(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The story of the crypto capital markets is one centred in North Asia – specifically, Greater China.

Side note: Greater China is the combination of Mainland China, Hong Kong, Taiwan, and Macau. If you go back to dynastic China, most of Southeast and North Asia paid tribute to the Emperor, and their scripts and cultures were directly impacted by what originated and was popularised first in China. (I can’t wait to see the comments from my Korean and Japanese readers…)

Here’s a quick timeline of the development of the crypto capital markets which illustrates their Greater China-centric nature:

For better or for worse, in the early 2010s, Mt. Gox – a Japanese crypto exchange – put crypto trading volumes on the map. (If you’re not familiar with the infamous Mt. Gox incident, you need to upgrade your crypto historical knowledge. You can read a bit more about that saga here.)

When I first began trading crypto in 2013, Mt. Gox had north of an 80% market share of global crypto trading volumes. When Mt. Gox imploded in early 2014, the bulk of the volume baton was handed off to the Big Three in onshore China: Huobi (based in Beijing), OkCoin (based in Beijing), and BTC China (based in Shanghai). And for market participants outside of the Greater China area, offshore China’s Bitstamp (based in Slovenia) and Bitfinex (based in Hong Kong) processed most of the USD-based trading volumes.

The next big revolution in crypto trading was spearheaded by Bitfinex, who allegedly (at least initially) built their platform using code from Bitcoinica, a New Zealand-based exchange started by a Chinese founder who spent his formative years in Singapore. Regardless of the origin of their codebase, Bitfinex innovated by successfully popularising a peer-to-peer borrowing and lending market for fiat and crypto. For the first time, this enabled traders to borrow from other traders to effect margin trades. Bitfinex also allowed users to use any form of collateral to fund their trades. For example, if you held Litecoin, you could place a long Bitcoin vs. USD margin trade. Back when I used to day-trade crypto, understanding the amount of Bitfinex loans outstanding was a crucial variable in forecasting price movements. Following a $5 million hack of Bitstamp – the leading non-RMB exchange at the time – in 2016, these innovations allowed Bitfinex to take the crown from Bitstamp as the biggest non-RMB exchange globally.

At that time, the crypto derivatives market made up just a small slice of the broader crypto trading pie. The first real derivatives exchange was ICBIT – founded by two Russians living in the Caribbean. ICBIT invented inverse Bitcoin/USD futures contracts. Back in 2013, when ICBIT ruled supreme, the futures cash-and-carry trade yield 200% per annum. Wowzers!

In 2014, 796 (based in GuangZhou), Huobi, OkCoin, BTC China, and BitMEX (started in Hong Kong – hooray!) all launched their version of a futures market using ICBIT’s inverse futures contract structure. (Technically, 796 used a quanto-style derivative, but they blew up because they didn’t understand non-linear features of quanto contracts.) The big innovation of these Chinese-focused exchanges was the socialised loss system. This shielded the exchange from the risk of individual trader bankruptcies. This feature was essential due to the volatile nature of Bitcoin and other cryptocurrencies.

Bitfinex was then responsible for the initial growth of the stablecoin market through their affiliation with / ownership of Tether. Crypto exchanges needed a way to fund in USD without touching the banking system. And likewise, Chinese people needed a way to send dollars around the world without involving banks. Bitfinex was the leading exchange and had deep ties to Greater China, and its support of USDT further enhanced USDT’s position as the biggest stablecoin because Binance – who, depending on who you asked, was based in either Tokyo, Shanghai or Hong Kong – based all its fiat vs. crypto pairs against USDT.

From there, derivatives volumes grew quickly as the major onshore Chinese exchanges dominated daily trading volumes. Their domination was predicated on a few factors. First, most of the firms mining Bitcoin and producing mining equipment were all in Mainland China. These firms were the OG whales, as they had large pools of Bitcoin to speculate with and to hedge. Second, the majority of all global trading volume on the spot side was centred in China. Third, there was no institutional investing class to cater to, as retail traders reigned supreme. Therefore, the products were created to appeal to the people actually using crypto, and not to money managers.

