(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I might sound sarcastic and flippant when discussing war, and the death of precious humans. The reality is, I believe that the men and women who serve in armed forces around the world are to be applauded for being willing to risk their lives for the imaginary concept of the nation state. I am not willing to do so, and as such I believe I have no right to vote in favour of any nation going to war. Who I vehemently despise are the politicians who sit on their thrones with no skin in the game and send beautiful humans to war. Most of these politicians have no direct family members serving in the armed forces nor have they served themselves. Yet, they gladly will send others to their death for personal political and financial gain. War is not a video game, war is wasteful, war is nasty, war is deadly. So, I say to all these spinless charlatans, FUCK YOU!

The human experience is characterised by a sequence of events out of our control. You didn’t choose to be born or who your parents were. You are dealt a hand in life, and it is your reaction that defines who you are and your success or failure.

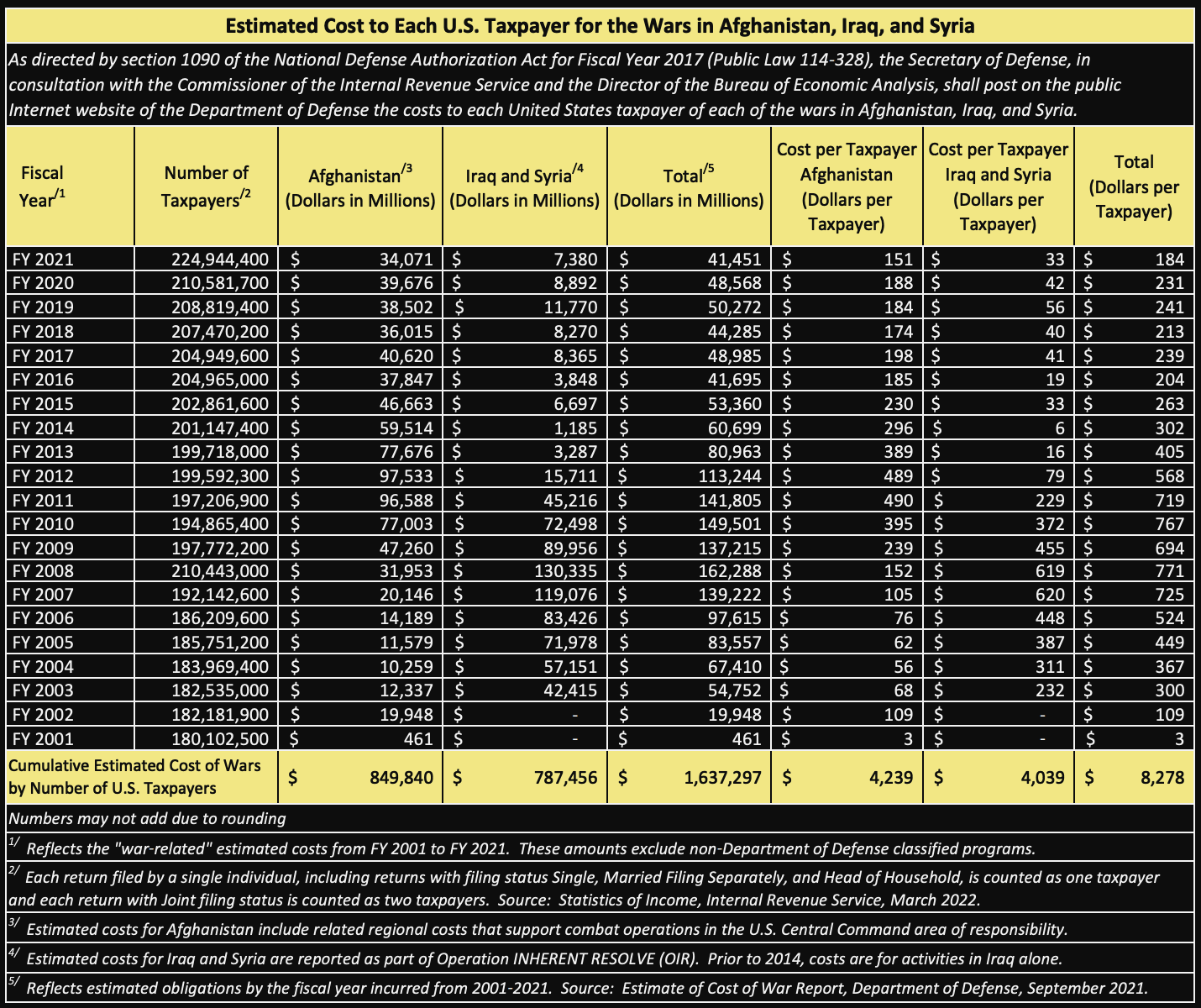

The reaction is more important than the precipitating event. The US declared “War on Terrorism” in response to the 9/11 attacks. Spanning three presidents and across both political parties, America fought wars in Iraq, Afghanistan, and Syria and many other places that are classified. What is left after over two decades of war on an idea with no objective measure of success? Millions of humans lost their lives and almost $10 trillion dollars were wasted. The thing that sparked this disproportionate reaction was an event that killed a few thousand Americans and destroyed a few buildings, which have long since been repaired or rebuilt.

Hamas’ October 7th attack on Israeli civilians has sparked Israel’s politicians to declare war on Hamas. Hamas is an organisation. But an organisation is just an idea held in the minds of humans. The only way to totally eradicate an idea, is to eradicate all humans who think it. As a result, Israel has responded with a war against Hamas and anyone who lends them support. I fear, and more importantly the market fears, that this ill-defined war on an idea will lead Israel down a path of continuous escalation against formidable adversaries both locally in the Middle East, and in the wider world such as Russia and China. The ultimate fear is that the US in supporting its pet and ally Israel will again get itself into another unwinnable and extremely expensive war on the periphery.

Empires fall due to multiple threats occurring simultaneously at the margins. Pax Americana is not directly threatened by anything that happens in the Gaza strip. But Pax Americana’s pet Israel requires billions upon billions each year to protect itself in a hostile environment. To Pax Americana’s patricians, this cost is worth it as it preserves the image of a strong America and embeds a fifth column in the oil-rich Middle East.

One cannot ditch any ally in a time of need – otherwise, your other allies cease to pledge allegiance to the flag. That is how America got dragged into the Ukraine vs. Russia war, and now the Hamas vs. Israel war. Therefore, Pax Americana must spend to the point of bankruptcy in order to support her ally Israel.

“Bankrupt the empire? How could a few hundred billion dollars bankrupt the juggernaut that is the American economy?” some readers might ask.

I admit that bankrupt is a strong word – I shall soften that statement to an increase in the cost of its debt to unaffordable levels. Once the debt becomes unaffordable for the government, the central bank must swoop in and print money to fund the government. And that’s when the fun really begins for fixed supply financial assets like gold and crypto. The long-end of the US Treasury market is rightfully discounting a future in which America is forced to spend billions and most likely trillions to fight wars by proxy not only in Ukraine, but now in Israel, and possibly the wider Middle East. The last time America entered the Middle East it cost $10 trillion; how much will it be this time?

Rather than get into a history lesson and speculations on military strategy, let’s just look at the market’s reaction to recent events. What I found interesting is how the US Treasury market reacted to recent statements from US Federal Reserve (Fed) board members and US President Biden. The financial instruments I will focus on are the 10-year & 30-year treasury bonds, and the long-term US Treasury bond exchange traded fund (ETF) TLT. Finally, I will compare how gold and Bitcoin reacted to the gyrations of Pax Americana’s risk-free reserve asset.

Mission Accomplished

The Fed believes it can vanquish inflation by raising borrowing costs via increasing its policy rate (Fed Funds) and reducing the size of its balance sheet, which consists mostly of US Treasury debt and mortgage-backed securities (MBS). When monetary conditions are sufficiently restrictive, which is an amorphous concept, they will stop raising rates. That is what Sir Powell has proclaimed repeatedly in various press conferences and speaking engagements.

During the press conference at the Fed’s September meeting, Powell essentially said that the Fed is very close to finished in its rate hike campaign. Subsequently, various Fed governors got on the speaking circuit and espoused views that the rising long-term rates (US Treasury yields >10 years) meant that the Fed no longer had to raise rates because the market was restricting monetary conditions as well.

Minneapolis Fed President Neel Kashkari noted Tuesday it is “possible” that further hikes may not be required.

– Reuters, 10/11/23

FED’S LOGAN: HIGHER YIELDS MAY MEAN LESS NEED TO RAISE RATES

– Bloomberg, 10/9/23

Rise in bond yields may substitute for a rate hike, Fed’s Daly says

– Bloomberg, 10/10/23

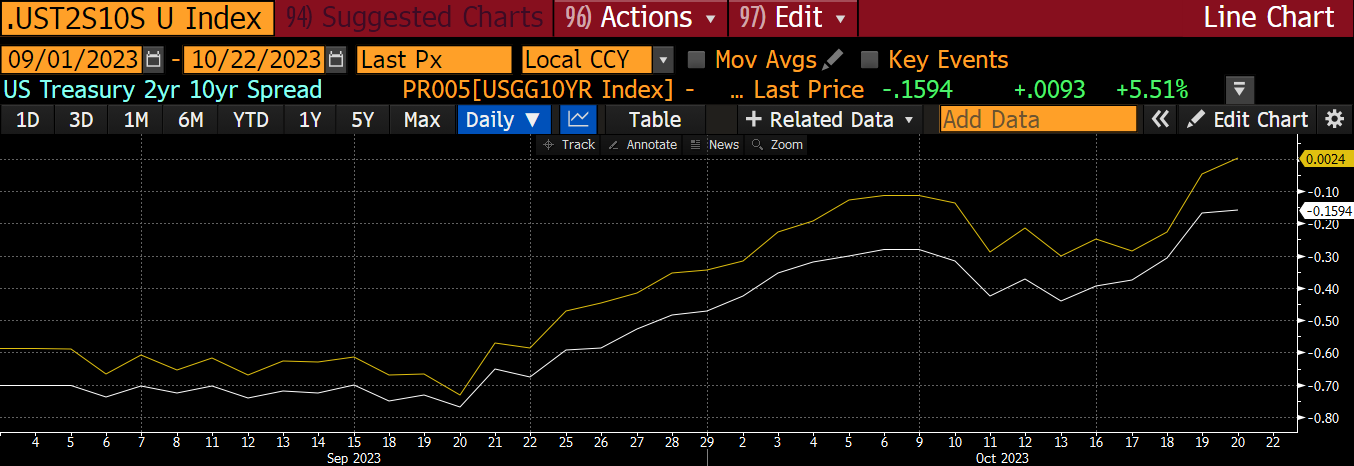

The Fed called off the dogs and the US Treasury market reacted by selling off sharply, which meant yields pumped. A phenomenon unseen in modern financial history began: the dreaded “bear steepener”. A “bear steepener” is a general rise in yields where the long-end rises more than short-end.

If the Fed isn’t going to fight inflation by raising rates, why should anyone own long-end bonds? That might seem counterintuitive, but put down that thirst trap TikTok video and think with me for a minute.

The spectre of inflation is still with us. The manipulated US government inflation statistic, the core consumer price index (CPI), is still more than double the Fed’s target of 2%. The Fed should keep raising rates until there is a recession, or some major financial services company goes bankrupt. Once either of those two things occur, then the Fed will cut rates as inflation would have declined due to a poor economic backdrop. The market is forward looking. Therefore, during a hiking cycle, as long as the Fed is committed to raising rates to kill inflation the yield curve will invert at some point (long-end rates lower than short-end rates) because the long-end investors anticipate a weaker future economy.

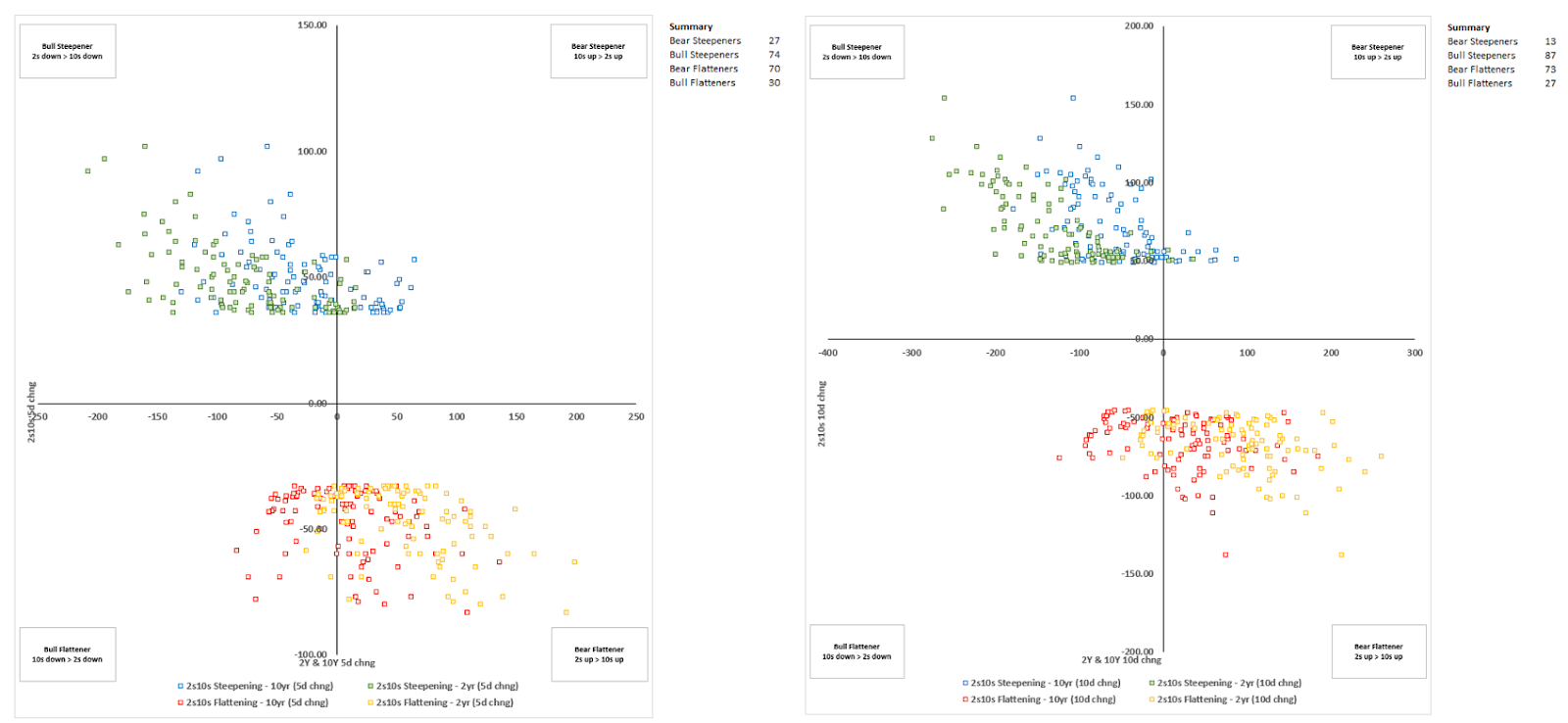

When the recession or financial calamity occurs, short-end rates will fall quickly as the Fed aggressively cuts its policy rate in response. That is the “oh shit” moment. The yield curve un-inverts and then steepens (long-end rates higher than short-end rates), but it will do so while yields are generally falling. This is called a “bull steepener” and is the classic way the yield curve has moved in modern financial history.

Right now, there is no US recession and no financial calamity. To the intellectually dishonest TradFi cheerleaders like Paul Krugman, the regional banking crisis doesn’t count; they will need to see a firm like Bank of America go bust to acknowledge the deep rot in the US banking system. Therefore, the market, aka bond vigilantes, expect the Fed to continue raising rates to fight inflation. But the Fed said rate hikes are paused, therefore the bull steepening scenario won’t occur. Then why should the vigilantes continue holding long-end bonds? They won’t, and they will express their view by selling long-end bonds at the margin.

2-year minus 10-year Yield (white), 2-year minus 30-year Yield (yellow)

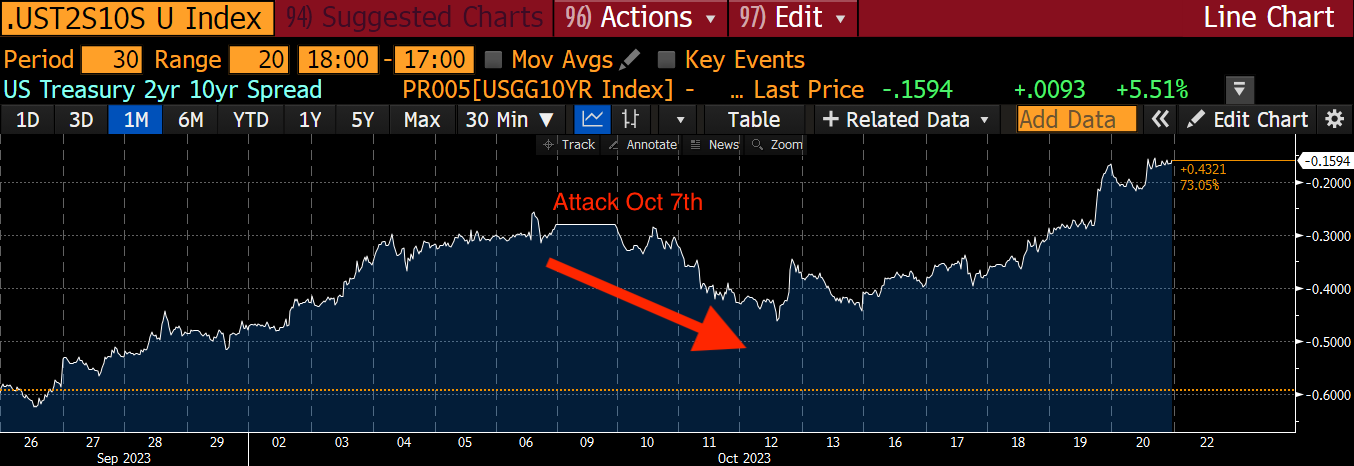

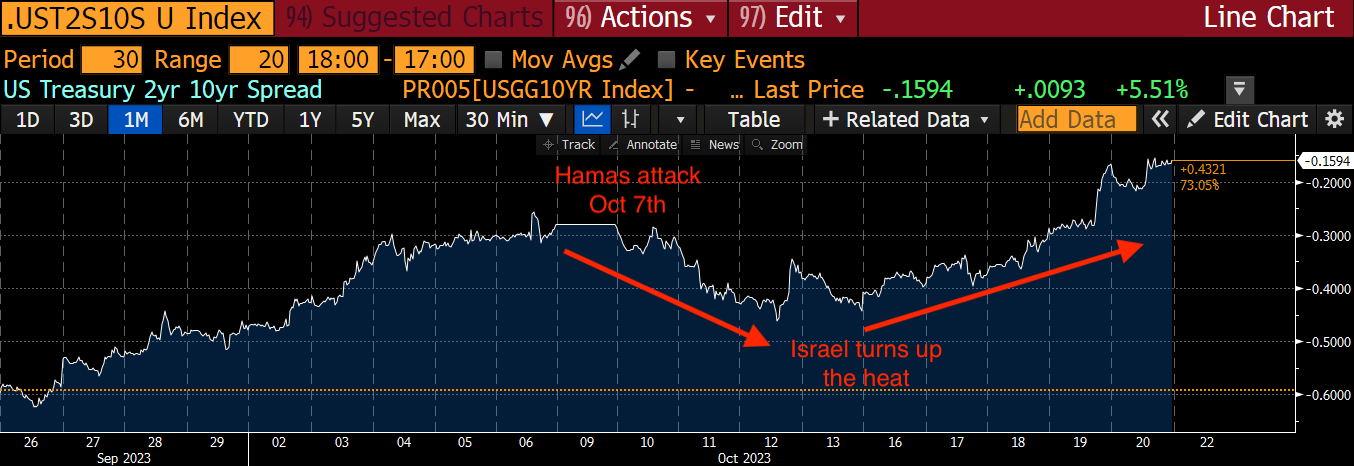

The Fed September meeting concluded on September 20th, look at how the bear steepener got worse immediately after the Fed said it was pausing.

In addition to the Fed not doing its job, concerns about the gargantuan amount of debt the US Treasury must sell to fund the government are suddenly relevant. It’s not like this data wasn’t known already – anyone can download the debt maturity and sales schedule which plainly show the oncoming debt tsunami. The market only started caring after the Fed communicated a possible pause, and we can observe this through various op-eds by famous investors in the mainstream financial press.

In recent weeks, the bond vigilantes have been challenging Yellen’s policies by raising bond yields to levels that threaten to create a debt crisis. In this scenario, higher yields crowd out the private sector and trigger a credit crunch and a recession. Since the root cause of the problem is profligate fiscal policy, the government would have to cut outlays and boost taxes to placate the bond vigilantes, which would exacerbate the recession.

Source: The Financial Times

The Fed is chickening out on raising rates, the federal government is spending more money than Sam Bankman-Fried on Adderall, and the market is throwing a fit. But why is a bear steepener so dangerous for the financial system? Well … let me tell ya.

Lions Tigers and Bears OH MY!

To understand why this market structure is so toxic for the global financial system, I need to go a bit deep on bond maths and fixed income derivatives. I will attempt to limit the amount of jargon, but for those who really want to understand this please get out your trusty John C. Hull derivatives textbook. I used to keep a copy at my desk when I worked for the devil in TradFi.

Let’s use a mortgage as a simple way to illustrate what happens to a bank’s hedging strategy when interest rates rise. To start, I’ll examine a 30-year fixed rate mortgage where the borrower has the option to prepay the principal in part or full whenever they like with no penalty. Once the bank makes the loan, a mortgage sits on its balance sheet and must be hedged.

What risks does a bank face due to this mortgage? There are two risks: interest rate risk and prepayment / duration risk.

Next, I’m going to talk about mortgages and short US Treasury bonds. When you short a bond, you receive money, but pay the advertised yield. E.g. If I short a $1,000 face value bond at a price of 99% with a yield to maturity of 2%, I receive $990 today, pay 2% in interest each year, and must repay the $1,000 principal at maturity. I’m being a bit loose with the bond maths, but you get the idea.

I’m going to use the term duration a bit loosely here. To be exactly correct, a long bond with a duration of 10 years will decline in price by 10% for a 1% rise in interest rates. A long mortgage bond has a negative duration, a short US Treasury bond has a positive duration. A bond with a positive duration makes money if yields fall, and loses money as yields rise.

Interest rate risk

The bank offered a fixed rate for the entire 30-year loan. The bank doesn’t know its deposit rate that far in the future. Remember, a bank borrows money from depositors on a short-term basis to lend out at a higher rate long-term. If interest rates rise and the deposit rate alongside them, then the bank could suffer a loss. Imagine if the bank originated a mortgage at a 3% fixed rate and deposit rates rise to 6%. The bank will lose money because it receives 3% from the mortgage borrower but pays 6% to depositors who provided the capital. Therefore, the bank must sell some treasury bonds to hedge those losses.

Prepayment / duration risk

What if the bank decides to short bonds? Maybe that can mitigate the losses it suffers on the mortgage loan. If the bank is receiving 3% on a mortgage, and shorts a bond with a 2% yield, its profit is 1%. That’s all great, but what bond maturity should be shorted?

Imagine you are the trader who must manage the bank’s mortgage portfolio. You would think that if you have a 30-year mortgage you should short a 30-year bond. Wrong.com. Because the borrower can prepay their mortgage!

If rates fall, the borrower will refinance. That means they will take out another mortgage at a lower interest rate and use the money they received to pay back the higher rate mortgage. Suddenly, what you thought was a 30-year asset vanishes and you are left naked short a 30-year bond. You no longer receive any income from mortgage payments to offset the money you are paying on the bond. In short, you’re fucked.

If interest rates rise, the borrower will not refinance and stick with the original cheaper mortgage. However, you can still get into trouble if you didn’t short a bond with a long enough maturity. Once the bond matures, you must pay back the principal. You now need to fund the mortgage that is still on the books, with deposits. Given interest rates have risen, the rate paid on deposits is higher than the rate received on the mortgage.

As a bank, the duration or length of your mortgage increases and decreases in line with interest rates. Therefore, your future expectations of interest rates determine how long of a hedge you purchase.

Look at the upper right quadrants – they represent the occurrences of a bear steepener. It’s sparse. That makes sense because in the past the Fed has usually raised rates, sparked a recession or financial crisis then cut.

A bank’s trading desk will use this historical data to inform their expectations on the future path of interest rates and hedge accordingly. Today’s interest rate regime is not in the models and as such banks and every other financial intermediary who deals with any type of bond or interest rate product is not hedged properly. As rates rise in a bear steepening fashion, the duration of the bonds held on bank balance sheets extends. Because bonds lose money in an exponential fashion as rates rise, this is called “negative convexity.” Trading desks start showing massive losses because their hedges’ duration is too short.

So, what’s the solution? As rates rise, traders must short more and more bonds of longer maturities. At this point, the bank could enter into a negative convexity death spiral.

Here is the negative convexity death spiral for a bank’s trading desk:

- Bear steepener increases.

- Trading book duration increases.

- Total bond portfolio losses increase as the bank is now net short duration.

- Traders short more bonds to flatten duration, which causes bond yields to increase more.

- The duration of the trading book increases.

- Repeat steps 2 through 4.

I used a mortgage hedged with treasury bonds as a simple example. I know that mortgage desks don’t hedge exactly in this manner but using this simple example allows readers to get the general idea.

We can’t forget the real issue here, which is that during and after the 2008 Global Financial Crisis, the Fed and every other central bank cut rates to zero or near zero, kept them there, and printed money to buy bonds in order to suppress yields. The result of this was simple for pension and insurance funds, who, with their enormous pools of capital in the tens of trillions, must earn a high enough yield on their assets to pay out benefits in the future: search for yield. Why? Because they have an entire generation of old people who retired (or are retiring) and likely need sick care paid for by pension and insurance funds. Sick care and the costs of living aren’t growing at a 0% rate, therefore the pension and insurance funds must juice yields somehow to make good on the financial promises made to Boomers.

Fixed income desks at global investment banks, being a primary source of yield for pension and insurance funds, stepped in and gladly sold their clients products that offered higher yields. It’s a bit ironic since rates were dropped to zero and money printed to save TradFi from their folly, and they turn around and earn money selling products to help institutions harmed by these same money printing policies. But how can these products offer higher yields than government or corporate bonds? The banks accomplished this by embedding options. The client sells an interest rate option and receives a premium, which manifests itself in a yield pick-up. The most common product is a callable note structure.

For the sake of completeness and accuracy for those who understand this, I must print this quote from David Dredge, my OG volatility fund manager:

In technical speak, the structuring bank ends up long a series of what is called Bermudan Swaptions, which they go out and hedge based upon the stochastic future probabilistic path of the duration, i.e. the probability of a call date. As rates rise, the probability of a call in subsequent years lessens, and they move their “hedges”, which results in selling of vanilla swaptions, further out in tenor.

Let’s bring that back to what happens in the swaps market. My next question to Dredge was, “So to keep this simple, when dealers face the oh shit moment my model is fucked they all rush to sell a Greek that in the spot market leads to selling of long-end bonds?”

Dredge responded, “As the bear steepener grinds away, dealers have sold too many back-end payer swaptions, they will find that they have over sold back-end vega and under sold bonds (technically under paid swaps, but same difference).”

Underneath the veneer of record-breaking profits is a ticking time bomb hidden in the recesses of Too Big To Fail global banks. I’m talking about the likes of JP Morgan, Goldman Sachs, BNP Paribas, Nomura, etc. They sold trillions of notional worth of these products to desperate pension and insurance companies, and now will find themselves gushing losses larger than Three Arrows Capital. To hedge and stop the bleeding, these banks all must trade the same way. The more they hedge, the more they lose. All of this is due to the bear steepener, which is a direct result of Fed and global central banking policy. Talk about a TradFi human centipede.

The size of the problem is partially invisible to global banking regulators. These products are traded on a bilateral basis off-exchange. Banks are required to report some things and not others. Banks and their clients do everything in their power to legally mask the risks. The banks want bigger bonuses based on accounting profits by strapping on more risk, and the clients don’t want to own up to their insolvency. It’s a fucking total cesspit of wilful ignorance. As a result, no one knows at what interest rate percentage everyone blows up or what the magnitude of the losses could be. But rest assured, global citizens – your central bank will print what’s necessary to save the filthy fiat financial system when it’s on the brink of collapse.

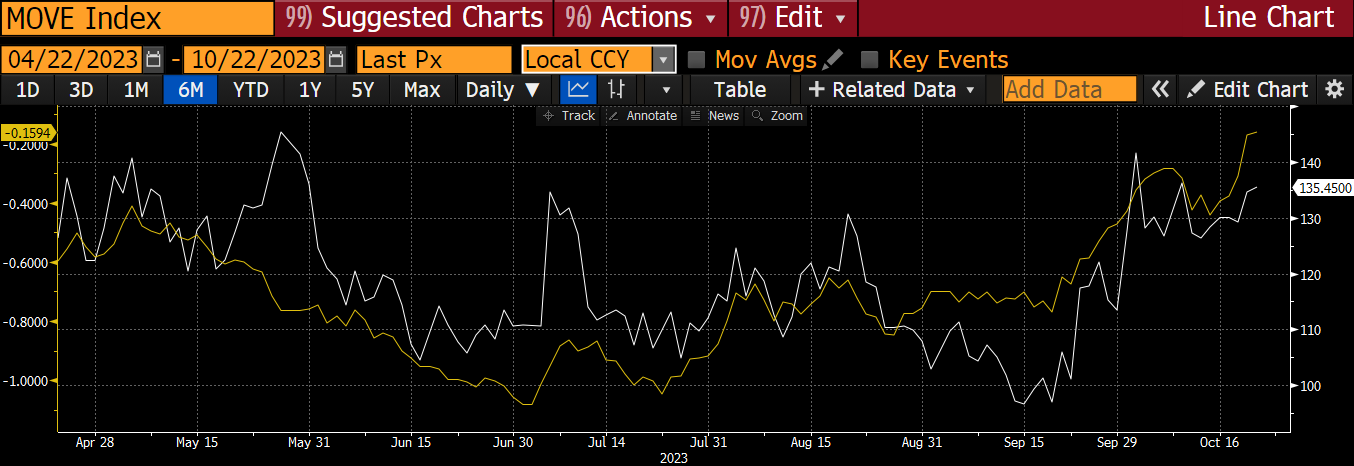

We know something unusual is afoot because the bond volatility measured by the MOVE index is rising alongside yields. That tells me that selling is begetting more selling in an exponentially increasing fashion. This is what causes the heightened volatility. And then suddenly, the market will go KLABOOM! And seemingly out of nowhere a dead carcass of a systemically important TradFi player will surface.

MOVE Index (white), 2-year minus 10-year Yield (yellow)

They look very correlated.

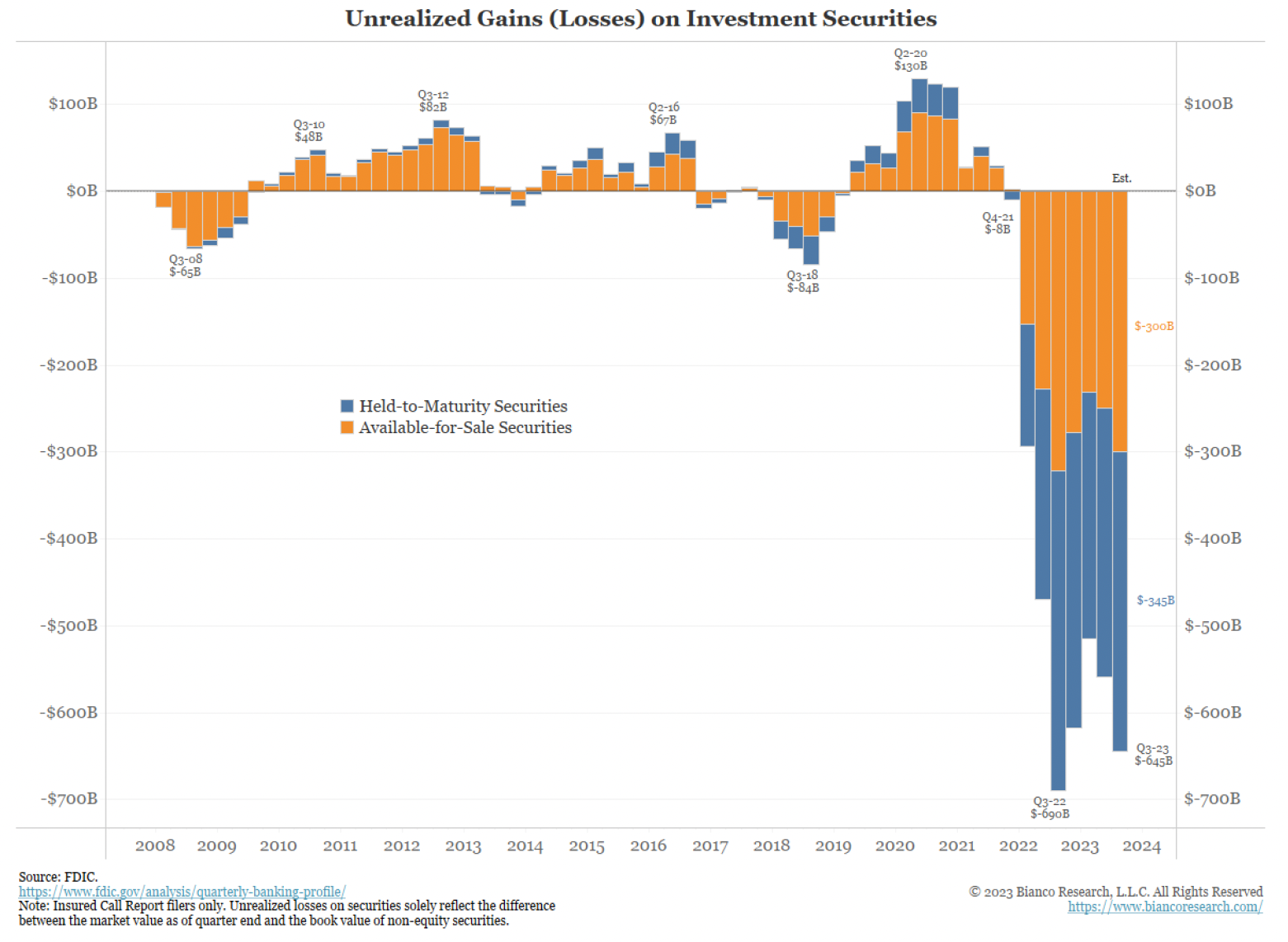

The Fed knows this, which is why they are trying their hardest to spin the story that their policy operates with a lag and therefore they must pause to “study the effects”. How long you gonna sit and wait, Sir Powell? The real reason they are pausing is because while raising rates would hopefully keep a bear steepener from occurring, the regional US banks will start biting the dust again if the Fed keeps raising rates. Remember, depositors would rather bank with the Fed and earn 5.5% or more than keep their deposits earning much less and risk their bank going bust. The regional banks are fucked – but instead of a jackhammer fucking due to continuous Fed rate hikes, the fucking is slow and rhythmic as the bear steepener thrusts on. Also, let me remind you that the US banking system is sitting on close to $700 billion of unrealised losses on US Treasuries. Those losses will accelerate as long-end bond prices continue tanking.

The Fed and US will step in to save the regional banks en-masse once a few more fail. The authorities demonstrated that earlier this year with Silicon Valley Bank, First Republic and so on. But what the market doesn’t believe yet is that the entire balance sheet of the US banking system is de facto government guaranteed. And should the market, and more specifically the bond market, come to that view, inflation expectations are going to MOON, and long-end bond prices will dump even further.

The point of that sojourn into what a bear steepener is and how it fucks the banks is meant to educate you on why the long-end rates will rise very quickly in a reflexive fashion. It also illustrates yet another problem facing the Fed and US Treasury.

Knee Jerk Reaction

Back to the Hamas vs. Israel cage match. When the markets opened the Monday after Hamas’ initial October 7th attack on Israeli civilians and soldiers, US Treasury bonds rallied, yields fell, gold was slightly lower, and oil slightly higher. The commentary was that investors were fleeing to the safety of the most pristine asset of Pax Americana, the US Treasury bond. America is strong, America is mighty, America is just, America is where capital goes when it is scared. Yeeehaw!!!

Does that make any sense?

On first blush, the muted reaction of oil meant the market didn’t believe this conflict would bleed over into the wider Middle East. Hezbollah kept its cool on the northern border in Lebanon, Iran had some strong words, but it didn’t appear they would get directly involved. US President Biden and his administration tried to calm the tense situation. They didn’t come out and try to blame the perennial US boogieman, Iran, for this attack, even though some US senators automatically called for a strike on the Islamic Republic. The market had lots of hope.

Oil prices might rise slowly over time as Saudi Arabia’s crown prince Mohammed bin Salman (MBS) maintains oil production cuts. The rumour was that MBS would increase output after the normalisation of Saudi and Israel relations. But that détente is now off the table as MBS needs to stand strong with his Arab and Muslim brothers and sisters. More to the point, young Saudi’s are very pro-Palestinian. MBS had no choice but to stand fully behind Palestine.

The market snorted another line of hopium and bought US Treasury bonds (especially long-end bonds). The 2s10s curve going more negative in the immediate aftermath illustrates this.

But as things dragged on it became clear that Israel would not go quietly in the night.

Instead, Israeli prime minister “Bibi” Netanyahu proclaimed the Israel Defence Force (IDF) would hit back at Hamas hard and strong. He authorised the IDF to exterminate Hamas, and proclaimed that their actions would be felt for generations. Bibi be bringin’ in the heavies.\

Every Hamas terrorist is a dead man

That’s all well and good, but Israel is surrounded by Arab and Persian countries that believe Palestinians are suffering in an apartheid state. If Israel hits back too hard, these Arab nations, fearing domestic unrest themselves due to a population urging them to do something to protect their religious and ethnic kin, must respond. To add to that, a potential refugee crisis with Palestinians moving into neighbouring countries creates issues. Specifically, many other Arab countries don’t want Hamas’ ideology challenging their rule, which is why they prefer them to stay across the border in Israel. The big question is, would Iran and its proxy Hezbollah engage in open conflict with Israel?

If Iran’s in, does that mean America is in? Israel’s aggressive foreign policy is predicated on unwavering American support. And then what about Russia? Does she get involved by proxy if her ally Iran is facing down America? And if Russia is involved, how does China respond?

Lots of questions, no easy answers. How ‘bout dem US Treasury bonds?

America spent $8 trillion on Afghanistan, pulled out disgracefully after 20 years, and that was a war of hide-and-go-Reaper-Drone-seek against broke-ass farmers. How much would America spend supplying the Israelis to fight Iran, who would have the implicit or explicit backing of Russia and China? Things that make you go hmmmmmm ….

Biden kept repeating that the US stands by Israel, but as the expected war costs started mounting, the US Treasury market resumed its selloff. The curve went back to bear steepening. Nothing dramatic happened, and then Gaza’s largest hospital got bombed.

Pax Americana’s Conundrum

I am a cynic, as you can tell. And I repeatedly say that the most important thing in politics is re-election.

Israeli Prime Minister Netanyahu is currently on trial for bribery, fraud, and breach of trust. The trial is still ongoing. About the best thing an embattled politician can hope for is a war that causes fearful plebes to support their leader at all costs. =

Hamas’ attack was terrible for the folks who died and are still in captivity, but it’s rehabilitating Bibi politically. As such, he must respond in the most aggressive manner possible to assure the Israeli citizens – and probably those judging his guilt or innocence – that he will keep them safe and therefore is the man for the job (that job being the eradication of Hamas and its ideology).

Israel’s aggressive response has already resulted in large swaths of Gaza reduced to rubble, and thousands of Palestinian civilians killed – presenting a problem for the Pax Americana ruling elites. The whole world is looking at Biden and wondering, is this the sort of behaviour America condones and financially supports?

America can support Israel and risk getting dragged into a war with Iran and others in the Middle East. For whatever reason, Iran said its red line is a ground invasion of the IDF into the Gaza Strip. That’s one flashpoint.

Israel has rendered the Damascus and Aleppo airports useless via aerial bombings. Syria is a client state of Russia. Russia, which has been an ally of Israel, is distancing itself. If the US supplies the bombs that are used to destroy an ally of Russia, what will Russia’s response be? Would that response require US military intervention in another part of the world?

Those are just two examples. I’m sure there will be more as Israel continues bombing portions of the Middle East back to the Old Testament.

Biden could tug on the leash and reel in his pet by telling Israel that there is a limit to what America will support. The threat being that if Israel continues on this tact, America’s pocketbook is shut. Seeing this, other American allies would reconsider whether doing what America says is worth it. That is because many governments have marginalised minority groups that agitate for a larger political say or piece of the economic pie. These minorities are sometimes kept in place by force. Application of this force could be embarrassing for America, which supposedly stands for human rights. Without American support, co-existing with antagonistic neighbours would be more difficult for many allies.

