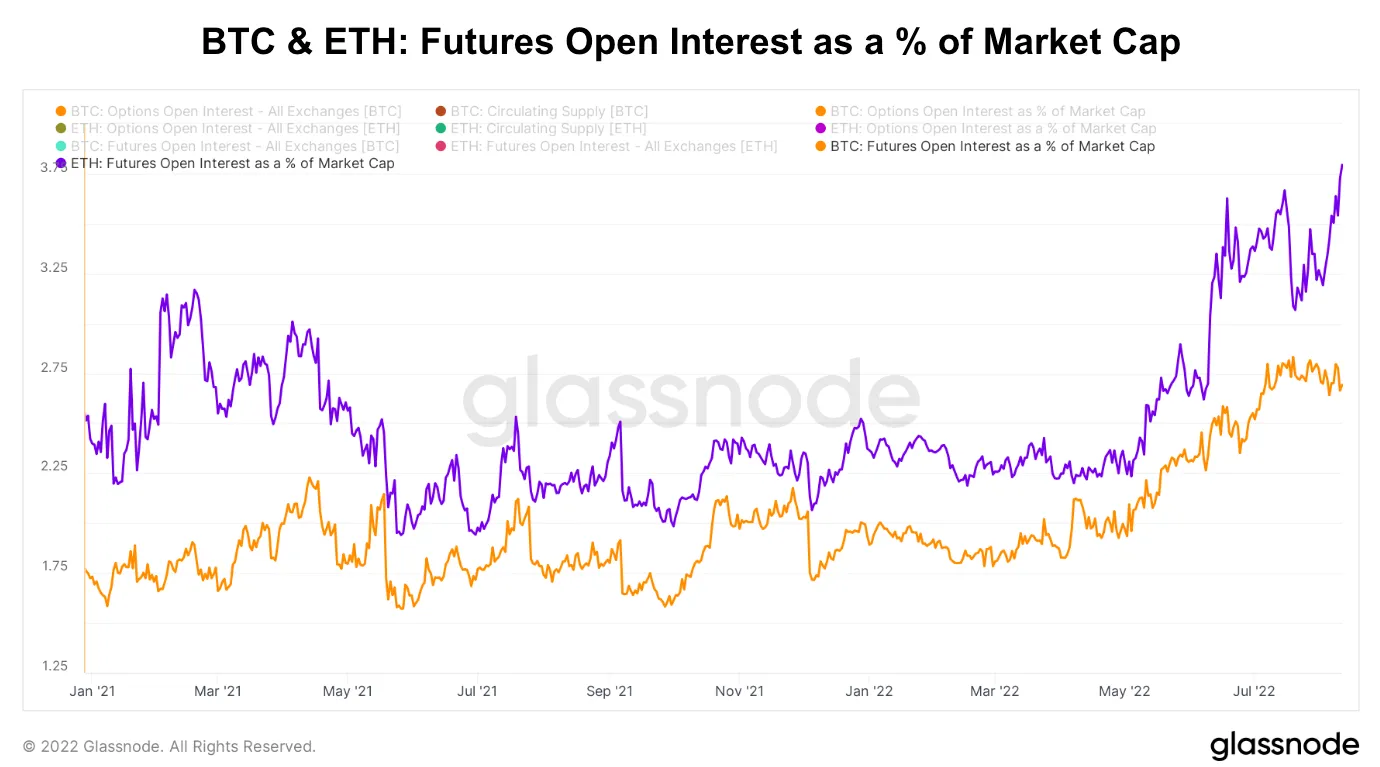

This, if nothing else, shows the large amount of short-term speculative interest in Ethereum. This can also be seen in regards to the two assets’ futures open interest as a percent of market cap, which has seen Ethereum leading since the start of the data set.

