BitMEX is proud to share that it continues to boast a low on-chain AML risk profile thanks to substantial investments in compliance controls and cutting-edge tools like Chainalysis.

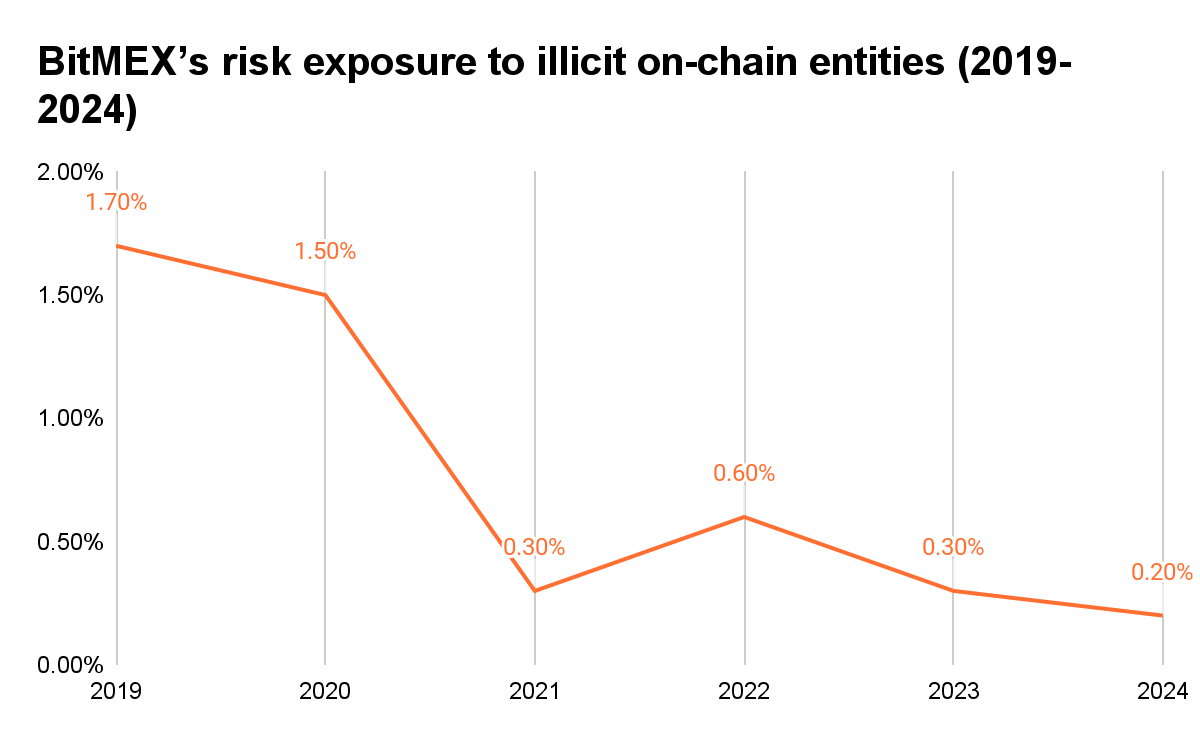

Today, we can proudly say that we have continuously worked to reduce our on-chain AML risk exposure over the years, achieving the lowest risk exposure to illicit activity of 0.2% in 2024.

On-chain risk exposure is the potential risk associated with deposits and withdrawals to and from the exchange based on counter parties or third party wallets that the assets have originated from or are being sent to. This includes direct and indirect transfers. Direct transfers are where transfer occurs between BitMEX and the other counterparty without any intermediary or wallet in-between. Indirect transfers are instances where funds pass through multiple addresses of which some may be illicit to obfuscate the source or destination.

Thanks to the transparency of blockchains and blockchain analysis solutions like Chainalysis Crypto Compliance and Crypto Investigations, BitMEX can easily assess its on-chain risk exposure to account for all services and entities interacting with its platform on-chain and conduct deeper due diligence on suspicious activity. This is very difficult in traditional finance, where funds may have moved through multiple financial institutions, with the recipient institution having only a view of transactions processed through their institution.

By developing a robust Compliance programme with the help of extensive data coverage and advanced analytics provided by Chainalysis, we are proud to share that we have successfully reduced our on-chain risk exposure from 1.7% in 2019 to 0.2% in 2024, representing an 88% reduction in risk exposure. This commitment to safety and regulatory adherence underscores our leadership in the crypto industry and commitment to maintaining a safe and secure trading environment.

Source: Chainalysis

How Did We Achieve the Reduction?

BitMEX’s compliance standards have significantly evolved over the last five years, with full support from the company Board and Senior Management. Since 2020, BitMEX has implemented a comprehensive compliance programme covering the full range of AML and regulatory compliance standards across traditional finance and Web3, even in jurisdictions where regulations or guidance may be absent.