The Pax Americana elites can’t win. Whichever way they go on their stance towards Israel weakens the empire. The empire will either spend trillions on wars to help Israel fight foes in the Middle East; or the empire’s allies will start defecting if it becomes clear that they could be excommunicated if their domestic actions are called into question.

Hamas provoked a reaction, and now the empire has to make a choice. There are no good choices left for this sunsetting empire. No good deed goes unpunished.

Now let’s move on to which path Pax Americana has taken.

Back to Sand Land

The effects of Israel’s military campaign reflected so poorly on it vis-a-vis its Arab neighbours, that when Biden attempted to meet with many of these leaders they backed out at the last minute. Ultimately all Biden did was land in Israel and affirm that the US stands by Israel no matter what. I think a zoom call would have sufficed and saved the American taxpayer a few million dollars in travel costs.

As the Israeli military response escalated and America stayed silent, the US Treasury market resumed its selloff. It became increasingly clear that the future cost of assumed military support to Israel, and other allies who would surely be challenged, was being discounted by the market.

How you feeling ‘bout dem US Treasury bonds?

The Budget

After the address to the American public explaining why the US had to stand behind Ukraine and Israel, Biden asked the US Congress for $105 billion. Here is the breakdown:

$60 billion in funding for Ukraine

The US continues to throw good money after bad. The war is at a stalemate. Ukraine has squandered hundreds of billions of US taxpayer money, and Russia sits firmly in territory taken at the outset of the war. In Biden’s speech he mentioned Russia’s President Putin many times as an example of a heinous dictator that must be defeated. It doesn’t seem like the US is trying to extricate itself from this quagmire.

$14 billion to Israel

This is just the start of the unwavering support Biden has pledged from America to Israel. Biden basically said America will do whatever it takes to ensure Israel has what it needs to continue its war against Hamas.

America is definitely in this war. Over to you, Iran?

If Iran gets involved, the amount of support to Israel will be in the trillions of dollars, and be sent faster than the time it takes to approve the Blackrock Bitcoin ETF. Don’t you ever fade the bald white man from New York City!

$10 billion in humanitarian aid to Ukraine and around the world

The reason why Ukraine needs aid is because weapons keep Ukrainian president Zelensky and his ragtag bunch of conscripts fighting. Stop funding the war and more humanitarian aid isn’t needed. Again, Biden will keep coming back to US Congress for more money if America stays the course assuming those in charge actually even know what that course is.

$14 billion for border funding to address drug trafficking and fentanyl

Some argue that the fentanyl crisis is a modern-day Opium War waged on American soil. China was forced at the point of gunships in the 19th century to allow the British empire to deal drugs on a colossal scale within its borders. A lot of the most iconic buildings in Shanghai on the Bund and in Hong Kong were built by opium drug dealers such as Jardines, the Kidoories, the Sasoons, etc. This was not illegal; the British parliament sanctioned it. Cheerio!

Could it be that some country(s) are not cracking down on cheap fentanyl being exported to America? Whoever is responsible, it is yet another attack on the American periphery, with no end in sight.

$7 billion for the Indo-Pacific and Taiwan

The US is busy trying to win friends and influence people over in Asia. Former US President Obama launched the pivot to Asia over a decade ago. To contain China, the US actively courts countries like India and the Philippines, and supports Taiwan, Japan, Australia, and New Zealand.

I bet we start seeing more aggressive sabre rattling out of China regarding the Taiwan situation, especially if the Taiwanese elect a pro-independence presidential candidate in January 2024. I don’t think China will attack Taiwan. But if China can force America to spend more treasure supporting Formosa, then that weakens the financial might of the empire. This is the exact same playbook the US used to undermine the USSR, ultimately leading – at least in part – to its disintegration. Force your enemy to keep spending money on a military buildup out of fear, and in the process corrode their domestic economy to the point of no return. What was nukes to the Soviets, will be ever-expanding military aid from America to Taiwan and other Asian nations.

A billion here, a billion there, and soon you are talking about real money. The bond market listened to Biden’s speech, read his budget, and threw a fit. The morning after, yields surged.

If you are a long-term US Treasury hodler, the most worrying thing is that the US government doesn’t believe it is spending too much. This is what US Treasury Secretary Yellen had to say when she was asked if America can afford two wars.

Sky News: Can America, the West, afford another war at this time?

Grandma Yellen: America can certainly afford to stand with Israel and to support Israel’s military needs, and we also can and must support Ukraine in its struggle against Russia. The American economy is doing extremely well.

Source Sky News

Whelp, cue the market selloff in long-term US Treasuries.

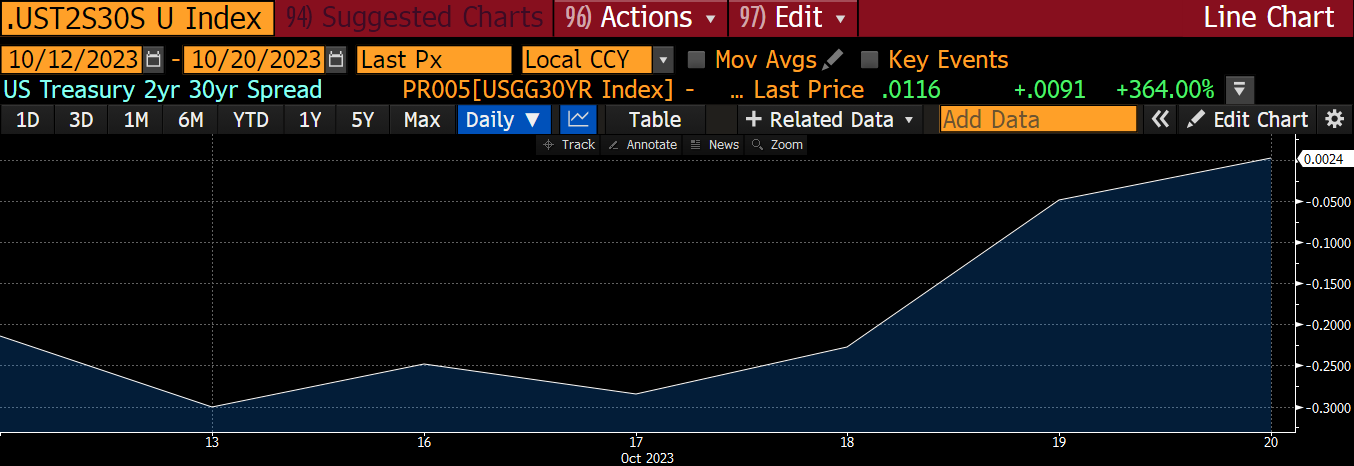

2-year Minus 30-year Yields

The 2s30s went positive for the first time since mid-2022.