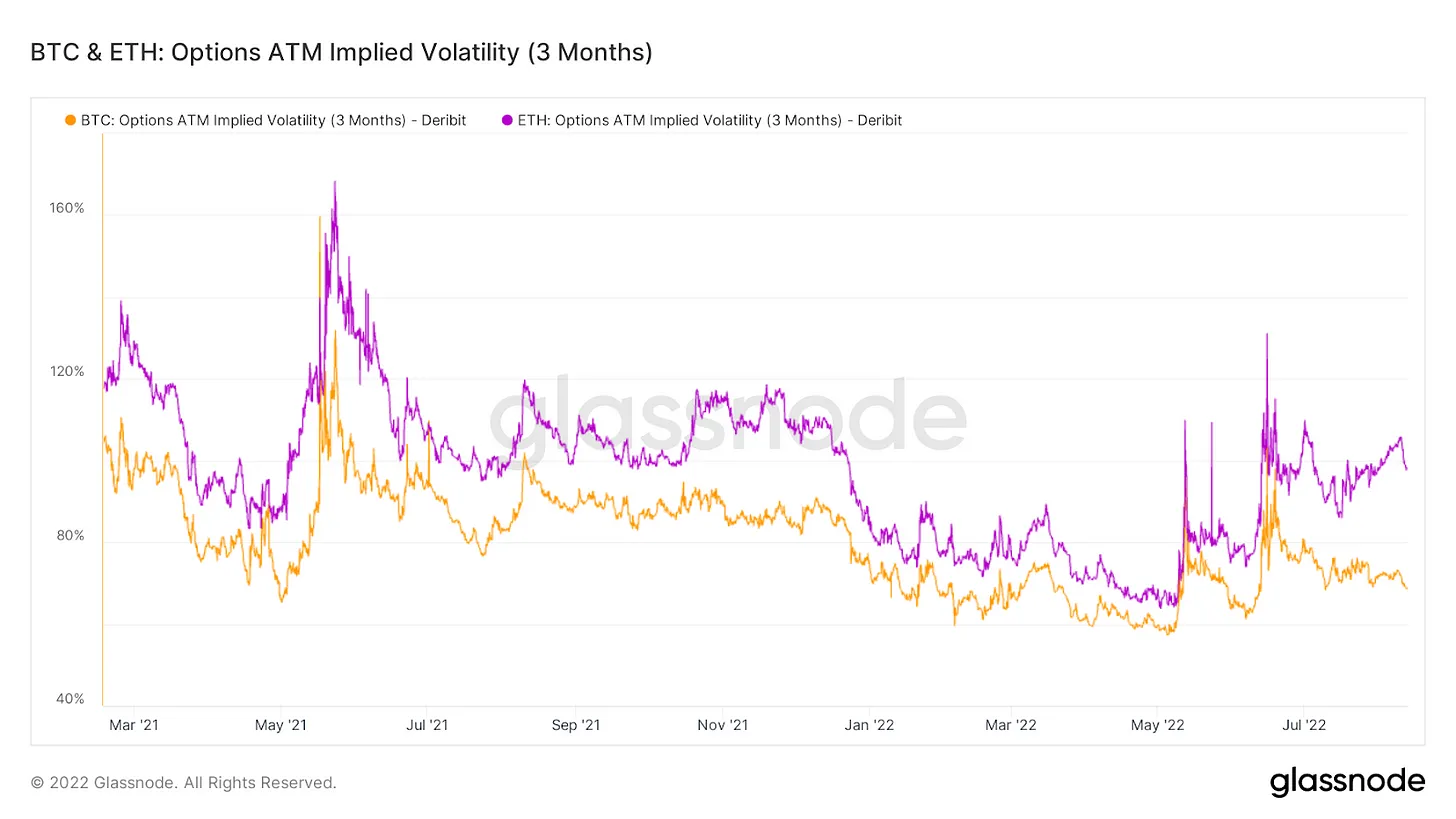

However, all of this speculative activity comes with a tradeoff: increased volatility. A look at the three-month implied volatility of both bitcoin and ether shows ether consistently ahead of bitcoin.

More leverage per unit in the system leads to increased volatility.

Final Note

Next week, Bitcoin Magazine will release an in-depth primer on everything to know about the Merge, including both the arguments for and against the long-term viability of Ethereum and a proof-of-stake system.

For bitcoin-first and bitcoin-focused readers who may be asking how today’s piece relates to bitcoin, Bitcoin Magazine’s response is the following:

The reality is as bitcoin grows in adoption and liquidity around the world, it is increasingly cross-collateralized with various asset classes. In the way that bitcoin responds to volatility in the legacy financial system, so it does to various assets/events in the broader crypto ecosystem.

On a more technical level, in regards to next week’s release, we find it valuable to be able to distinguish the fundamental differences between Bitcoin and Ethereum and various altcoins with precision and eloquent articulation.

To be the first to know about our contracts, new listings, product launches, and giveaways, you can connect with us on Discord, Telegram, and Twitter. We encourage you to follow our blog and subscribe to the Bitcoin Magazine Pro newsletter.

In the meantime, if you have any questions please contact Support.

Related

The post appeared first on Blog BitMex