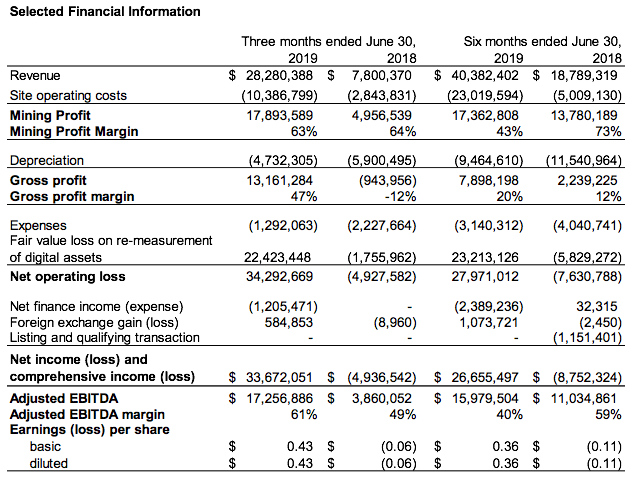

Hut 8, one of the largest public Bitcoin mining farms by operating capacity, has released its financial report for the second quarter of 2019. The mining firm recorded a tremendous surge in its net profit and overall revenue for Q2, with the net profit for the firm reaching $33.7 million Candian dollars while the overall revenue was $28.3 million Canadian dollars.

The mining farm is also listed on the Toronto Stock Exchange, an exchange where its shares are currently valued at $0.43 per share. The company has also reduced its cash expenses to $637k from $747k in Q1 of 2019 and $994k in Q4 of 2018. Further, the production cost per Bitcoin has fallen to $2,757 from $3,950 in Q1 of 2019 and $3,995 in Q4 of 2018.

Source: Hut8mining

Andrew Kiguel, Chief Executive Officer of Hut 8, commented on the recent surge in revenue. He said,

“Q2-2019 represents Hut 8’s best quarter on all metrics since inception. We reduced our cost of mining to US$2,757 while the price of bitcoin appreciated from US$4,158 at the beginning of the quarter to US$10,817 at the end of the quarter. In addition, management has reduced corporate overhead quarter over quarter. Our cost reduction initiatives put in place during crypto-winter came to fruition during the second quarter to produce exceptional earnings per share of $0.43 for shareholders.

In addition, our strategy of retaining bitcoin resulted in a gain of $22.4 million re-measurement of our bitcoin inventory. If Hut 8 had sold its entire bitcoin inventory at the end of Q1-2019, we would not have had the benefit of the appreciation in the price of bitcoin during Q2-2019.”

The mining farm has mined 2816 Bitcoins over the second quarter, with the firm earning $22.4 million on re-measurements of its Bitcoin inventory. The re-measurement gain is significantly higher than the losses for the whole of 2019 and the firm is looking to continue its cost-saving methods to help improve its quarterly performance.

The post appeared first on AMBCrypto