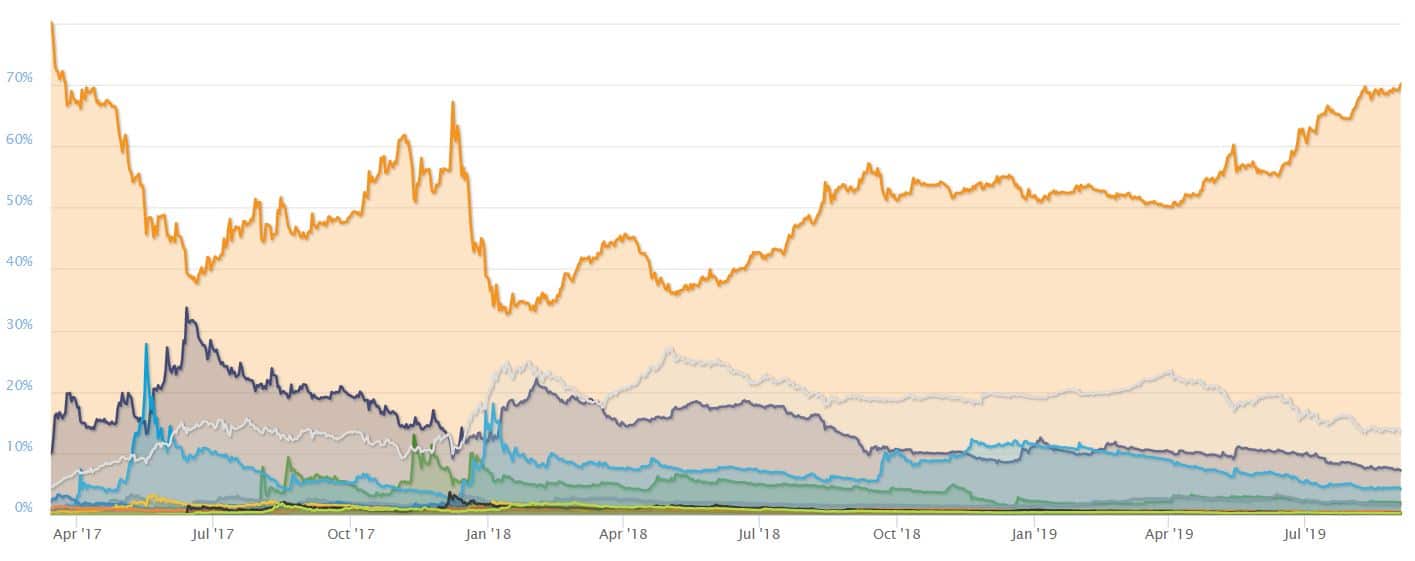

Bitcoin added another $700 to its price tag over the past 24 hours, pushing its dominance index above 70% for the first time since March 2017. This demonstrates that Bitcoin has definitively established itself as a market leader, leaving little room for altcoins to thrive.

Bitcoin Dominance at 26-Month High

Bitcoin dominance is the index that tracks the relative share of Bitcoin in the entire market. At the time of this writing, it’s standing at 70.1% which is the highest it has been since March 2017.

BTC Dominance. Source: CoinMarketCap

As Cryptopotato reported, Bitcoin surged upwards of $700 in the past 24 hours, catapulting its price over $10,000 to reach where it currently trades at around $10,360. This sudden spike also pushed its overall market dominance, which increased by more than 1.1% in the respective period.

The fact that Bitcoin’s dominance is increasing suggests that the cryptocurrency has definitively established itself as the market leader. It’s perhaps because Bitcoin has managed to effectively prove its use cases and utility, while the majority of altcoins have still a long way to go to do that.

At the same time, we can also see that Bitcoin’s network is only growing stronger. Recently, the network’s hashrate surged past 80 quintillion hashes per second, reaching its all-time high.

Where Does This Leave Altcoins?

Naturally, the logical question when outlining the growth in Bitcoin’s dominance is what happens to altcoins? The truth is that they’ve been struggling over the past few months.

