(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Everything is relative except maybe the speed of light. So, when I proclaim that Central Bank Digital Currencies (CBDC) are pure evil, the next logical question is – from whose perspective? What is evil to some is pure goodness to others.

The three players in this sad tragedy are:

- “We the people”, or those who are governed.

- The government and the political elites that pull the strings.

- Commercial banks chartered by the government of a particular nation state.

To us people, CBDCs represent a full-frontal assault on our ability to have sovereignty over honest transactions between ourselves. To the government, it is the most perfect tool for modifying the behaviour of its subjects since we all decided to voluntarily upload our lives onto social media platforms like Instagram and TikTok. To the banks, CBDCs represent an existential threat to their existence as going concerns.

I believe that the apathy of the majority will allow governments to easily take away our physical cash and replace it with CBDCs, ushering in a utopia (or dystopia) of financial surveillance. But, we have an unlikely ally that I believe will impede the government’s ability to implement the most effective CBDC architecture for controlling the general populace – and that ally is the domestic commercial banks.

Lord Satoshi brought forth the blockchain. While the Lord is pure and good like the light that shines, the outcrop of their teachings on the blockchain can be perverted by those with callous hearts and cruel intentions. This is an issue of great importance because the nature of the inflation to come is going to be distinctly different from the inflation that we have become inured to over the last 50 years – and it will require the government to adopt an equally novel, blockchain-driven mechanism, the CBDC, to stave it off. I expect that the CBDC will enable the government to tackle this new kind of inflation with vigour, but to the great detriment of the people.

Let us pray.

This Inflation not That Inflation

Since exchange rates began floating in the early 1970’s, participants in the world’s largest economies have largely experienced inflation that has been financial in nature. Of course, people’s fiat money went a lot further back in the day, but the creep higher in the cost of living has (at least for the most part) not been too aggressive.

West Texas Intermediate Spot Oil Prices vs. S&P 500 Index (Start = 100)

Oil is up almost 180% since 1983, reflecting a CAGR of 2.75%. The S&P 500 Index is up almost 35x since 1983, for a CAGR of 8.44%. Energy is the master currency. When viewed in that light, the Federal Reserve is only 0.75% above its 2.00% inflation target on average. Over the same period, the Federal Reserve’s balance sheet has gone from basically nothing to almost $9 trillion.

The orgy of money printing benefited financial asset prices, which in turn drove a drastic widening of global income inequality – but that kind of inflation isn’t what destabilises a government. That kind of inflation just makes a condo on 57th Street parallel to Central Park worth hundreds of millions of dollars. That kind of inflation makes your avo smash $25 at the Aussie cafes in any international financial centre.

We’re staring down a much scarier type of inflation today: food & fuel inflation. It’s the kind that brings everyone except the richest out into the streets – and it is gradually tightening its already iron grip on all the world’s developed and developing countries. The plebes don’t give a fuck what economic “ism” is supposedly practiced by the government of the squiggly line territory to which they belong. They are hungry and cold, and if those in charge don’t have an immediate solution, then off with their heads.

The government is in a bind. They must print money and hand it out to those who are suffering. But at the same time, the government must also make sure capital does not escape its grasp. In all of human history, the world has never been so indebted at such low interest rates. The losses to savings and capital in general will be stupendous because the debt must be inflated away. Because its two objectives are at direct odds with each other under a traditional financial monetary system – since not printing money leaves folks suffering, but printing money destroys capital via inflation – the government will need to lean on some sort of technological innovation to achieve both of its objectives and remain in power.

I believe that innovation will be the CBDC.

CBDC is the Answer!

Open up your wallet and take out your cash.

Reach into your pocket or handbag and grab your phone.

Now, try shoving your cash into your phone.

If this were Zoolander Part Deux, maybe that might’ve worked – but I’m guessing you just found out that the physics in the real world don’t check out.

A CBDC is government issued digital currency (i.e., digital cash) that exists purely in electronic form and allows you to defy the above physics lesson. It is base money just like physical cash – a liability of the central bank. This is different from the electronic money you are familiar with, which rides on the traditional commercial bank rails. That money – created by the banking system through loans – is made-up credit money, rather than a direct liability of the central bank (a la cold, hard cash).

