The cryptocurrency industry continued to mature while eliminating FOMOs and FUDs at all stages. With the FOMO-fuelled spectacular but short-lived crypto rallies and FUDs-led dumps, the industry has begun to show signs of maturity. The market started off on a slow note in 2019 after the infamous Bitcoin crash the previous year. The market, however, saw significant recovery after consistent bull runs by mid-year.

The comeback

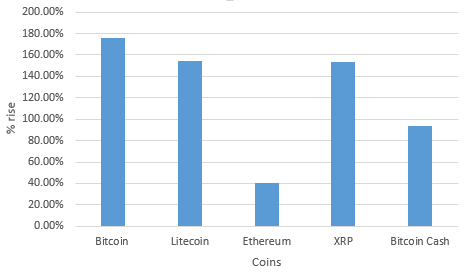

Bitcoin recorded the highest YTD gains of 175.52%. The silver coin to BTC’s gold, Litecoin followed suit posting 154.5% YTD gains. Ripple’s native XRP was positioned third with 153.5%. The contentious Bitcoin hard fork, BCH stood fourth with 94.15% YTD gains while Ethereum, which is the second-largest crypto by market cap stood fifth with just 39.99% YTD gains.

Year to Date [YTD] returns of top five cryptocurrencies

Despite massive gains this year, 2019 failed to match with the colossal rise of 2017. According to the latest LongHash post, the 2019 price rise has been pretty low compared to the skyrocket gains in the 2017 bull run. In 2017, nearly 15 virtual assets posted a staggering 10,000% gains while this year, only 18 cryptocurrencies managed to achieve 100% returns.

A sign of market maturity?

Even as the legal status of digital currencies remains vague, the cryptocurrency market has ostensibly matured. The harsh crypto winter took a toll on numerous promising projects which failed to yield profits. Substantial crypto projects continued to encourage investors to remain optimistic about the future of the industry.

The likes of JP Morgan, Facebook, Nike’s entry into the crypto space provided a necessary momentum, which was earlier associated with the darknet web and perceived as scams by outsiders. In the current regulatory scenario, the narrative of the industry replacing the legacy market is far-fetched; however, massive disruption in the traditional institutions by leveraging the digital currencies and the underlying tech [DLT] is what seems plausible.

The post appeared first on AMBCrypto