Cryptocurrencies, being relatively new, are getting more and more attention as potential investing tools. People within the community are often discussing prices and how each coin they have invested in could skyrocket, thus providing them good returns.

While some might be thinking that ETH’s current price is around $145 and its all-time high was at close to $1400 – that’s a devaluation of 90% in less than two years. However, by checking Ethereum’s launch, it actually provides a return exceeding 5000%.

Short Ethereum History Lesson

Without involving too many details, let’s take a quick look at Ethereum’s emergence in the blockchain world. Vitalik Buterin, a name easily recognizable today, supposedly decided that Bitcoin has to have a general scripting language, and went on to create one. Several more people joining in, quite a few different versions and updates, lots of testing, and a launch – a typical product start.

To gather resources, the team decided to initiate a crowdfunding campaign. All participants were purchasing the Ethereum token, ether (ETH), which functions as shares in the project. The campaign turned out to be rather successful, to say the least, raising more than $18 million in July 2014.

However, it wasn’t until the following July of 2015, when the first live release was actually launched officially, called Frontier.

ETH’s Rocky Price Start

2015 doesn’t appear that far away when we look at the grand scheme of things. But when we take a deep look at what happened to Ethereum’s price since then, we might be in for a memorable ride.

According to a popular monitoring resource, ETH began trading at $2.77 in August, but as it frequently happens when the initial hype is gone, the price dropped almost immediately. In fact, it took 6 months before it could reach that level once again.

At that time, Ethereum was starting to get more attention and implementation as a network for the deployment of smart contracts and the development of decentralized applications (dApps). It boosted the price and on February 6th, ETH was reportedly at $2.53. In just five days, it surged with over 150% to $6.38, hinting slightly on what’s to come in the next few years.

The Golden Age Of 2017

We can’t sugar code this – the end of 2017 was the most significant price increase in all of the cryptocurrencies’ history. Ethereum was among the leaders with incredible price actions on a daily basis. It had become a vital part of the crypto world by now, serving as a platform for numerous new projects to be launched as ICOs.

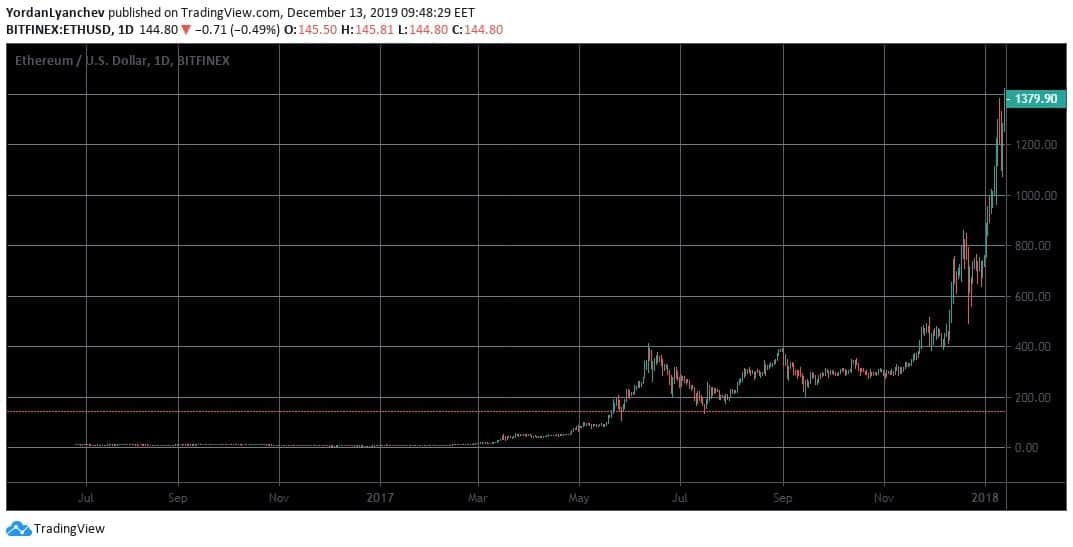

Looking at ETH’s price on different exchanges, we can conclude that the all-time high was reached in early January 2018 of around $1,400. There’s no easy way to say this, but a little over two years ago, this same cryptocurrency was worth as much as a cup of coffee.

Let’s try to put this into perspective. If we conclude that upon its launch, ETH had a value of $2.77, reaching $1,400 in 29 months means a total return on investment of over 50,000%.

ETHUSD1d. ATH. Bitfinex. Source: TradingView

The Flippening

Bitcoin, being the largest digital asset, reached its all-time high at $20,000 in December 2017 but in January, it had begun its slow descend. On the other hand, Ethereum just hit its ATH that month and this led to some generous claims.

The cryptocurrency community is a vocal one, and being in the center of attention is quite important at times. Some people noted that on the date that ETH was at its highest, Bitcoin has lost around $6,000 of value, so they started asking the question – what would happen if this trend continues? The result came shortly, as they invented a new phrase – the flippening. It represented a potential move when an altcoin could surpass Bitcoin as the highest-seeded cryptocurrency by market capitalization, and Ethereum was the favorite at that point.

However, not only the flippening didn’t occur but the following events had a catastrophic impact on all prices.