In May 2016, BitMEX invented the perpetual swap (aka “perps” or “the perp”). BitMEX’s rise to prominence stems almost entirely from this financial invention, and by 2020 all major derivatives exchanges copied this product design and achieved great success. With trillions of dollars in cumulative trading volumes to-date, it has become the most traded crypto instrument ever. Mic drop, bitches!

After that, Deribit – originally based in the Netherlands and now Panama – blew open the crypto options trading market. By my measure, this is the only non-Asia based exchange that contributed any major innovation to the crypto capital markets.

Binance (now the largest exchange by trading volume of most products), FTX (started in Hong Kong, now in The Bahamas) and Bybit (started in Beijing, now in Singapore / Dubai) are three monster platforms that in recent years have taken the best products and features of all their predecessors, improved upon them and achieved success.

To recap, let’s run down the list of major developments in order again and note the source of their invention.

- Inverse Futures Contracts – ICBIT, which hailed from a Russian yacht in the Caribbean.

- Socialised Loss Derivatives Margining System – 796, Huobi, OKCoin, and BTC China, hailing from GuangZhou, Beijing, Beijing, and Shanghai, respectively (all Greater China).

- Margin Trading – Bitfinex, which hails from Hong Kong – (Greater China).

- Stablecoins (USDT) – Bitfinex, which hails from Hong Kong (Greater China).

- Perpetual Swap – BitMEX, which started in Hong Kong (Greater China).

- Options – Deribit, which hails from the Netherlands.

- Current Largest Exchange Volume – Binance, which got its start in Greater China.

I supremely hope Crypto Twitter can challenge me on this next point, which I know is a spicy one: I maintain that there has been absolutely no innovation brought to the crypto capital markets by centralised, American-based exchanges. While the likes of Coinbase, Gemini, Kraken, et al. are important, trade serious volumes, and are highly valued, they have not contributed anything “new” to our markets. They are simply places where American retail and institutional investors can purchase crypto and custody it.

Some Perspective

Up until the 16th century, China was the world’s largest economy. A variety of factors – which I won’t get into because they aren’t important to this essay – contributed to its fall in economic relevance and technological innovation vs. Western Europe. But regardless of China’s economic status, Hong Kong (a deepwater port at the mouth of the Pearl River Delta) has always been China’s window to the world. Whether it was shipping, capital, or narcotics supplied by the biggest drug dealer in human history (the British Crown,) Hong Kong has historically been where China and the West met.

As Deng XiaoPing allowed China to re-engage with the world starting in the late 1970’s and early 1980’s, the importance of Hong Kong grew. Its status as a duty-free port where Chinese and Western goods and capital could be exchanged caused the wealth and global importance of the city to skyrocket. Hong Kong was about as close as one could get to a place where free market ideology was practised.

Hong Kong is a “can do” kind of place. The energy and hustle of its residents is intoxicating – it’s why I knew from my very first night of bar hopping in Lan Kwai Fong that it would be my home. (I am a bit ashamed at my complete lack of Cantonese language skills, but no one is perfect, right???)

Hong Kong is Hong Kong because it is open and China is closed (at least in many respects). Beijing allows Hong Kong to exist in this way because it is beneficial for it to have controlled openness. As we all know by now, Hong Kong is part of China. Hong Kong has no real economy other than being a portal to China, with some softness around the edges. And therefore, its financial system is allowed to be freer and more experimental. That is why as a tiny, natural resource-poor territory, Hong Kong punches above its weight in terms of the globally significant crypto capital markets companies it has fostered.

China possessed all the ingredients necessary to become the epicentre of crypto trading volumes and related innovations, but at a certain point, Beijing decided crypto wasn’t part of the plan. Slowly, over many years, the crypto capital markets were cleaved from China’s side and an exodus began.

In 2017, ICO’s were the hot thang, and at one point Chandler Guo drove around China in a bus signing up projects to do ICOs. That all came to a screeching halt in the fall of that year when the trading of ICOs was banned by the Chinese government. Over the next few years, the PBOC banned this and that, until finally, no Chinese people were allowed to trade crypto in any shape or form. BTC China became BTCC and was sold to a Hong Kong-listed company. Both Huobi and OkCoin (which became OKEx, and has since rebranded again as OKX) did reverse takeovers and each listed a business line in Hong Kong, subsequently ceasing all business in Mainland China. And that was the end of the Big Three.