The other big difference between CBDC’s and current electronic cash is that, due to the innovations afforded by blockchain technology, the government can program their CBDCs to be 100% under their control. It’s this additional level of control that will enable them to solve their two-pronged inflation problem.

In this CBDC dystopia, those who would otherwise be on the streets protesting the high price of food and fuel would be given e-money directly to increase the affordability of staples. Those with capital could be barred from investing their capital in anything other than government bonds that yield less than the rate of inflation – with those restrictions enforced by the actual coding of the currency itself, rather than just the law. This can all be done programmatically, with few (if any) errors.

That in and of itself is not pure evil. It is definitely no bueno from the perspective of savers, but it isn’t markedly different than forcing pension plans to hold a certain amount of below-inflation-yielding government debt as a “suitable” investment for their retirees. CBDCs make these policies easier to enforce than legislated regulations, though – by nature of their rules being hardcoded into the CBDCs themselves – and they can prevent citizens from taking their hard-earned money and escaping to gold, other higher-yielding foreign government bonds, or Bitcoin.

But what really makes the CBDC future a potential hellscape is the fact that governments never stop at the most innocuous use case for a technology when pushing that technology to its limits might benefit them. Instead, they go all out. And when wielded to their full capabilities, CBDC’s can be used by the government to directly control who is allowed to transact and for what.

Imagine you are the “other”. The others in any society are those who are economically exploited, either by virtue of their ethnicity, their immigration status, their religious beliefs, and/or their accent. Their exploitation is allowed to continue by the majority because the majority are led to believe the others deserve their lowly station due to their supposedly deficient qualities.

Now imagine that you and the rest of the others decide to try to change your circumstances by nonviolent means. You march, sing songs of protest, and generally engage in non-violent civil disobedience. You use social media platforms like Facebook, Twitter, and Weibo to organise and galvanise. Your movement grows to be quite large, and you decide it is time for a march on the capital to show the country how unjust its discriminatory policies are.

Prior to the big march, the movement continues to gain viral levels of visibility by effectively generating and disseminating heart-wrenching images from other smaller protests around the country. The government gets nervous. The police try to fight back by using tried-and-true tactics like firehosing and sicking attack dogs on you and your fellow peaceful protestors. Images of children mangled at the hands of the supposed protectors of the people sway public opinion against the government. That, as history has warned us, the government cannot abide.

The police inherit a new tool, the CBDC. Instead of carrying out overt acts against the protestors to stop the upcoming march on the capital, the police decide to ask Facebook, Twitter, Weibo and other platforms to hand over all data on anyone their algorithms believe were involved in the movement or sympathetic to it. On the days leading up the march, these individuals are completely frozen out of the financial system.

At this stage of the CBDC-verse, all economic activity between citizens occurs using digital money, and no other former currency (like physical cash) is accepted or even exists. The protestors and those who support them are thus unable to fill their cars up with gas, unable to purchase a bus, train, or plane ticket, unable to dine at a restaurant, unable to purchase food and water at the grocery store, and ultimately unable to organise effectively– so the march on the capital never materialises. You can’t march if you are starving or can’t get to the march in the first place.

There can be no social progress under this monetary regime because there is no way to effectively organise against the government when it can completely restrict the ability for citizens to engage in honest commerce. To the extent you believe in some sort of hell, this would be hell on earth. A static society where nothing changes. The dynamism that is the human condition can be forcibly squashed using this insidious tool.

Allies

When it comes to CBDCs, the plebes share a common foe with a powerful – if unlikely – potential ally: domestic commercial banks. Let me explain.

The power and profitability of banks stems directly from government-granted charters to legally print money via loan creation. Banks also benefit from a legal system that enforces financial contracts. This allows them to recover pledged assets with the threat of state-sanctioned violence hanging over any debtor that resists. The problem is that the bankers want to make profit, while the government wants power. Power and profit are usually tight bedfellows (although sometimes not), making this a somewhat contentious relationship.

