Abstract: On 10 November 2022, the Bitcoin SV (BSV) Association released a new hardfork client, BSV 1.0.13. This new client contains a potential hardfork protocol change. It is difficult to gain absolute clarity over what the upgrade enables or how it works. However, it appears as if the upgrade may allow anyone cooperating with miners or the administrator of a centrally controlled “whitelist” to confiscate any BSV coins from any user at any time. In the aftermath of the bankruptcy of FTX and concerns over the reserves of cryptocurrency exchanges, it may therefore be important for exchanges and custodians who support BSV, to understand and consider the potential security risks of the new BSV protocol.

Overview

Bitcoin SV (BSV) is a Bitcoin Cash spin off token which launched in November 2018. BSV is primarily promoted by Craig Stephen Wright, an individual who appears to have put forward various pieces of fraudulently generated evidence supporting the assertion that he is Satoshi Nakamoto, the creator of Bitcoin. BSV appears to be engaging in a major protocol upgrade. On 10 November 2022, a new BSV client was released. This client was released right in the middle of the scandal and storm generated by the failure of FTX, therefore it may not receive much attention or scrutiny. It is possible that the timing of the release could be a deliberate attempt to avoid scrutiny, although we have no evidence for this. The new version of BSV appears to include highly significant changes to the protocol, namely something called “confiscation transactions”. These changes may not be appropriately highlighted in the official release notes. In this report, we have attempted to explain the protocol changes and the potential ramifications and risks.

Explanation in BSV Release Notes

The release notes for the new BSV client, BSV 1.0.13, describe a process called “Digital Asset Recovery”. This includes a “confiscation transaction protocol”, which means transactions can have an OP_Return reference to a “court order”. The release notes say:

Introduces support for confiscation transactions, which when explicitly whitelisted can spend consensus frozen TXOs without providing unlocking scripts.

This appears to indicate that any BSV coins can be confiscated. This might mean that an entity who does not possess the private key or details to a script normally required to authorise a spend, can just arbitrarily confiscate funds and benefit from coins belonging to somebody else. The official BSV narrative appears to be that this feature will somehow mean the chain is able to comply with court orders to confiscate funds, which the proponents of the coin may argue makes the chain more legally legitimate. The claim is that the ability to confiscate coins only applies to UTXOs on a “whitelist” and this whitelist appears to be managed centrally in a private way. However, exactly how this whitelist process works has not been made totally clear.

Coin Confiscation Mechanism

What appears to be the most substantive code changes to the BSV client can be found here. We are not able to determine exactly what this change entails or how it works. However, after speaking to some Bitcoin developers, who have briefly examined the code, it appears that the coin confiscation mechanism may function as follows:

- Normal transaction validation rules are bypassed for a new special type of transaction, called “ConfiscationTx”. Therefore, for these transactions, the upgraded client will not check for authorisation before accepting a transaction as valid. (e.g. no signature is required).

- A ConfiscationTx just means the transaction has certain flags added to the script. These can be added by anyone to any transaction.

- A ConfiscationTx transaction is still likely to be considered a non-standard transaction, therefore one may need to cooperate with a miner to get it into the BSV blockchain.

- There is another new check implemented or which is attempted to be implemented, which checks if the ConfiscationTx is on a “whitelist”.

- The details around the whitelist are not included in the repository, therefore it is not clear what transactions are included in the whitelist or how transactions may be added.

- The intent of the developer appears to be that the whitelist check only applies when the block is within six blocks from the tip. Therefore, once a block has six confirmations, nodes may accept ConfiscationTx’s as valid, even if they are not on the whitelist.

In summary, it appears as if the upgrade could enable anyone to steal BSV coins belonging to anyone else, if they are able to cooperate with the miners. If these miners can make a winning chain six blocks deep, the theft may be successful. On the other hand, the administrator of the whitelist may only need to mine one block at any time to successfully conduct a theft. It should be noted that the analysis above is only based on a basic review of the code and we are unsure if the conclusions are accurate.

Potential Motivations For The Coin Confiscation Feature

One can only speculate on what the intentions are here, however it is possible that the whitelist administrator may wish to use the confiscation feature, although we have no evidence for this. There could be be two primary objectives:

- To make profits by confiscating the coins of others and then selling them into the market.