CZ, the founder and CEO of Binance, is ethnically Chinese but holds a Canadian passport. The maple leaf that adorns his papers, coupled with an adept strategy to be everywhere and nowhere at once, allowed him and Binance to survive the crackdown in China and consolidate the business of the Chinese diaspora. The Big Three were each under different pressures at the time, as some of their most senior executives spent time in custody. This gave Binance the space to grow its business rapidly.

In conjunction with the onshore China crackdown, Hong Kong became a less friendly place for crypto. The territory’s strategic ambiguity with regards to the legal status of crypto – which had initially given many companies the space to innovate – was hardened into a regime that was on the more restrictive side of things. As a result, the leading companies decamped for Singapore, Dubai, and The Bahamas.

Hong Kong’s position as the most important crypto hub began to tumble gradually at first, and then quickly with the imposition of its zero-COVID policies. But now, it looks like something curious is happening…

For some reason, Hong Kong wants crypto back.

Cointelegraph reports: Not like China: Hong Kong reportedly wants to legalize crypto trading.

Your initial reaction might be, “so what?” Hong Kong has a population of close to 7 million people, which you might think is too small to be relevant. But, you have to remember that Hong Kong is the proxy through which China interacts with the world. Is this a harbinger for a reboot of China’s crypto dominance? Will Chinese capital find its way into the global crypto markets through Hong Kong?

The nuclear crypto bear market spanning 2013–2015 was vanquished when China conducted a shock devaluation of the CNY in August of 2015. From that point until November, the price of Bitcoin tripled from $200 to $600. The rest of this essay will argue that Hong Kong’s friendly reorientation towards crypto portends China reasserting itself in the crypto capital markets. When Choyna loves crypto, the bull market will come back. It will be a slow process, but the red shoots are budding.

Hong Kong = China

As crypto investors, we care about Hong Kong’s ability to facilitate Chinese capital’s needs. Whether it is in retail sales or capital flows, it is the ordinary wealthy Chinese people that power the Hong Kong economy. I’ll share a few charts in just a bit that demonstrate the power of the Chinese consumer and investor. And the reason we care about the Chinese consumer – rather than just Chinese investors – is because I believe that Chinese investors and consumers are one and the same.

According to the Hong Kong Tourism Board, in 2019 78% of all arrivals into Hong Kong came from Mainland China. By the end of the first quarter in 2020, COVID lockdowns resulted in a closure of the Hong Kong / Mainland Chinese border. While one could still move between the two territories, lengthy quarantine stays required on one or both ends effectively meant no one other than someone with a very serious need to be in Hong Kong would travel there from Mainland China.

If we want to form a view on the impact of Mainland China on the Hong Kong economy, we need to focus on the wealthier individuals. A good proxy for them are sales of jewellery, watches, and clocks reported by the Census and Statistics Department of Hong Kong. There is a high concentration of watch and gold shops anywhere that is an on- or off-loading point for buses, trains, and ferries to China.

As you can see from the above chart, the total amount of jewellery, watches and clocks sold in total between 2020 and 2021 dropped 54% when compared to the total between 2018 and 2019. The takeaway is that it’s the Mainland tourists who buy the fancy shit (and thereby have an outsized impact on the Hong Kong economy). COVID lockdowns took away the Chinese tourists, and thus sales suffered.

Moving onto the capital markets, a good metric for measuring the Chinafication of Hong Kong is to look at the league tables for Equity IPO underwriting.

|

Year |

2022 |

2012 |

Change |

|

Top 20 Banks’ Share Total |

82.52% |

85.51% |

-2.99% |

|

% of Banks in Top 20 That Are Chinese |

65.00% |

50% |

15.00% |

|

Chinese Banks in Top 20 Share of Market |

54.43% |

37.34% |

17.09% |

To date in 2022, the top four spots are held by Chinese banks. In 2012, the top two spots were held by two European banks. The Hong Kong capital markets have become a reflection of China, but with a slight Western twist. The large Chinese banks are either directly or indirectly controlled by Beijing, meaning that the Hong Kong capital markets – while open to Western firms and capital – are stewarded by firms controlled by Beijing.

