Bitcoin’s price has been stuck below $58,000 for a long time. Despite being in a bull market, Bitcoin isn’t moving up, and both market and non-market factors are to blame.

Impact of US CPI

The US Consumer Price Index (CPI) rose by 3% in June. Analysts see this as a bullish signal for Bitcoin, but the price isn’t rising. If the US central bank cuts interest rates, incentives for fixed-income investments will drop, and people will look for investments with higher returns.

Chris Larkin, managing director of trading and investing at E-Trade, told CNBC that the Federal Reserve (Fed) is “one step closer to a September rate cut,” especially after real average hourly earnings for workers slowed by 3.9% from the prior year.

The labor force participation rate also increased slightly, from 62.5% in May to 62.6% in June. Despite the data pointing to higher odds of rate cuts, with a 90% consensus for at least one 0.25% rate cut by September, Bitcoin’s price remains below $60,000. Meanwhile, the S&P 500 stock market index is 0.5% below its all-time high, and gold is trading 1.2% below its $2,450 record high from May 2024. Even the Russell 2000 small-cap index, which excludes the 1000 largest US-listed companies, rose 3% on July 11.

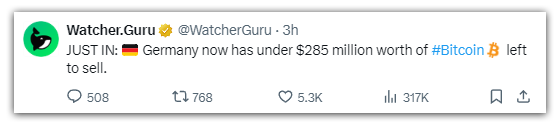

German Government BTC Sales

The German government continues to dump nearly 50,000 bitcoins, seized in 2013, into the market. These are worth almost $3 billion. According to Watcher Guru, the German government now has only $285 million worth of BTC left.

Price Analysis

Due to these issues, the market feels like a bear market despite being in a bull market. BTC is currently trading at $57,412, with an RSI value of 48.30. The Bitcoin chart shows a big rejection at $59,500, a strong resistance zone where the MA100 is also located. This 3.87% fall pushed BTC back into the triangle zone, indicating that bears are currently holding a strong base.

Bitcoin’s market cap has dropped to $1.1 trillion, which worries investors. Sources suggest that while retail investors face selling pressure, BTC whales and sharks are accumulating. Once the German government finishes selling its BTC and the Mt. Gox repayment pressure eases, the market might stabilize. It could take another 1-2 months for everything to settle down.

The post appeared first on Coinpedia