- To confiscate coins believed to belong to Satoshi Nakamoto or other large balances, to use as further fraudulent evidence to support the claim that Mr Wright is Satoshi.

For example, Mr Wright has long claimed the “Tulip Trust”, which fraudulently backdated documents say was created in 2011, may control over a million Bitcoin. It has been claimed the Tulip Trust owns 80,000 Bitcoin at the 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF address. However, these coins were actually stolen from MtGox in March 2011. After the BSV network upgrade, these coins could be stolen and spent. The thief could then sell these coins for profit or somehow claim that that control of these coins is evidence that Mr Wright is Satoshi Nakamoto. Of course, stealing coins believed to be mined by the apparent dominant miner in 2009, rather than ones stolen from MtGox, may be a slightly more rational approach in attempting to trick people into believing that Mr Wright is Satoshi. On the other hand, stealing coins this way, as a method of supporting the claim, is probably sufficiently absurd, such that which coins are stolen might not make that much difference.

Hardfork Timing

There is no date or activation methodology for the hardfork. The new BSV client, 1.0.13, simply relaxes the protocol rules. No chain split should occur until a block is produced which violates the old rules, as in one of these confiscation transactions is included in a block. This could happen at any time. According to data from Blockchair.com, as at 11 November 2022, there are 18 BSV nodes, 12 of which are at or near the tip. The nodes at or near the tip are all running BSV 1.0.11, which is the old consensus rules. There does not appear to be any nodes running BSV 1.0.13 at the moment. Therefore, a hardfork may not be imminent as there are no nodes to follow the new hardfork chain. However, this is still a security risk and a split could happen at any time. Anyone using BSV and any exchanges supporting BSV should be on alert from this point onwards.

Block Explorers

Perhaps due to the challenges of running BSV nodes, as at 12 November 2022, Blockchair.com no longer supports BSV. It is difficult to find a third party block explorer website that supports BSV. Coin.dance still supports BSV, however this is not a full block explorer. It is possible that the lack of any third party BSV nodes, due to the difficulties of syncing, could be a deliberate strategy from the promoters of the coin. The lack of nodes and block explorers could cause confusion over which chain to follow and it could increase the concentration of influence and control over the BSV chain.

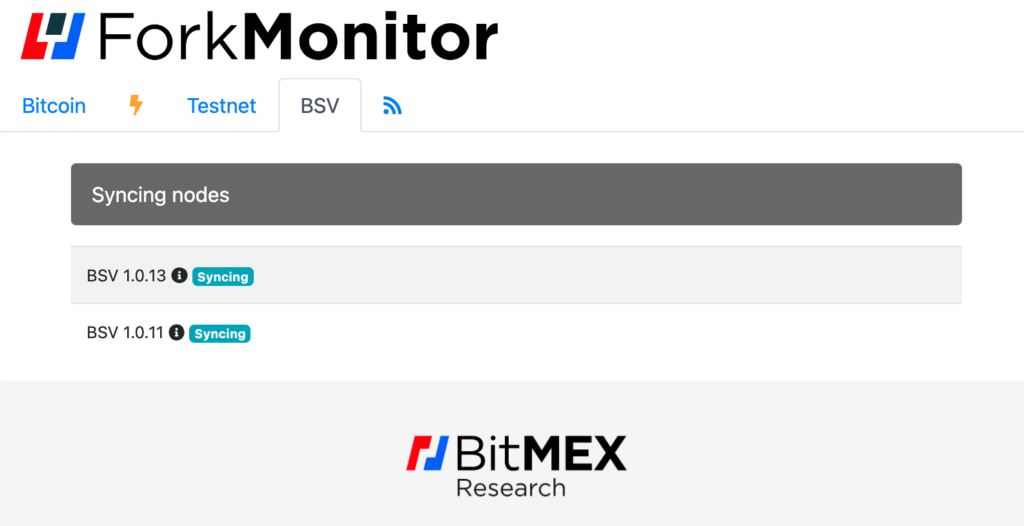

ForkMonitor.info

The BitMEX Research supported node monitoring website ForkMonitor.info ended support for BSV several years ago. The reason for this was that it was challenging to keep the node at the tip and it was considered that interest in BSV was declining. However, due to this coin confiscation hardfork, ForkMonitor aims to temporarily support BSV again, to help monitor events surrounding this potential hardfork upgrade and the new coin confiscation system.

