(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

There are many activities we modern humans engage in so that we can be more present. Mental clarity and internal peace takes on extreme importance in a global society addicted to their endlessly pinging, internet-connected devices.

One way I achieve mental clarity and live in the present is through skiing. As long-time readers know, I am an avid skier. There is nothing like a snorkel sesh in deep powder. Take a densely packed forest, add a steep pitch, and throw in a couple feet of fresh snow, and I’m in heaven. But, while that setup brings me pure joy, it is not without risk.

Skiing rapidly downhill through a thicket of trees requires 100% of your mental attention. Should your attention slip for just a moment, you might find yourself playing the age-old game of man vs. tree. And at the speeds I travel, tree always wins – with getting knocked on my ass being the best-case outcome.

PSA: Always wear a helmet when skiing. I refuse to ski with anyone who isn’t wearing one. I’m not going to be escorting your ass to the hospital because you didn’t want to look lame.

I got a lesson in being present last week during a day out cat skiing. Cat skiing is when you ride a cat – which is the machine that grooms the slopes – to get to the top of your runs. The resort that I was at could only be accessed by a cat.

The pièce de résistance of this resort is a back bowl called the E bowl (so imaginative, I know). Once you arrive at the top of the bowl, you traverse for 5 to 10 minutes and then drop into some seriously deep powder. I chose my line, dropped in, and was loving life.

The gully of the bowl was filled with wind-swept rollers that were fun to jump off of. As I was cruising in to meet the rest of the group I was skiing with, I took a bit of my attention off of the present task of skiing and started to think about the cold beer and burger I was planning to have for lunch. As I approached what I thought was a normal mound of soft powder, I looked down and saw dirt. It was a crack in the snow. I quickly jumped, and then pushed my skis and legs forward like I was in a long jump in order to catch the other side of the crevasse.

Thud … I hit the opposite snow bank awkwardly and used my momentum to barrel roll over my skis. I narrowly missed falling into the crack. If I had fallen into the crack I probably would have broken my skis and possibly tweaked my knee which, in the best case, would have ended my day, and in the worst case, ended my season. All this happened because I wasn’t giving 100% of my attention to the present task of skiing.

I made a similar mistake with my recent financial markets forecast.

You Can Sell

In my last essay, “Bouncy Castle”, I laid out my thoughts on scenarios in which the Fed might pivot. I argued that I was afraid that the Fed would pivot due to market dysfunction. If the Fed did decide to hit the “money printer go brrr“ switch, a nasty correction in all risky asset prices – including crypto – would precede such an action.

My concerns about this potential outcome, which I handicapped would most likely happen later in 2023, has led me to keep my spare capital in money market funds and short-dated US Treasury bills. As such, the portion of my liquid capital that I intend to eventually use to purchase crypto is missing out on the current monster rally we’re seeing off of the local lows. Bitcoin has rallied close to 50% from the $16,000 lows we saw around the FTX fallout. The jump hasn’t happened in a vacuum, either, as all manner of high-risk assets are on the upswing.

Park that thought for a second.

One day last week, as I was chilling in the gondola – playing on my mobile device and recuperating before my next run – I got to chatting with my K-pop star wannabe hedge fund bro. I asked him what he thought about the Fed’s recent meeting and policy decision. He thought it was super dovish, and revealed that he is fully invested in the markets. He made the decision to exit short-term treasuries and go long equities back in December of last year.

I asked him if he was afraid of the potential effects of Quantitative Tightening (or “QT” – i.e., the Fed reducing the money supply and lowering its balance sheet by $100 billion each month). As we know, risky markets move in lock step with the balance sheets of central banks – particularly the Fed’s.

Federal Reserve Balance Sheet (white) vs. S&P 500 (yellow)

He said that he isn’t concerned because he believes that the Treasury General Account (TGA) will be drawn down due to the US government hitting the debt ceiling. I won’t bore you too much with the technical minutiae of what that means, but the TL;DR is this: the US Treasury has about $500 billion sitting in the TGA (i.e., its checking account). The US Treasury can roll over expiring debt, but it cannot issue new debt – that is, debt that would increase the aggregate balance of US Treasury bills, notes, and bonds outstanding. So, if the Treasury wants to incur new expenses, it must pay for them out of pocket. That means the Treasury is likely going to spend all $500 billion of the TGA into the US economy, adding liquidity to the system and lifting risk asset prices. For a more detailed discussion of this please read “Teach Me Daddy”.

