Cardano (ADA) is making headlines as it leads the market with a remarkable price surge, defying broader crypto trends. On November 16, 2024, while other assets struggled to gain momentum, the ADA price registered a significant price surge of 28%.

Cardano (ADA) Price Momentum and its 28% Gain

Meanwhile, the asset has experienced a 7% upward momentum in the past hour and is currently gaining significant attention from crypto enthusiasts. With this notable price rally, ADA is currently trading near $0.732. Additionally, the asset’s trading volume has jumped by 180% in the past 24 hours, highlighting heightened participation from traders and investors amid the ongoing rally.

ADA Technical Analysis and Upcoming Levels

With a significant price surge in the past 24 hours, the asset’s price has reached a crucial level. According to expert technical analysis, ADA has reached a crucial resistance level of $0.775 for the first time since March 2024. This notable rally follows a breakout after four days of small consolidation near a support level of $0.60.

Based on recent price action and historical momentum, if ADA breaches the resistance level and closes a daily candle above $0.80, there is a strong possibility that the asset could soar by 27% or 55%, reaching $1.01 or $1.23 in the coming days.

Looking at the current market sentiment and recent price action, it appears that ADA could reach this level in the coming days.

Bullish On-Chain Metrics

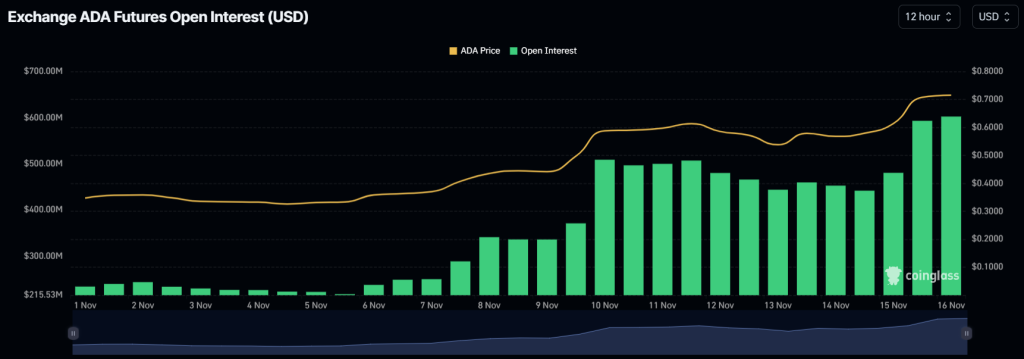

On-chain metrics further support ADA’s positive outlook. According to the on-chain analytics firm, its open interest has surged by 39% in the past 24 hours and 13% in the past four hours. This rising open interest suggests heightened participation and strong confidence among traders, resulting in a significant increase in open positions.

Notably, such a substantial rise in open interest at a crucial resistance level is considered a bullish sign for Cardano (ADA) in the long term. Additionally, ADA’s long/short ratio currently stands at 1.002, indicating strong bullish sentiment among traders.

The post appeared first on Coinpedia