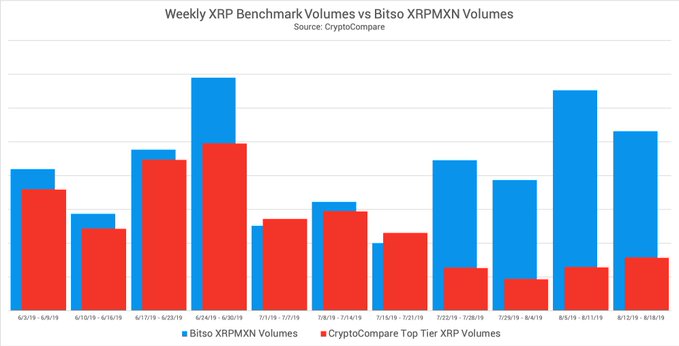

Ripple, a real-time gross settlements system and remittance network, had recently announced a strategic partnership with MoneyGram, one of the world’s foremost money transfer companies. Immediately after this partnership went live, XRP/MXN volume on Bitso rose by 25%.

Breanne M. Madigan of Global Institutional Markets at Ripple commented,

“New (and notable) data shows that although overall XRP trading volume was down nearly 65%, XRP/MXN volumes on Bitso went up more than 25% – during the same period of time that MoneyGram payments into Mexico using XRP went live. A real use case driving real volume.”

Source: Twitter

Even though Ripple’s technology, xRapid, has been widely accepted among financial institutions, there has been no data to understand how much these partnerships have impacted XRP’s market. For the first time, Ripple has provided insights about its biggest partnership and how it has impacted XRP’s volume.

However, far away on the trading view chart for XRP/USD, the third-largest coin was being traded at $0.2721, at press time. The coin has been under $0.30 for the past 10 days and has not been able to make a recovery. With its support marked at $0.2373, XRP needs to bounce back hard to make it up for its recent loss. XRP’s YTD return stands at -25.48%, the least among the top 10 cryptocurrencies on CMC, with a reported market cap of $11.67 billion.

Recently, Ripple onboarded a new customer on its RippleNet bandwagon, Xendpay, a UK-based remittance firm. The partnership between the two would allow Ripple to expand its legs in the new markets of the Philippines, Bangladesh, Malaysia, Vietnam, and Thailand. As RippleNet homes many different currencies including Malaysian ringgit and Bangladeshi taka, Xendpay could perform transfers without having to “create a whole business case for each partner.”

According to reports, RippleNet surpassed 200 clients globally just in 2019, claiming to onboard an average of “two to three financial institutions to RippleNet each week.”

The post appeared first on AMBCrypto