Hong Kong Politics

Shortly before COVID, protests raged throughout the city. I remember walking down the escalator to Wyndham Street to have dinner one night, only to be greeted on one side by the police in riot gear, and on the other side by students in gas masks banging drums. I promptly changed my dinner plans to an establishment further up the mountain.

The protests were foiled by a pandemic, as well as Beijing deciding enough was enough. The National Security Law – the subject of much of the protesting – was passed, and it became clear in no uncertain terms that Hong Kong was a territory firmly inside of China. This was further confirmed during the Chief Executive election when John Lee, the top cop during the protests, ran unopposed to secure the top spot.

Xi Jinping’s first trip outside of Mainland China following COVID was to Hong Kong, where he travelled to swear in the incoming CE John Lee. Do you see any flags with a bauhinia?

Beijing monitors Hong Kong through the Hong Kong Liaison’s Office. Below is a picture of the office, which you’ll notice kind of resembles the Eye of Sauron.

Militarily, The People’s Liberation Army (PLA) has over ten thousand troops stationed throughout Hong Kong. As a fun aside, I have played rugby at their military base in Stanley, depicted below.

The point of this slideshow (besides my rugby humblebrag) is to illustrate that politically, Hong Kong leaders do what Beijing tells them to do. Any substantive policy – and especially ones that diverge from what has been implemented on the Mainland – must be pre-approved by the appropriate party organ.

We saw this play out when Hong Kong followed China diligently in its execution of the zero-COVID strategy. But now, with this news that Hong Kong is rethinking its stance on crypto, it appears that Beijing may allow its testbed territory to follow the West a bit more. Hong Kong is starting to open for business with the West – and to prove it, let me share a particularly poignant recent example.

A few months ago, the Hong Kong authorities were separating children from their parents and shipping people off to quarantine facilities in the infamous Penny Bay in order to squash a COVID outbreak.

Fast forward to about a month ago, and the Hong Kong government suddenly allowed Hong Kong Stadium to begin selling tickets to the Hong Kong Sevens, the premiere tournament on the World Rugby Sevens Series competition. You can expect the stands at the upcoming competition to look something like this:

And just this past week, the authorities announced that they are going to allow the tens of thousands of attendees to eat and drink (and be merry) all smushed together in a rugby stadium.

Until recently, Hong Kong’s continued enforcement of Beijing’s zero-COVID policies had myself and many other Hong Kong expats wondering if Beijing was content for Hong Kong to fade as an international finance centre and concede its crown to Singapore.

A quick cultural lesson: an “expat” is code for an upper class version of an immigrant. The helpers, who hail from places like the Philippines and Indonesia and do the actual hard labour needed to keep the country upright – like cleaning and childcare for the middle and upper income folks – are oh so respectfully referred to as “overseas foreign workers”.

The Hong Kong vs. Singapore rivalry runs deep. Both city-states are vying to be the hub of international finance in Asia. Shanghai would easily take the top spot if Beijing was confident it could remain politically pure, but I suspect that handing that sort of relevance to the Shanghai clique is not something Beijing is interested in.

Singapore did very well as a destination for international capital throughout COVID. It was the only major financial centre in Asia that remained open to foreign business. Hong Kong shut its borders to international travel and only recently reopened them. Tokyo was shut due to the Japanese policy of not allowing foreigners in. Singapore did have a similar policy in the early COVID era, but it was quicker than its other Asian counterparts to loosen entry restrictions for foreign businesspeople and then tourists.

Many banks that had a large Asian presence of well-paid front office workers began shifting employees from Hong Kong to Singapore. (As a result, the Singaporean apartment rental market is on fire right now. Some of my friends are having their rent jacked 50 to 100% when negotiating lease renewals.)

As far as crypto goes, many firms and individuals– particularly Chinese nationals – moved their businesses and persons to Singapore during the pandemic. My little birdies tell me that Token2049 was LIT AF. The vibrancy of the crypto scene was on full display. Singapore also just rolled out a new employment visa scheme aimed squarely at high-earning engineers and bankers.

The policies necessary to reassert Hong Kong’s relevance in terms of finance (and crypto specifically) are quite straightforward. The issue is one of political will, and whether the Chinese government is comfortable allowing Hong Kong to drift further apart from Mainland China. It has left many – including myself – wondering whether Hong Kong will (or even can) respond.

That said, recent events such as the allowance of the Hong Kong Sevens seem to suggest that the Chinese government is starting to view Singapore as a bigger threat to its dominance than the continued political drift of Hong Kong. In that same vein, required quarantines on your way into China and between provinces are still the norm, and COVID flare ups are dealt with via severe lockdowns – but in Hong Kong, stay in a quarantine hotel is no longer required upon arrival.

We’re also seeing a similar shift on the work visa front. Hong Kong has historically had a more straightforward system for issuing foreign employment passes compared to Mainland China (I would not characterise it as easy or hard) but is now making it even easier to issue and receive these passes by waiving many of its usual stipulations, such as requiring businesses to advertise all positions to the local market and making them prove that any roles offered could only be filled by a foreigner.

Here is Fortune talking about how aggressively Hong Kong is now courting foreign talent:

Hong Kong is overhauling visa rules to attract foreign talent as it battles with rival finance hubs like Singapore for talent following nearly three years of pandemic isolation.

Chief Executive John Lee said in his maiden policy address that the city will grant a two-year visa to high earners who earned at least HK$2.5 million ($318,480) in the past year, as well as for graduates from the top-ranked universities. The city will also suspend the annual quota of its current program for skilled talent and extend the limit of stay for non-local graduates from one to two years.

The moves seek to stem a brain drain following Hong Kong’s slow reopening of its international borders, with many foreigners leaving the city for alternative locations like Singapore, which has relaxed Covid restrictions much faster.

And then most recently, we have the apparent forthcoming divergence in Hong Kong’s crypto policy. Retail traders cannot trade crypto in China, but recent media coverage suggests that the Hong Kong Securities and Futures Commission (SFC) is poised to allow retail to directly buy and sell crypto in the near future.

Hong Kong is doing what it needs to do in order to regain its role as the global hub for crypto trading. The capital can come from China via retail. If the Chinese capital is there, the Western capital will meet it. That is why the Hong Kong financial markets are so powerful. The people needed to build the services can now easily get employment visas.

But just because it can be done, doesn’t mean it will be done. What’s to say that Beijing won’t change its opinion tomorrow and rescind all these positive crypto policies?

We’ve certainly seen that happen before, so I’ll admit it’s within the realm of possibility – but I firmly believe that this time, China is for real. Don your optimist caps with me as I outline why I think allowing crypto in Hong Kong solves a critical, existential problem for China that will make it difficult for the country to back out again.

China’s Dollars Problem

John Connally, President Nixon’s Treasury Secretary, bluntly told a group of European finance ministers “The dollar is our currency, but it’s your problem.” Connally’s statement is part of what’s now labelled as “Nixon Shock”.

To help explain China’s dollar problem, I’m going to throw in a few quotes from a truly amazing book entitled “Changing Fortunes” by Paul A. Volcker and Toyoo Gyohten. That’s right – the Paul Volcker is one of the authors. He and Gyohten-san take an American and Japanese perspective on financial events from the 1950s to 1990.

As Japan was on the come up after WWII, Gyohten-san writes about how they were treated by the Western finance minister (page 57).

But at the BIS meeting, central bankers from all the European countries gathered; had cocktails, luncheons, and dinners; and talked endlessly about gold, the dollar, and the pound sterling, switching among English, French, and German. But there was absolutely no interest shown in the upheavals going on at that very moment in China. The Vietnam War was at a very critical stage, but apparently those bankers had very little interest in such events outside their sphere. I thought uneasily, this is a group of people for whom the world still stops west of the Dardanelles.