He said that he isn’t concerned because he believes that the Treasury General Account (TGA) will be drawn down due to the US government hitting the debt ceiling. I won’t bore you too much with the technical minutiae of what that means, but the TL;DR is this: the US Treasury has about $500 billion sitting in the TGA (i.e., its checking account). The US Treasury can roll over expiring debt, but it cannot issue new debt – that is, debt that would increase the aggregate balance of US Treasury bills, notes, and bonds outstanding. So, if the Treasury wants to incur new expenses, it must pay for them out of pocket. That means the Treasury is likely going to spend all $500 billion of the TGA into the US economy, adding liquidity to the system and lifting risk asset prices. For a more detailed discussion of this please read “Teach Me Daddy”.

I countered by pointing out that the rundown of the TGA is going to be a temporary thing. Sometime in the summer, the Treasury will have spent all its TGA money, the US Congress will vote to raise the debt ceiling, and the Treasury will get back to flooding the market with debt. At that point, the Fed will continue to shrink its balance sheet via QT, keeping the liquidity taps off and offsetting any market upside that a potential pause in rate hikes might bring.

His response was cutting and on point. He argued that it is a problem for the future, and that he could always sell. But right now– and I fully agree with him here – the dollar and global central bank liquidity situation is positive for risky assets. So he said he plans to live in the present, riding this potentially short-term wave of loose monetary policy and racking up some runs on the board.

I thought a bit more about what he said and emailed my banker to start pulling money from my money market funds and US treasury portfolio. Its intended destination? All aboard the S.S. Bitcoin, en route to a final port in Shitcoin City.

Am I Too Late?

Buying into Bitcoin when it is already up 50% off the lows is dangerous. Has the market already priced in all the easing to come over the next few months?

Remember March 2009, when the Fed began buying bonds as part of its Quantitative Easing (QE) money printing operation?

The S&P 500 rallied 40% off its lows. For the most heavily traded stock index globally, that’s a monster move in only 3 months. The market popped because it anticipated future easing. If you refused to participate after June 2009 because you thought it was all baked in … well, I’m sorry for your loss.

The S&P 500 Index continued to rally 440% from June 2009 until December 2021. It continued to rally because the Fed continued to supply the market with free money (via QE).

The S&P 500 Index continued to rally 440% from June 2009 until December 2021. It continued to rally because the Fed continued to supply the market with free money (via QE).

In a similar vein, part of my portfolio missed the early innings of this recent rally of Bitcoin – which was also driven by expectations of forthcoming monetary easing – but that doesn’t mean I should be obstinate and refuse to participate in the next part of the rally, which will be driven by the flows out of Reverse Repo Agreements and (as previously discussed) the spending of the TGA. Let me explain.

My USD Liquidity Index has three main components (see my article “Teach Me Daddy” for a full breakdown):

Size of the Fed’s balance sheet

Size of the TGA held at the Fed

Size of the Fed’s Reverse Repo (RRP) facility

We know that the Fed’s balance sheet will shrink $100 billion per month, which is negative for risk.

But we also know that the Treasury will draw down the TGA to zero due to the debt ceiling being hit. The TGA is at ~$500 billion currently.

That means the downside of the Fed’s QT over the next 5 months is likely to be cancelled out by the spending of the TGA in the US economy.

Before I get to the expected direction of the RRP, I need to first make an assumption about the market’s sentiment re: risky assets. In the Fed’s latest meeting, Sir Powell acknowledged that inflationary pressures are easing, and, depending on the data, the Fed may continue to slow down the pace of rate hikes or even pause them altogether. The rate of change of rate hikes is slowing, which, vs. 2022, is a major improvement for market sentiment towards risky assets. My assumption is that others – like myself – will remove money from money market funds and go long risky assets, causing the RRP balance to shrink. And when the RRP balance decreases, it adds liquidity to the system, which is positive for risky assets.

Money market funds make up the majority of participants in the RRP scheme because it offers a risk-free way to earn yield. It’s even less risky than owning short-term treasury bonds. That is because the Fed pays interest on RRP balances daily, while short-term treasury bills are zero-coupon fixed-income instruments – and there is always the risk that the US government decides to default on its obligations. And, given the yield difference between the two options isn’t that large, the prevailing wisdom is “why take more risk than you need to?” Money market funds have therefore piled into RRPs – and as people like myself pull money from money market funds to invest in asset markets, it causes RRP balances to decrease, which then increases liquidity in the market. Number go up!

So the TGA drawdown and the decrease in the Fed’s balance sheet will cancel each other out, but as the pace of Fed hikes begins to slow and market sentiment starts to turn more bullish, the RRP balance will shrink – which, all else being equal, is positive for risk at the margin. At present, there is slightly more than $2 trillion parked in RRPs, which is down approximately $200 billion year-to-date when you remove the 2021 end-of-year window-dressing effect.