Irrespective of the direction of Bitcoin’s price, altcoins seem unable to reclaim any notable market share. In other words, regardless of whether Bitcoin goes up or down in value, altcoins keep on struggling.

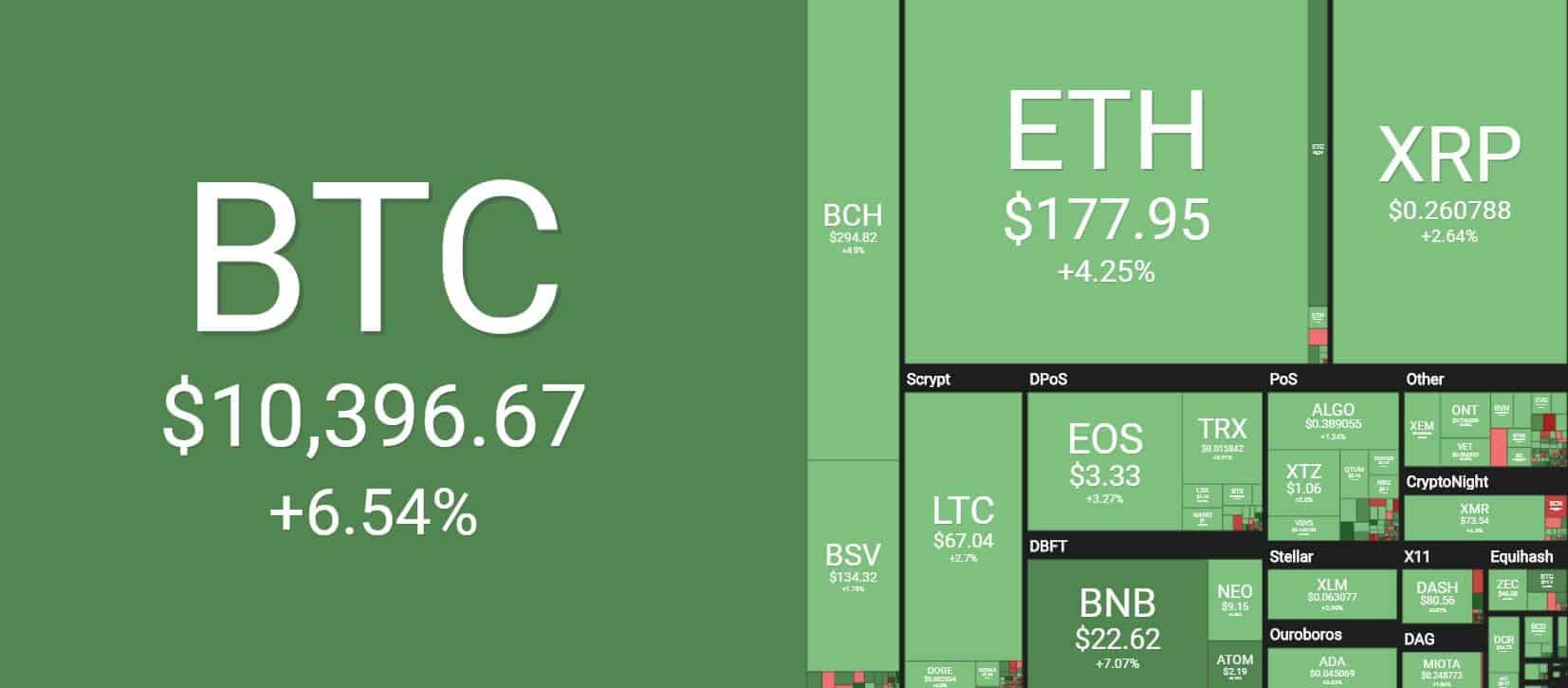

At the time of this writing, all large-cap top 10 alternative cryptocurrencies are trading in the green.

Market Overview. Source: Coin360

However, they’ve been struggling to reclaim any market share at all. Currently, Ethereum holds around 7.2% of the market, followed by Ripple with 4.26%, and Bitcoin Cash with 2.05%.

It remains interesting to see whether altcoins will eventually be able to catch up and whether there is any chance of an altcoin season to take shape in the near future.

More news for you:

The post appeared first on CryptoPotato