In the last 48 Hours, Bitcoin has broken to the upside as bulls attempt to regain control of price action. Price action tested the 50MA in today’s trading session and could propel price levels above $11,000.

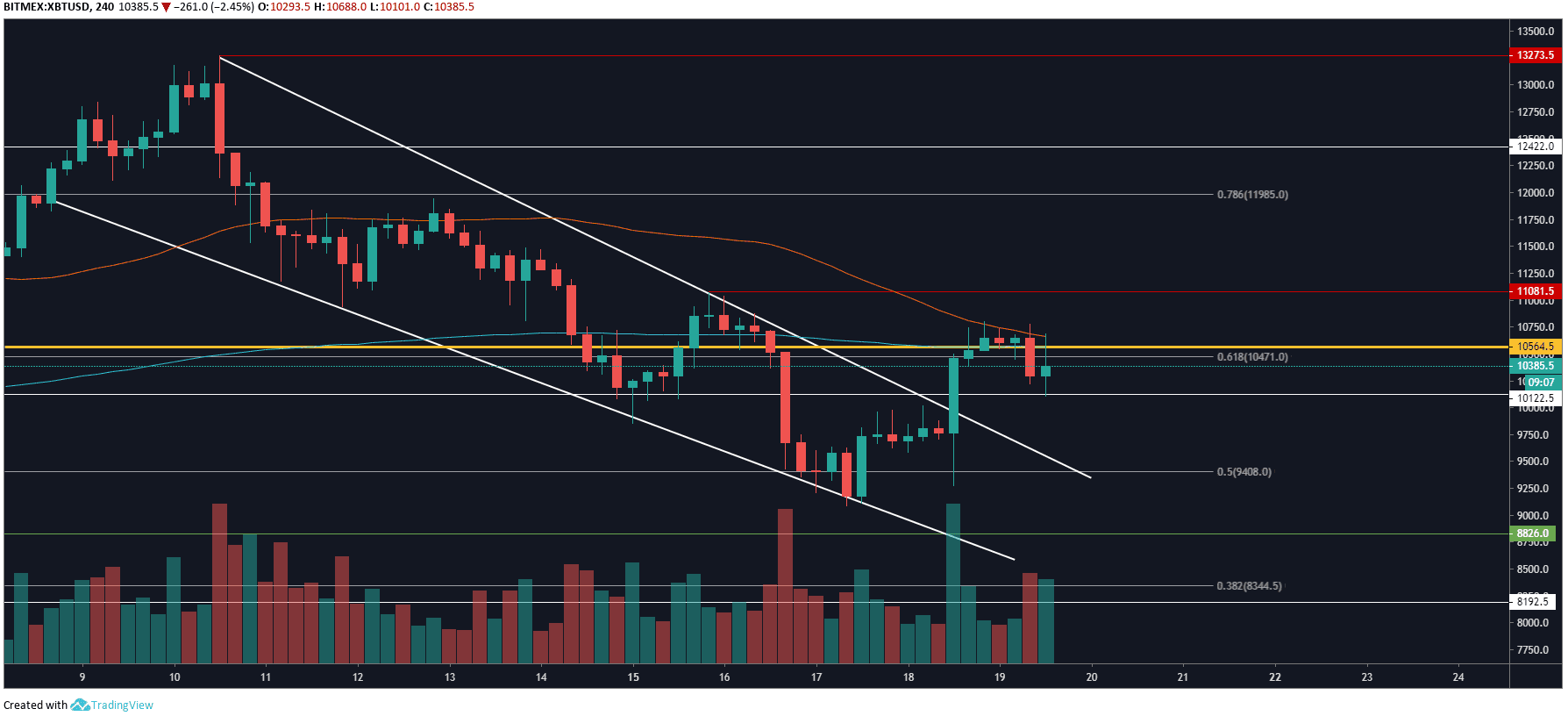

Bitcoin Price Analysis 4 Hour Chart

On the 4 Hour chart, we can see the downtrend over the last 9 days formed a descending channel that was broken to the upside less than 48 hours ago. Since then, Bitcoin price levels have retested support at $10,120 whilst POC moves up to $10,560 around current market price indicating there’s a good amount of support around the current market price.

The 200EMA is running through the same levels as POC with 50MA closely behind. Both moving averages are the closest they have been to each other in well over a month, this leads me to firmly believe there’s strong support around $10,300.

Typically, when both moving averages are so close together after a period of volatility it’s a sign of further volatility to come. This will most likely be kickstarted by an explosive move in any direction, as the trend is still bullish after BTC held above the key support at $8,800. It’s likely that if an explosive move does happen it will likely be to the up-side, but that’s wishful thinking of course.

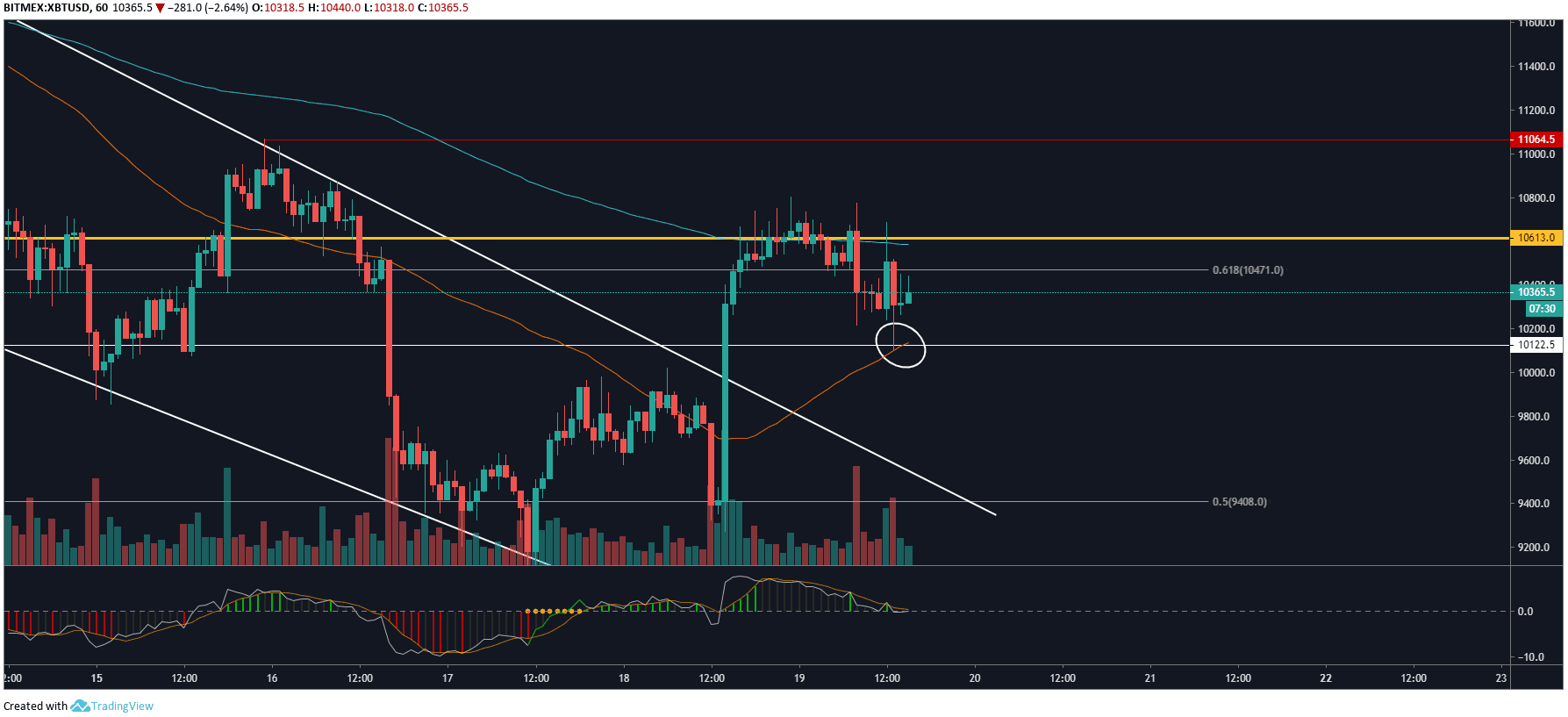

Bitcoin Price Analysis Hourly Chart

On the Hourly chart, we can see the most recent breakout of the descending channel and the large volume that accompanied this move. Since the breakout price levels have been trading close to POC (Point of Control) at $10,600. Recent retest of the 50MA highlighted on the chart resulting in a strong wick is a sign that bulls are still in control, and Bitcoin price levels will likely move up further over the rest of the intra-day trading session.

Both the 200EMA and 50MA are clearly sandwiching the price action, similar to what we can see on the 4 Hour analysis above. This is a strong sign of suppression, which is also evident by the very short-headed candles with large wicks. This simply means that bots and whales are fighting for price levels to remain in a tight trading range in the short-term.

Providing BTC see’s further upside over the coming days and weeks, key resistance levels to look out for are $10,600, $11,080, $11,900 and $13,270.

Do you think bulls will take back control of BTC’s short-term price action over the coming days and weeks? Please leave your thoughts in the comments below!

Images via Tradingview, Shutterstock

The Rundown

The post appeared first on Bitcoinist