If US defence spending is entering ludicrous mode, then there will be trillions more borrowed to support the war machine. As America enters a true wartime economy, Biden referenced all the Americans who have jobs producing death goods like bullets – as if that justifies spending money – and they crowd out production of other goods and increase inflation. A worker making bullets, tanks, and bombs is a worker that isn’t making cars, cleaning adult diapers, or saying “Do you want fries with that?”

That is why bonds are selling off and yields rising.

But the more important development is the price action in gold and Bitcoin.

Ever since Israel turned up the heat on Gaza, gold has caught a bid. It is discounting a future where the US support of Israel escalates this conflict, possibly drawing in Iran. Because you don’t want to own bonds of a nation fighting two forever wars, investors are beginning to park wealth in an apolitical safe haven like gold.

Bitcoin didn’t respond much at all when the Hamas vs. Israel conflict started. But it has rallied sharply, breaking above $30,000 as US Treasury yields rose and the bear steepener re-asserted itself.

Gold nor Bitcoin yield anything. Therefore, if they are rallying while US Treasury yields spike, that tells me that both safe haven assets are discounting a future of more government spending and more inflation.

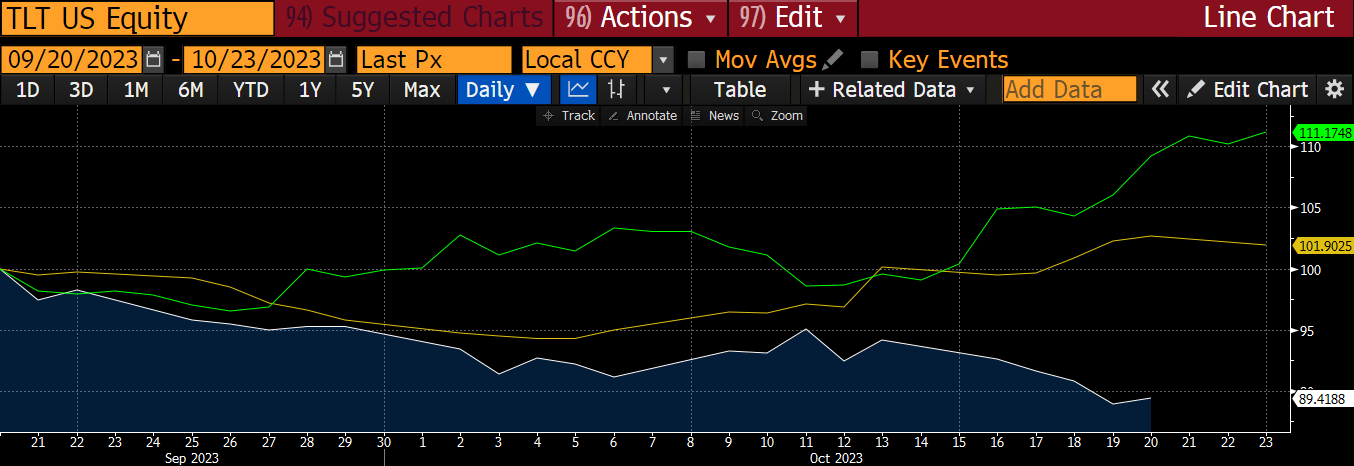

Bitcoin (green), Gold (yellow), TLT (white)

Since the Fed’s September 20th meeting, TLT (aka long-term US Treasuries) dumped 11%, Bitcoin pumped 11%, and gold is up a modest 1%. The market is worried about inflation, not growth, which is why Bitcoin and gold are rising alongside long-term yields.

I have spoken mostly about the US in this essay and its financial and moral predicament. But if the world devolves into various proxy fights between the US vs. Russia / China fought in various locations? All major economies must ramp up production of war materials to hand to their allies. As an example, due to increased train traffic between North Korea and Russia, some speculate North Korean leader Kim Jong Un is supplying Russia with ammunition and weapons to continue fighting. A dollar, ruble, yuan spent on a bullet is a dollar, ruble, yuan not spent on producing things we need like food. Everything costs energy, there is no war without inflation.

If this is the new reality, I don’t want to own the bonds of any country. It’s bad news bears all around. Gold and Bitcoin are starting to tell us this.

The Flows

Let’s put this all together.

The Fed told us rate hikes are on pause until inflation is vanquished. As a direct result, the US Treasury bond vigilantes threw a fit. They started dumping long-end bonds at the margin. As such, the yield curve steepened in a grizzly fashion (rising 2s10s and 2s30s). This kicked off a reflexive action by global banks that must sell more bonds in one way shape or form, which results in volatility rising alongside yields.

The US, as Biden indicated, will stand firm behind its ally by providing an open-ended commitment to spend whatever is necessary on arms to support Israel’s war effort. Added to Ukraine’s tab, America’s military budget is set to truly explode – especially if Hamas’ allies, such as Iran, respond by entering the fray via its proxies. This will increase future government borrowing, and the sky’s the limit when it comes to the sums of capital a war can waste. Therefore, bonds are selling off and yields are rising on a future expectation of the expanded US expenditures on peripheral wars.

The structural hedging needs of banks and the borrowing needs of the US war machine reflexively feed on one another in the US Treasury market.

If long-term US Treasury bonds offer no safety for investors, then their money will seek out alternatives. Gold, and most importantly, Bitcoin, will begin rising on true fears of global wartime inflation. What will I do with my portfolio?

Ideally, I wanted to wait for a financial blowup or the Fed to pivot and start cutting rates. But rarely does the market give you exactly the setup you desire. Biden is attempting to commit America to another open-ended conflict. Of course, the US Congress could say no, but there are scant few politicians with enough backbone to oppose the military industrial complex, and fewer who will take a stance that doesn’t support Israel. If Afghanistan chewed up $8 trillion, how much would a war with a real adversary like Iran waste?

Bitcoin spiked above $30,000 on false rumours that the US Securities and Exchange Commission approved the Blackrock spot Bitcoin ETF. When crypto Twitter began to suggest that Cointelegraph (the source of the rumour) probably went 100x yolo long, published the fake rumour, and then dumped on the plebes, the price of Bitcoin quickly retreated to $27,000.”

But now, directly after the Biden speech, Bitcoin – along with gold – is rallying against a backdrop of an aggressive selloff in long-end US Treasuries. This isn’t speculation as to an ETF being approved – this is Bitcoin discounting a future, very inflationary global world war situation.

And the end game, when yields get too high, is for the Fed to end all pretence that the US Treasury market is a free market. Rather, it will become what it truly is: a Potemkin village where the Fed fixes the level of interest at politically expedient levels. Once everyone realises the game we are playing, the Bitcoin and crypto bull market will be in full swing.

This is the trigger, and it’s time to start rotating out of short-term US Treasury bills and into crypto. The first stop is always Bitcoin, then Ether, and finally my beloved shitcoins. I’ll start small in case I’m wrong, but you can’t sit on the sidelines forever waiting for the perfect setup. The perfect setup is usually staring you right in the face, and you are just too preoccupied with the past to notice.

Related

The post appeared first on Blog BitMex