I would be delighted to hear about how PBOC officials feel they are treated as the up-and-coming Asian economic super power in the midst of the Americans and Europeans at the various central banking jamborees.

Here is Gyohten-san again (pages 160-161) discussing how hard it is to correct the balance of payments imbalances. Japan ran massive surpluses with America and Europe in the 1980s. China has found itself in a similar position since 2001, except it’s even more grotesquely imbalanced.

One important lesson of the period, particularly for Japan, was that under the floating-rate regime, monetary authorities could not manipulate the exchange rate by simply intervening against an underlying market trend. That lesson cost us billions to learn. We also learned that a change in exchange rates by itself will not have a quick effect on most countries’ balance of payments. That was certainly obvious from the performance of the Japanese and United States economies.

The Japanese Ministry of Finance seems to have forgotten these learnings. Oh well, what’s a few billion dollars between friends …

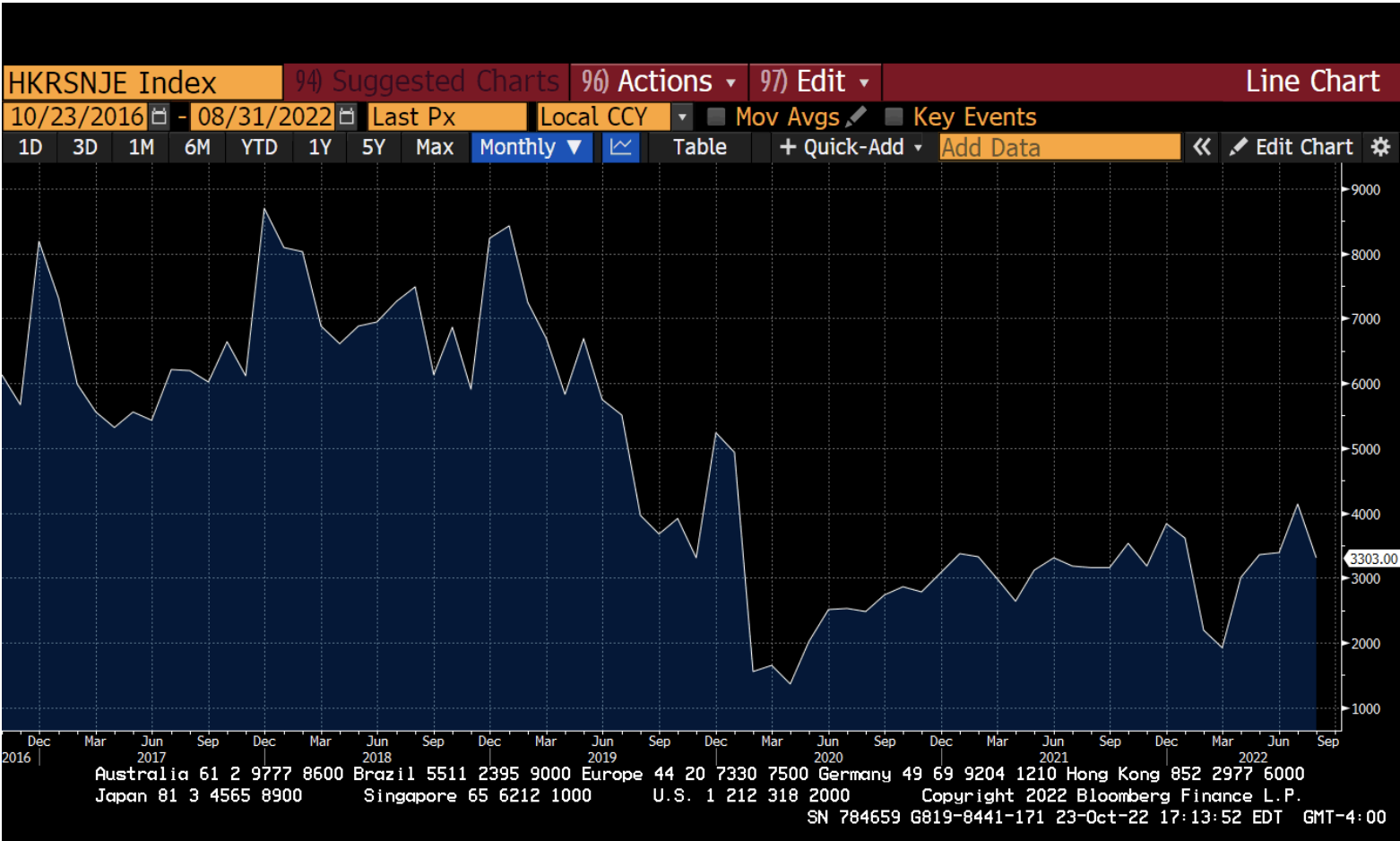

China has a USD problem. The problem is that it earns billions of dollars each month from its exports to the world minus imports. China must recycle its internationally-earned dollars by purchasing commodities or financial assets. This has led them to become the second largest foreign holder of Treasuries behind Japan.

US Treasury Securities Held by China in USD Billions

Those dollars are not really theirs, though – they merely rent them from the American-led Western financial system. Prominent economist and former adviser to the PBoC Yu Yongding actually acknowledged this concern directly in a recent conversation with Nikkei Asia regarding the U.S.’s recent freezing of foreign countries’ USD assets:

“We never expected that the U.S. would freeze a country’s foreign currency reserves one day. And this action has fundamentally undermined national credibility in the international monetary system.

“Now the question is, if the U.S. stops playing by rules, what can China do to guarantee the safety of its foreign assets? We do not have an answer yet, but we have to think very hard.”

China clearly knows it holds too much US debt – but what have they done about it this year?

|

All in USD Billions (January to August 2022) |

|

|

1. Change in China UST Holdings |

-$96.90 |

|

2. Total Balance of Payments Surplus |

$560.52 |

|

3. Net UST Deficit |

$657.42 |

Let’s walk through lines 1 through 3 of this table.

The US Treasury Department publishes a monthly dataset that details the holdings of foreign countries. This field is the amount China’s holdings has dropped by year-to-date.

