Hamilton Lane, a global investment firm with over $920 billion in assets under management, has taken a bold step into the world of blockchain. The firm is launching its Senior Credit Opportunities Fund (SCOPE) on the Solana blockchain through a partnership with Libre, an institutional Web3 infrastructure provider. This move marks a significant milestone in the adoption of digital assets by mainstream financial institutions.

What This Means for Solana Users

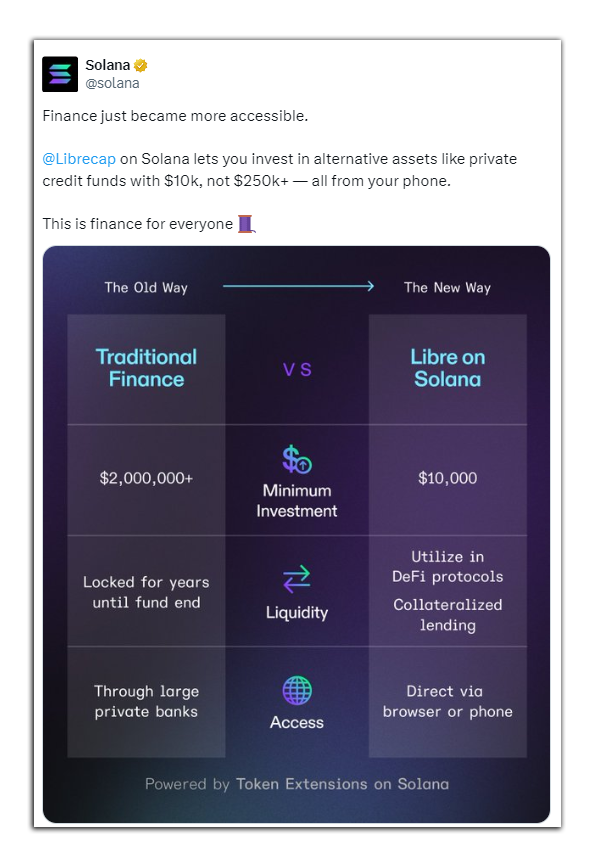

This partnership allows Solana users to access Hamilton Lane’s SCOPE fund via a feeder fund structure. Accredited, professional, and institutional investors can now directly access top-tier funds on-chain, including Brevan Howard’s Master fund and BlackRock’s ICS Money Market fund. This initiative provides greater transparency, efficiency, and accessibility for investors, aligning with Hamilton Lane’s objective to democratize access to private market investments.

The Power of Tokenization

Victor Jung, head of digital assets at Hamilton Lane, emphasized the significance of this partnership. He highlighted that it positions Hamilton Lane as a leader in the tokenization of private market funds, leveraging Solana’s low latency and high throughput capabilities to expand access to historical strong returns and performance opportunities. The tokenization of real-world assets (RWAs) like private credit, cash, real estate, and artwork brings these assets onto the blockchain, creating greater liquidity, transparency, and accessibility.

A Leap Forward for Alternative Assets

Alternative asset managers have increasingly explored tokenization as a way to expand fund distribution. Hamilton Lane has been particularly active in leveraging blockchain technology to widen access to its investment funds. Recently, it participated in a $47 million funding round by Securitize, a platform focused on tokenizing real assets. The SCOPE fund is also available through Securitize, demonstrating Hamilton Lane’s commitment to innovative investment accessibility.

Expanding Investment Opportunities

Libre’s chief executive and founder, Dr. Avtar Sehra, called the launch of the Libre Gateway on Solana a significant advancement. This step enables access to wealth and treasury management tools for users on Solana and allows Libre to introduce new and innovative services. Libre plans to roll out additional services to Solana users over the coming year, reflecting a broader trend among asset managers to explore tokenization for expanding fund distribution. Solana is currently trading at $178 and experts believe funds like this will be the supporting stone to pump solana towards $500 towards the end of this year.

The Future of Fund Management

The integration of Hamilton Lane’s SCOPE fund into the Solana blockchain represents a significant step in the evolution of investment fund distribution. By leveraging blockchain technology, the company aims to provide greater transparency and efficiency in fund management while democratizing access to high-performing investment opportunities. This partnership underscores the transformative potential of blockchain in the financial sector, setting a new standard for the future of fund management.

Also Read : Top 10 Cryptos Trade in Red Zone: Will Solana (SOL) Price Reverse the Trend & Reclaim $180?

The post appeared first on Coinpedia