Bitcoin had fallen to a danger zone between $56,600 and $52,500 on September 5. Last time this happened, Bitcoin touched $49,000 twice in one day on August 5. The recent fall of BTC under $56,600 caused huge tension in the market, as September is very notorious for being a red month for the largest cryptocurrency. However, on September 9, it suddenly took a jump and shocked the market. Let’s explore all the answers to why this happened.

Chart Showing Momentum

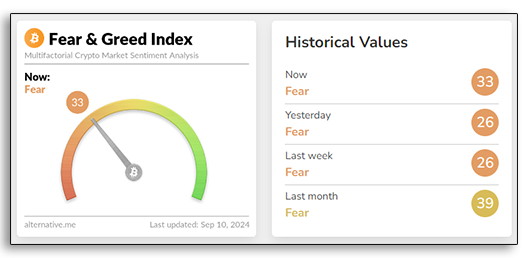

In the last 24 hours, the market cap of the cryptocurrency ecosystem has increased by 2.51% and reached $2.09T. The price of BTC suddenly took a surge of around 6.52% and by passing Moving average 20 and 50. However, MA 100 did not let it pass; it dropped by 2.5% to retest the nearest support zone around $56,600. The RSI is showing a bullish momentum and recorded at 61 points. Fear and Greed index, that was showing a high fear at 26 mark is at 33 and showing a reduction in market fear.

Looking at the chart, it looks like BTC will try to solidify its support at $56,600 however the fear of September will still give advantage to bears. Closing above this support level is very important for Bitcoin or there are chances it has to look towards $50,000 for a support and rebounce.

Other Market Metrics

Data from IntoTheBlock shows that at the current price, most of the Bitcoin investors are in the money. This clearly shows that 79% of the BTC investors bought the coin under $56,960. This leaves 13% out of the money meaning they are still in loss, and 8% investors bought at the current price.

Around 4.55 million BTC addresses holding a total volume of 2.26 million Bitcoin have bought the assets between the price range of $55,507 to $61,396 with an average buying price of $58,690. The major resistance lies ahead of $60,000. There are 6.93 million addresses holding 3.14m BTC with a minimum buying price of $61,396 and a maximum price of $72,500. This $11,000 price gap created a huge resistance.

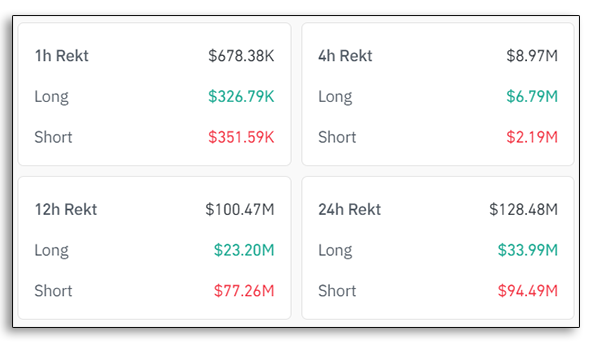

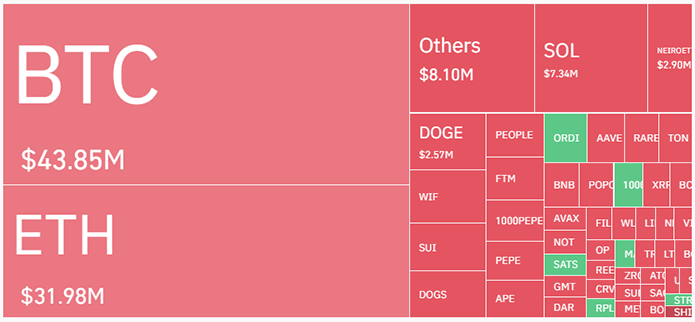

Liquidation Data

In the last 24 hours around 39,647 trades were liquidated and the total liquidated amount was $128.42 Million. What is interesting to see is that just two days ago, the liquidation data consisted of long trades. However, the current data shows that in the last 24 hours, the market has liquidated short trades which gives a bullish signal.

Bitcoin had the biggest short liquidation of around $43.85 M followed by ETH at $31.98 M. Interestingly, Dogecoin, which follows Bitcoin price movement very closely, also has a short liquidation of $2.57 M.

How Michael Saylor Boosted Bitcoin Today?

The founder and chairman of famous Microstrategy, Michael Saylor was invited by CNBC on September 9 for a discussion on Bitcoin. When he was questioned about his opinion on the profits generated by Bitcoin he did not hold back and clearly shared the profits his company is making with BTC. He said that since August 2020, Microstrategy has bought about $8.3 Billion worth of Bitcoin. He said ” We leveraged Bitcoin and are 825% up while the number 1 stock in S&P is 821%. So we beat every single company in S&P using our Bitcoin strategy.”

When asked about the recent $1.2 Billion worth of outflow from the Bitcoin Spot ETFs, Saylor replied by saying that he thinks generally that’s a good thing as it created more demand. Bitcoin is a smart money and it is the most liquid and fungible free market in the world.

Bitcoin Price Prediction

Talking about Bitcoin referred to as digital gold, Andres Ross asked Saylor about the behavior shown by Bitcoin in times of panic. Saylor replied by explaining that if you are a long term holder, you are in profit as bitcoin moves with yearly profit of around 44%. And even if you are a short term trader, the market provides a lot of arbitrage opportunities.

In the words of Saylor

If you can hold Bitcoin for more than 4 years, you are going to get superior performance with its volatility. As of now Bitcoin is merely 0.1% of world market cap and it is going to be 7%.

He shared his prediction of Bitcoin price in the next 21 years. According to him Bitcoin is going to be at $13 Million in the span of 21 years, and all you gotta do is hold some bitcoin.

The result

After this interview was aired, Bitcoin started to show positive momentum. If Michael Saylor is so confident in Bitcoin, the market will follow. Bitcoin showing a sudden up movement of around 7% in the notorious month of September is a signal that over the period of decade, BTC has evolved. For the last few years, we have witnessed that whenever there is panic in the market, it creates buy opportunities. That is how the Bitcoin whales accumulate assets and fill their bags.

The post appeared first on Coinpedia