The banks’ desire to make money via reckless lending always lands the government in political hot water. But the government has historically had no choice but to tolerate their antics, as banks – prior to the invention of CBDCs – have been essential in a functioning financial system. In particular, they have been better equipped to assess credit risk than the government, as they prioritise profits over politics. Bad credit is bad credit, regardless of which political party the debtor belongs to.

Because of their importance to the overall financial system, even when banks have fucked up and caused financial crises, the government has always had to step in, print money, and rescue the banking system, without being able to impose any real consequences for the havoc the banks wreaked.

But now, the government has a tool to completely take over the most important functions of a commercial bank – namely accepting, storing, and loaning the deposits of its citizens. This can all be done at a fraction of the cost and manpower of the commercial banking industry.

The government and the government’s bank, the central bank, have a few options with regards to how they choose to implement their CBDC. They can do one of the following:

- Create a network where nodes are commercial banks. The end user has an account with the bank, and the nodes are able to move data (aka money) around on the network. I will call this the Wholesale Model. The central bank backstops the commercial banks such that there are never digital bank runs.

- Create a network where there is only one node, the central bank. Every citizen has an account directly with the central bank. I will call this the Direct Model.

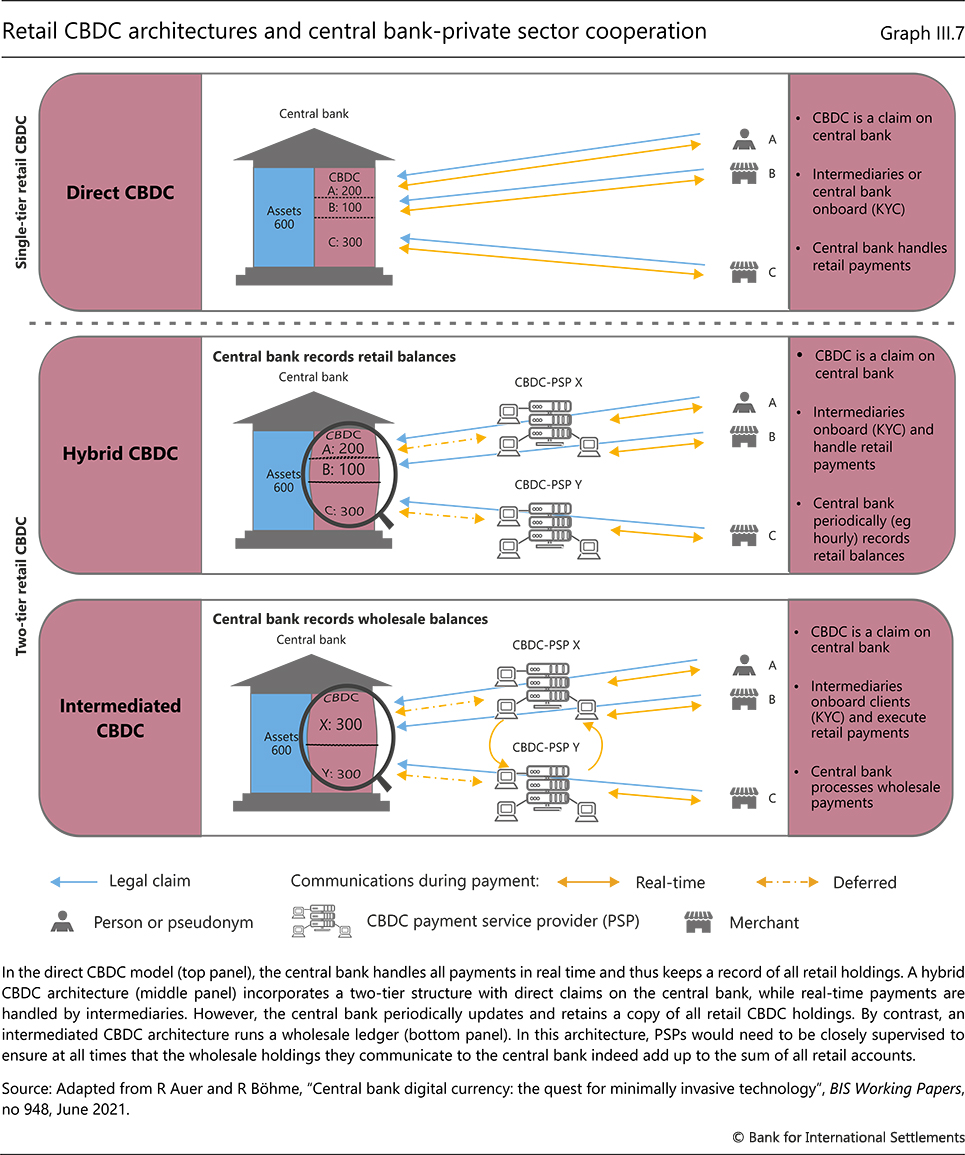

The Bank of International Settlements produced this nice infographic that categorises the various types of CBDCs:

The Wholesale Model I described above is an amalgamation of the Hybrid and Intermediated CBDCs listed in this chart.

The Wholesale Model

JP Morgan (JPM) and Bank of China (BOC) are two of the largest global commercial banks. They are both able to clear USD with the Federal Reserve. Let’s imagine that the Federal Reserve launches their own CBDC, which we’ll call FedCoin (FED). There are only two FED nodes, and they are operated by JPM and BOC, respectively.

As a US citizen (it could include foreigners, but let’s keep it simple), you either download the JPM app or the BOC app. On whichever app you choose, you have a digital wallet where your FEDs are kept. Moving FEDs between two accounts with JPM is an internal database transfer within the JPM ecosystem. Moving FEDs between a JPM account and a BOC account, on the other hand, requires JPM and BOC to agree on the transaction. It’s like the Bitcoin network, except it’s private and only JPM and BOC can validate transactions.

