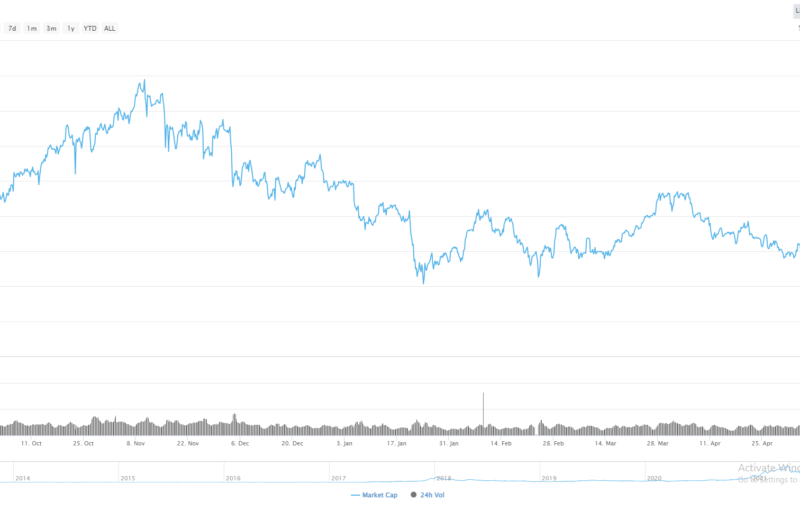

- Ethereum is trading in its narrowest seven-day trading range since April this year

- Technical analysis suggests a move towards the $200.00 level is increasingly likely

- Sizeable bullish falling wedge pattern seen on the four-hour time frame

Ethereum is poised for a major technical breakout, as the second largest cryptocurrency trades in its narrowest seven-day trading range since April this year. The fact that bears have been unable to build on the August 28th decline is encouraging for ETH / USD bulls, although they have so far been unable to rally the cryptocurrency away from the danger zone.

Widespread weakness across the altcoin space has led to Ethereum languishing towards its weakest level since mid-May, leaving Bitcoin in pole position by an even greater margin. Ethereum currently trades higher by around twenty-five percent since the start of the year and would need slide back towards the $139.00 level to completely relinquish its yearly gains.

Technical analysis suggests that if buyers can keep the ETH / USD pair above the $172.00 level then the cryptocurrency can start to advance back towards the $200.00 level. The four-hour time frame currently depicts a falling wedge pattern breakout in progress, which further suggests a potential bullish reversal in the ETH / USD pair.

The daily time frame highlights that a head and shoulders pattern has largely played out to the downside, with bulls needing to move price above the $230.00 level to stabilize the ETH / USD pair above the neckline of the bearish head and shoulders pattern.

Interestingly, the daily time frame also shows that once above the $230.00 resistance level, the ETH / USD pair could potentially soar towards the $285.00 level.

To the downside, the four-hour time frame shows that if the ETH / USD pair falls back under the $172.00 level we will likely see a loss of the recent upside momentum, leading to a drop back towards the lower part of the falling wedge pattern, around the $158.00 level.

According to the latest sentiment data from TheTIE.io, the short-term sentiment towards Ethereum is still quite weak, at 44.00 %, while the overall long-term sentiment towards the cryptocurrency is also neutral, at 48.00%.

ETH / USD H4 Chart by TradingView

ETH / USD H4 Chart by TradingView

Upside Potential

The four-hour time frame shows that the ETH / USD pair is likely to face resistance from the $187.00 level if a breakout above the $180.00 level occurs. Once above the $187.00 level, the ETH / USD pair’s 200-period moving average on the mentioned time frame, at the $200.00 level, is the near-term target.

The daily time frame continues to highlight the $228.00 to $230.00 level as a major upside target and an area of technical significance. Once above the $230.00 level, technical analysis suggest that the ETH / USD pair is unlikely to look back until the $285.00 level is achieved.

ETH / USD Daily Chart by TradingView

ETH / USD Daily Chart by TradingView

Downside Potential

The four-hour time frame shows that the $158.00 level is likely to come into focus if we see sustained weakness below the $170.00 level over the coming sessions.

The $139.00 level is the major support area to watch in case we see a major decline below the $150.00 level, although this scenario currently appears unlikely.

Summary

Short-term technical analysis suggests that a move towards $200.00 level is coming if bulls can continue to build upside momentum above the $172.00 level.

Overall, the recent period of narrow price consolidation points to a strong technical breakout on the horizon for the ETH / USD pair.

Check out our introductory guide to Ethereum.

The post appeared first on CryptoBriefing