A spiraling financial crisis won’t drive investors to bitcoin, according to a major venture capitalist. | Source: Shutterstock

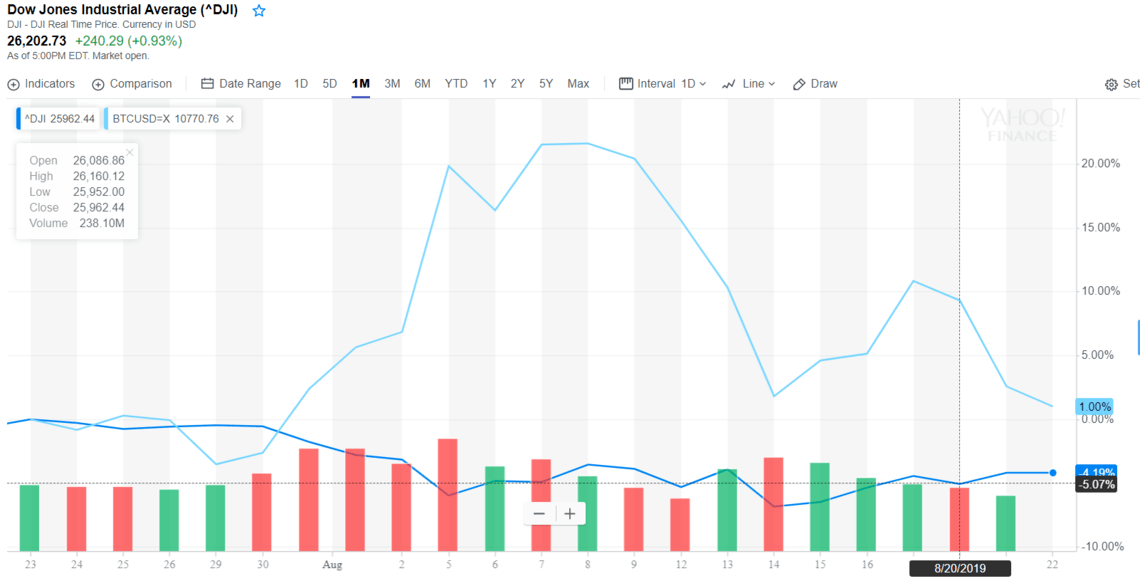

By CCN Markets: The Dow Jones Industrial Average has been moving south for the past one month, and what’s surprising to see is that the price of bitcoin has followed suit.

The Dow has been sliding over the past month, and bitcoin has followed suit. | Source: Yahoo! Finance

The falling price of bitcoin is in stark contrast to the narrative that the cryptocurrency is a safe-haven asset that investors will flock to at times when the stock market is in distress. Now one blockchain venture capitalist believes that bitcoin might not save you when there is a severe financial crisis, and that’s not the first time we are hearing it.

[embedded content]

Blockchain Capital’s Bogart drops a bomb

In an interview with Bloomberg, Blockchain Capital general partner Spencer Bogart was asked if he thinks bitcoin to be a safe-haven or like “any other asset.” Bogart decided to tread the middle path. He said:

“I think longer term Bitcoin will absolutely be a safe haven. I mean as it grows up the adoption curve we see bitcoin kind of evolving as it goes. So I think right now it is kind of in this intermediate state right now where you really have to think what the risks are and how severe are they.

So I think that when you have looming risks of monetary devaluation, things like this, Bitcoin certainly looks very attractive, and I think that was a large driver of the recent run-up in price.”

But it didn’t take long for Bogart to temper his bullishness. In fact, he delivered a surprising contradiction with his next statement:

“When you think about really severe crises taking place, a liquidity crunch, another global financial crisis, I think that Bitcoin will struggle to do very well from a price perspective.”

This is something that a lot of bitcoin bulls wouldn’t have liked to hear as bitcoin has been projected as an alternative to gold thanks to the uncorrelated nature it was displaying earlier this year.

Over the next two decades, #Bitcoin will replace #gold as the leading commodity to store value

— Brendan Blumer (@BrendanBlumer) March 17, 2019

In a period where:

—political tensions escalate between US and China,

—global equity markets fall sharply

—VIX largest spike in many months

—global yield curves flatten/invert#bitcoin has RISEN and >$6,000Crypto showing its value as an uncorrelated asset.

— Thomas Lee (@fundstrat) May 9, 2019

Did bulls make a wrong call in projecting bitcoin as a gold alternative?

The price of gold usually rises in times of grave financial crises.

Precious metals such as gold have done well in times when the stock market has crashed. | Source: GoldSilver

The yellow metal has been showing that characteristic once again as its price has shot up over 19% in the past three months. But the same cannot be said about bitcoin as recent price trends suggest.

That’s probably the reason why Bogart indicates that investors could dump bitcoin when the flight to safety happens in case of a severe financial crisis. If that’s indeed the case, then all those massive price targets based on the crypto asset’s equivalence to gold are nothing more than wild fantasies.

This article is protected by copyright laws and is owned by CCN Markets.

The post appeared first on CCN