JPM and BOC compete with each other for FED deposits by offering attractive deposit rates. JPM and BOC then use their short-term deposit funding to make longer-term loans to businesses in FEDs.

The Federal Reserve is not a for-profit entity and therefore doesn’t charge JPM or BOC a fee for running a node. However, from time to time the Federal Reserve may ask for details on who did what on the network, and the banks must comply and furnish the requested data. The Federal Reserve may also direct the banks to lend at attractive rates to certain demographics, and/or conduct direct handouts by sending FEDs to JPM and BOC and instructing them to give them out to certain customers.

While JPM and the BOC are beholden to the Federal Reserve, they are one step removed from the government’s politics. That means they have their own priorities – namely, earning a profit – and they may pursue those priorities at the expense of the timely execution of orders from the Federal Reserve. In this model, the control of the government over the money supply is definitely greater than in an economy with physical cash – but given that the government relies on private organisations to effect policy, said policy may not be executed as written.

This model doesn’t improve much on the current FedWire clearing system for USD. The banking system is still operated by private banks who have profit-first motives. They are likely to bristle at policies that impact their ability to make money. The only major change is that cash is banned, so usage of digital payments is 100%.

The horror story of complete government control over citizen transactions I outlined in the previous section is still possible in this scenario, but it would require many more cooks in the kitchen to effect. And the more people involved, the more the process is at risk of poor execution.

The banks would obviously prefer this model. They still get to charge whatever they like as gatekeepers to the financial system, and they also get to remove a key competitor – physical cash.

Direct Model

The Federal Reserve builds its own app, which every citizen downloads. This app is the only means through which FEDs can be stored and transferred. The commercial banks can still obtain licences to take deposits and lend, but they compete directly with the Federal Reserve. Given that the Federal Reserve cares only for politics, the Federal Reserve can enact policies that, if banks followed suit, would send those banks into bankruptcy. Specifically, the Federal Reserve can pay the highest rates of interest on deposits and offer the lowest rates on loans, because it can operate at a negative net interest margin for as long as it can get away with it politically. The Federal Reserve can do this because it can never go bankrupt, since it’s the government. This makes it the safest place for citizens to deposit FEDs.

The commercial banks will quickly lose the entirety of their deposit base unless they are willing to go against the Federal Reserve. Here is an example: imagine that the Federal Reserve becomes a social justice warrior and tries to correct for certain of its citizens’ historical advantages due to wealth accumulated from slavery and other discriminatory practices. Under its new policies, Black Americans can deposit their money and receive 10%, and borrow to start businesses at 0%. White Americans can deposit their money and receive -1% and borrow to start a business at 20%.

A bank could counter that policy by offering a higher savings and lower business loan rate to whites than blacks. But, they would likely run into some problems, as there are anti-discrimiation laws on the books which apply to federally-chartered banks. This puts the banks in a bit of a pickle. There is a real business opportunity to offer better terms to a group the government wants to disenfranchise, but the compliance department says nein – and there goes that possible profitable business line. This example, while extremely oversimplified, illustrates why commercial banks cannot fight and win against the government under the Direct Model. The government can and will make rules that the banks have to follow and the government does not.

The Real World

Here is a quick summary of what the five major central banks have in place or plan to implement with regards to CBDCs.

People’s Bank of China (PBOC) – They launched the e-CNY using the Wholesale Model.

The Federal Reserve – The Boston Fed is studying the issue in conjunction with the Massachusetts Institute of Technology. They have yet to decide on whether to use a Wholesale or Direct Model.

The European Central Bank (ECB) – They have decided to implement the Wholesale Model but continue to study the issue.

The Bank of England (BOE) – They are studying the issue and have not fully decided whether to issue a CBDC at all – but if they do decide to, they have said they would implement the Wholesale Model.

The Bank of Japan (BOJ) – They are still studying the issue but have determined that when the time comes to implement their CBDC, they will adopt the Wholesale Model.

For more in-depth information about each of these government’s CBDC plans, please refer to the Appendix below.

Given that every country that has at least reached the “choosing a CBDC model” stage has opted for the Wholesale Model, it’s clear that no central bank wants to bankrupt their domestic commercial banks. Not even in China, where the biggest banks are all directly owned by the government. That tells you how much political power the banks have inside of the government. For politicians who care more for power than profits, this is their chance to completely destroy the influence of Too Big to Fail banks – and yet, they seem to remain politically unable to do so.

Certain Bankruptcy

How much business do commercial banks stand to lose globally if CBDC’s are introduced using the Direct Model?