- The Chinese government publishes their Exports minus Imports in USD terms every month. This field is the amount of dollars China has earned abroad year-to-date.

- If China was following the traditional recycling playbook to the letter, it would buy US Treasury bonds in the same amount as its earnings from trading internationally. However, this field details the amount of Treasuries that China should have bought under the recycling playbook, but didn’t.

When you have a big, intractable problem, the first step is to not make the problem worse. China has clearly realised that it should not dig itself into a deeper hole by reinvesting maturing Treasuries or coupon payments or recycling international trade income into Treasuries. China should have bought almost $700 billion worth of extra Treasuries this year, and they haven’t.

What to Buy?

China has a substantial amount of dollars sloshing around internationally. With Treasuries off the table, the question becomes, what do they do with all of this capital?

The one thing that Beijing appears unwilling to do is to correct this imbalance by giving Chinese households a greater share of GDP. As of September 2022, Chinese consumption represented just 41.3% of China’s GDP. As the second largest economy, that is extremely, extremely low. For comparison, consumption as a % of GDP in America hovers around 60% to 70%. If Beijing expanded the social safety net and rebalanced income away from the export sector toward the household sector, it could “spend” its surplus. But that is an extremely difficult political decision for it to make, because it would mean hurting the factions that gained wealth and power over the last 30 years as China became the workshop of the world.

Instead of rebalancing its economy, Beijing must buy shit with its dollars. To that end, Bitcoin and crypto can solve part of China’s problem. People equate Bitcoin with evading capital controls, but since China already has truckloads of dollars that are outside of China (and thereby outside of its own capital controls), holding crypto outside of China shouldn’t be much more dangerous. By this logic, China should have no problem allowing the purchase of crypto with dollars held by its entities outside of China. This would have several benefits.

Reduce the Dollar Long

Bitcoin is outside of the control of any nation, making it a much better financial asset to recycle surplus dollars into than US Treasuries. This of course assumes the primary concern of the buyer is to avoid being subject to arbitrary confiscation of their capital. (If that isn’t the buyer’s chief concern, Treasuries are actually the superior choice – Bitcoin doesn’t offer a yield and is extremely volatile compared to US Treasuries.)

