Binance, the world’s leading cryptocurrency exchange, has acquired a cryptoasset derivatives trading platform JEX. Binance JEX, as the new venture will be called, will focus on delivering cryptocurrency derivatives, including futures contracts, options, and other derivatives. With this new acquisition and Binance’s latest developments, the exchange is starting to look a lot like a one-stop-shop that offers pretty much everything on the table.

Binance Closer To Becoming a One-Stop-Shop

Leading cryptocurrency exchange Binance has announced the acquisition of a crypto-asset derivatives trading platform JEX. The new joint venture dubbed Binance JEX will be allowing users to engage with different trading instruments such as options, futures, and other derivative products.

Per the release, Binance is going to be managing the JEX tokens alongside the JEX team which is supposed to bring more utility for them.

Interestingly enough, earlier today Binance also introduced the so-called “Battle for Binance Futures,” launching two Binance Futures Testnet Platforms. According to the rules, those users who participate in the platforms will receive a total of 10,000 BNB. Moreover, those who vote correctly for the winner will also receive an additional 50% trading fee discount on the Binance Futures Platform for a full month of trading.

Have you seen any business launch 2 competing products at the same time? Well, with @Binance, there is a first time for everything, again.

Our Futures is in your hands! https://t.co/BNxjUHiULH

— CZ Binance (@cz_binance) September 2, 2019

Now, it’s also worth noting that during the past couple of months Binance introduced a few other interesting products. First back in July, the exchange enabled margin trading for its users which allows them to use leverage on different cryptocurrency trading pairs.

Second, just a few days ago, Binance also launched the so-called Binance Lending feature. This allows users to lend their crypto, namely Binance Coin, Tether (USDT), and Ethereum Classic (ETC) for a certain preset amount of time in exchange for an annualized interest rate.

Competition For BitMEX?

As of yet, BitMEX is one, if not the most popular Bitcoin margin trading platform which allows users to use up to 100x leverage on certain perpetual contracts.

With Binance stepping into the field of futures and derivatives, however, things might get a bit more challenging for BitMEX.

Moreover, BitMEX has been involved in a CFTC probe since July, which has caused some issues for the exchange. Nevertheless, data from TokenAnalyst shows that the BTC inflows in BitMEX over the past 30 days are around 26%, while those in Binance are around 19%.

Still, it remains very interesting to see how this new acquisition will impact the market if it will at all.

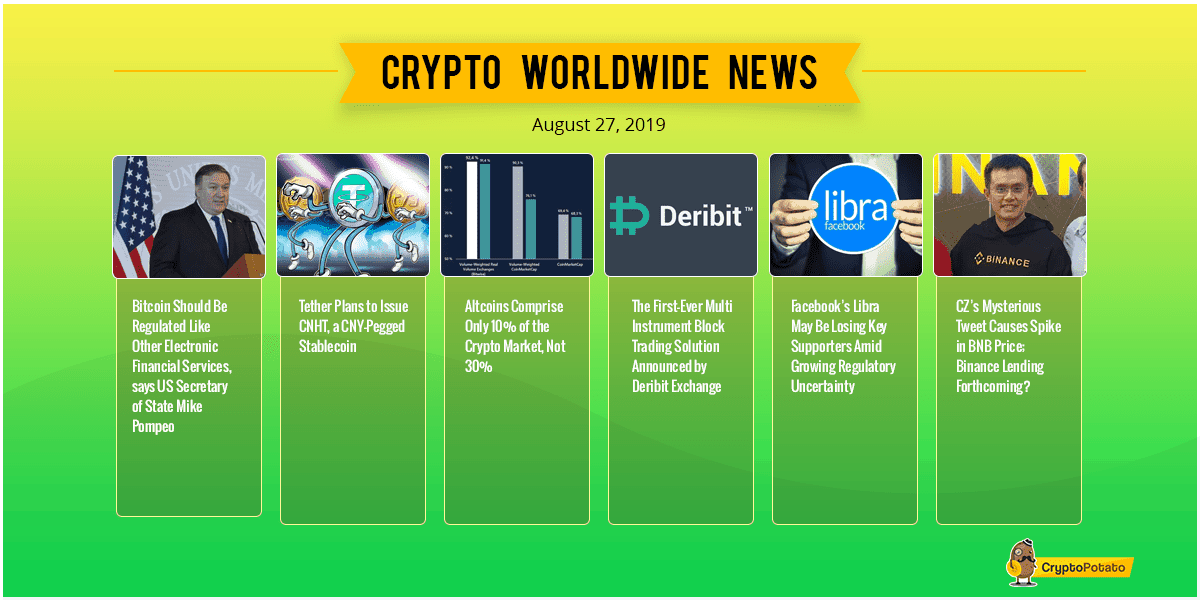

More news for you:

The post appeared first on CryptoPotato