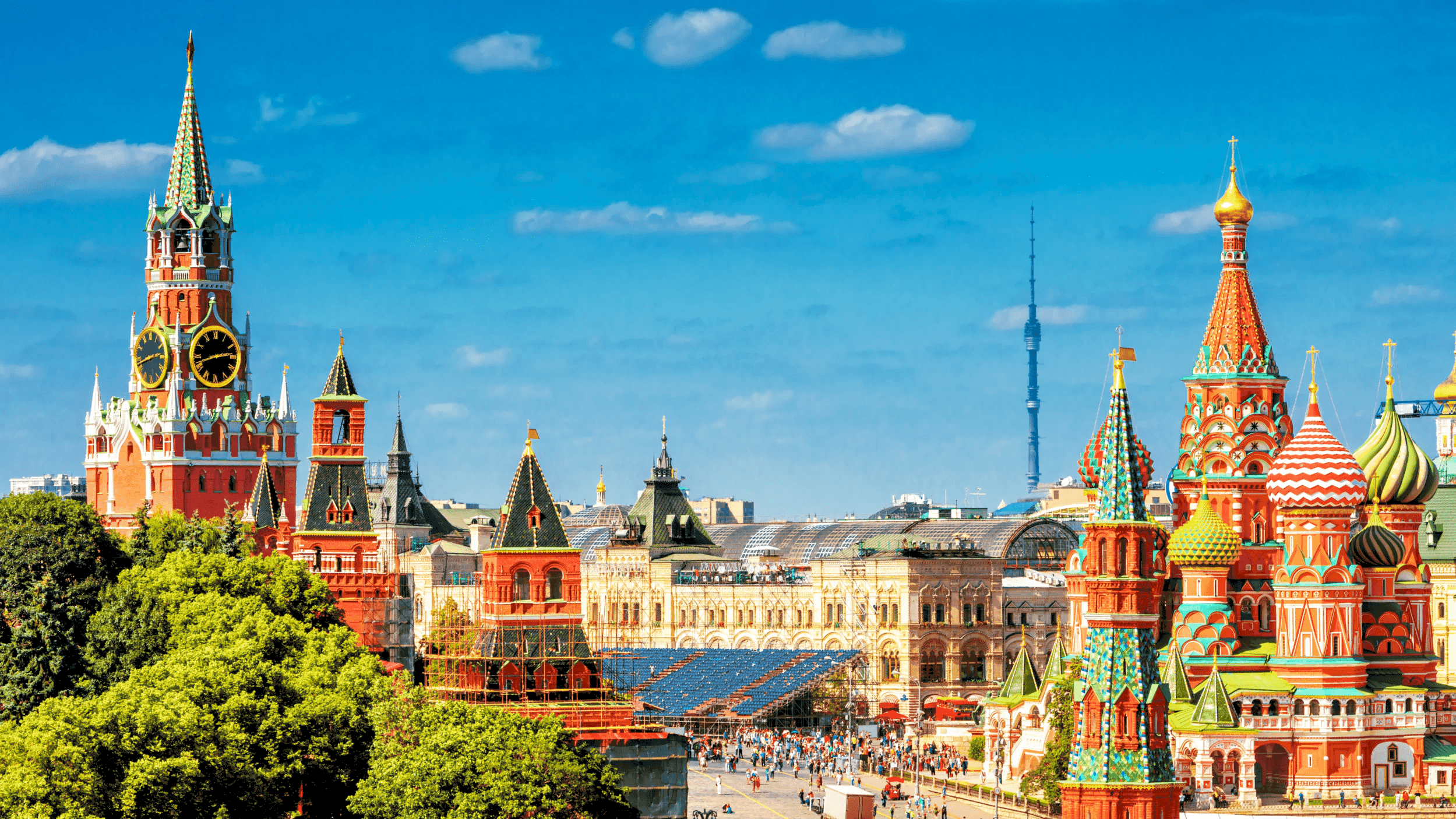

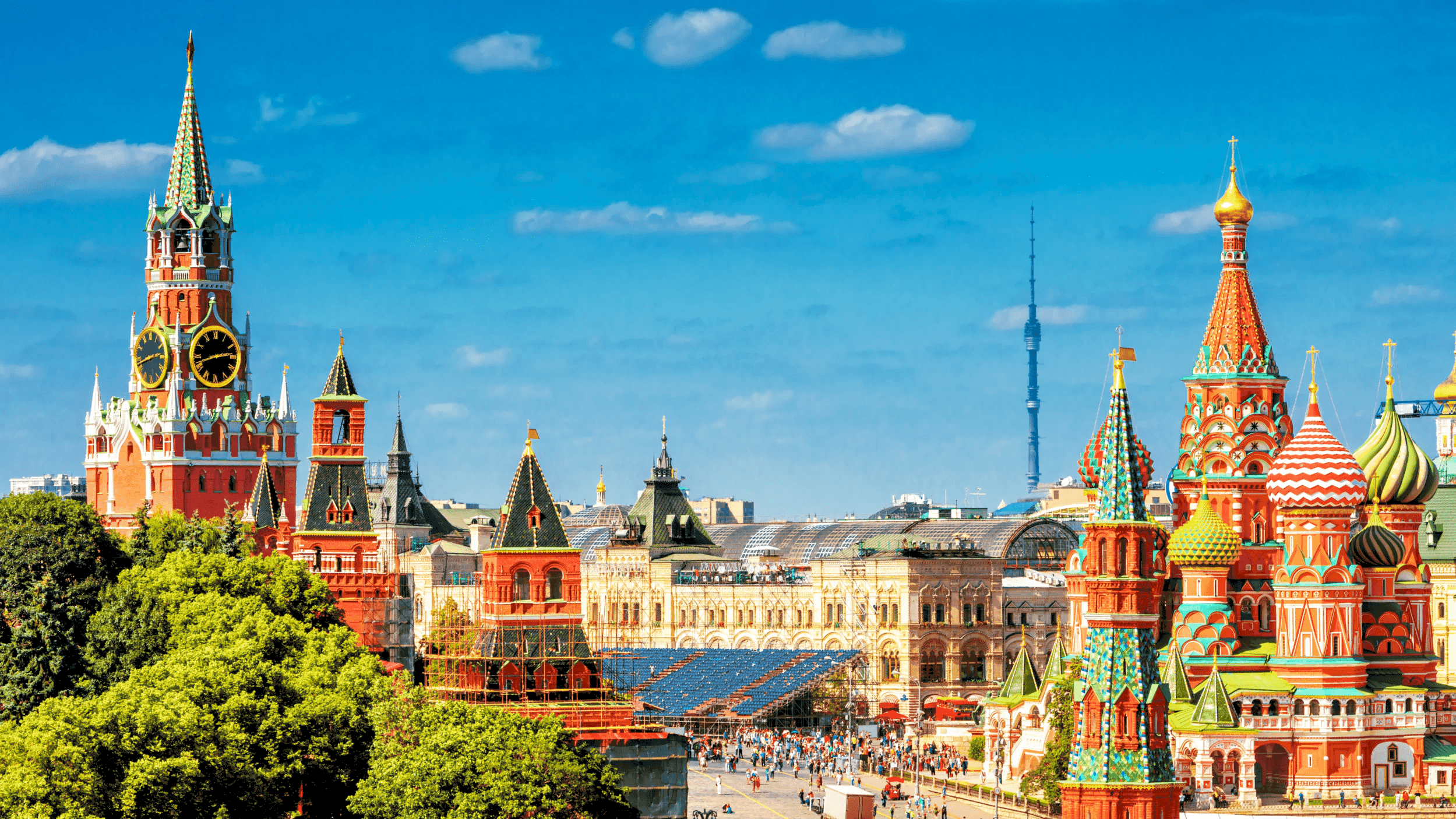

Russia is on course to launch its CBDC early next year and use the new currency in mutual settlements with China that has already tested its digital Yuan, a senior Russian lawmaker said in an interview.

The move aims at reducing the US hegemony over the global financial system, media reports said.

Russian CBDC to Take on US Hegemony

“The topic of digital financial assets, the digital roble and cryptocurrencies is currently intensifying in society, as Western countries are imposing sanctions and creating problems for bank transfers, including in international settlements,” Anatoly Aksakov, head of the finance committee in Russia’s lower house of parliament, said in an interview with Russia’s parliamentary newspaper.

With that objective in mind, Russia is looking at alternatives, he added.

“If we launch this, then other countries will begin to actively use it going forward, and America’s control over the global financial system will effectively end,” the Russian lawmaker said.

The digital ruble has been in the works over the past couple of years. It was primarily aimed at modernizing the country’s financial system and speeding up payments. But given the sanctions, its implementation is being fast-tracked, and Russian banks are reported to be testing it.

Crypto Legislation on the Anvil

The senior Russian lawmaker also hinted at the possibility of a new crypto regulation to come later this year. With the Bank of Russia adopting a strict non-accommodation approach and batting for a complete ban on cryptocurrencies, the Russian crypto legislation has been in limbo throughout the last year.

ADVERTISEMENT

Typically, Russia pursued a strict dismissive approach to digital assets, and the CBDC project was planned partly as a response to “the threat of cryptocurrencies like bitcoin gaining influence.”

In the changed circumstances, the central bank is believed to have moderated its stance on the crypto regulation bill. It’s currently reviewing a version that seeks to allow digital asset trading at Moscow Exchange, the country’s largest exchange.

Moderating Stance

Early this month, the Finance Ministry and the central bank agreed to use cryptocurrencies in cross-border payments to facilitate the country’s trade with other nations.

In June, Russian President Vladimir Putin signed a bill into law that made the use of cryptocurrencies as a medium of domestic payments illegal. But he expressed interest in crypto mining, saying the country can use its spare electricity and favorable climate to develop the industry.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato