(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

US Treasury Secretary Bad Gurl Janet Yellen and her simp cuck towel boy US Federal Reserve Chairperson Jerome Powell oscillate between decisive action and vague talking points. When they act, you best not fight them. But when they just talk, watch out because many market signals will point you down a path to sure losses.

On November 1st, 2023, Janet was Yellen. Included in the US Treasury’s quarterly refunding announcement (QRA) was a proclamation that she would shift the majority of borrowing to Treasury bills (T-bills), which are sub-one year in maturity. This enticed money market funds (MMF) to pull money out of the Fed’s Reverse Repo Program (RRP) and invest in higher-yielding T-bills. The result, described in detail in my essay “Bad Gurl”, was and is providing a liquidity injection that will total close to $1 trillion once it is completed.

In mid-December 2024, during the FOMC press conference, Powell proclaimed that the governors were now discussing rate cuts in 2024. This was a dramatic pivot from his rhetoric two weeks prior, where he assured the markets the Fed would stay tight in order to ensure inflation did not return. The market took this to mean the first rate cut of this Fed hiking cycle would occur in March of this year. Subsequently, earlier this month, Dallas Fed governor Logan threw out a trial balloon that the pace of Quantitative Tightening (QT) would be tapered as and when RRP balances approached zero. The rationale was that the Fed did not want any dollar liquidity hiccups when one source of money printing ceased.

Let’s recap what is just talk versus what actions have actually been taken. Yellen acted by shifting her department’s borrowing to T-bills, thus adding hundreds of billions of dollars’ worth of liquidity so far. That is actual money being pumped into the global financial markets. Powell and other Fed governors talked a big game about rate cuts and tapering the pace of QT in some distant future. This talk hasn’t produced any increase in monetary stimulus. However, the market equated the actions and talk as the same thing and rallied after November 1st, continuing to rise throughout this month.

The market I’m referring to is the S&P 500 and the Nasdaq 100, which both hit new all-time highs. But all is not well. The real smoke alarm for the direction of dollar liquidity, Bitcoin, is throwing a cautionary sign. After the US spot ETF launch, Bitcoin has sagged from a high of $48,000 to below $40,000. Coinciding with Bitcoin’s local high, the 2-year US Treasury yield hit a local low of 4.14% in mid-January and is now marching upwards.

The first argument for Bitcoin’s recent dump is the outflows from the Grayscale Bitcoin Trust (GBTC). That argument is bogus because when you net the outflows from GBTC against the inflows into the newly listed spot Bitcoin ETFs, the result is, as of January 22nd, a net inflow of $820 million.

The second argument, which is my position, is that Bitcoin is anticipating the Bank Term Funding Program (BTFP) will not be renewed. This event will not be positive as the Fed still has yet to cut rates to a level that pushes the 10-year Treasury into the 2% to 3% range. At these levels, the non-Too-Big-to-Fail (TBTF) banks’ bond portfolios are back in a profit vs. the current massive unrealised loss nursed on their balance sheets. Until rates are reduced to the aforementioned levels, there is no way these banks can survive without the government support provided via the BTFP. The financial markets’ buoyancy gives Yellen and Powell a false sense of confidence that the market won’t bankrupt a few non-TBTF banks once the BTFP isn’t renewed. Therefore, they believe they can stop the BTFP, which is politically toxic, and there will be no negative market reaction. However, I believe the exact opposite: the cessation of the BTFP will cause a mini-financial crisis and force the Fed to stop Talkin’ and start Yellen with a rate cut, tapering of QT, and/or a resumption of money printing via quantitative easing (QE). Bitcoin’s price action tells me I’m right and they are wrong.

The Fed would rather just jawbone the markets with speeches and Wall Street Journal op-eds because they are deathly afraid of inflation. The war-mongering muppets in charge of Pax Americana’s foreign policy have now bungled their way into another Middle Eastern war with no end against the Yemen Houthis. Later in this essay, I will expand on why this war in the Red Sea is important, and could lead to an uncomfortable spike in goods inflation just in time for the US elections in November this year.

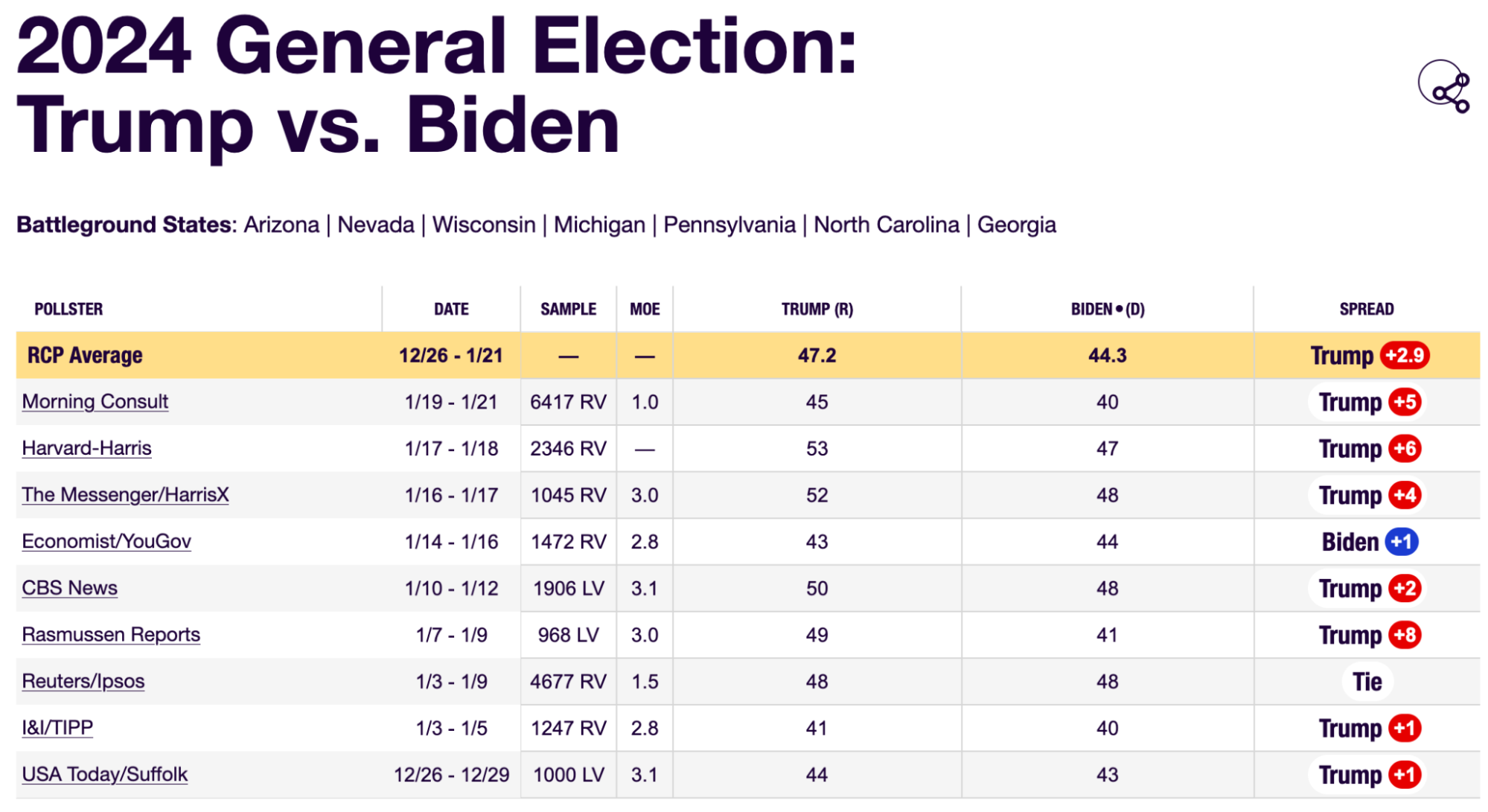

Contrary to what the mainstream financial Western press tells you, inflation is still a problem for the majority of broke-ass Americans. Voters decide the President based on the economy, and right now, US President and Vegetable in Chief Joe Biden and his woke Democrats are slated to get smoked by the Orange Man Trump and his deplorable Republicans.

As I wrote in my essay, “Signposts,” I believe Bitcoin will dip before the BTFP renewal decision on March 12th. I didn’t expect it to happen so soon, but I think Bitcoin will find a local bottom between $30,000 and $35,000. As the SPX and NDX dump due to a mini financial crisis in March, Bitcoin will rise as it will front-run the eventual conversion of rate cuts and money printing talk on behalf of the Fed into the action of pressing that Brrrr button.

I will now step through some charts to quickly bring readers up to speed on why I believe the Fed needs a mini-financial crisis in order to stop Talkin’ and start Yellen.

Chart Porn

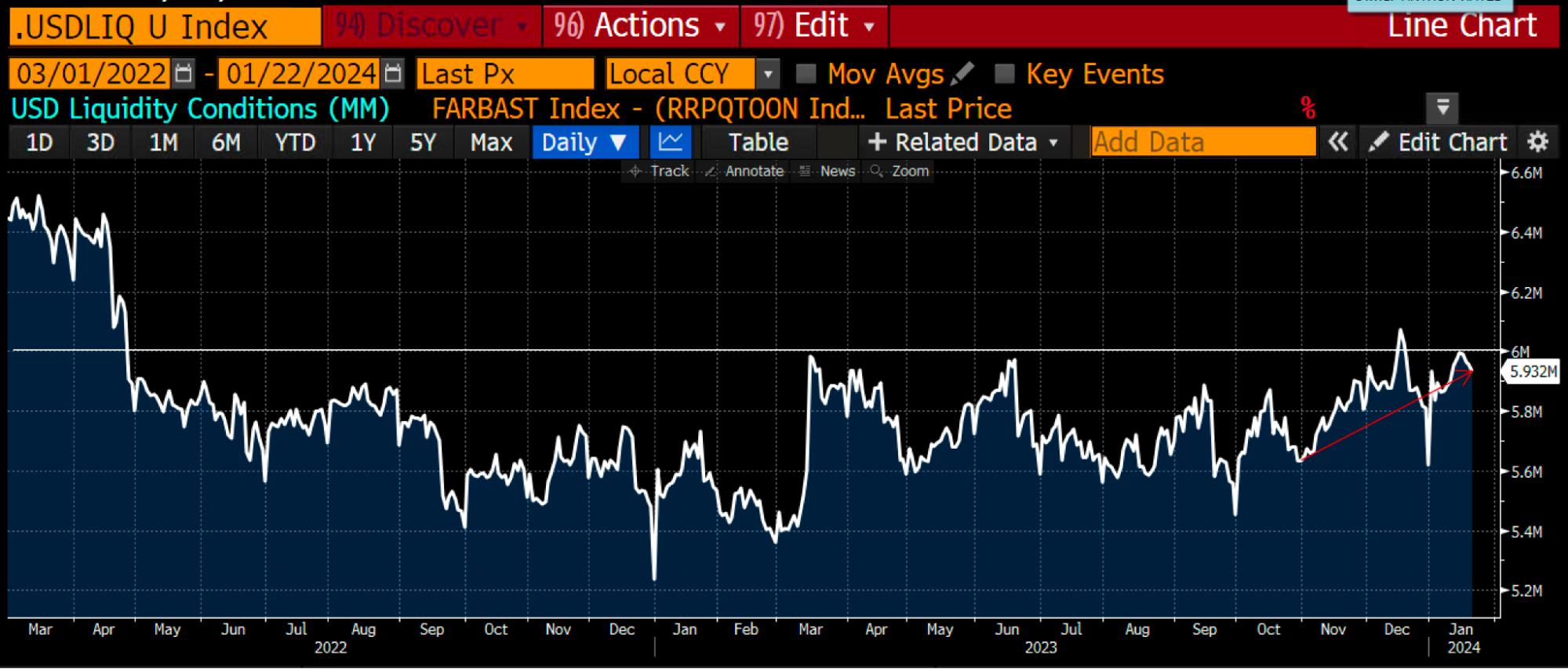

This is a chart of USD liquidity. To understand how this index is constructed, please read “Teach Me Daddy”. As the Fed started its rate hike and QT campaign in March 2022, the index crashed. However, due to the RRP falling since June of 2023, the index is back at levels not seen since April of 2022.

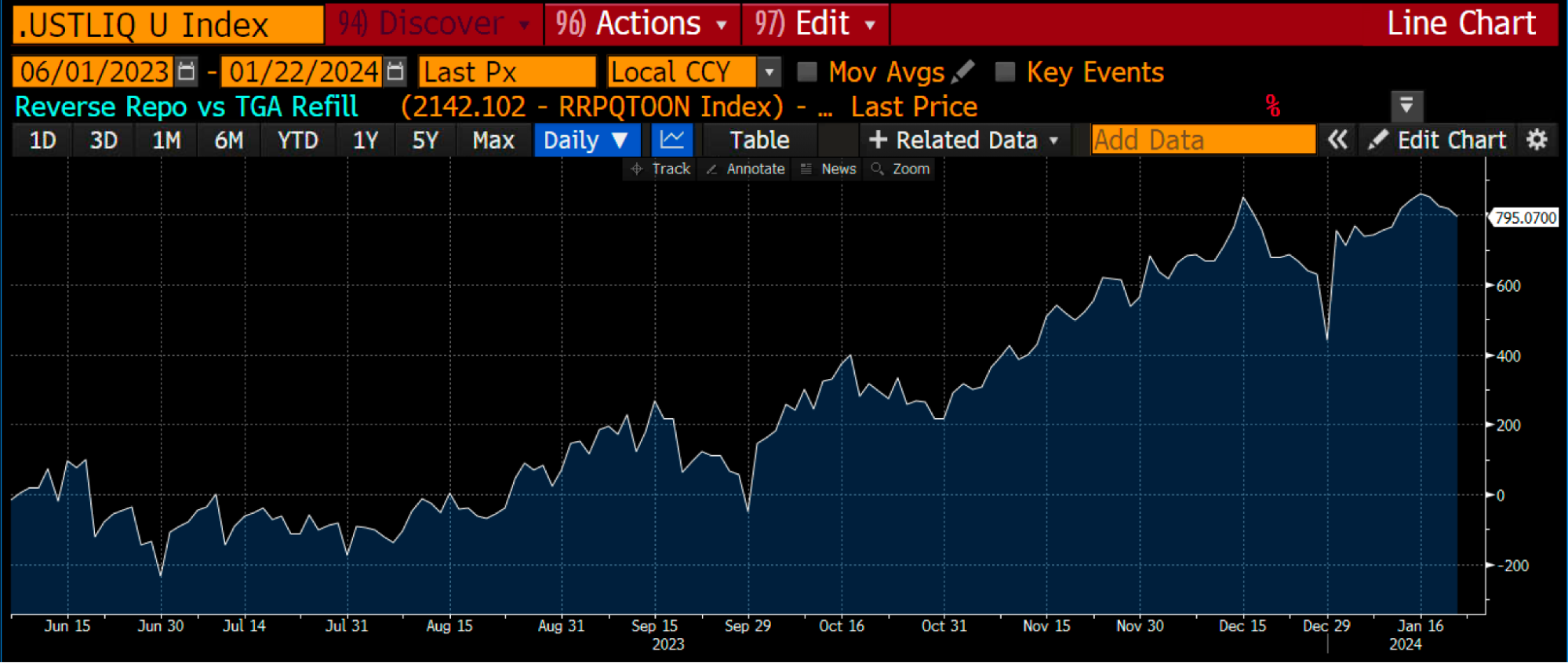

This chart is a subcomponent of the index, which is the net of RRP and TGA balance changes. Since the US government passed its budget in June 2023, almost $800 billion of liquidity has been added.

At a macro level, risk assets are pumping – despite the $1.2 trillion reduction in the Fed’s balance sheet – due to the relatively high levels of dollar liquidity.

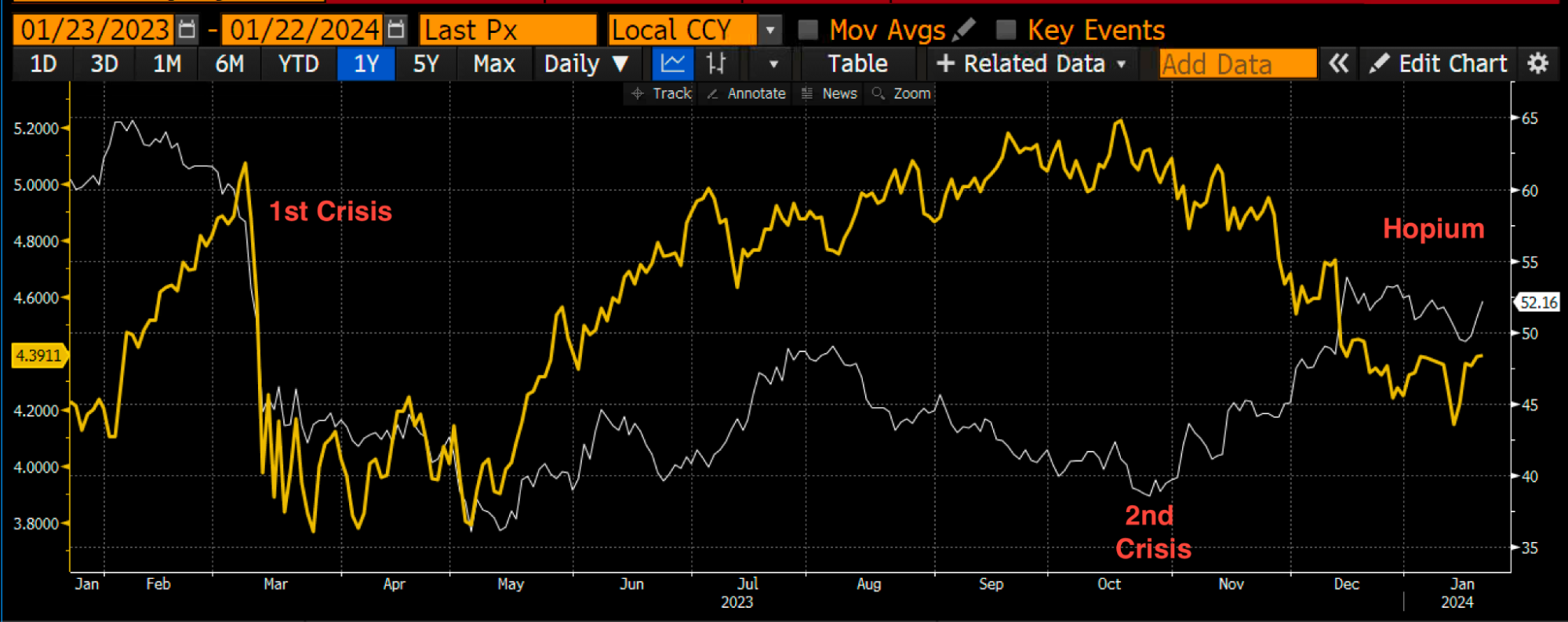

1st Crisis

If we drill down to the non-TBTF insolvent banks, we see that Yellen and Powell were forced to act in order to bail out the US banking sector. The above chart is the S&P Regional Banking ETF (KRE) in white vs. the 2-yr Treasury yield in yellow. The banks in this index are the runts of the system as they do not enjoy a government deposit guarantee like their more prominent and profitable TBTF brethren. The sharp rise in yields in Q1 of 2023 caused the KRE to plummet as three major non-TBTF banks (Silvergate, Signature, and Silicon Valley Bank) went bust within fortnight. Yields crashed as the market knew the Fed would have to print money to save the system, which they did via the BTFP.

2nd Crisis

All was good for a time, but the market started focusing on the runaway US deficit and the gargantuan amount of bonds that must be issued to finance it. Compounding this problem was Powell’s statements at the September 2023 FOMC press conference, where he said the financial markets would do the monetary tightening work for the Fed. The bond market wanted the Fed to fight inflation and make government borrowing more expensive by raising rates even more and not just chilling watching their Bloomberg terminals. Rates across the curve rose, and most worryingly, long-end rates rose in a bear-steepening fashion. I detailed why this is deadly for the financial system in my essay “The Periphery.” KRE responded by dumping to levels not seen since the height of the banking crisis in April. Yellen was forced to act in November by shifting borrowing into T-bills. This saved the bond markets and caused a vicious short-covering rally in stocks and bonds.

Hopium

The market is now forecasting when RRP balances will reach near zero and wondering what is next. There is a lot of talk about this, including speculation about how the Fed can add liquidity without calling it money printing. But there has yet to be any action taken. The 2-year yields are marching back higher, but the KRE continues rising. The market is trading on hopium. If Yellen and Powell say the right things, 10-year yields will magically fall from 3% to 2%. Without fresh dollars buying bonds, that ain’t happening. This is the disconnect between the story the 2-year yield tells vs. the KRE. I believe the market is in for a nasty surprise as it becomes clear Powell is all bark and no bite.

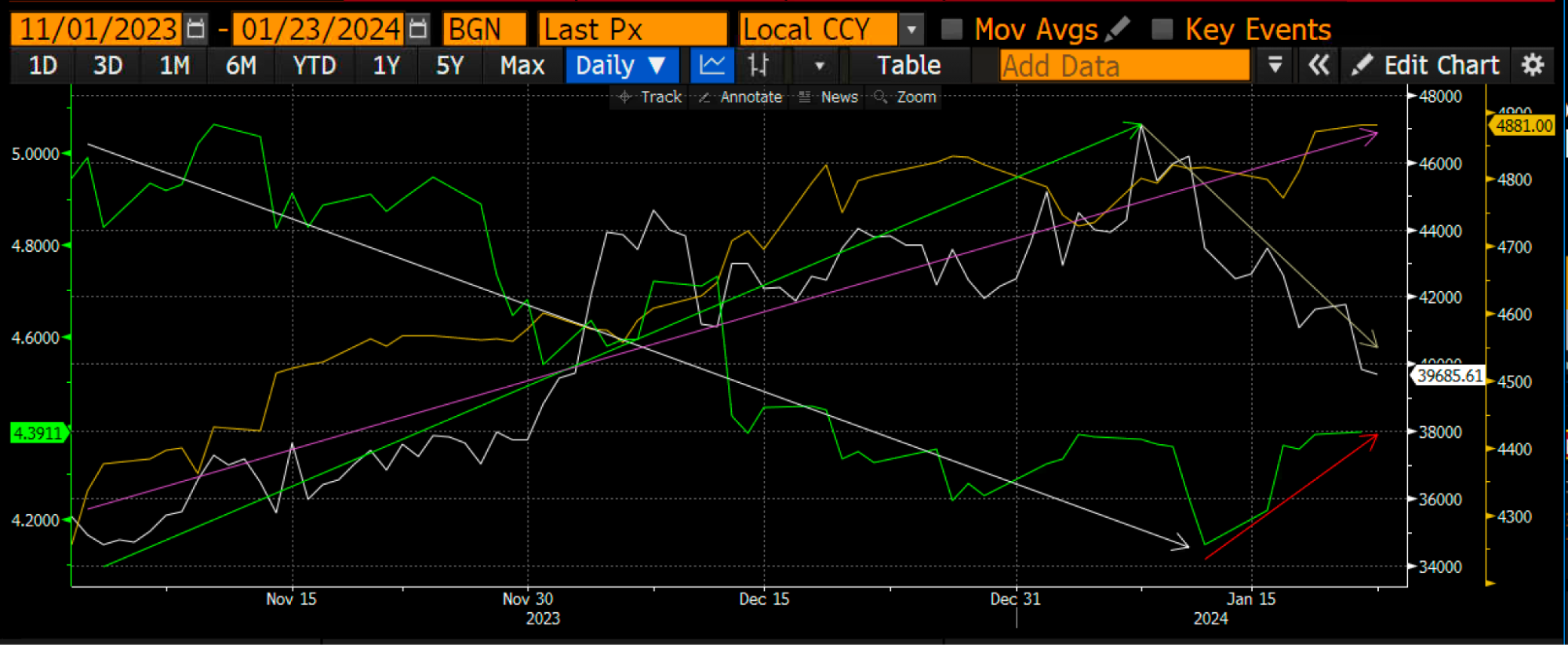

This busy chart shows the divergence between Bitcoin (white) and the 2-year Treasury yield (green), which tell the same story, and the SPX (yellow), which tells a different one. As 2-year yields fell from November 1st, 2023, Bitcoin and the SPX rallied. Once the 2-yr yield bottomed and reversed direction, Bitcoin fell, and the SPX continued rising.

Bitcoin is telling the world that the Fed is trapped between inflation and a banking crisis. The Fed’s solution is to attempt to talk the market into believing the banks are sound without providing the requisite money to make that fantasy a reality.

Broke Ass Plebes

Jim Bianco produces some excellent charts which I will lean heavily on throughout the rest of this essay.

As readers know, I spend northern hemispheric winters in Hokkaido, Japan. One noticeable change this season is the sheer number of Americans. Travelling to this powder heaven is a pain in the ass, even for someone who lives in Asia. It’s even more time-consuming and expensive if you live in the US. And yet, there are noticeably more US boomers skiing at the resorts. Boomers are the richest they have ever been in their lives. That is because the stock market and housing prices are at all-time highs. Also, their cash stash is yielding something for the first time in a few decades. For a cohort of humans who just saw life flash between their eyes during COVID (remember, the flu kills predominantly old fat people, aka boomers), now is the time to travel the world.

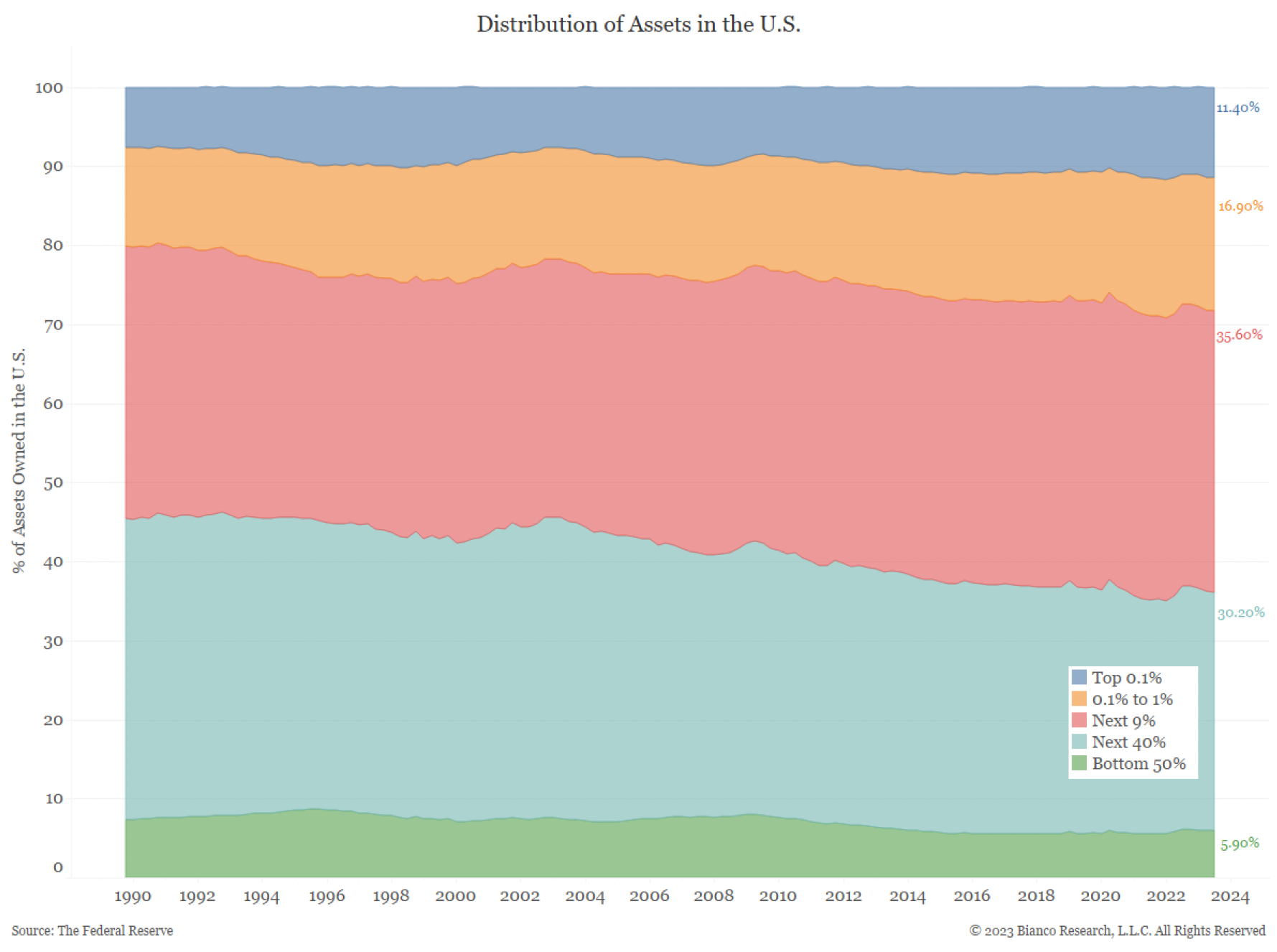

The top 10% of US households own ~65% of all the financial assets that the Fed pumps via its various money printing programs. Boomers are the wealthiest generation, and their spending is powering a very strong US economy.

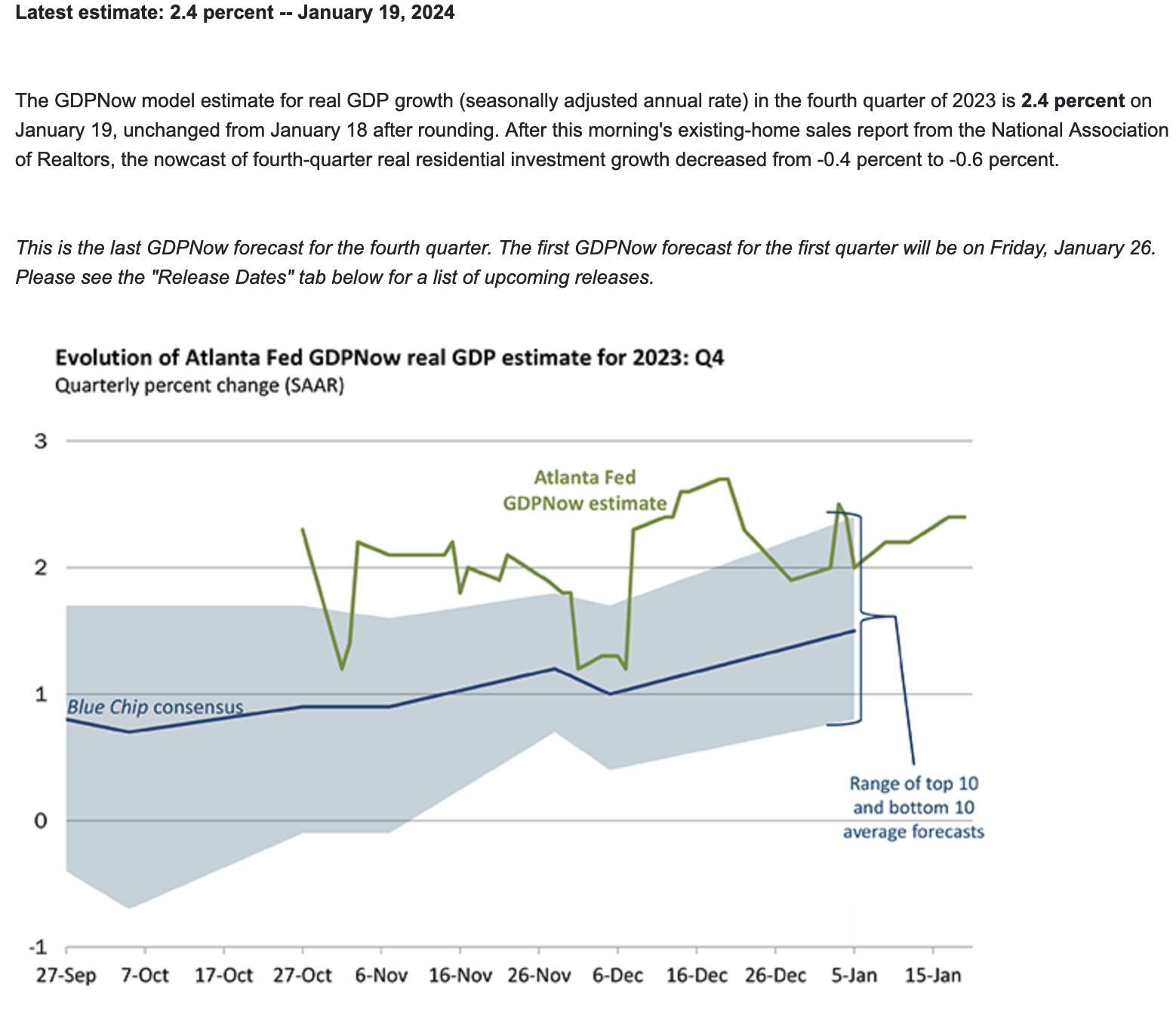

The Atlanta Fed estimates 4Q2023 GDP growth will clock in at a strong +2.4%- strong to very strong!

However, the rest of America is broke as fuck, and drowning in debt.

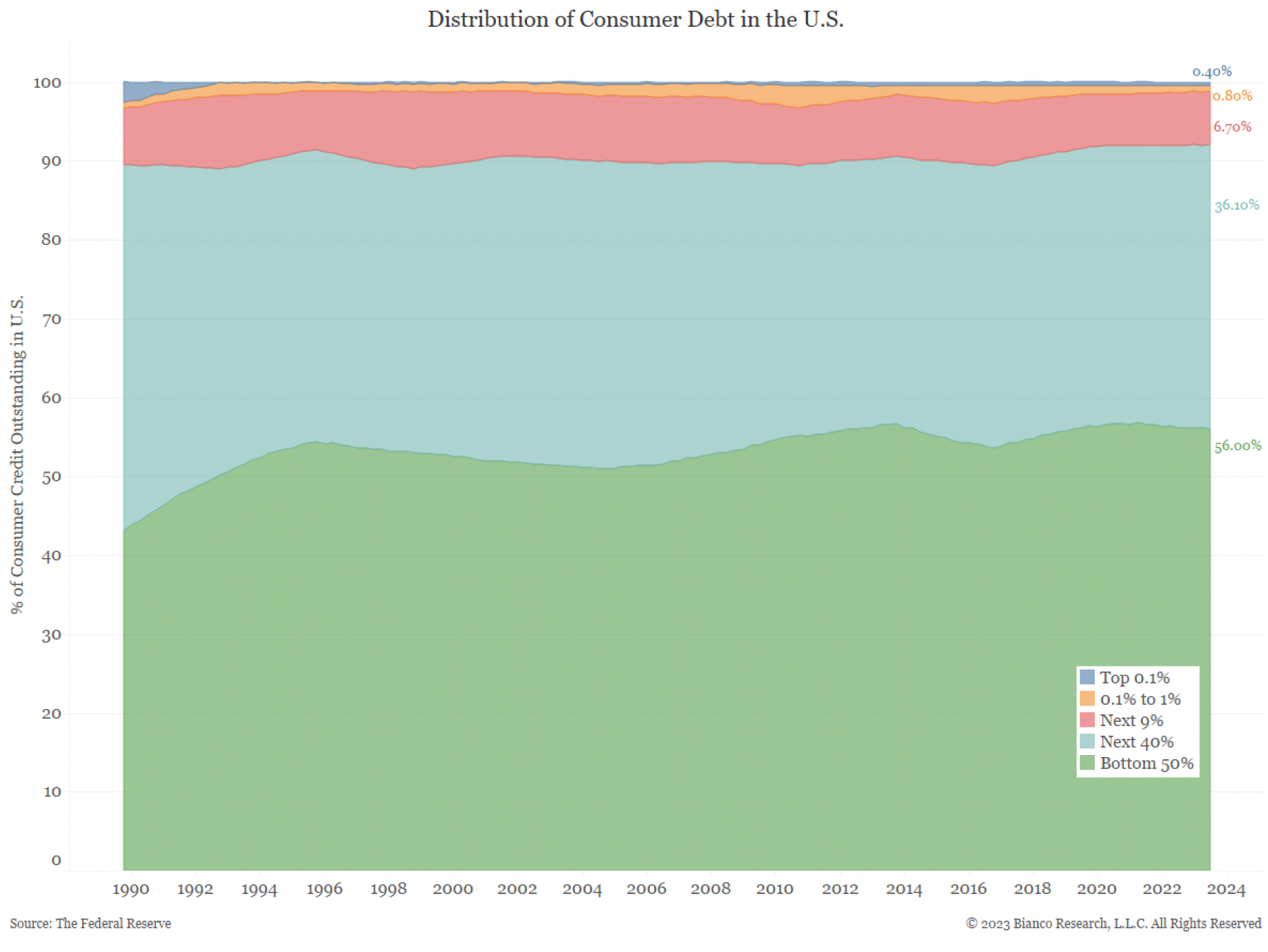

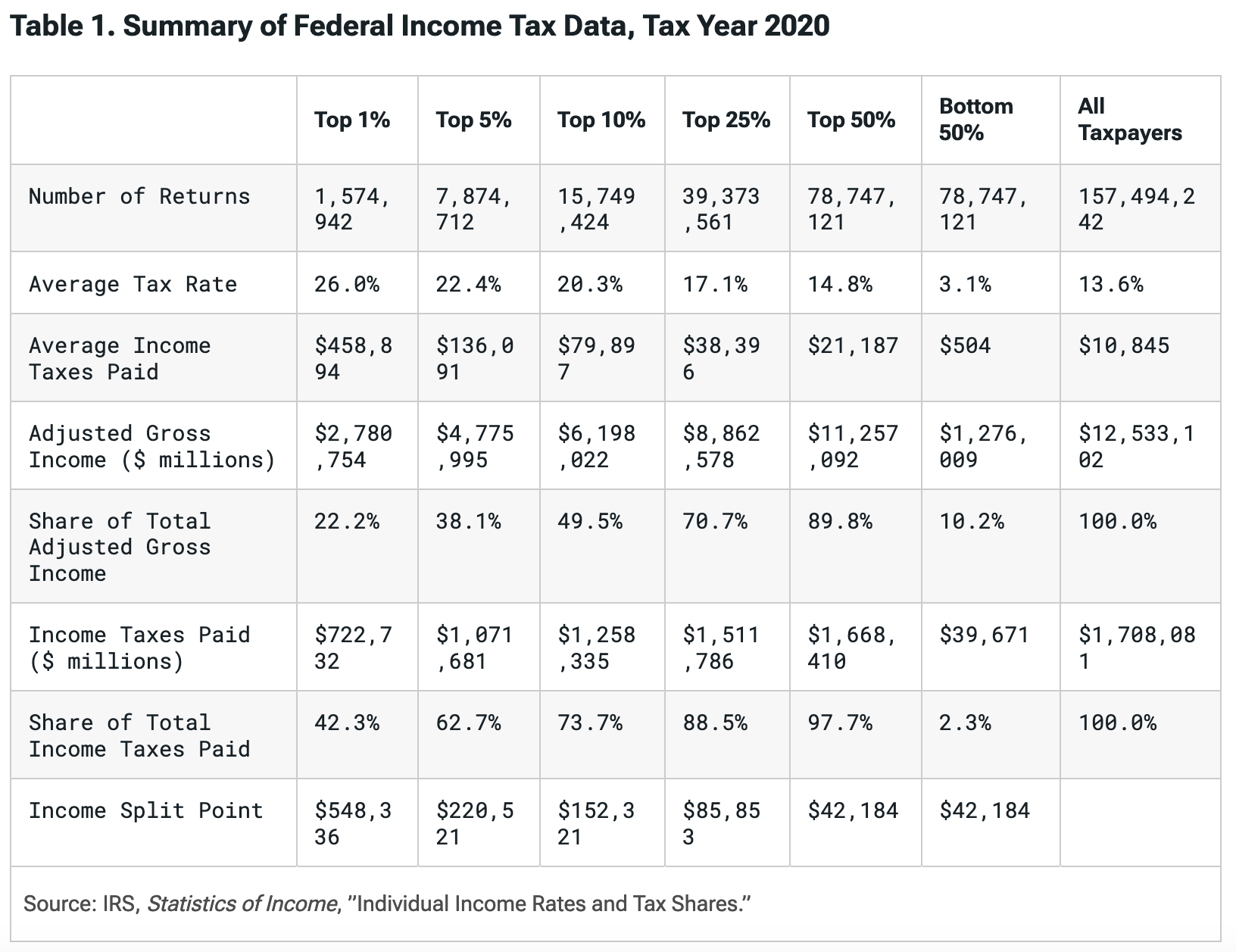

The top 10% holds ~65% of all financial assets but only ~8% of the debt. The bottom 90% holds 92% of the debt but only 35% of the assets. This highly unequal distribution of wealth and debt presents a problem for a politician in a democracy. While the politicians endeavour with great resolve to do all in their power to make the rich richer, they need to get elected by garnering support from the broke plebes. This is why when inflation shows up, it’s a problem.

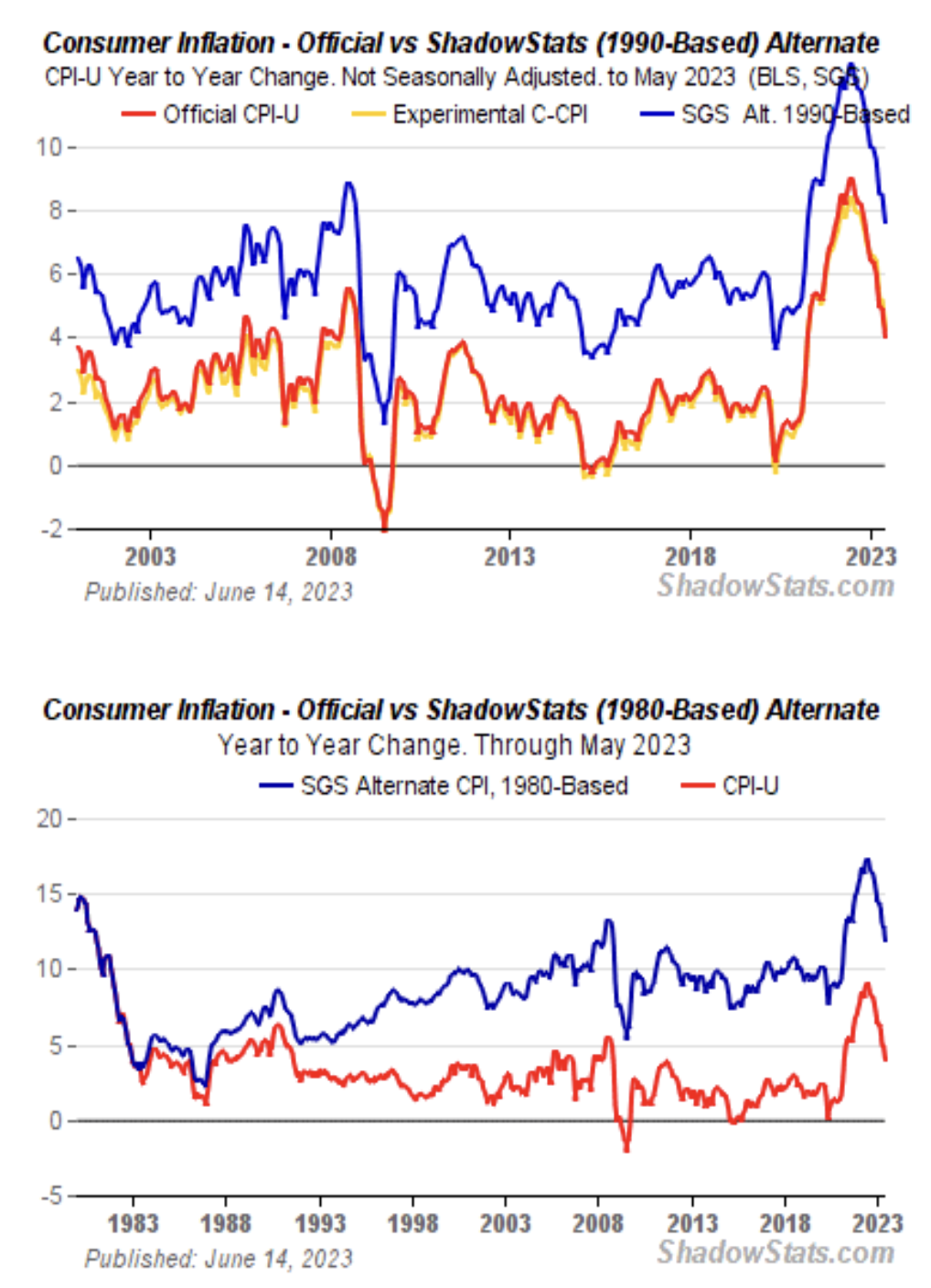

The current Consumer Price Index (CPI) calculation methodology is Fugazi. If we go back to the 1980 or 1990 CPI calculation methodology, the actual rate of inflation is around +10% vs. the +3% rate you read in the news.

And this is why, according to the most recent polls, Trump is a slight favourite to beat Biden.

US politics, in a nutshell, is a circus whereby the rich buy ads to raise awareness for their favourite clown, who in turn dances and sings for the votes of the plebes. Biden must hand out goodies to the rich and the poor alike to win. At a cynical macro level, the strategy is to pump the stock market owned by the rich, thereby increasing tax receipts, and then provide handouts to the poor paid for out of the loot collected from the rich.

The top 10% pay 74% of all income taxes. Their disproportionately large contribution stems from the huge sums the government collects in capital gains taxes earned during a rising stock market. As a result, the American government’s finances are tied to the stock market’s performance.

Biden has two financial generals with different missions. Yellen must use the US Treasury’s powers to pump the stock market. She can do this by adjusting the US Treasury’s bond issuance schedule or running down the TGA. Powell must reduce inflation to an acceptable level. He can do this by raising rates and reducing the Fed’s balance sheet.

Yellen’s job is much easier than Powell’s. Yellen can unilaterally pump the stock market by issuing more T-bills and bonds, or by running the TGA from the current $750 billion to zero. Powell can reduce the money supply and raise rates, but there are geopolitical issues that he has zero control over. He also cannot influence the size of the government deficit or surplus. Suppose the government is committed to running massive deficits that Yellen will duly fund, increasing the demand for goods and services. In that case, Powell’s inflation-fighting actions at the Fed would be neutered.

The post-COVID bout of US inflation was so pronounced because the government handed out stimmies to the plebes that were financed by Fed money printing at a time when it was difficult to ship goods globally. There were work stoppages and labour shortages driven by COVID lockdown and vaccine policies. The result was levels of inflation not seen since the late 1970’s and early 1980’s.

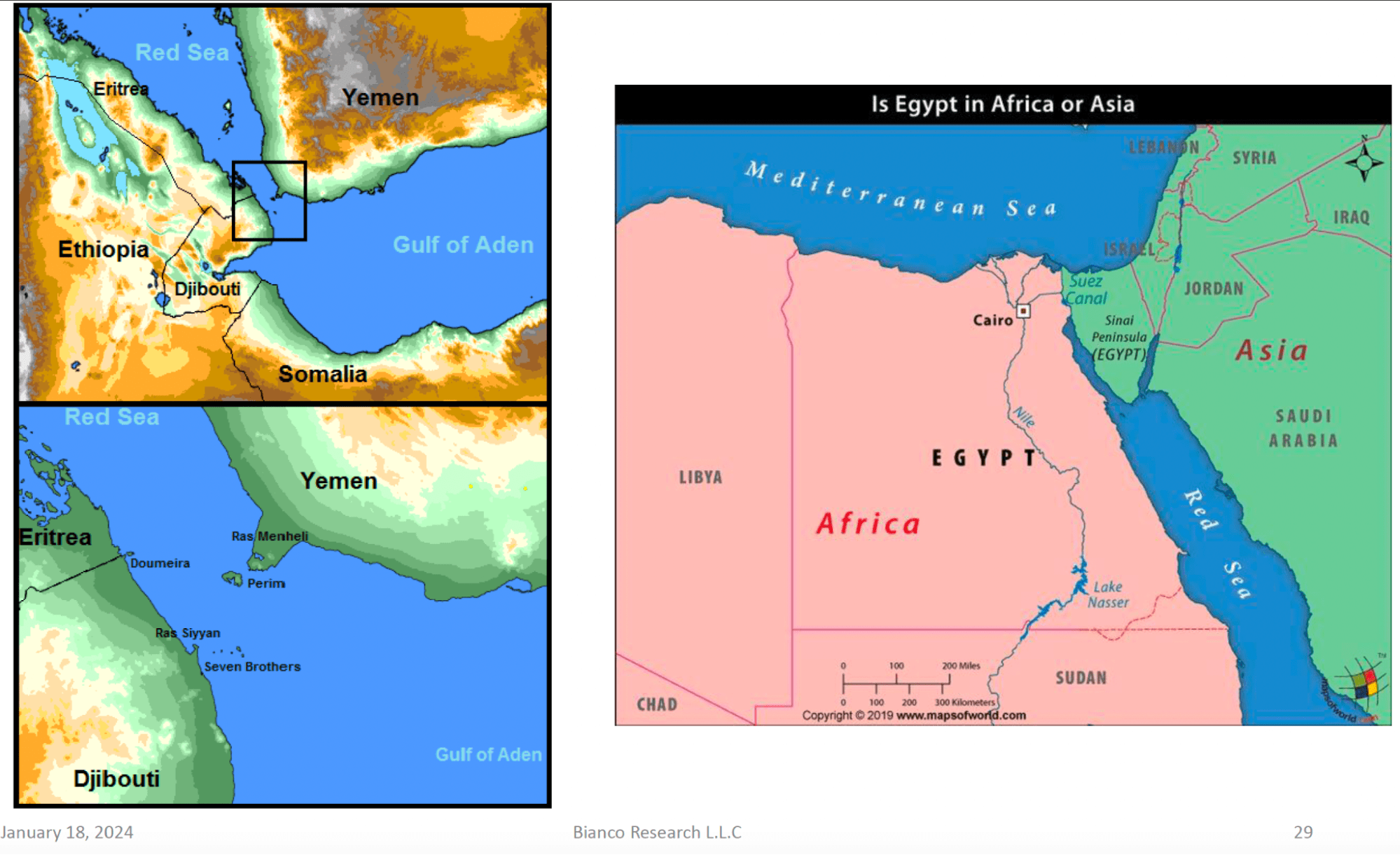

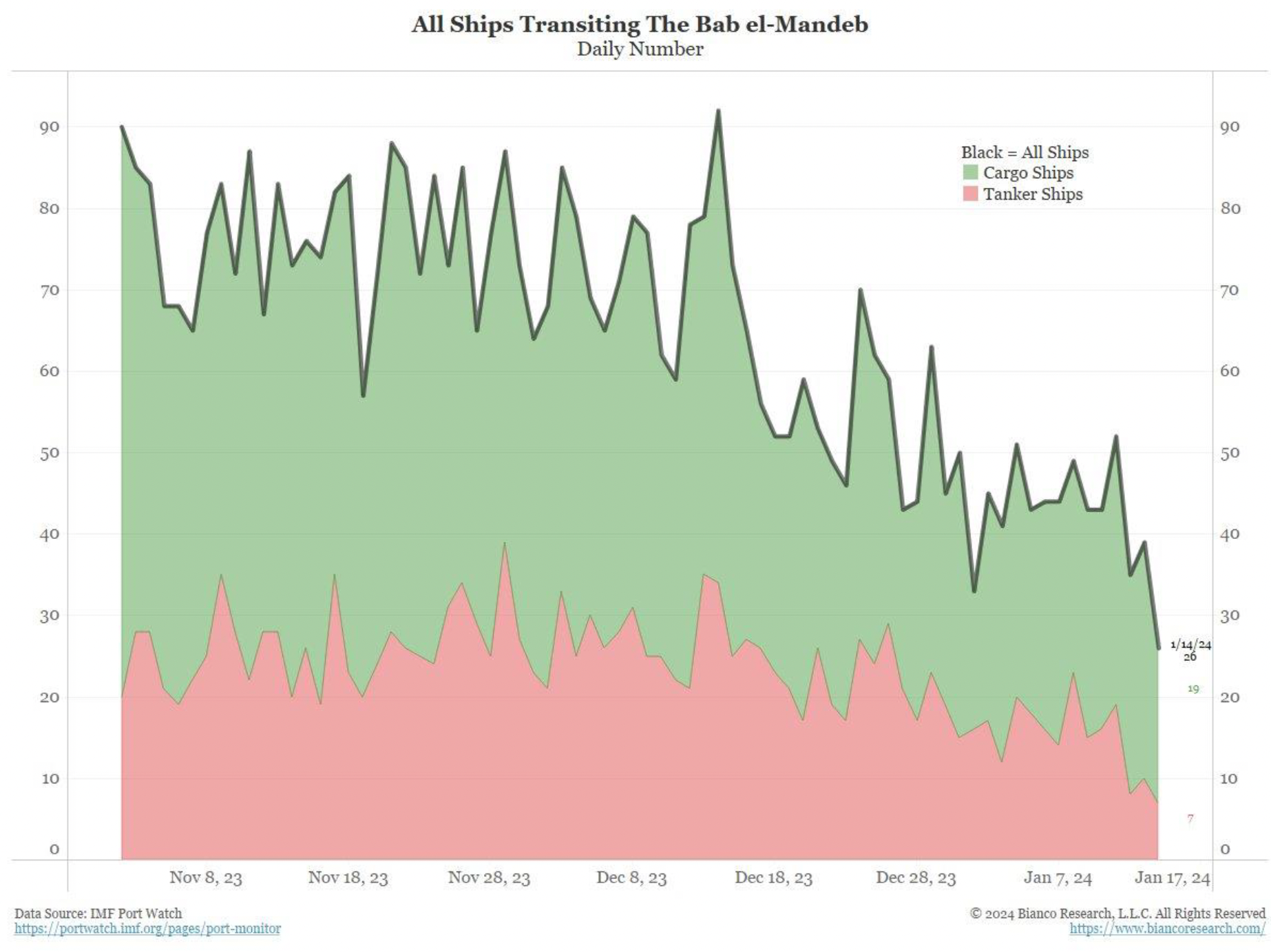

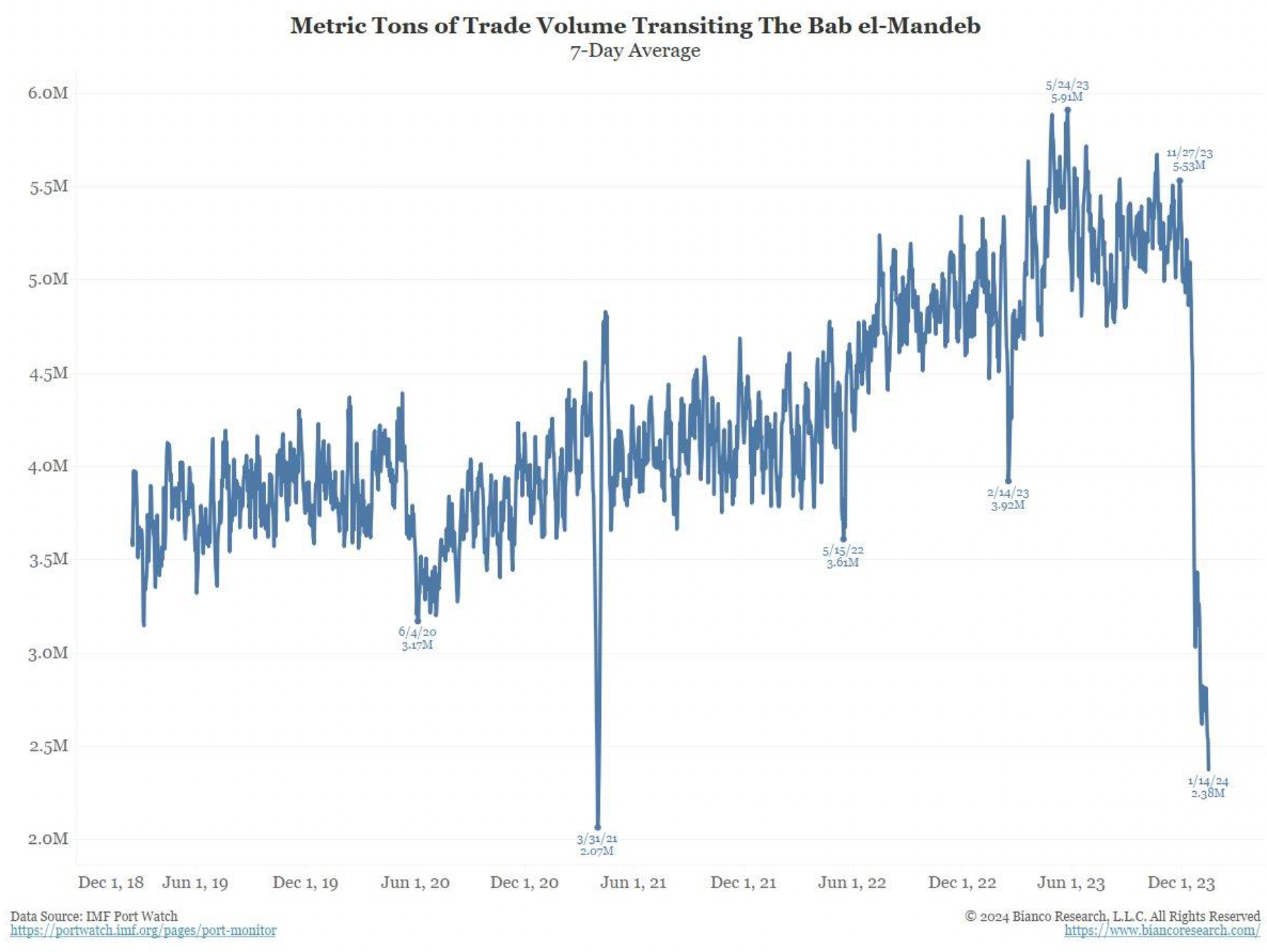

A similar global supply chain crisis is unfolding, but this time, the difficulty in shipping goods is driven by El Niño and the closure of the Bab el-Mandeb to Western vessels.

Of Horns and Hope

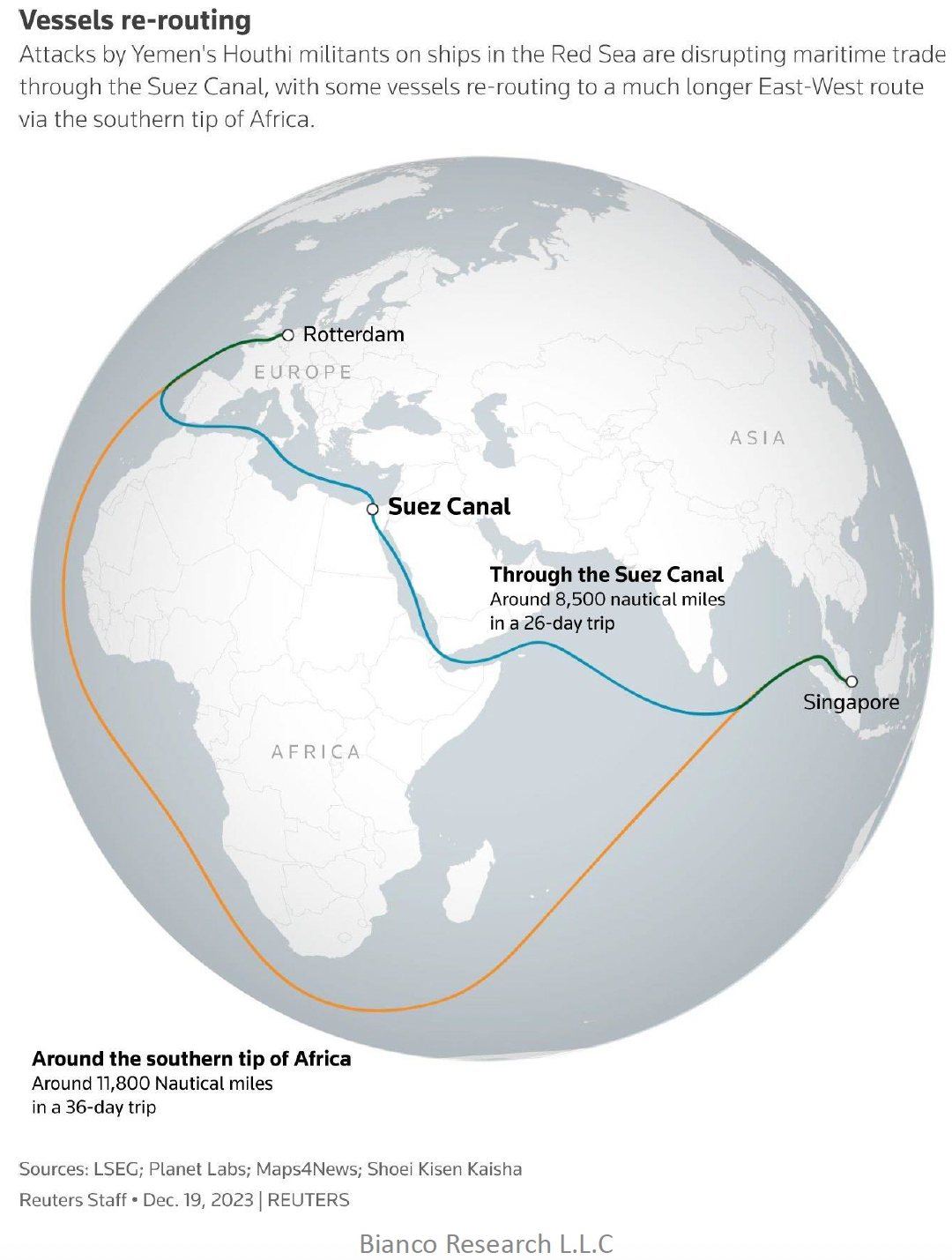

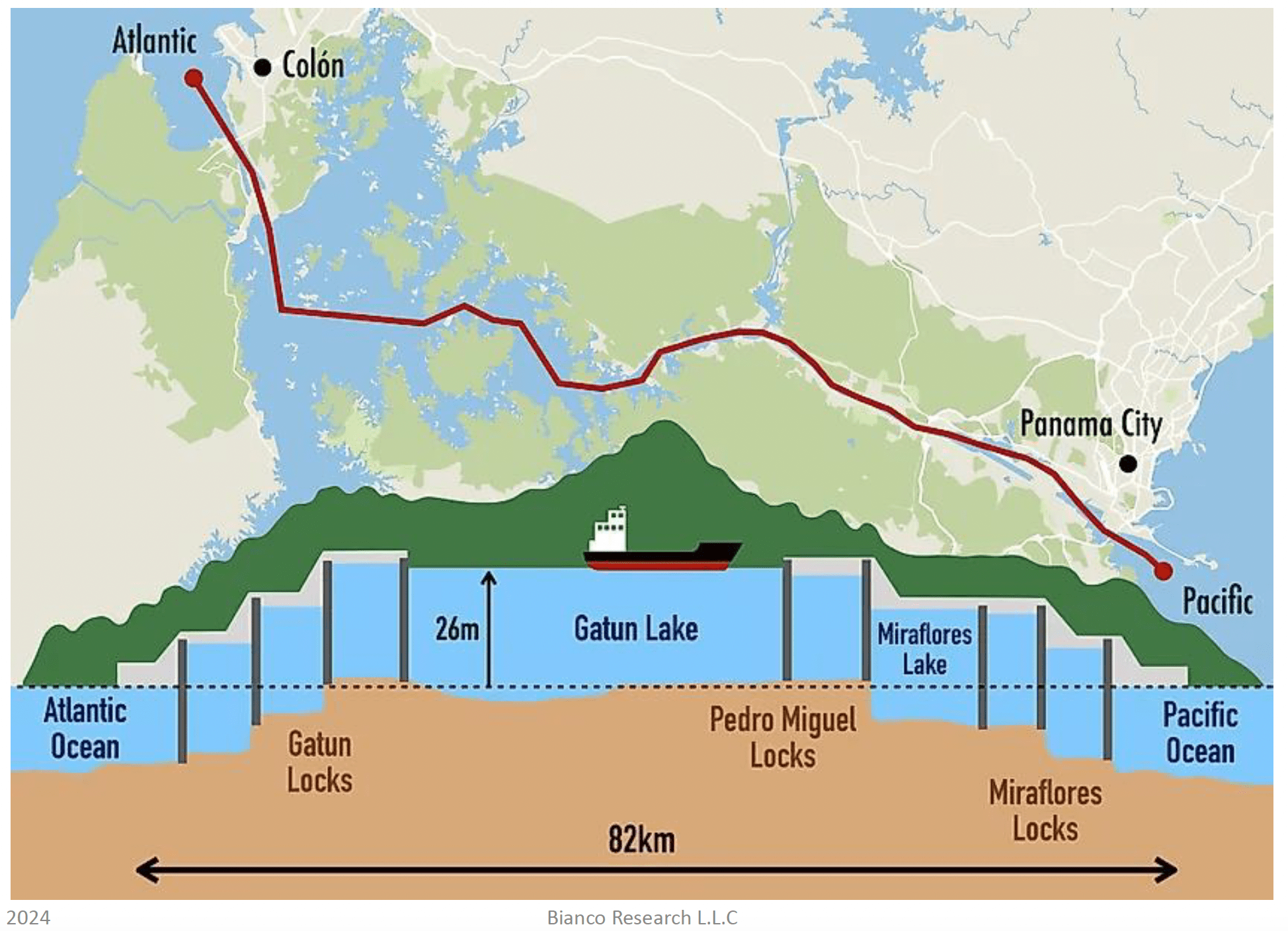

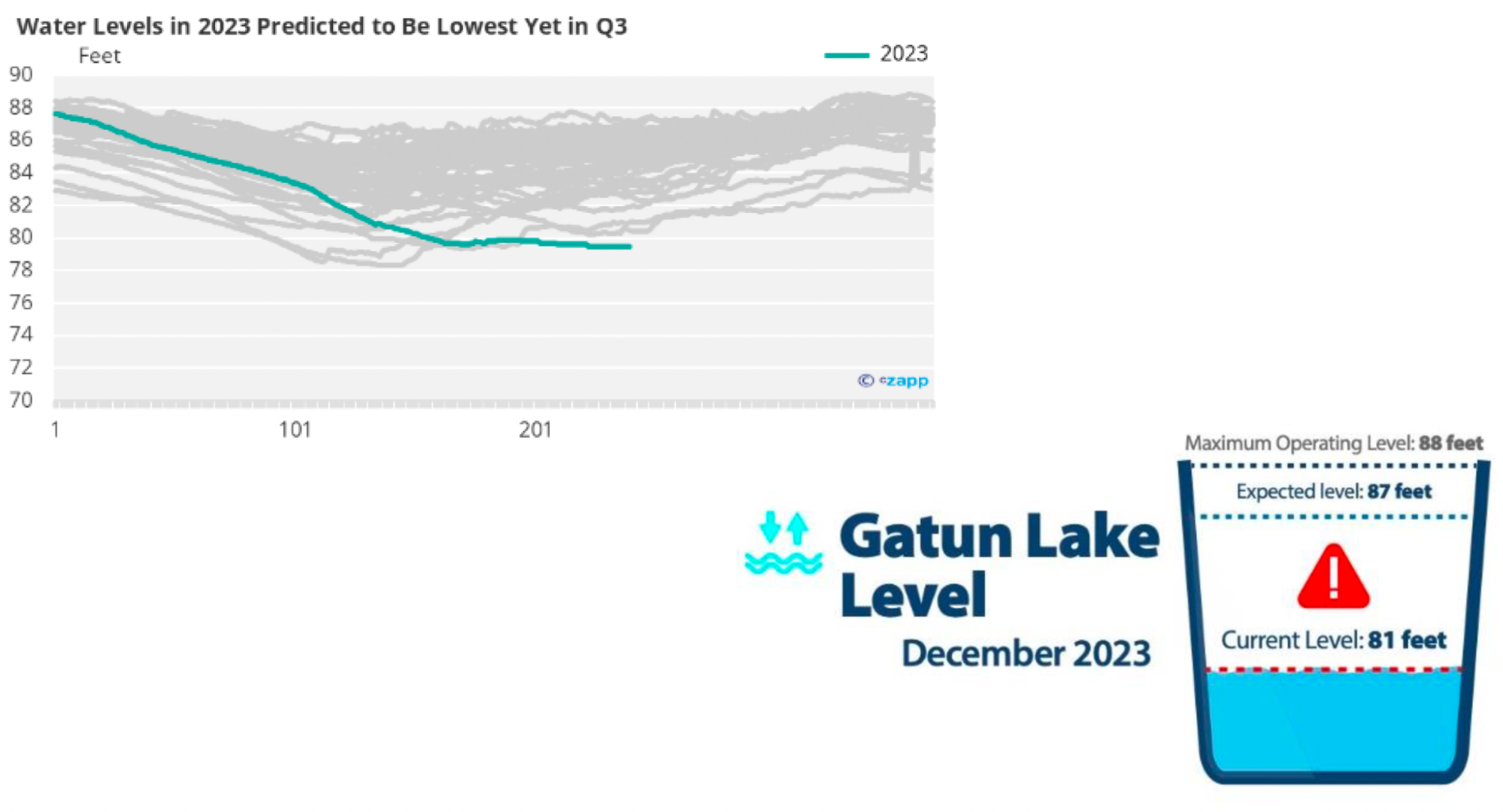

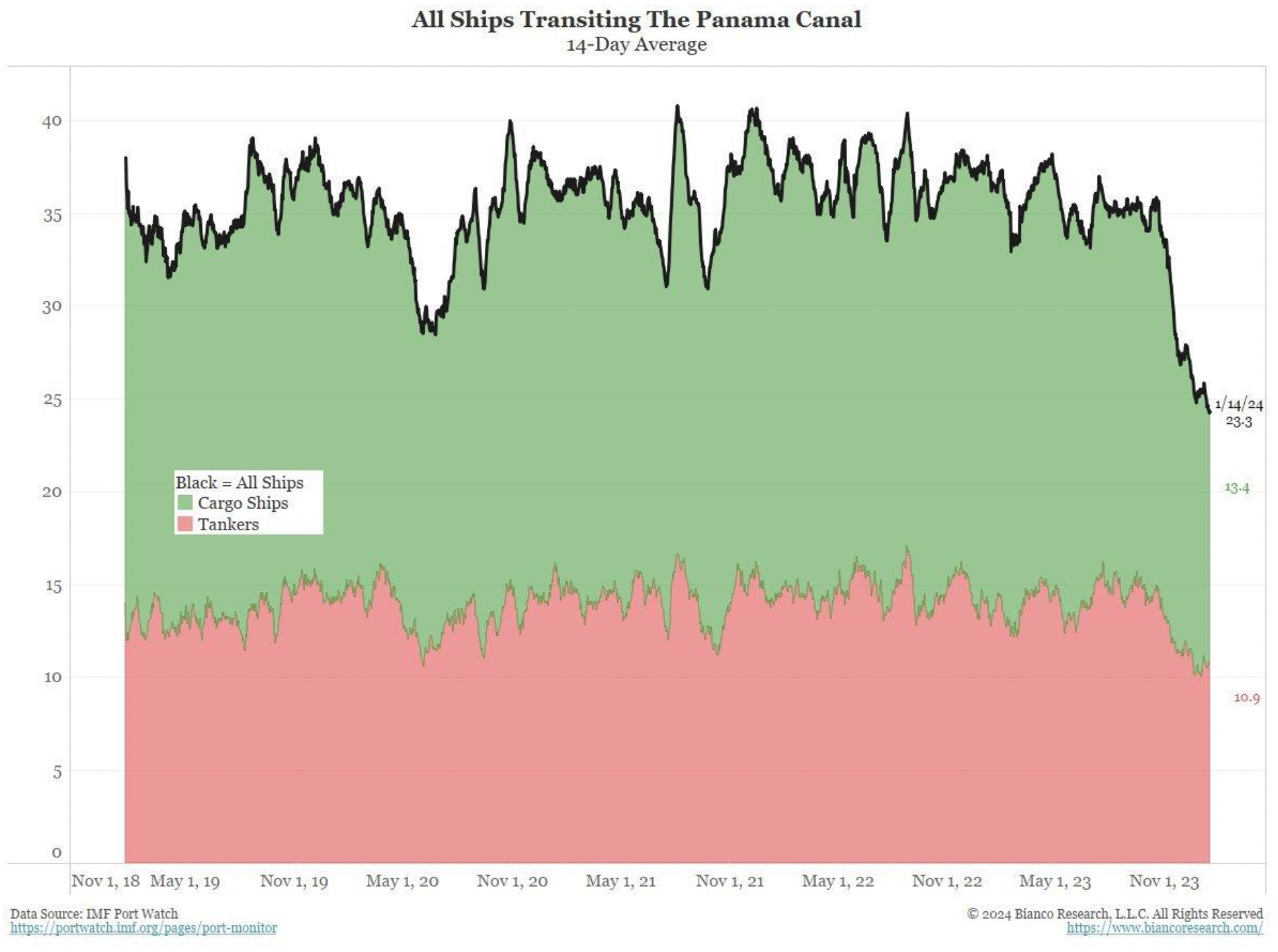

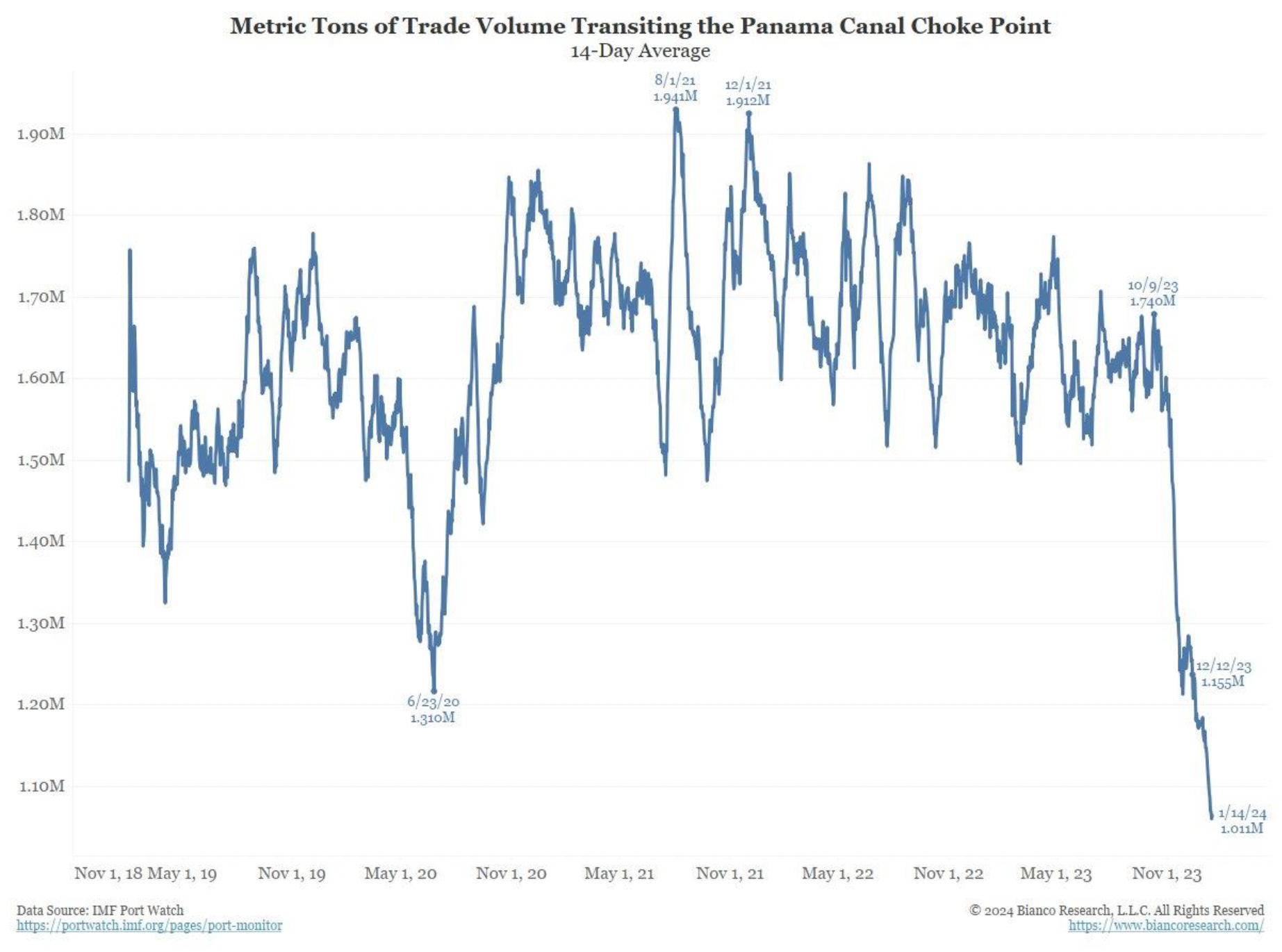

Shipping is an old but essential business. The cost per kilometre travelled is cheapest by sea vs. rail, road, or air. Without the Panama Canals or passage through the Bab el-Mandeb, ships must travel around Cape Horn or the Cape of Good Hope. The onset of the El Niño weather pattern has caused drought conditions at the Panama Canal, resulting in lower-than-average water levels inside the canal, which means fewer ships can transit. The Yemeni Houthis’ asymmetric drone warfare has effectively closed the Bab el-Mandeb for Western ships. They must now sail around the Cape of Good Hope.

This rerouting affects 20% to 30% of all shipping globally and adds considerable time and expense. For an inflation statistician, anything that travels by ship will get more expensive, all else being equal. Given that inflation operates at a considerable lag, if this situation persists, the effects will only appear many months from now. While the markets are cheering YoY inflation statistics falling in the US and elsewhere, it might be a pyrrhic victory.

The El Niño weather pattern is just getting started. A mild El Niño typically lasts for one to two years. However severe this El Niño is, it will still be present in November of this year. Sadly, if you are a Biden supporter, he can do nothing about the weather. Humans are not even a Kardashev Type I civilization. El Niño and climate change in general have lowered the Panama Canal’s water levels, reducing the number of ships that can transit.

Reducing shipping activity through the Panama Canal is important because the US was rerouting some goods through Europe to Eastern seaboard ports to avoid the canal. But, given that goods from Asia to Europe loaded on Western ships must now travel around Africa rather than through the Red Sea, delivery costs and time will increase.

The Houthis have declared they will attack any ship of any nation that supports Israel. They believe Israel’s Gaza war is a genocidal exercise that is being prosecuted by war criminals such as Israeli Prime Minister “Bibi” Netanyahu. In solidarity with their Muslim and Arab kin, they are using $2,000 drones to attack merchant ships. The fact that a cheap drone can completely incapacitate a multi-hundred-million dollar vessel is the definition of asymmetric warfare. Ponder this: in order to nullify a $2,000 drone, the US must launch a missile costing $2.1 million. Even if the Houthis never hit a single target, every drone they send costs the US 1,000 times more to defend. Mathematically, this is an unwinnable war for the US.

The cost of using expensive naval missiles — which can run up to $2.1 million a shot — to destroy unsophisticated Houthi drones — estimated at a few thousand dollars each — is a growing concern, according to three other DOD [Department of Defense] officials.

– Politico

Given that the US is responsible for global maritime security due to its role as the global reserve currency issuer, the entire world is looking at how Pax Americana deals with this flagrant military bitch slap. Taking the Houthis’ statements at face value, if the US broke off relations with Israel and forced Bibi to end the war, the Houthis would cease their attacks. However, even if the US believed Bibi was a genocidal madman, the empire could not be seen to ditch its ally because a government of a “shithole” country launched a few cheap drones and shut down one of the most essential waterways in the globe.

