Solana’s (SOL) price is set for a massive upside rally after facing significant selling pressure at its strong resistance level of $161. In the past few days, SOL has dropped by over 18% due to the overall bearish market sentiment and the recent price decline in Bitcoin (BTC).

Trend Reversal Sign

However, SOL’s daily chart has formed a bullish divergence, signaling a potential trend reversal from a downtrend to an uptrend. Since the beginning of August 2024, SOL has been forming lower lows, while the Relative Strength Index (RSI) has been creating higher lows.

The formation of bullish divergence on a daily time frame indicates a potential upside rally. Traders and investors view this as an ideal buying opportunity.

Solana Price Prediction

According to the expert technical analysis, SOL has been consolidating within a tight range near a crucial support level of $127. This support level has always been special for Solana. Since March 2024, SOL has revisited this level several times, and each time it has seen a massive upside rally of a minimum of 20%.

However, given the bullish divergence and historical price momentum, there’s a strong possibility that SOL could soar by 20% to the $161 level.

On-chain Metrics and Market Sentiment

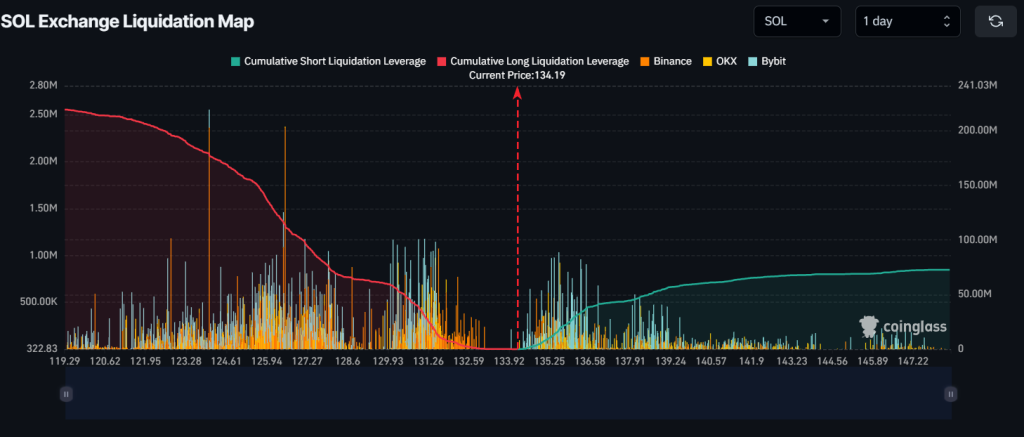

As of now, the major liquidation levels are near $126.5 on the lower side and $136.8 on the upper side, as traders are over-leveraged at these levels, according to the on-chain analytic firm Coinglass.

If the market sentiment for SOL remains bullish and the price rises to $136.8 level, nearly $41 million worth of short positions will be liquidated. Conversely, if the sentiment shifts and the price falls below the $126.5 level, approximately $115 million worth of long positions will be liquidated.

The higher long liquidation shows that currently bulls are dominating the asset and have the potential to liquidate larger short positions.

At press time, SOL is trading near $134 and has experienced a price surge of over 3% in the last 24 hours. Meanwhile, its trading volume has also skyrocketed by 65% during the same period, indicating higher participation amid a bullish outlook.

The post appeared first on Coinpedia