New York Federal Reserve Overnight Reverse Repo Agreements

The Party Is On

The Party Is On

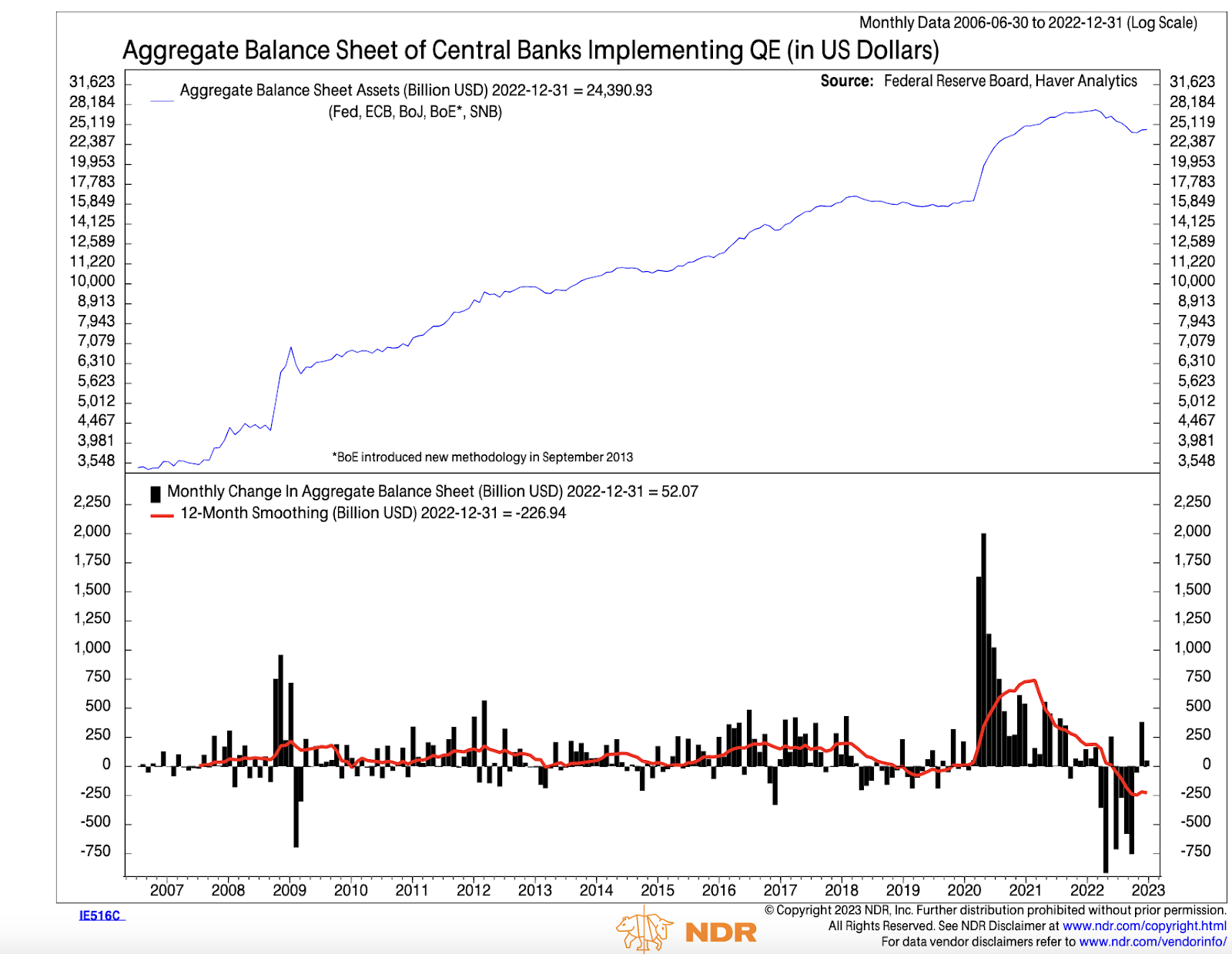

What are the rest of the world’s major central banks doing vis-à-vis money printing? Well, the below chart for NDR Research indicates that after a dismal 2022, the central bankers are returning to business as usual – i.e., printing dat monay by enlarging their balance sheets.

I have a doozy of an article in the works about how the Bank of Japan (BOJ) is on its way towards taking money printing to the next level. But for now, all you need to know is that the BOJ seems absolutely determined to ensure hyperinflation takes hold in the land of setting sun.

With this shift afoot across the world, all signs point to “Go Go Go!” globally – but this, as with all things in the universe, is a temporary phenomenon.

