In an industry that moves like no other, crypto has had a year like no other. As 2023 rounds to an end, we’ve taken a look back at the top 10 events that transpired and how they shaped our industry.

TL;DR?

- Markets had a bearish entrance into 2023 while battling the aftereffects of FTX and a challenging macroeconomic backdrop.

- A banking crisis in March with the collapse of Signature Bank, Silicon Valley Bank, Silvergate, and Credit Suisse et al brought a ray of light to crypto winter.

- Bitcoin price accelerated its recovery with talks of Bitcoin spot ETF applications from Blackrock, Fidelity, and other TradFi juggernauts.

- The BUIDL market returned to Bitcoin and Ordinals reached an all-time high, pushing Bitcoin on-chain transactions to new heights.

- The SEC started receiving increased pressure to clarify crypto regulation after going to battle with Kraken, Coinbase, and Ripple – subsequently over 40 countries announced their regulatory frameworks.

- Sam Bankman-Fried was convicted on all seven charges, facing up to 115 years of imprisonment.

- Binance pleaded guilty, paying a $4.3 billion fine to the US Department of Justice and CZ stepping down as CEO.

- The Solana ecosystem overpowered Ethereum with new project rollouts and improvements, leading to a 500% increase in the value of SOL.

- Meme coins made a comeback through the likes of PEPE, SHIB, DOGE, and BONK.

- Pre-IEO listings began to gain popularity, with BitMEX standing at the forefront.

TradFi Tragedies

The 2022 Aftermath

The topic of macroeconomics and inflation undoubtedly dominated all conversations this year – the Fed raised rates to the highest in decades, central banks were undergoing further monetary tightening, and economies were struggling with the effects of the COVID-19 pandemic.

For context, the Fed executed its fastest rate hike in history – there were seven hikes in 2022 alone, with four more following in 2023.

The Banking Crisis

Challenging macroeconomic circumstances meant customers’ risk appetite was low and government bonds became the preferred class of investment. Banks underwent pressure to service long-term debt interests on a much higher cost of capital with inflation – and it didn’t take long for the first high-risk bank to crack.

Customers began to panic and withdraw their funds which led to runs on various banks. Multiple banking institutions including Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse collapsed.

As a result, government programs looked to money printing via bank deposit rescue programs. Total money supply didn’t stop growing and the need for non-inflationary assets like gold and Bitcoin became evident. The failure of long-standing centralised entities meant confidence in decentralised monetary systems increased – and people began looking to crypto as an alternative.

Rate hikes continued up to June, with J.Powell playing the strong man in disguise. Only in August did inflation start to plateau, and the latest December Fed meeting reaffirmed that rates will remain steady or go south next year – which should reflect positively on the crypto market in 2024.

BUIDLing for Bitcoin

Bitcoin began the year 2023 in the $16K range, likely holding onto some FTX baggage.

That narrative quickly began to change as the year progressed. The primary reason being the banking crisis – followed by news of Bitcoin spot ETFs and building efforts for the network’s use cases.

The Advent of Bitcoin spot ETFs.

“We do believe that if we can create more tokenisation of assets and securities – that’s what Bitcoin is – it could revolutionise finance.” – Larry Fink, CEO of Blackrock

The second half of the year was met with better news of TradFi giants like Blackrock starting to show confidence in digital assets. This was made obvious when they filed for a Bitcoin spot ETF back in June, closely followed by others like Fidelity and Grayscale.

All of which validated that institutional adoption was making a comeback, naturally leading to a boost in retail confidence.

The Rise of Bitcoin Ordinals.

Another push to the Bitcoin ecosystem came with the rise of Ordinals, which gave users a gateway to creating digital assets like NFTs on the Bitcoin blockchain. In just a year, the total number of inscriptions soared to 48 million, driving Bitcoin’s daily transactions to a new high. Signalling a moment of realisation for all that Bitcoin is capable of growing way beyond its long static state.

Fast forward to today, Bitcoin is at its 12-month high, showing a remarkable 180% growth since the beginning of the year.

Throughout the volatile journey that Bitcoin has had, BitMEX has stuck by its core offerings – which is to provide our pro traders with trading opportunities for them to make the most of the market. Case in point? BitMEX is the second-most liquid platform to trade BTC-margined derivatives contracts, boasting a total of 100+ contracts that are available to trade today.

Crypto Goes to Court

What a difference one year makes – especially so for crypto regulation. This time last year, news of FTX, the SEC, and crypto companies being under fire scattered headlines – a rather stark contrast to the situation today.

The Battles of Kraken, Coinbase, and Ripple.

After the downfall of FTX, many asked the “what next?” – or precisely, the “who next?” question. First came Kraken, which paid a $30 million fine for having provided its staking services as an unregistered security. The scrutiny towards ‘unregistered securities’ continued, with the next target being Coinbase.

Coinbase was the first crypto exchange to sue the SEC – in an attempt to encourage the writing of regulations explaining exactly how TradFi securities laws apply to crypto. The SEC fired back, with a complaint alleging that Coinbase was operating as an unregistered securities exchange. The company’s battle with the SEC is still very much ongoing, and many say it will last a while.

However, it wasn’t all bad news. A big regulatory win came crypto’s way when news got out that the SEC had dropped its case against Ripple. The case was formed when the SEC had asserted Ripple’s native token XRP as a security – which was ruled against in July and the case was dismissed.

The result? These cases pushed the SEC to provide more clarity on its approach to crypto assets. Aside from the US, the world saw over 40 countries announcing official regulatory frameworks for digital assets in 2023.

The Sam Bankman-Fried (SBF) Trial – Live on Twitter (X)

From a household name as a university graduate who founded the once-dominant crypto exchange FTX, SBF was transformed into a convicted felon within a year. He was found guilty on all seven charges including money laundering and securities fraud, and could face up to 115 years of imprisonment.

The silver lining? SBF’s trial was a moment of profound clarity for crypto. A gesture that restored confidence in the consequences of wrongdoing and most importantly, a way to emphasise the urgent need to prioritise transparency and accountability in the industry.

Like everyone else, BitMEX closely followed the trial throughout. Beyond just that, our team identified an opportunity for our users – leading us to launch Prediction Markets, a unique breed of crypto derivatives for our traders to take positions on the outcomes of topical, “juicy” events – just like the fate of SBF.

Big Dog Binance.

As a final blow (and to little surprise), Binance and its former CEO Chengpang Zhao (CZ) were next in line to stand in court.

On 21 November, the US Department of Justice announced a settlement of a criminal case against Binance US and CZ, for engaging in anti-money laundering and unlicensed money transmitting amongst other things.

Binance was fined $4.3 billion and CZ was forced to step down as CEO – with his fate yet to be determined. Compared to the FTX saga this was no blow to crypto prices but was generally seen as a positive sign for a growing adoption and one of the last checkboxes before the ETF approval.

Re-emergence of Altcoins

Accompanying Bitcoin’s recovery in the past quarter was the altcoin market, with tokens like Ethereum (ETH), Solana (SOL), Ripple (XRP), and Cosmos (ATOM) having their moment of glory this year.

Solana’s Rally.

The altcoin that captured everyone’s attention this year was Solana – which made a remarkable recovery starting Q3 after having taken a big hit from the FTX debacle.

SOL, the native Solana token, hit rock bottom in Q1 but like many others, it didn’t stop them from building. Their hard work eventually paid off and against all odds, SOL hit its pinnacle of $94 in December – a 500%+ increase since the beginning of the year.

This is largely due to the rollouts of improvements and projects within the Solana ecosystem – with projects like Jito Network sparking a DeFi summer through reintroducing airdrops, farming, NFT minting, and more.

At BitMEX, we want you to benefit from the most exciting markets. So rolling out trading opportunities across emerging projects in a timely manner comes naturally to us. Which is why we rolled out derivatives contracts for several Solana projects this year:

Meme Coins Make a Comeback.

The year is ending on a note marked by a meme coin frenzy, proving that the DOGE hype in 2021 may not have been an anomaly. Meme coins began to generate buzz again in the second half of the year, closely aligned with Bitcoin’s price recovery.

Some prominent meme coins that took the spotlight were PEPE, SHIB, and BONE. Perhaps the most noteworthy is BONK, Solana’s first dog coin, which was airdropped to Solana ecosystem members and surged to a $2 billion market cap within just six weeks.

You can trade all the popular meme coins on BitMEX via derivatives contracts:

- PEPEUSD and PEPEUSDT – trade here and here.

- SHIBUSD and SHIBUSDT – trade here and here.

- BONEUSD and BONEUSDT – trade here and here.

- WSMUSDT – trade here.

- MEMEUSDT – trade here.

- 100BONKUSDT – trade here.

Pre-IEO Futures Gain Popularity

Innovation in crypto is unmatched, and so are its product rollouts. One of the concepts that came to life this year across big exchanges was pre-IEO future listings.

Pre-IEOs are a step ahead of IEOs – allowing traders to profit off of anticipating a new token launch by participating in token price discovery. Such products are growing in popularity as they give traders exposure to token listings without having to farm airdrops or be early investors in a project.

Pioneering Pre-IEO Futures Listings.

At BitMEX, we introduced pre-IEO futures contracts early in the year, with the help of our product team who are nonstop devising ways to support our traders in making the most of the market. Before any token airdrops or official spot listings, we listed seven pre-IEO futures this year alone:

- SEIUSDTQ23 – Sei Network

- CYBERUSDTQ23 – Cyber Network

- TIAUSDTZ23 – Celestia

- MEMEUSDTX23 – Memecoin

- PYTHUSDTZ23 – Pyth Network

- BLASTUSDTZ24 – Blast Network

- ACEUSDTZ23 – Fusionist

Looking Ahead to 2024

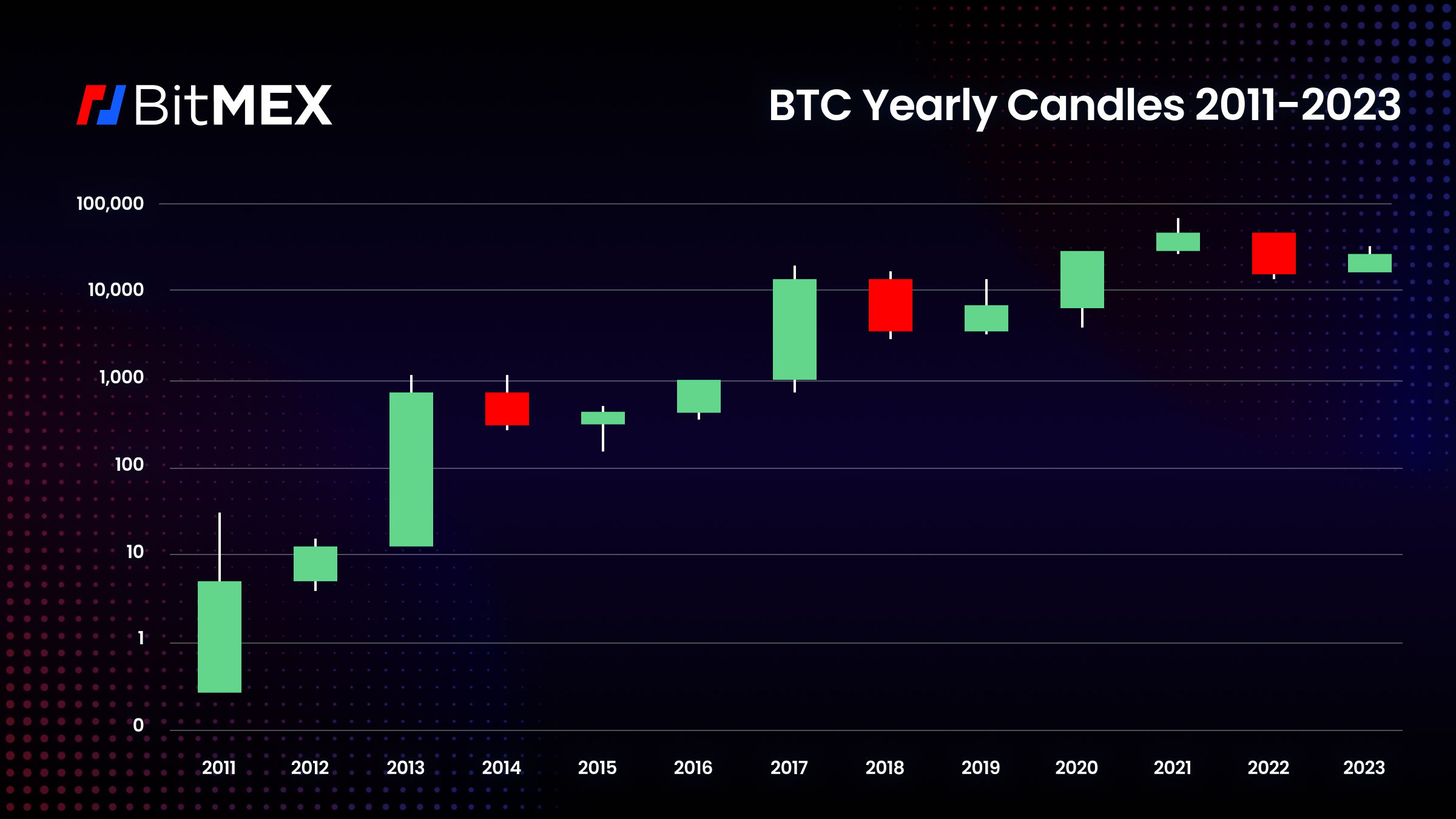

The crypto rally is only just beginning. Looking back at previous market cycles in 2015 and 2019, it seems a green candle is likely to come next in 2024 (see below).

To top it off, interest from TradFi giants in Bitcoin spot ETFs, Real-World Assets (RWAs), and blockchain technology indicates that the traditional and new are coming together. The recent price surges of Bitcoin have laid out an upward path for crypto and 2024 holds great promise to be a pivotal year in the industry’s evolution.

At BitMEX, we took 2023 for what it was – a time to build and prepare for the next bull market. This meant more contracts, platform features, and upgrades to bring the best trading experience possible for our users.

Some stats to recap the year we’ve had:

- Welcomed thousands of new traders and increased platform liquidity in preparation for the bull run in 2024.

- Launched 70+ derivatives contracts including new breeds like Prediction Markets and pre-IEO listings.

- Delivered 5+ new pro trading platform features including Chart Trading, Sub Accounts, Multicharting, News Feeds, PnL realisation, and more.

- Achieved a 95% reduction in order book latency with trading engine updates.

- Introduced Guilds – our take on competitive trading – with $100k+ in rewards distributed to date.

To be the first to know about our new listings, product launches, and giveaways, you can connect with us on Discord, Telegram, and Twitter. We encourage you to also check our blog regularly.

In the meantime, if you have any questions please contact Support.

Related

The post appeared first on Blog BitMex