Although the finance sector continues to find a common ground between the leading assets gold and Bitcoin, gold-backed cryptocurrencies are promising to bridge this divide. In this light, Crypto Research Report identified stablecoins as the latest competition for gold, and stated,

“All of the gold-backed stablecoins on the market are centralized, which means they have counterparty risk. Unlike storing your own physical gold, trusting a company to store your gold is required.”

Source: Crypto Research Report

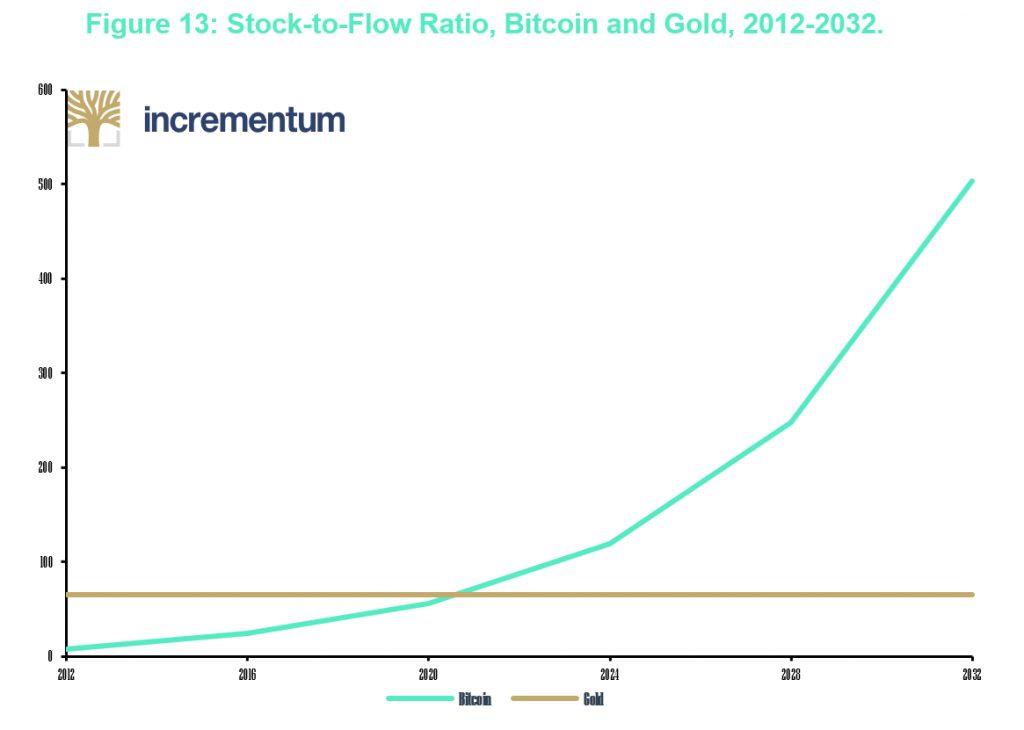

The above graph shows a comparison between the supply of gold and Bitcoin, which are being mined in their own unique ways. The report highlighted that while Bitcoin mining determined the price of the asset, “gold mining does not secure the price of gold.” It added,

“Therefore, we would like to make the subtle distinction that Bitcoin is not a bearer instrument in the same sense that gold is.”

While the argument that both Bitcoin and gold are limited in nature and cannot be created as per demand, the assets have witnessed significant amounts of loss over the years. In addition, the use of gold in manufacturing electronic items have primarily resulted in 12% loss of current world gold production. The report also drew similarly “to Bitcoin’s annual loss of coins that are unspendable due to lost private keys and fat-finger mistakes while typing cumbersome recipient addresses.”

Based on the said figures and the supply trajectories of Bitcoin and gold, Crypto Research Report estimated that Bitcoin is expected to have a lower inflation rate by 2021.

The post appeared first on AMBCrypto