“You are only as good as your last race”, the famous line is also quite applicable to the crypto-verse. After its stunning rise during mid-year, DeFi tokens have somewhat lost their shine due to a series of misfortunes over the past few weeks.

Certain projects underwent massive depreciation and others exhibited rug-pulls, to the joy of their critics. However, DeFi tokens are currently making quite the comeback, and they have the numbers to back it.

Amidst UNI collapse, DeFi Usage registers Rebound

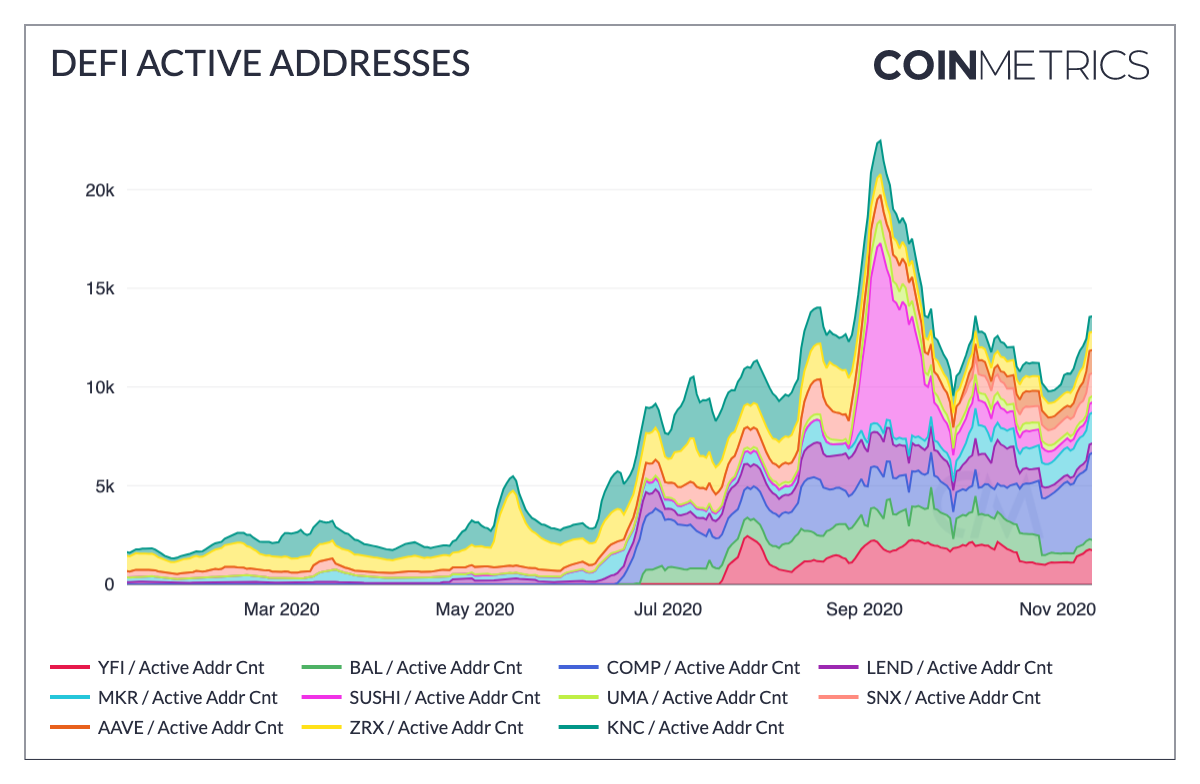

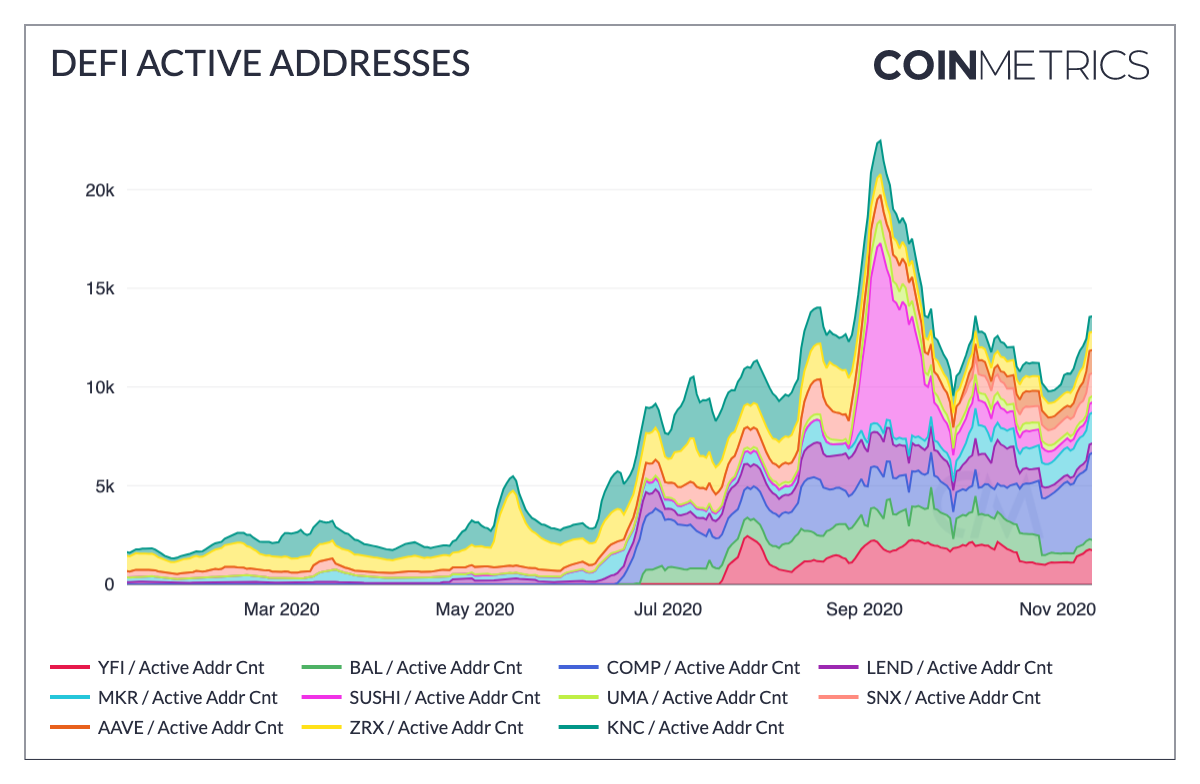

The first drop for DeFi occurred on 4th November. Before that, the DeFi usage had gone down tremendously as DeFi’s daily active addresses declined to 5,000 per day from an average of 176,000 in September.

Source: Coinmetrics

What seemed like a dealbreaker, turned out to be a minor blip as according to Coinmetrics, removal of UNI addresses indicated current recovery of usage. UNI‘s problems were all linked to the turbulent rise and fall of SuShiSwap. However, key factors were currently incorporating together to trigger DeFi’s current rise.

COMP Token Interest and Potential Institutional Capital?

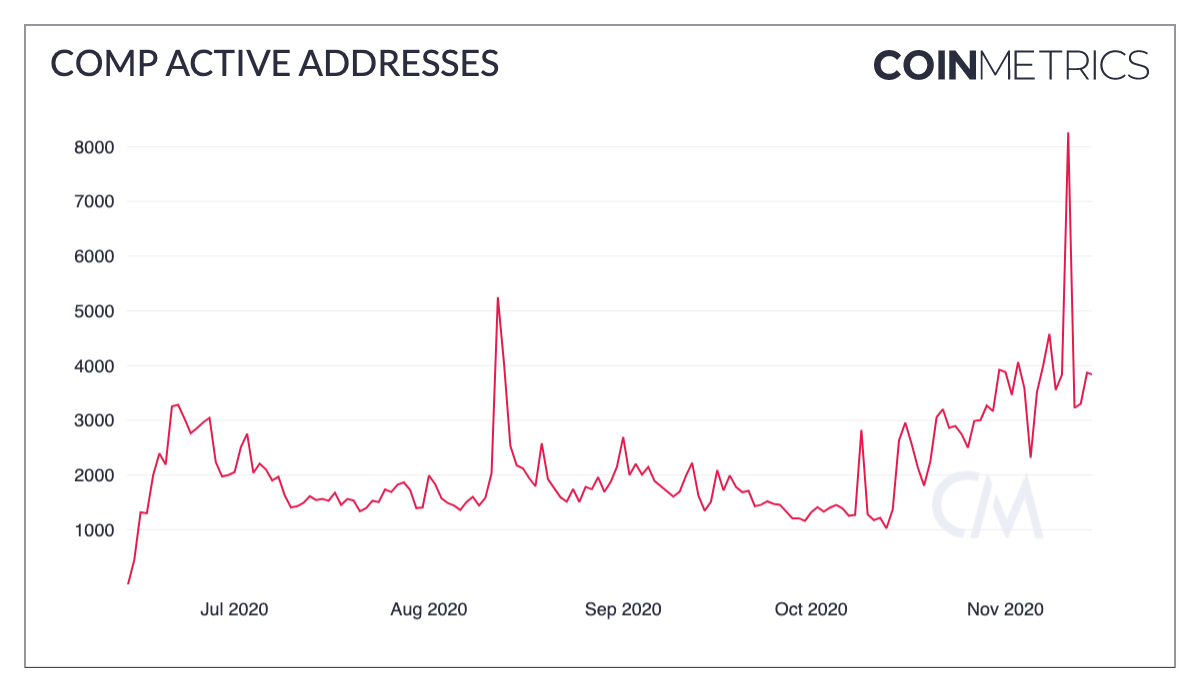

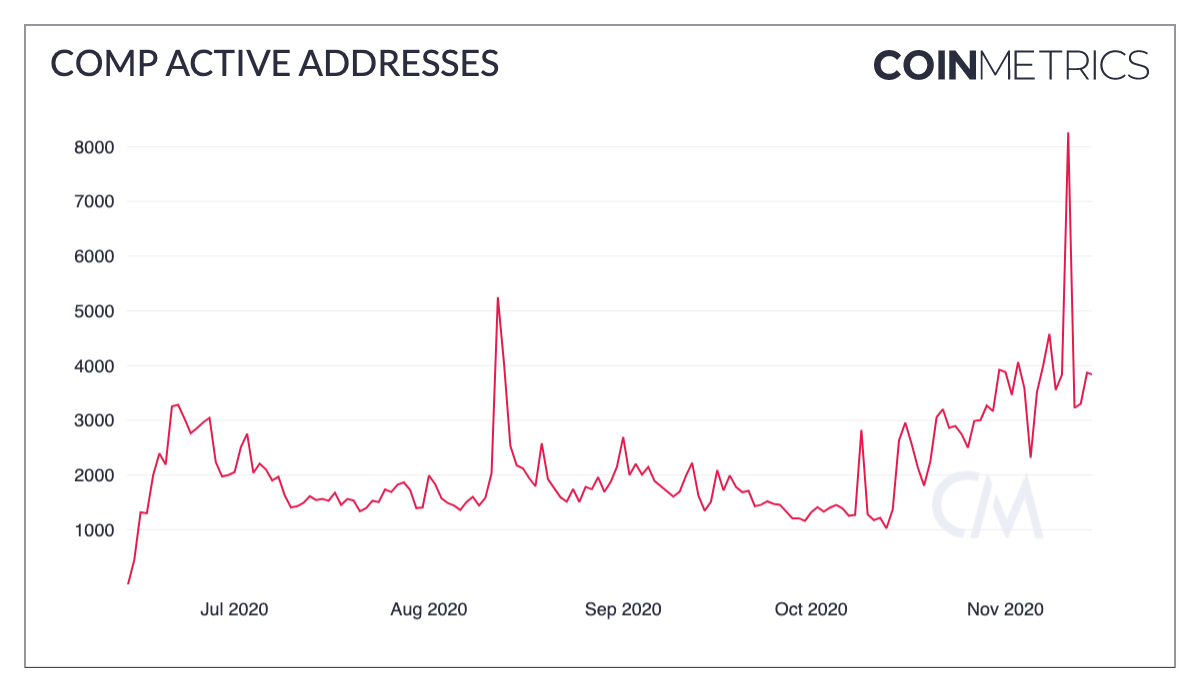

Source: Coinmetrics

There is no doubt that the bullish sentiment manifested by Bitcoin has played a major role. Regardless of that, COMP usage registered a massive spike, and its active addresses pictured an ATH of 8,265 on November 11th.

Additionally, MakerDAO and MKR activity also corresponded towards a positive move. The report added,

“MakerDAO recently reached a new record of over $2.3B total value locked (TVL), passing the $2B mark in early November. DAI, the decentralized stablecoin issued by MakerDAO, also hit a milestone in the last week, reaching a supply of 1B for the first time.”

From an investment point of view, a recent report suggested PolyChain Capital, became the 10th largest YFI holder despite holding zero YFI tokens until Mid-October. That is a huge vote of confidence for the functionality and future of YFI and potential DeFi projects respectively. At the moment, Polychain controlled 470 YFI, which is about 1.6% of the total supply.

DeFi is possibly here to stay

To be honest, DeFi had a case of a few bad apples spoiling the box but the legitimate ones are shining through. The key identification with DeFi remains the idea of decentralized financial instruments, which still caters to many potential investors. Hence, while the total market cap of DeFi might have taken a hit, organic growth seems inevitable. It is a market where investors are becoming more and more inclined towards investment in digital assets, just ask MicroStrategy.

The post appeared first on AMBCrypto