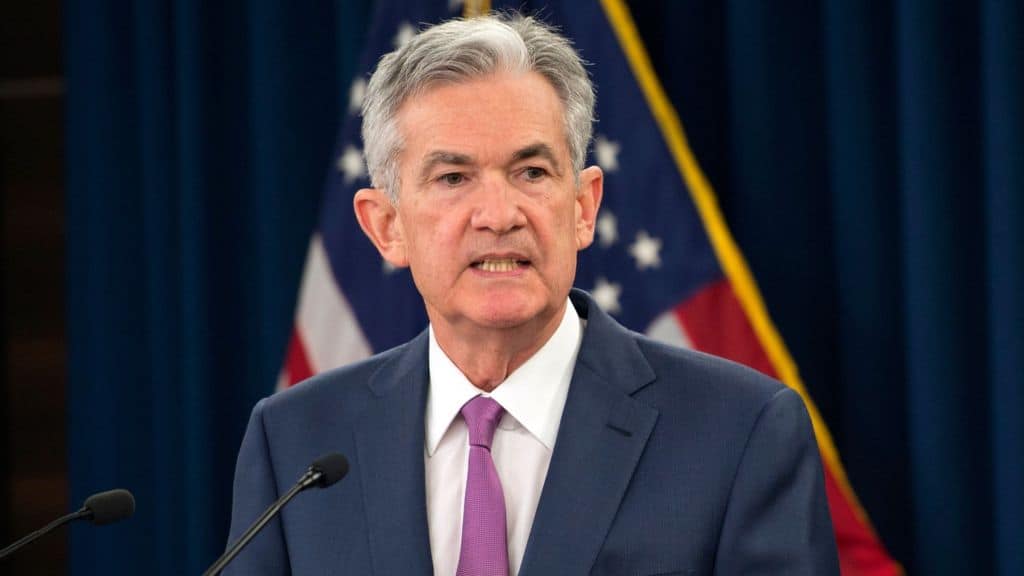

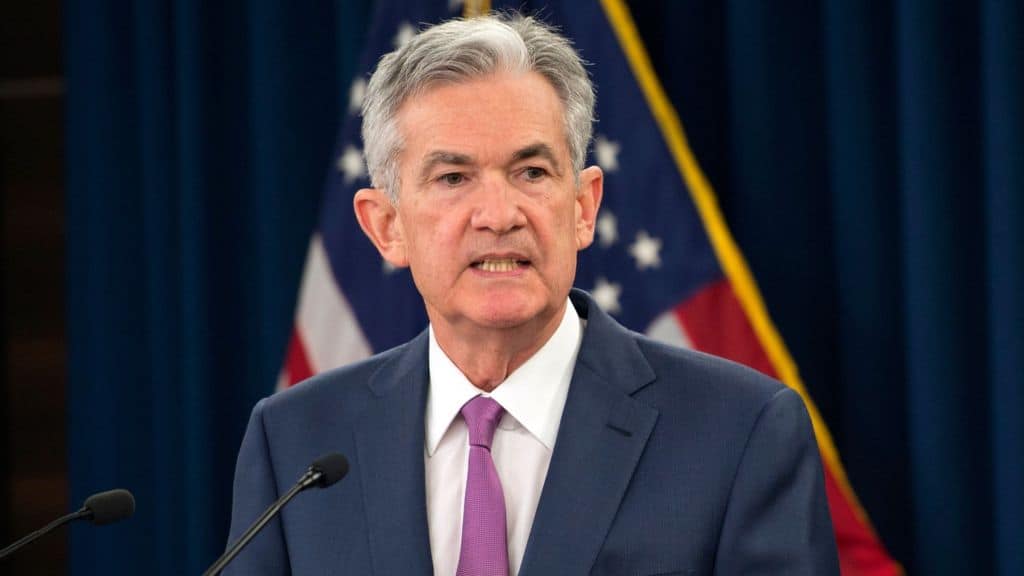

The likelihood of another Federal Reserve policy rate hike grew stronger on Friday after Fed Chairman Jerome Powell’s speech at the Jackson Hole Symposium.

- During the speech, Powell reiterated that the Federal Reserve remains committed to bringing inflation down to 2%, despite some economists suggesting that achieving that target may be difficult.

-

“Two percent is and will remain our inflation target,” said Powell. Getting there, he added, will require a “period of below-trend economic growth.”

- So far, the Fed isn’t getting the results it needs, as the economy “may not be cooling as expected,” he continued.

- Earlier this week, popular economist Paul Krugman wrote a piece for the New York Times, arguing that the Fed may want to target 3% inflation instead, arguing that 2% is “probably bad economics.”

- After the speech, the odds of a rate hike at the Fed’s next meeting in September rose to 19%, according to the CME FedWatch tool. Meanwhile, the odds of another hike this year rose to 52.1% – a two-month high.

- Rate cuts, which many expect will trigger more investment into crypto and stocks, are not expected until June 2024.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato