Litecoin’s hash rate continued to plummet as it entered the third week after its halving on August 5th. According to the popular cryptocurrency stats website, BitInfoCharts, Litecoin’s hash rate on 28th August was 331.4 TH/s, a decline of 33.3% from a hash rate of 458.3 TH/s on the day of halving. In the words of Litecoin Creator Charlie Lee, “mining rewards get cut in half, some miners will not be profitable and they will shut off their machine.”

Price drop

Litecoin evangelist, John Kim, also had something to say about the same,

“Real talk: litecoin controls 98% of the hash rate for it’s “Scrypt” mining algorithm. Think about this for a second? When it comes to adoption, hashrate, and liquidity Litecoin is on a major bull run. Price “Must” follow sooner or later.”

In addition to the hash rate, the silver crypto has also recorded a significant fall in its price, ever since its halving. At press time, Litecoin held a market cap of $4.13 billion and was priced at $66.43, a drop of over 30% from the valuation of the coin on the block size halving day when it was trading at around $95, after a brief spike to $101.

Source: Messari

In terms of the price, Charlie Lee had previously said that the halving “should be priced in because everyone knows about it since the beginning.” But, the problem according to Lee was that people expected Litecoin’s prices to shoot up. He said,

“So a lot of people are buying in because they expect the price to go up and that’s kind of a self-fulfilling prophecy. So, because they’re buying in, the price does actually go up.

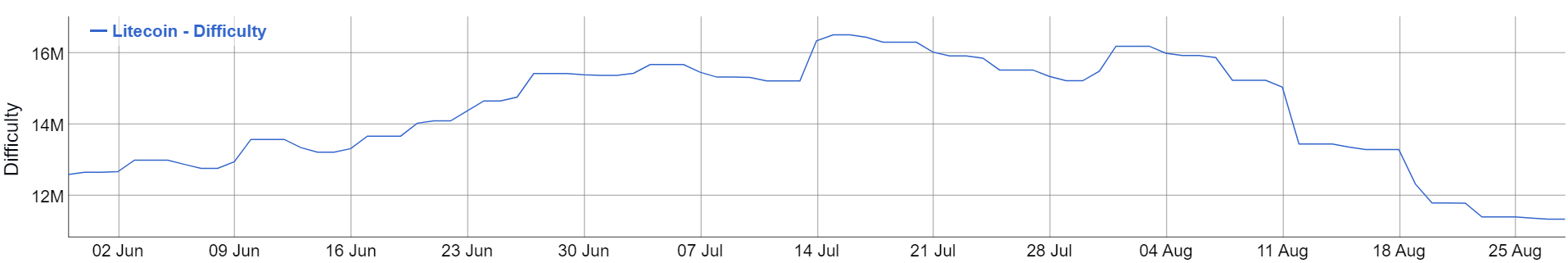

Declining difficulty

According to BitInfoCharts, mining difficulty for the cryptocurrency until the event was around 16 million and fell to 11.33 million as of 28th August. Lee had warned investors of volatile days in an interview prior to the halving event and the charts reflected the same.

Source: BitInfoCharts | Difficulty

The post appeared first on AMBCrypto