Need convincing reasons to purchase Bitcoin? President Trump signed a financial agreement that increases the US national debt by about $22.5 Trillion.

To some people, Bitcoin is money, while to some people Bitcoin can be multiple things depending on how it is utilised. A long term investment, a trading vehicle for short term profits, a form of virtual money, or as per the recent hedge against government initiate economic hardships.

The United States Increasing Debt

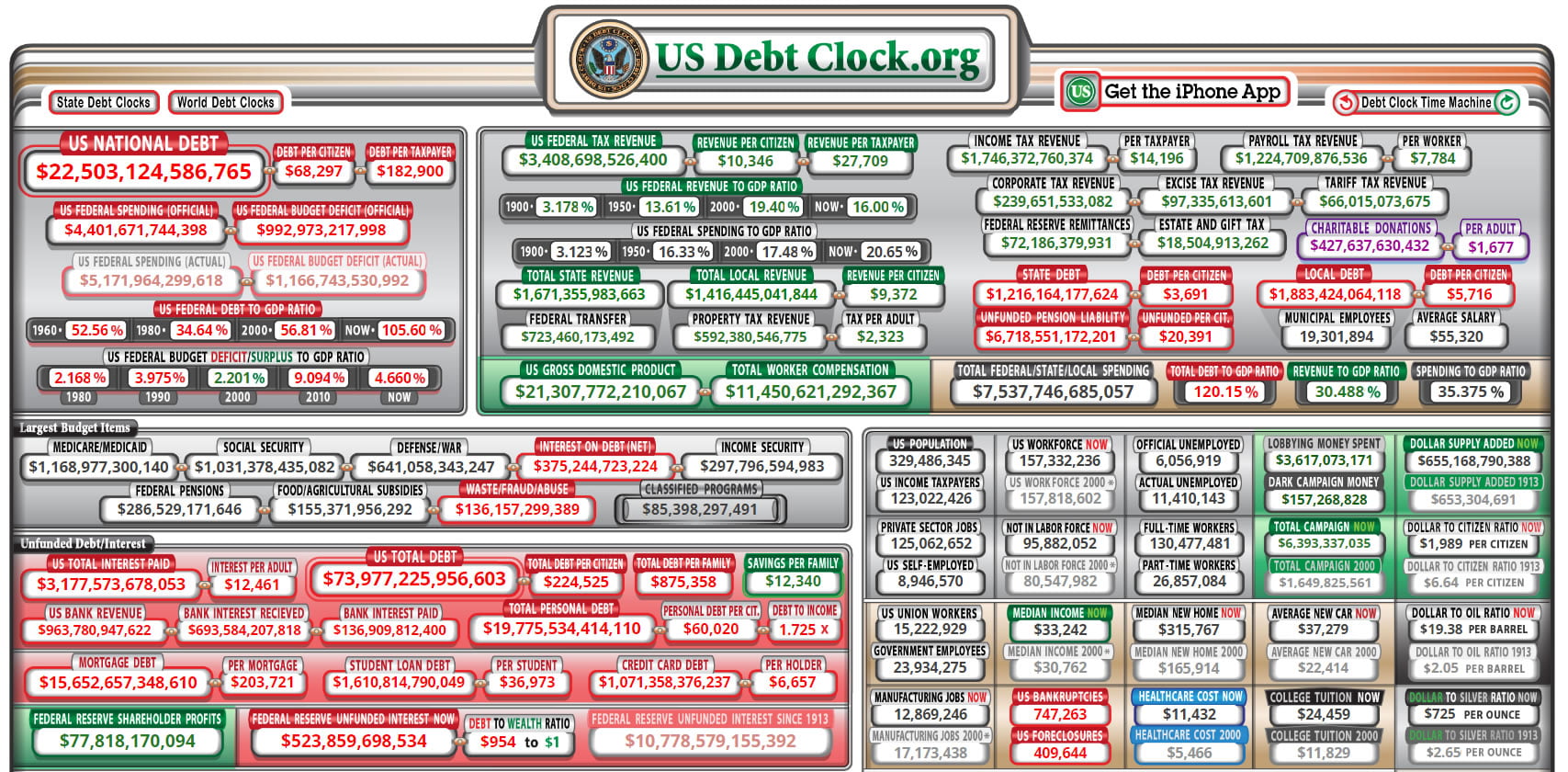

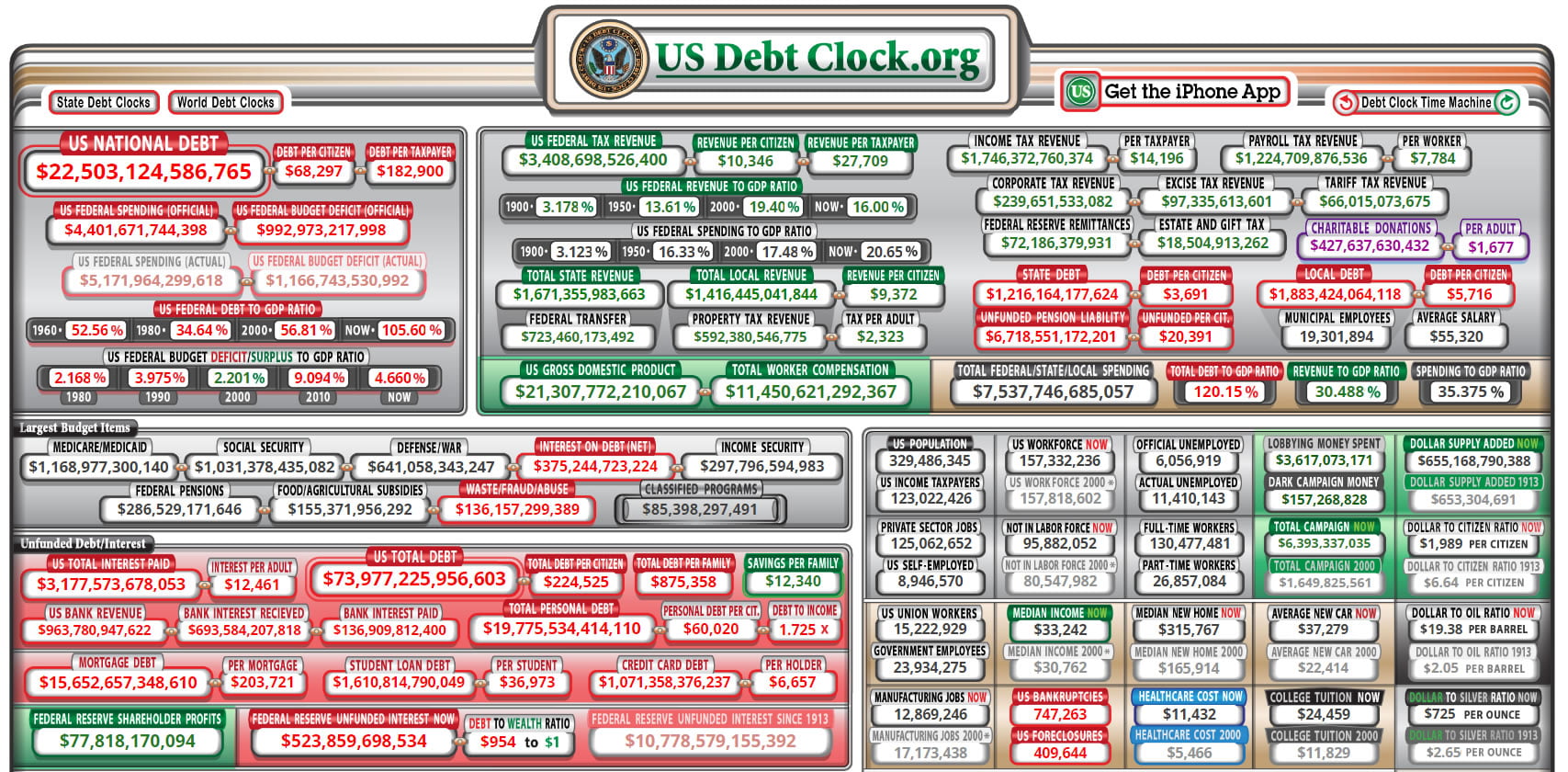

According to the statistics conducted by usdebtclock.org, the average national debt for the US has now accumulated to $22.5 trillion. This outrageous number amount to over $68,000 of debt per citizen. Currently, the ratio of GDP to debt beyond 105% and is promising for further growth. There is an ever-leap frogging debt limitation in the United States as they soar out of control, which could influence another financial disaster.

The United States isn’t alone, and government debt is uncontrollable in several vital international economies. World wide debt has recorded an all-time high of above $180 trillion. The United States is one of the multiple nations that have been utilising the financial market to borrow excessive amounts of cash. The debt has accumulated now that government is unable to manage their financial liabilities, and it has turned into a negative return.

In 2016 the presidential candidate by then Donald Trump in an interview with the Washington Post, he forecasted a ‘very massive recession’ but promised that he would do away with the country`s debt by the end of his second term. Three years later an additional $3 trillion has been added to the debt which is worsening by over a trillion-dollar annually. The debt clock counter projects debt of $30 trillion by 2023 and it`s obviously not disappearing anytime soon.

In addition to the skyrocketing countrywide debts is a bond bubble that enjoys boosting record highs. According to Ma Keiser, RT anchor and bitcoin bull, it will result in a substantial global defeat:

“Bond prices are hitting highs not seen in… 3,000 years. That’s right, the bond bubble is hitting a 3,000 yr high. When it pops, more than $150 trillion gets wiped out.”

Bond prices are hitting highs not seen in… 3,000 years. That’s right, the bond bubble is hitting a 3,000 yr high. When it pops, more than $150 trillion gets wiped out. #Bitcoin #Gold

— Max Keiser, tweet poet. (@maxkeiser) August 12, 2019

To make it worse, the US student loan is incorporating fuel to the fire, according to Forbes. A report earlier this year indicated that there are more than 44 borrowers who together owe in over $1.5 trillion in student loan debt. It`s the second-highest debt type in the United States after mortgages.

Bitcoin Is an Extra-Ordinary Hedge

Bitcoin has multiple activities going for it when determined as a hedge against the devaluation of fiat currency and monumental debts. Together with its finite supply, anticipated halving event, immunity from the banking and political systems, mathematical integrity, and a developing mainstream as well as institutional interest, Bitcoin could be the better option when the globes economies begin to collapse.

The post appeared first on CoinSpeaker