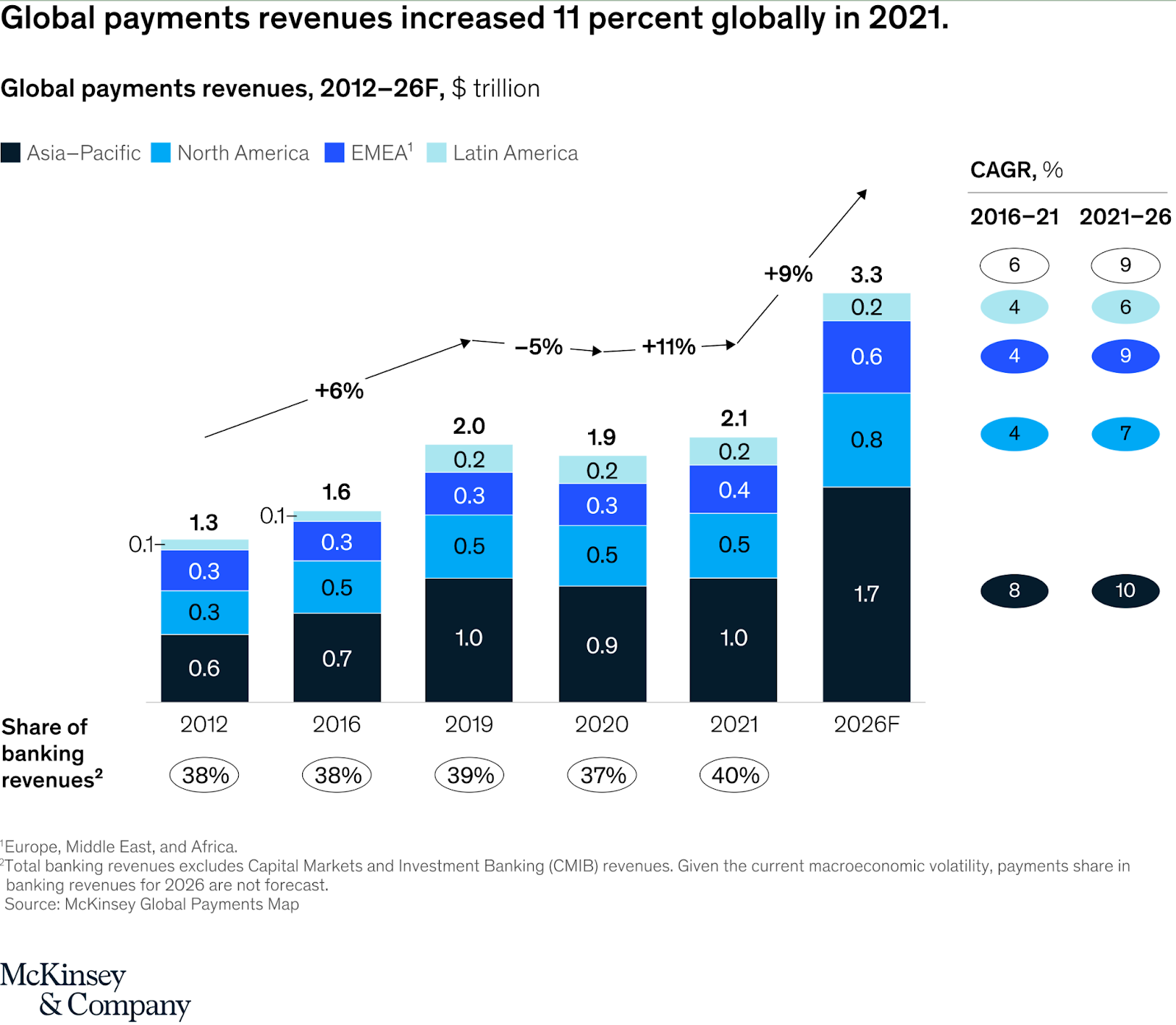

McKinsey published a very informative chart about the % of banking revenues that payments represent.

We can assume that if the government issued currency directly to the people, there would no longer be any need for the global payments industry. As of 2021, that industry represented $2.1 trillion worth of revenue, or 40% of total banking revenues.

So, $2.1 trillion worth of revenue hinges on which model is chosen for CBDCs– and that’s why the banking sector will do whatever it takes to still be included in the payments flow assuming that CBDCs come to pass.

The Competition

The CBDC discussion heats up every time the collective mainstream financial press publishes FUD about stablecoins. The stablecoins that have the largest circulation are those that hold dollars in the banking system against a token pegged at $1.

For every $1 token outstanding, the stablecoin issuer usually holds a combination of cash, short-term government bonds, and short-term corporate bonds. I pulled the latest public information on the 3 largest stablecoins, and estimated the Net Income Margin (NIM) and yearly revenue of each stablecoin:

|

Stablecoin |

Net Interest Margin |

Total Assets |

Yearly Earnings |

|

USDT (Tether) |

1.95% |

$66,409,619,424.00 |

$1,295,277,764 |

|

USDC (Circle) |

2.04% |

$47,479,523,938.00 |

$969,475,849 |

|

BUSD (Binance) |

3.14% |

20,967,956,737 |

$659,069,989 |

|

Total |

$134,857,100,099 |

$2,923,823,603 |

Booyakasha! That is a fuck-ton of revenue. But what about costs?

The beauty of running these stablecoins is that they cost a fraction of what it costs to run a bank.

A bank has thousands of branches, staffed with humans who demand a salary and benefits. A stablecoin has no branches, a handful of employees doing middle-office work, and the transactions take place on a public blockchain like Ethereum.

A bank must pay billions of dollars to build, secure, and maintain physical infrastructure that secures various forms of money like cash, coins, and precious metals. A stablecoin pays nothing for security. In fact, the user covers the security cost by paying a transaction fee to the network each time they wish to send value. On the Ethereum network, for example, you pay a gas fee in Ether each time you send a transaction on the network.

Banks pay billions of dollars for legal and compliance professionals to stay compliant with the law. A stablecoin must also pay these folks, but the business model is simply accepting fiat from a trusted counterparty and purchasing fixed-income securities. I wouldn’t imagine the total spend on legal and compliance for the three above issuers combined totals more than $100 million per year.

Just like a bank, stablecoin issuers love a rising interest rate environment. They don’t pay anything to holders of the tokens, so every time JayPow raises short-term interest rates, it puts more cash money in their pockets. This week JayPow increased short term rates another 0.75% – that’s an extra $1 billion in yearly revenue, assuming their NIM rose by an equivalent amount.

Now do you understand why banks HATE these monstrosities? Stablecoins do banking better than banks since they operate on almost 100% profit margins. Any time you read FUD about this or that stablecoin, just remember: the banks are just jealous.

Also, keep in mind that it’s the large, Too Big to Fail banks and financial intermediaries (TradFi) that take out glossy full-page ads in The Wall Street Journal, Financial Times, and Bloomberg. I haven’t seen many – if any – USDT, USDC, or BUSD ads in said newspapers. The TradFi players pay for the existence of these publications, so it’s not a large mental leap to argue that the coverage of direct competitors is likely to be negatively biassed.

The reason why stablecoins exist and are popular is because there is no competing CBDC. Should the Federal Reserve roll out FedCoin, there will be very little reason to use any of these solutions, as the FedCoin will be backed by the government and can never go bankrupt.

For those interested in the details on how I arrived at my revenue per year approximations for these stablecoin issuers, please take a look at this spreadsheet. Due to inconsistent and patchy disclosure about the assets held by the issuers, I had to make a number of assumptions. For example, I don’t know when certain securities were acquired, and I don’t know exactly what certain assets actually are, as they are described in quite generic terms. I do appreciate that Circle and Binance gave CUSIPs for most of the assets they hold. This sort of transparency should be copied by all to give the banks even less to complain about through their mainstream financial press mouthpieces.

The Supreme Antidote

I am pessimistic because I believe CBDCs using the Wholesale Model will be launched in all major economies. There is just no other way out of the current inflation pickle without tools like these to placate the plebes and financially repress the patricians.

I am also pessimistic because I know that genpop is too busy liking the latest dance video on TikTok to wonder first why their physical cash disappeared, and then why their financial sovereignty was openly taken from them.

On the other hand, I am optimistic because at least the most utilised CBDC model will be the Wholesale one, and the most negative aspects of this technology will likely be neutered by profit-hungry, Too Big to Fail commercial banks that operate at odds with power-hungry politicians.

I am also optimistic because today I still have the ability to buy the supreme antidote: Bitcoin. This window won’t last forever. Capital controls are coming, and when all money is digital and certain transactions are not allowed, the ability to purchase Bitcoin will quickly vanish. If any of this doom porn resonates with you and you don’t own at least a very small % of your liquid net worth in Bitcoin, the best day to have bought Bitcoin was yesterday.

Appendix

|

China’s e-CNY |

Backed and predominantly operated by the PBoC, China’s e-CNY is the most widely used CBDC in the world. According to Central Banking, “Transactions using the digital yuan surpassed 100 billion yuan ($14 billion) as of August 31, the People’s Bank of China reported on October 12, up from around 88 billion yuan in 2021. More than 5.6 million merchants can now accept payments. Users in the 15 pilot areas, covering 23 cities, executed 360 million transactions, the PBoC said.” These numbers are best contrasted with the statistics from late 2021, listed below. A report card from the Atlantic Council notes that the PBoC has not released official numbers on e-CNY adoption and usage since October 2021. However, earlier this year, some PBoC officials said that there are 261 million wallets, with total transaction values over RMB 87 billion (~$13.75 billion). Based on the more comprehensive October 2021 numbers,123 million individual wallets and 9.2 million corporate wallets were opened with a transaction volume of 142 million and transaction value of RMB 56 billion (~$8.8 billion). This means that the average balances are RMB 3 (~$0.47) for individual wallets and RMB 31 ($4.90) for corporate wallets. The relatively high number of wallets suggests that many wallets were opened, but are not being used for transactions or holding e-CNY balances. China has an operational architecture in which the private sector onboards all clients, is responsible for enforcing AML/CFT regulations and ongoing due diligence, and conducts all retail payments in real time while the central bank acts as backstop. The e-CNY directly competes with mobile / online payments services like Alipay (owned by Ant Group) and WeChat pay (owned by Tencent). Ant Group disclosed in 2020 that monthly payment volume averaged 10 trillion CNY, and they had 711 million monthly active users (MAU) as of June 2020. Tencent in its 2022 interim report disclosed WeChat has 1.3 billion MAU. It did not break out WeChat pay volumes. |

|

United States’s Project Hamilton |

The Federal Reserve Bank of Boston and the Massachusetts Institute of Technology’s Digital Currency Initiative (MIT DCI) are collaborating on exploratory research known as Project Hamilton, a multiyear research project to explore the CBDC design space and gain a hands-on understanding of a CBDC’s technical challenges and opportunities. While it has not seen any test runs yet, the project boasts impressive stats such as a TPS upwards of 100k. As of Phase 1, the Project has not yet decided on how it will handle intermediaries (i.e., which BIS categorization it will aim for). “The Bank for International Settlements (BIS) simplifies intermediary choices to three possibilities—the ‘direct’ model, in which the central bank issues CBDC to users directly, ‘two-tier’, in which the central bank issues CBDC to intermediaries who then manage relationships with users, and a hybrid of the two. We do not directly address intermediary roles in Phase 1” –Project Hamilton Whitepaper, 2. |

|

ECB |

Many of the details regarding the ECB’s CBDC are still under development. The ECB has indicated that they are interested in using supervised intermediaries, but have not specified in what capacity or role these agents would act. The current guidelines are:

Following the experimentation work done by the ECB and the euro area national central banks, in July 2021 the ECB launched the investigation phase of the digital euro project. This phase aims to identify the optimal design of a digital euro and ensure it meets the needs of its users. During this phase the ECB will also analyse how financial intermediaries could provide front-end services that build on a digital euro, with projected completion around October 2023. |

|

BoE |

In the words of the BOE, “We are looking carefully at how a UK central bank digital currency (CBDC) might work. But we have not yet made the decision to introduce one.” While they have released some discussions and papers regarding potential commercial impacts and technical options, they have not specified an architecture for central bank-private sector cooperation other than a preference for private sector intermediaries. The BoE released a proposed CBDC in 2020, soliciting feedback from the public. The paper outlined an illustrative ‘platform’ model for CBDC where the Bank would provide the core technology infrastructure and minimum necessary functionality for CBDC payments. This would then serve as a platform for private sector Payment Interface Providers (PIPs) to connect to in order to provide customer-facing CBDC payment services and any additional value-added services as part of a competitive and diverse payments landscape. Public feedback agreed the Bank should provide the minimum level of infrastructure for the system to be reliable, resilient, fast and efficient. But the private sector should take a leading role in responding to the needs of the end users, including by competing to provide them with innovative ‘overlay’ services using the core CBDC infrastructure. The BoE will continue to refine and develop the idea of a “platform model” in its CBDC exploration. Interoperability – the ability of users to switch with minimal cost in time or money – between CBDC and other forms of money, including innovations like stablecoins, is likely to be an essential requirement. |

|

BoJ Digital Yuan |

While the BoJ does not currently plan to release a CBDC, the Bank is exploring various design possibilities for an eventual implementation. As phase one of the BoJ’s investigation into CBDCs, the BOJ conducted a “Proof of Concept (PoC) Phase 1” from April 2021 to March 2022. The bank built a publicly available CBDC based around a ledger system. The BOJ experimented with all three designs simultaneously, collecting data regarding TPS, latency, and other KPIs. However, as the Bank moves into phase 2 they have not given an indication of which design (if any) they would implement. |

Related

The post appeared first on Blog BitMex