This includes initiatives focused on corporate governance, adopting the Three Lines of Defence risk management model, AML risk assessments, risk-based KYC, sanctions compliance, anti-bribery & corruption practices, transaction monitoring, market surveillance, Travel Rule compliance, cooperation with law enforcement, STR & regulatory reporting, training, and independent audits. This is in addition to the extensive transaction lookbacks and customer KYC remediation initiatives that BitMEX completed following the introduction of mandatory KYC requirements.

The development of a robust and reliable transaction monitoring capability has also been central to this change. Utilising Chainalysis for on-chain monitoring provides unprecedented visibility into counter-party and transaction risks, enabling the investigation team to proactively manage these risks. This capability is supplemented by the implementation of AML transaction monitoring capabilities, similar to those used in traditional finance, that monitors for behaviour or patterns common to money laundering or terrorism financing typologies.

“As part of the AML programme build out, we have been selective on the vendors and partners that we work with to ensure they are fit for purpose and industry leaders. Chainalysis has been a key partner in this journey.” – Julian Tehan, Chief Compliance Officer, BitMEX

BitMEX Compliance Programme: Key Propositions

Our compliance programme incorporates several unique elements that sets it apart including:

- TradFi & Web3 Compliance model: The compliance framework implemented by the firm leverages traditional finance AML compliance standards and the technologies offered by Web3 developments. This 3 lines of defence model balances technological innovation against ongoing AML risks.

- Mandatory KYC: A high quality KYC standard underpins the transaction monitoring capabilities.

- Geo-blocking & On-Chain Analysis: BitMEX Compliance combines IP geo-blocking and on-chain analysis together to substantially minimise sanctions exposure.

- Agile Tuning & Optimisation: Given the industry’s rapid changes and ongoing new typologies detailed in annual crime reports from blockchain analytics firms like Chainalysis, BitMEX stays up to date by proactively adjusting risk settings which includes enabling new AML monitoring categories and evaluating new scenarios.

- Continuous Feedback Loops: BitMEX actively collaborates with compliance vendors through ongoing discussions, providing feedback based on real-world cases to incrementally refine and enhance the vendors’ products.

- Behavioural and Off-Chain Monitoring: BitMEX supplements its on-chain screening with behavioural monitoring, incorporating both off-chain activities and traditional money laundering typologies, for more holistic oversight.

- Law Enforcement Portal: BitMEX has a dedicated portal for law enforcement and external regulatory authorities and is committed to cooperating with those requests, where permitted.

- Data Integrity Verification: BitMEX conducts periodic data integrity checks to ensure there are no data leaks in its compliance processes, enhancing the reliability and security of its operations.

- Proof of Reserves and Liabilities: BitMEX is one of the few exchanges that updates a verifiable Proof of Reserves and Liabilities twice a week, enhancing on-chain transparency. Since 2014, we’ve lost zero crypto. Ensuring the exchange is safe, secure, and reliable is at the center of all our operations.

- Independent Reviews: BitMEX’s AML/CFT compliance programme undergoes regular, independent reviews by qualified auditors.

“BitMEX has continuously taken an innovative and proactive approach towards enhancing their risk management strategy and prioritising consumer safety. The team has always valued a strong collaboration when working with Chainalysis, and it’s really impressive to see their investment in a skilled investigations and compliance team, and the adoption of advanced tools – which have yielded impressive results.” – Chainalysis

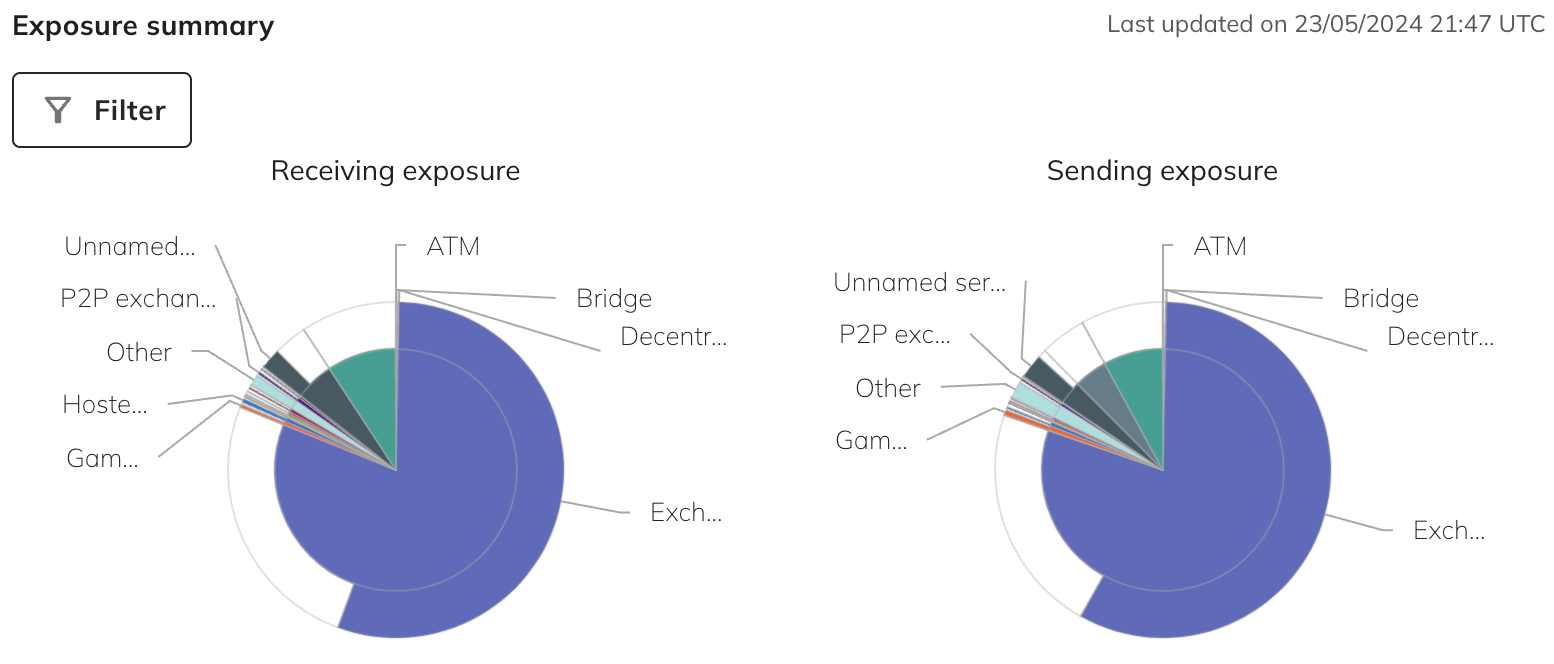

BitMEX On-Chain Exposure

Depicted above, BitMEX’s on-chain exposure in Chainalysis from the receiving side is displayed on the left, reflecting a breakdown of the sources of funds received by the exchange. The right hand side displays the sending exposure, which is a breakdown of where funds sent from the exchange have gone. Exposure categories include services like exchanges, and merchant services providers, as well as illicit categories like darknet markets, or even wallets known to be associated with exchange hacks and other forms of criminal activity. It is apparent from these graphs that the share of illicit services on both sides represents a tiny fraction of the overall exposure.

BitMEX’s figure of 0.2% in risk exposure means that BitMEX is 35% below the global level in terms of risk exposure.

How BitMEX Leveraged Chainalysis Features

Chainalysis’ risk solutions including real-time transaction monitoring have helped to keep BitMEX users safe by pre-screening and blocking direct withdrawals to wallets attributed to illicit entities, including scams. BitMEX subsequently educates its customers about the risks of transacting with such services to prevent future transactions and maintain its low risk profile.

Separately, Chainalysis’ insightful industry research reports and intuitive investigations solutions enabled BitMEX to trace and thwart a multi-million dollar ponzi scheme, which was also referred to and picked up by police agencies. This investigation led to an arrest via Interpol Red Notices of the two masterminds behind a well-known scam. By utilising Chainalysis investigations solutions, BitMEX was able to visually trace the source of funds for a subject linking the adverse media to their on-chain activity. This was possible due to the ease of use and superior UX of Chainalysis solutions, allowing BitMEX to easily identify the exposure of connected wallets.

One of the standout features of this partnership is BitMEX’s utilisation of Chainalysis’ evolving new risk categories and highly configurable alert parameters, which are constantly evolving. These categories are designed to keep pace with the fast changing trends in AML and cryptocurrency regulation. This, together with Chainalysis research reports, enabled BitMEX to be more surgical in its risk-based approach to monitoring and allowed it to decrease the rate of false positives to review, increasing accuracy and lowering workload.

“We appreciate how user friendly and seamless it is to use Chainalysis via their intuitive visualisation of transactions on the blockchain, especially when investigating indirect risky exposure. Moreover, their support team is world-class when it comes to answering our queries and listening and implementing our feedback.” – Dias Malayev, Head of Investigations, BitMEX

BitMEX relays that its partnership with Chainalysis is highly valued for the reasons mentioned above, along with its regulatory knowledge, user-friendly interfaces, and dedication to education and research, which reinforces the longstanding partnership over many years.

“We are honoured to have supported BitMEX on their risk and compliance journey over the past few years. It’s inspiring to see an innovative organization deeply committed to enhancing their risk management strategy and prioritizing consumer safety. Their strong collaboration, investment in a skilled investigations and compliance team, and the adoption of advanced tools have yielded impressive results. We look forward to continuing our partnership with BitMEX as they advance their commitment to compliance and strive to build a trusted platform for their clients” – Diederik Van Wersch, Regional Director, ASEAN & Hong Kong, Chainalysis

Related

The post appeared first on Blog BitMex