Even if Biden loudly calls on Bibi to wind up the war and stop murdering so many Gaza men, women, and children, Biden will never pull the financial and military plug on the Israelis for fear of losing face. The result is that the entire world gets a front-row seat to the future of warfare. The conventional US Navy, represented by aircraft carrier groups that cost trillions to float, is going head-to-head against sand people, launching drones that cost less than your bar tab at Zero Bond.

I predict that we will witness just how difficult it is for the mighty Red, White, and Blue fist to swat a drone swarm of flies. For shipping companies to feel confident sailing through the Red Sea again, the US Navy must be perfect in every engagement. Every single drone must be neutralised. Because even one direct hit with a drone’s payload could incapacitate a commercial vessel. Additionally, because the US is now at war with the Yemen Houthis, shipping insurance premiums will skyrocket, making it even more uneconomical to sail through the Red Sea.

Due to weather and geopolitics, higher shipping costs could cause a surge in inflation in the third and fourth quarter of this year. As Powell is undoubtedly aware of these issues, he will do everything he can to talk a big game about rate cuts without having to actually cut them. What might be a mild increase in the rate of inflation due to increased shipping costs could be supercharged by rate cuts and the resumption of QE. The market doesn’t appreciate this fact yet, but Bitcoin does.

The only thing that trumps fighting inflation is a financial crisis. That is why, to get the cuts, QT taper, and the possible resumption of QE the market believes is already in the bag come March, we first need a few banks to fail when the BTFP is not renewed.

Tactical Trading

A 30% correction from the ETF approval high of $48,000 is $33,600. Therefore, I believe Bitcoin forms support between $30,0000 to $35,000. That is why I purchased 29 March 2024 $35,000 strike puts. I also dumped my trading positions in Solana and Bonk at a slight loss.

Bitcoin and crypto in general are the last freely traded markets globally. As such, they will anticipate changes in dollar liquidity before the manipulated TradFi fiat stock and bond markets. Bitcoin is telling us to look for Yellen and not Talkin’.

Yellen has a chance to add more juice to the markets in the upcoming QRA, published on January 31st. If she telegraphs that she will run down the TGA from $750 billion to zero, then we know there is another source of liquidity the market hadn’t anticipated that will prop up markets. The question then becomes: will it be enough to forestall any bank failures once the BTFP is not renewed?

I believe the BTFP will not be renewed because neither Yellen nor Powell has mentioned it once. Therefore, the natural assumption is that it will expire, and the banks must pay back the almost $200 billion borrowed. If that changes, and they explicitly state it will be extended, then it’s off to the races. I will close my puts and go to maximum levels of crypto risk by continuing to sell Treasury bills and purchasing crypto.

If my base case comes to pass, once Bitcoin drops below $35,000, I will start bottom fishing. I will load up on Solana and $WIF. Bonk is the last cycle’s doggy money, and if it ain’t Wif Hat, it ain’t shit.

Related

The post appeared first on Blog BitMex