Ethereum’s Crash

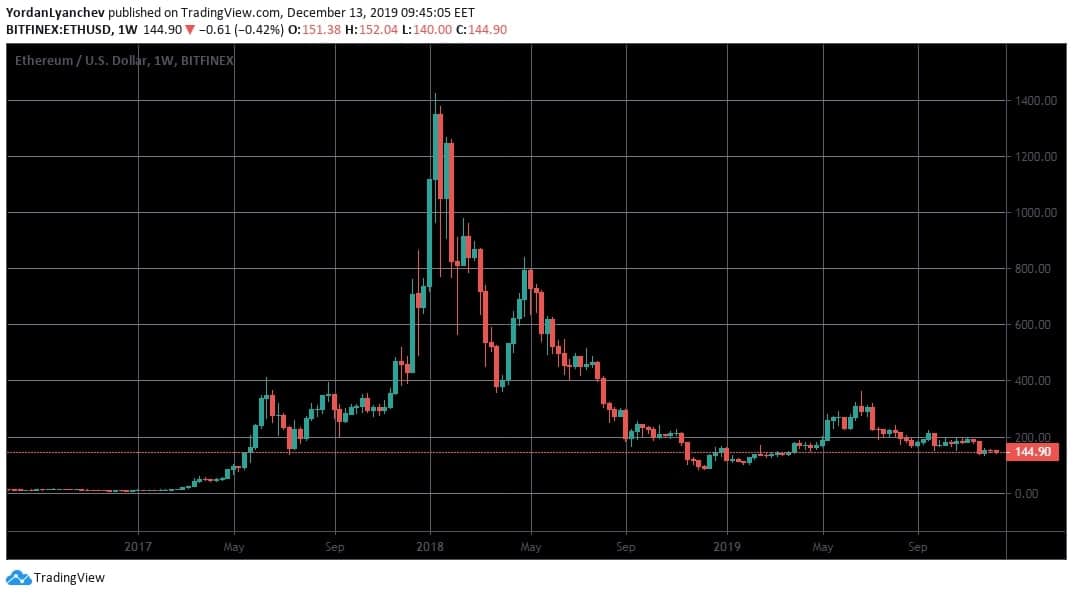

Despite all hopes and promises, one cannot argue with the immortal words of Sir Isaac Newton – what goes up must come down. The cryptocurrency market fell, and some argue that it keeps feeling the full force of that phrase. Unfortunately for Ethereum, it was again among the leaders in this manner. In less than three months, ETH’s plunged to around $370, meaning a loss of over 73%. It wasn’t alone – Bitcoin was at around $6,600 – 66% less than the all-time high from a few months ago.

While the market tried to regain some of its value in the summer of 2018, the rest of the year was violently negative. Bitcoin ended at $3,700, and Ethereum was at $133,49. This meant for the latter a total devaluation of 90% in less than a year.

2019 started somewhat positive for most of the market. Ethereum and Bitcoin noted price increases, and by the summer, the former was trading at $333, but the latter reached almost $14,000. At that point, it was quite clear that Bitcoin’s spot as the largest cryptocurrency by market cap remains unchallenged. Moreover, even though both are currently down since the year-to-date high, ETH’s plunge is more significant. In fact, Ethereum is almost at the end of 2018 level, while the price of BTC is at $7,200 currently – twice from where it started the year.

ETHUSD1w. Bitfinex. Source: TradingView

The crash brought down the price notably, however, interesting statistics from earlier this year showed Ethereum’s incredible ROI. If you had been lucky enough to invest $100 at ETH’s crowdfunding campaign, the same amount would net at $68,305 in May this year, despite being a long way down from the all-time high.

The DAO Effect

As important as the price is, let’s step out of it at the moment and focus on other aspects.

While Ethereum has served throughout the years, as a stable and mostly secure platform, one serious event appears in mind when we discuss Ethereum’s security.

Back in 2016, members of the Ethereum community worked on a new project, called The DAO. It represented a smart contract built on the Ethereum blockchain, and it raised an unprecedented amount of 12.7 million ETH – around $150 million at the time. A month later though, a hacker had found a loophole in the system and managed to steal 3.6 million ETH (value of $70 million).

Even though the bug didn’t originate from Ethereum itself and The DAO ultimately couldn’t succeed, the former took a severe hit. The community started questioning the security and if it’s really worth using it. However, the team behind Ethereum continued to innovate and update the project ever since then, and it’s worth noting some of the upgrades it has received through the years.

Upgrades and The Future

Ethereum has gone through eight hard forks since its inception. Constantinople was the first one this year, taking place in January at the 7,080,000 block. The changes after that one were in the following categories: energy and speed improvements, cutting down block rewards, gas cost reduction, and enhancing the scalability.

Ironically, the latest major “network update,” as Buterin wants to call them, was called Istanbul. It happened just recently at block number 9,069,000, and out of eleven Ethereum Improvement Proposals (EIPs), six were selected for implementation. When summarized, they are addressing the gas costs again but also the added resilience against Denial-of-Service attacks (DDoS), and the interoperability with equihash PoW-based cryptocurrencies.

Ethereum has been criticized because of the possible lack of scalability, which could be related to the Proof-of-Work consensus algorithm that it uses. As a result, Buterin and the rest of the team have decided to launch a new and improved version at the start of 2020, called “Ethereum 2.0”.

One of the many differences will be the supposed transition from Proof-of-Work to Proof-of-Stake, which would not only be more energy-efficient but should address the scalability issue, as well. Furthermore, such a shift would make Ethereum more secure against 51% attacks, as the relative low hash rate could be putting it at risk.

Final Words

Ethereum is definitely a game-changer in the blockchain space, as it has provided the platform for numerous projects to be built on top of it. The team behind Ethereum appears to be continually working on improving the product, and the upcoming 2.0 version should address most of the issues that it’s facing today. As far as the price of ETH goes, it has experienced a serious crash since the all-time high in January 2018. However, when looking at the big picture, ETH started at $2.77, and with a current price of around $145, the generated return is over 5000% in a few years!

You might also like:

The post appeared first on CryptoPotato