ForkMonitor is running two clients:

- Bitcoin SV 1.0.11 (An older client which may not support coin confiscation), and

- Bitcoin SV 1.0.13 (A newer client which may support coin confiscation).

At present the two nodes are syncing.

Exchanges

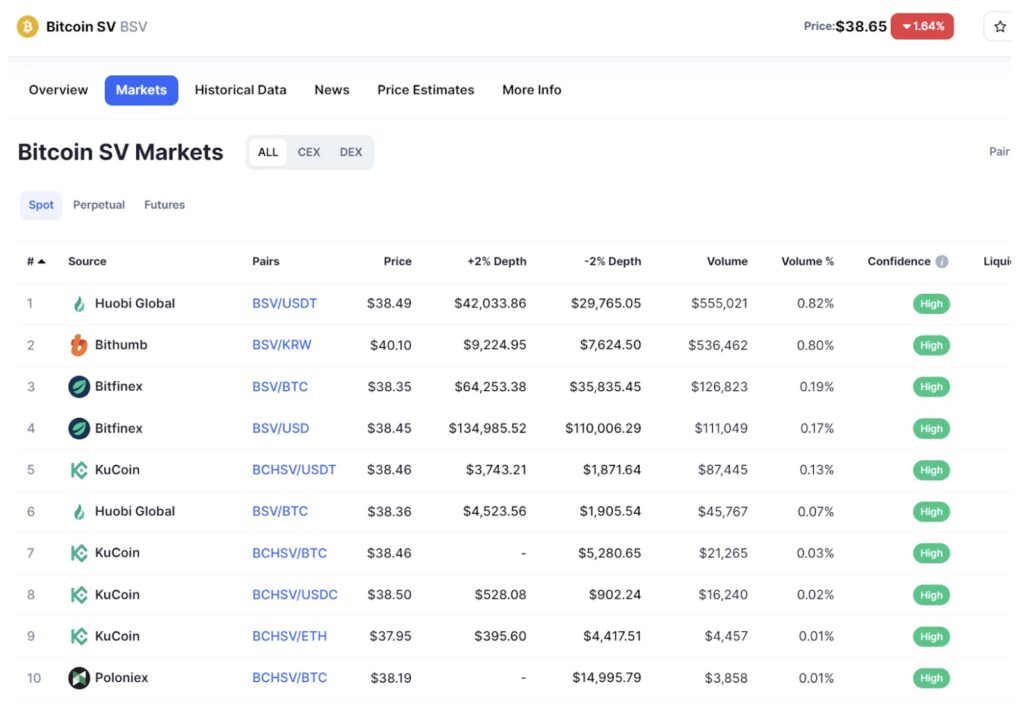

According to CoinMarketCap, the highest volume exchanges who support BSV are as follows:

Source: Coinmarketcap.com

There have been rumours circulating that Bitfinex have indicated that they do not like or support BSV, however they want to retain the listing of the token on their platform to make the market more resilient to manipulation (As in to make it more difficult for certain entities to pump up the price of BSV). Robinhood may also be a significant trading venue with respect to BSV and they are not included on the above CoinMarketCap list. Robinhood describes BSV as follows:

Bitcoin SV (BSV)-the SV stands for “Satoshi’s Vision”-was created in 2018 as a spinoff (aka a “hard fork”) of Bitcoin Cash (BCH), which itself was a spinoff of Bitcoin (BTC). Like Bitcoin, Bitcoin SV is a digital currency that can be used for peer-to-peer transactions.

Robinhood includes BSV in its “Bitcoin Family” of tokens, which it describes as “Bitcoin-based currencies”. These coins include Bitcoin, Bitcoin Cash and BSV.

Given the nature of this hardfork upgrade, there are potential security considerations for exchanges who support BSV. In the aftermath of FTX’s bankruptcy and renewed concerns about the solvency of exchanges, demands for proof of reserve systems are increasing. In this environment perhaps one should be careful and consider the potential risks before running BSV 1.0.13 in live production systems. If the hardfork upgrade occurs, it is possible that client funds may be at risk. Another risk for exchanges is that BSV tokens are stolen and the thief then uses one of the trading platforms that supports BSV as a venue to sell the stolen coins.

Related

The post appeared first on Blog BitMex