China can keep its RMB capital controls quite strict such that its Bitcoin purchases don’t erode its internal financial stability. To illustrate this, let’s walk through a theoretical transaction.

A Chinese punter travels to Hong Kong to go shopping, eat bomb-ass Cantonese food (which I would argue is the best of the eight national Chinese cuisines), and buy some Bitcoin.

Chinese Punter:

- Sell CNY

- Buy USD

- Sell USD

- Buy BTC

If done en masse, this would quickly weaken the CNY, since everyone would be selling CNY without enough buyers on the other side to stabilise its value. That is not what Beijing wants. To sterilise these flows, the PBOC would need to take the opposite position – and it has the USD to do so sitting outside China.

PBOC:

- Buy CNY

- Sell USD

Why couldn’t China have done this before? Because it only works if the PBOC is content with its dollar long position diminishing over time. If the PBOC wanted to remain at the same level of dollar long while allowing capital to exit (i.e., if it allowed the purchase of Bitcoin but was adverse to parting with its USD to buy CNY and offset the ensuing capital outflows), then all else being equal, the CNY would weaken against the USD.

But, given that China still holds close to $1 trillion worth of Treasuries and is continuing to export record volumes of stuff to the world, it has more than enough dollars to its name and should be comfortable with gradually reducing its USD balance over time and using it to buy CNY – meaning this sterilised Bitcoin trade can continue for a very long time with no impacts to the internal Chinese financial system.

Revitalise Hong Kong

For better or for worse, China is where it is today because it embraces technology, and the Chinese government knows it. The amount of control Beijing has internally is only possible because they nurture, develop, and implement the newest technologies.

As such, if there is a governmental belief that crypto and the technological revolution it heralds have value, then having a vibrant crypto ecosystem in an adjacent territory is a sound policy. Beijing never has to allow the aspects of crypto that might be socially destabilising to its political model across the border. Hong Kong can be used as a safe space for Beijing to experiment with the crypto capital markets.

The crypto ecosystem is an employer of high paying jobs. It attracts the best engineers and financial services professionals. Some of the most innovative solutions to many problems will come from our industry. And if you are a government thinking about the long term, you want the talent and the innovation to spring from your borders, not elsewhere. The current semiconductor trade war going on between China and the US is evidence that failure to nurture a homegrown version of key technologies leaves you exposed.

New technologies always need deep capital markets. That is why American tech companies are so dominant. Government-funded basic research spawned many entrepreneurs who were able to raise capital from a deep and sophisticated network of venture capitalists and equity investors.

Hong Kong can be that hub for crypto. It was in the past. A vibrant ecosystem of exchanges, DAOs, and venture funds would provide the world’s best engineers with a place to flourish. And even though we are an internet-connected society, we physically want to be where the action is. That is what makes a city a city. Silicon Valley still exists as a place to live and work, even though all the work could be done remotely via video conferencing. It would surely be much cheaper, but the reality is that humans want to be near other humans in their industry.

Just Do It

Hong Kong is saying all the right things. Now we need to see them in action. What will the final shape be of Hong Kong’s attempt to re-crown itself the premier crypto capital hub? I don’t know– but I’m hopeful.

I am also biassed as someone who has called Hong Kong home for his entire post-university adult life. I want to see the city do well. I want opportunities for graduates of Hong Kong universities. I myself was an exchange student at Hong Kong University of Technology. I want Hong Kong to return as a stop on the crypto-haj.

Most importantly, I want the bull market back. China has not left crypto – it has just been dormant. The current global geopolitical situation will force China to do something with its dollars. I believe that the reorientation of Hong Kong as a pro-crypto location is a prong in Beijing’s strategy to reduce its position in a way that won’t destabilise its internal financial system. If these flows actually materialise in the way I imagine, they will be a strong supporting pillar of the next bull market. Imagine a bull market supported by every major central bank engaging in yield curve control and Chinese retail buying Bitcoin in Hong Kong. OOOOOHHH BABY!

Related

The post appeared first on Blog BitMex