The University of Cambridge’s third Global Cryptoasset Benchmarking Study is here. Highlights from the report point to an almost 200% growth in the number of cryptocurrency users over the last two years. The extensive digital asset market study by Cambridge also revealed that year-on-year growth in all segments dropped to 21 percent in 2019 from 57 percent in 2018.

Unique Cryptocurrency Users Grew 189% In Last 2 Years

As per the latest edition of the Global Cryptoasset Benchmarking Study published by the University of Cambridge and the school’s Centre for Alternative Finance, the global cryptocurrency user base has jumped 189 percent since 2018.

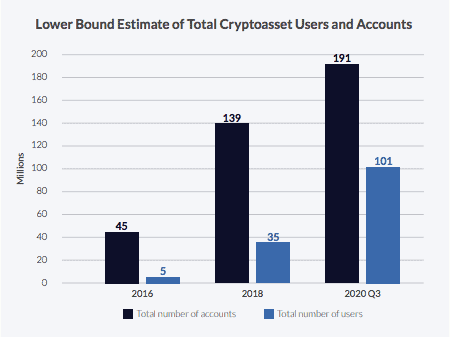

Observations show that 101 million unique users signed up for Bitcoin and crypto-asset usage with ‘service providers’ in Q3 2020. These service providers, mainly cryptocurrency trading platforms and wallets, registered 191 million accounts for the said users. According to the Cambridge report:

In 2018, the 2nd Global Cryptoasset Benchmarking Study estimated the number of identity-verified cryptoasset users at about 35 million globally

UC has also explained this meteoric growth in crypto usage demographics.

This 189% increase in users may be explained by both a rise in the number of accounts (which increased by 37%), as well as a greater share of accounts being systematically linked to an individual’s identity, allowing us to increase our estimate of minimum user numbers associated with accounts on each service provider.

The report authors have stated that not just their survey, but studies conducted by the UK Financial Conduct Authority also arrived at a 78 percent increase (compared to 2019) in crypto asset ownership amongst individuals globally.

Retail Users Are More Than Institutional Users

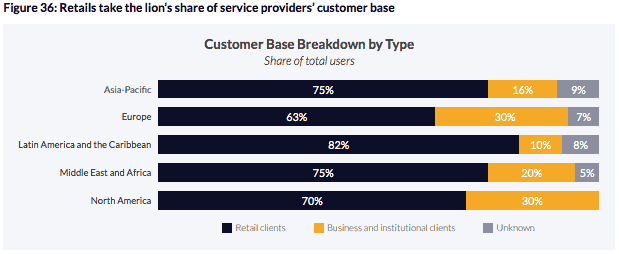

The latest UC crypto study states that despite the development of professional cryptocurrency investment infrastructure for institutions, retail customers are the most dominant section of users.

…cryptoasset service providers’ customer base is still primarily retail-driven, showing that despite growing institutional interest, the conversion rate (from expression of interest to investment) remains limited.

As per the team who conducted and compiled the research, gnawing issues such as market manipulation and cryptocurrency price volatility have resulted in the traditional institutional investing class reflecting a tepid interest in entering positions.

On the bright side, however, the benchmark cryptocurrency study noted that 30% of customers registered with North American and European service providing firms are ‘business and institutional clients.’ In contrast, this figure for APAC, LAC, and MEA is 16%, 10%, and 20%, respectively.

In the conclusion of the observations on crypto users, the UC research states that many service providers in the Asia-Pacific (APAC) region have bitcoin and cryptocurrency miners as their customers. This is due to the extensive concentration of mining activities, ‘especially in China.’ The report said:

Miners use their services to liquidate their coin inventory for national fiat currencies and cover fiat-based expenditures.

Also, miners engage in hedging their crypto earnings considerably. An increasing number of these digital asset minters prefer putting up their cryptocurrencies as collateral in exchange for fiat funds.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato