Last Week Today – Bitcoin and Cryptocurrency Weekly Digest

August 10-17

- Bakkt receives all regulatory approvals, set for September launch

- China’s central bank set to launch state-backed cryptocurrency

- IRS sends a second letter of warning to cryptocurrency traders

- Litecoin network suffers dusting attack from Russian mining pool

Bakkt at long last. How will it affect Bitcoin?

After a year-long saga of repeated deferrals, Bakkt announced on Friday that it had obtained all necessary ratifications for its physically delivered Bitcoin futures platform. Originally set for an August 2018 launch, Bakkt will now go live on September 23.

Making the announcement through a blog post on Medium, Bakkt CEO Kelly Loeffler confirmed that with the approval of New York State Department of Financial Services to create Bakkt Trust Company and Bakkt warehouse as custodian for physically delivered Bitcoin futures, the platform now had all requisite regulatory approvals to hold custody of Bitcoin and provide physically delivered daily and monthly Bitcoin futures contracts backed by institutional grade infrastructure.

During the last few weeks of testing, Bakkt has hosted various events in New York and Chicago with potential customers and regulators from both the CFTC and the SEC, lobbying for regulation of digital assets.

Loeffler revealed that the platform would support margin trading and let on an interesting piece of information regarding settlement price for futures,

“Uniquely, Bakkt bitcoin futures contracts will not rely upon unregulated spot markets for settlement prices, thus serving as a transparent price discovery mechanism for the benchmark price for bitcoin. The importance of this differentiator is only amplified by reports of significant manipulative spot market activity.”

It was a good week for institutional investors looking to get into Bitcoin as Coinbase beat out competition from Fidelity Investments to acquire Xapo’s Bitcoin custodial services. Xapo, a Switzerland-based crypto wallet, exchange and cold storage service provider for institutional Bitcoin holders, will still retain its wallet app and exchange services.

The deal will allow Coinbase to potentially hold in its custody more than 860,000 bitcoins from Xapo’s institutional clients, taking the US wallet provider’s total holdings beyond a million bitcoins. Following the acquisition, Coinbase now boasts more than 150 institutional clients for its Bitcoin custodial services.

Trading and custodial infrastructure for Bitcoin not being up to snuff is unquestionably the only reason risk-averse institutional money has resisted the temptation of Bitcoin. Now that the inadequacy is being taken care of, how is the expected influx of big money going to affect Bitcoin? The cursory consensus is that these are the most bullish developments in Bitcoin’s history.

Bakkt is a futures platform. Given the tepid reception for CME and CBOE futures, which simply allowed betting on the price of Bitcoin without any bitcoins changing hands, should we expect greater interest in Bakkt?

But this is backed by the Intercontinental Exchange (ICE), NYSE’s parent company, and that makes it a bigger deal. Another important distinction is that Bakkt contracts will not track the price of dodgy, unregulated spot exchanges. So let’s say Bakkt futures generates a lot of interest.

What’s about to happen with the launch of Bakkt is that big money is getting an opportunity to bet on Bitcoin. That may ostensibly seem like good news but big money could be looking to short it to oblivion. Bill Gates said last year that he would short Bitcoin if there was “an easy way of doing it.” Perhaps Microsoft will get in on the action now.

Bitcoin markets are rife with wash trading and fake volumes across the board. Some studies have found actual trading volume to be less than 5% of volume reported by exchanges. If there is serious institutional interest in Bakkt futures, sufficient to dwarf current actual trading volumes, and if institutional sentiment is bearish, we’ll be heading south in no time.

But it could also be that institutions looking to accumulate and hoard bitcoins for the long-term will now have a trusted, secure and reliable way of doing so, thereby taking a good amount of coins out of circulation, further driving up the demand.

China tries to market digital yuan as a cryptocurrency

Shangai Securities News reported this week that China’s central bank, People’s Bank of China (PBoC) is all set to launch its national cryptocurrency after carrying out a five-year research process.

Director of PBoC’s payment and settlement division, Mu Changchun announced at the China Finance 40 Forum in Shanghai that the prototype for the “People’s Bank digital currency can now be said to be ready.” The prototype, developed by PBoC’s digital money research group, is said to “fully adopt the blockchain architecture.”

Changchun then contradicted the statement, arguing that a pure blockchain architecture without intermediaries would hinder retail adoption of the currency in a country as big as China due to the high degree of concurrency required. Therefore, it was determined that it would be best not to entirely rely on the blockchain.

PBoC will be adopting a two-tier system, whereby there will not be a direct interface with the public. Instead, the central bank will control issuance of the digital currency to other banks and financial agencies, who will then provide the public with services to exchange their yuan for the digital currency.

Said to be designed for high-frequency business scenarios, Chinese authorities believe that their digital currency will be able to evade US trade sanctions and promote influx of foreign money into its economy. The developments are also seen as a reaction to Facebook’s Libra proposal, after the PBoC rebuked Libra as a serious threat to the global economy.

Under the guise of progressively espousing the greatest innovation in money, China attempts to leverage the transparency afforded by blockchain to further its stranglehold over monetary supply and surveillance of financial activities within the country.

IRS gets real serious about taxes on crypto trading

For the past five years, the US Internal Revenue Service (IRS) has largely ignored cryptocurrency with regards to tax guidance. Then, back in May, further to a request by Minnesota congressman Tom Emmer, IRS Commissioner Charles P. Rettig assured that an in-depth guidance on reporting of cryptocurrencies was in the works.

Late in July, the IRS announced in a news bulletin that it had begun sending letters to more than 10,000 owners of virtual currencies who failed to report their income from cryptocurrency transactions, advising them to pay back taxes as part of the agency’s larger efforts to provide clarity on taxing for cryptocurrencies.

Rettig urged the recipients of these letters to take them very seriously “by reviewing their tax filings and when appropriate, amend past returns and pay back taxes, interest and penalties.” He also revealed in the bulletin that the IRS was expanding its efforts into tracking cryptocurrency transactions through “increased use of data analytics.”

Contrary to a tax guidance on cryptocurrencies released in 2014, which asked taxpayers to “apply the exchange rate for the day, in a reasonable manner that is consistently applied”, the letters sent in July advise traders to report both date and time of a transaction to calculate its value.

Although the IRS styled these letters as educational, crypto holding taxpayers in the US are still awaiting a comprehensive tax guidance for reporting their income pertaining to cryptocurrency activities. By sending out these letters and asking traders to report returns under penalty of perjury without issuing a formal guidance, the IRS has rather put traders in an invidious position.

That didn’t stop the IRS reaching out again to some traders this week, reminding them that they had misreported their cryptocurrency activities. It’s clear that the IRS has all the data from centralized KYC compliant exchanges and anyone that uses one of these exchanges is susceptible to having all their cryptocurrency holdings exposed as the exchange address could help trace their other addresses.

Litecoin dusting attack sheds spotlight on UTXO model

It was first spotted and reported by James Jager at Binance on Thursday that the Litecoin network had been victim of what’s known as a dusting attack on August 9.

“It was network-wide, which meant it affected all users of litecoin that had an active litecoin address at the time. The person behind the dusting attack owns a mining pool based out of Russia, EMCD[dot]io.”

The owner of the mining pool has since come out and said that they were simply trying to promote their mining pool and had no malicious intentions.

Blockchain data analytics company Glassnode found later on Thursday that the attack affected 294,582 Litecoin addresses and that a similar attack was also discovered to have occurred in April this year.

Use of the word attack may have alarmed users of Litecoin as the currency sunk over 12% following the revelation. So what exactly is a dusting attack and can Bitcoin be subject to such an attack?

Dusting attack is not so much an attack per se, but an attempt to expose potential victims by breaching their anonymity or leaving them vulnerable to a further malicious attack. All networks, including Bitcoin, using the UTXO (Unspent Transaction Output) model can be subject to a dusting attack.

In crypto lingo, the term ‘dust’ is used to refer to a very tiny, trivial fraction of a cryptocurrency which cannot be traded or spent due to being of lower value than the fee that would be required to spend it.

In the UTXO model, the unspent transaction output is the remaining balance in a wallet address. In a hierarchical deterministic (HD) wallet, which allows users to generate new addresses for each transaction, UTXOs from different addresses can be collected to be spent in the next transaction and the transaction would reveal all those addresses as input addresses.

In a dusting attack, the attacker would spam dust amounts of a cryptocurrency to numerous addresses in an attempt to get unsuspecting users to use those addresses receiving dust amounts as input for their next transaction, thereby allowing the attacker to track the other activities of the user or even gain access to the user’s identity or personal information, exposing the user to more malicious attacks.

Trading Insights

After closing last week strongly above 11500, Bitcoin looks set to close this week in a bearish engulfing pattern.

Spurred on by the news regarding Bakkt launch, Thursday’s trading saw a strong close above 10000 and the top cryptocurrency has since been trading sideways around 10300 with little volatility.

But looking at the bigger picture, the resistance at .38 Fibonacci retracement level has been tested thrice and has held firm. The latter two of these tests constitute waves 2 and 4 of the most recent impulse wave (12345) following a corrective spell (ABC) from the earlier impulse wave beginning in April. In the broader scheme, the current impulse wave could be the third phase of a longer-term impulse wave.

We’re looking at short-term resistance at 10801 and a target of 13700 for the next wave. A close above 10801 could propel Bitcoin towards that target.

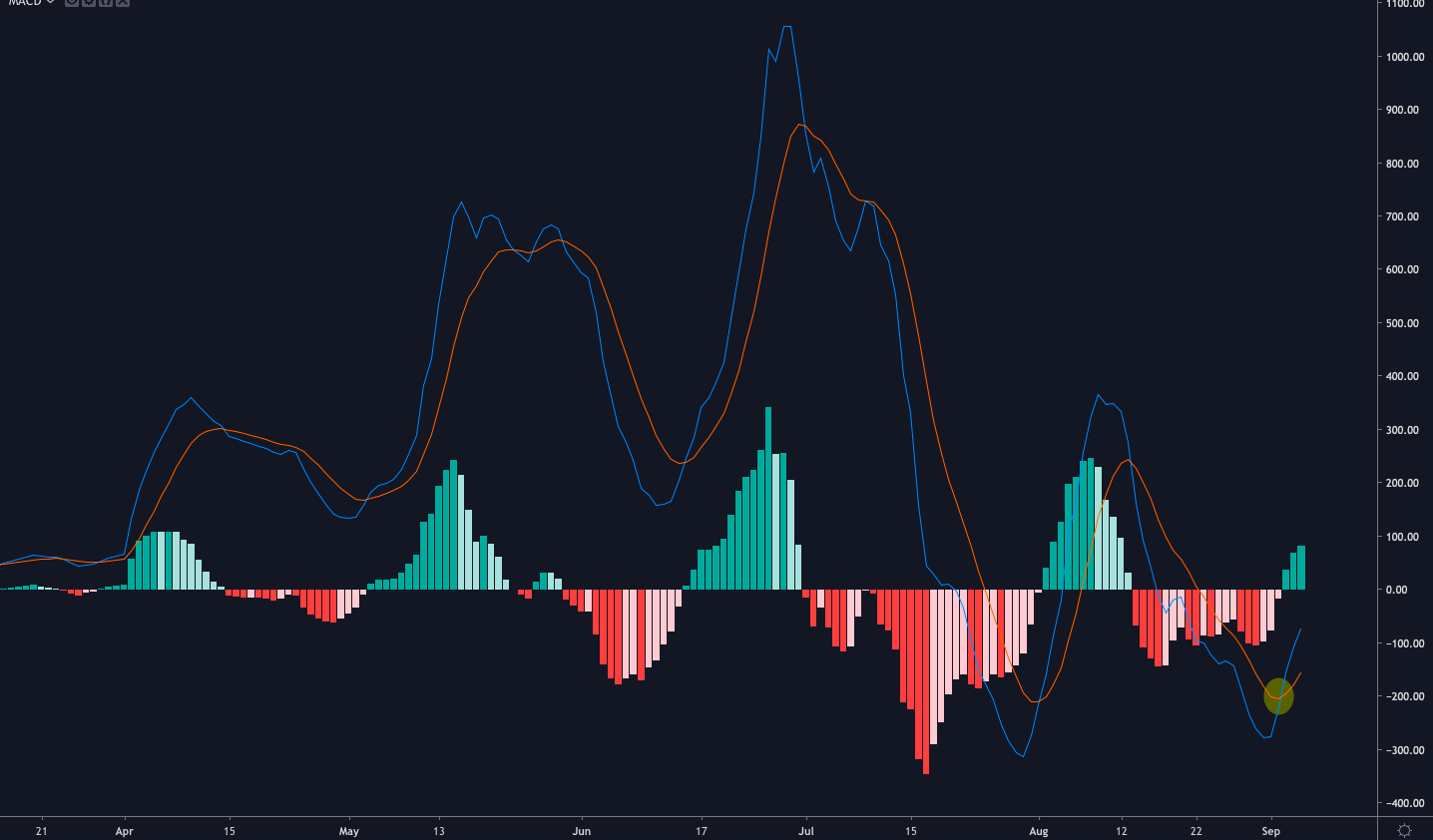

As the daily chart shows signs of consolidation above 10000 for the past few days, the stochastic oscillator indicates a sharp bullish %K crossover just above oversold range.

For short-term traders, the 4-hour chart is showing bullish RSI divergence and MACD divergence, converging towards the zero line, which are fairly strong signs of imminent uptick.

Ethereum fans are in for some respite this week as the most popular altcoin began sprouting some green shoots of recovery.

Daily DMI shows falling ADX, indicating relenting momentum of the recent avalanche and more positively, a bullish convergence between +DI and -DI. Looking at stochastic, there’s a return above oversold level accompanied by bullish %K crossover. These are strong signs of recovery for the embattled altcoin.

With the likes of XRP and EOS also recovering slight ground, Bitcoin’s dominance has slipped back to 68% after briefly breaching beyond 70% during the week.

Last Week Today Bitcoin and Cryptocurrency Weekly Digest: August 10-17th

The post appeared first on Crypto Asset Home