The Scary Future

The TGA will be exhausted sometime in the middle of the year. Immediately following its exhaustion, there will be a political circus in the US around raising the debt limit. Given that the Western-led fiat financial system would collapse overnight if the US government decided to forgo raising the debt ceiling and instead defaulted on the assets that underpin said system, it’s safe to assume the debt ceiling will be raised. And once the debt limit is raised, the US Treasury will have some work to do.

The Congressional Budget Office (CBO) estimates that the 2023 USG Federal Deficit will be in the range of $1.1 to $1.2 trillion. The US Treasury must issue bonds to fund that deficit. Given it could not do so for the first half of the year, it means that a gargantuan amount of debt must be sold for the 2023 fiscal year in half the amount of time.

While the Treasury is busy selling debt, the Fed’s policy as of right now is to continue reducing its holdings of US Treasuries by $100 billion per month. That is double trouble for risky assets. That would mean a massive amount of liquidity is being pulled from the market. The question then becomes – if inflation, the US labour market, and the US economy in general is softening in the second half of 2023, will the Fed on the one hand pause rate hikes (or even cut rates), while at the same time tightening monetary conditions by continuing to reduce its balance sheet via QT?

I asked Danielle DiMartino Booth (DDM) and the team at Quill Intelligence what they thought Powell would do in this scenario. DDM was a former Fed staffer and is quite plugged into how the Fed is thinking about the market. She told me that she believes Powell would in fact simultaneously cut rates while continuing QT. If that happens, it becomes a bit unclear as to what would have a greater effect on USD liquidity – the price of money (which would be decreasing due slowing rate hikes and would be liquidity positive) or the quantity of money (which would be decreasing due to the shrinking of the Fed’s balance sheet and would liquidity negative). I am in the camp that believes the quantity of money is more important, but we won’t know for sure until Sir Powell actually sets this scenario in motion.

I also pinged my macro daddy Felix Zulauf with the same question. He acknowledged that financial conditions are easing and will continue to loosen due to the TGA run down. In his view, if Powell was a real Paul Volcker acolyte and he wanted to continue tightening financial conditions, he should be increasing the pace of QT to offset the reduction in the TGA and RRP. But, he has not altered the Fed’s pace of QT, nor indicated that any changes to the pace of QT is in the cards. (Should Powell decide he wants to loosen financial conditions and step the pace of QT at the next Fed meeting, though, my bullishness would evaporate.)

In any case, with the Treasury flooding the market with debt and the Fed talking out of both sides of their ass, I would say this future is negative at the margin for risky assets. That means that, if you are planning to buy risky assets now, you need to be prepared to watch the market very closely and be ready to pound the sell button as soon as the TGA has been completely drawn down to zero but before the debt ceiling is raised.

Next Steps

Step 1: Correct Thought

I can’t always wait for the perfect setup. It’s time to get in while the getting is good.

Step 2: Raise Cash

I moved the portion of my liquid fiat money that I’m comfortable risking out of money market funds / short-term US Treasury bills and into USD cash, which I can then deploy quickly into the risk assets of my choosing.

Step 3: Buy Bitcoin

I’ll deploy over the coming days. I wish my size actually mattered, but it doesn’t – so please don’t think that when this happens, it will have any discernible effect on the price of the orange coin.

Step 4: Let’s Go Shitcoining

I believe there’s currently a narrative taking hold that is inspiring a lot of copy-pasta piles of shit to launch. I will give you guys an update on my thesis on this sector of dog shit once I have done a bit more research – but if Bitcoin and Ether continue to rally, there will definitely be a shitcoin vertical that goes bananas over the next few months.

The key to shitcoining is understanding they go up and down in waves. First the crypto reserve assets rally – that is, Bitcoin and Ether. The rally in these stalwarts eventually stalls, and then prices fall slightly. At the same time, the shitcoin complex stages an aggressive rally. Then shitcoins rediscover gravity, and interest shifts back to Bitcoin and Ether. And this stair-stepping process continues until the secular bull market ends.

Step 5: The Unwind

When the TGA hits zero, get out of the market. At this point, I have to sell everything that I bought from now until then, no questions asked. I must avoid falling in love with the piles of shit I own, and instead be a cold, hard market operator.

Of course, there could be some global political event that would spark a risk-off movement. I have a few in mind, and am currently noodling on how significant of an impact they could have on the price of Bitcoin should they come to bear. When I’ve thought those all the way through, expect a detailed essay relaying my findings.

For now, I am very mindful of the fact that nothing ever goes according to plan, and that I must maintain a flexible mindset. We are all Bayesians now!

Related

The post appeared first on Blog BitMex