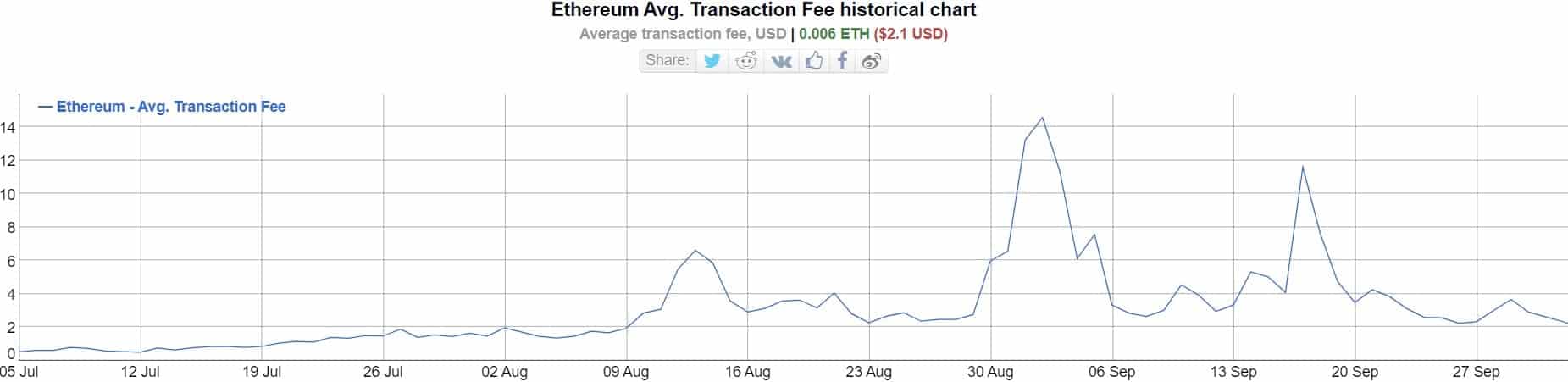

Ethereum fees are recovering from the devastation caused by the DeFi. After reaching record highs during September 2020, the network seems to have achieved a calm moment during October’s first days.

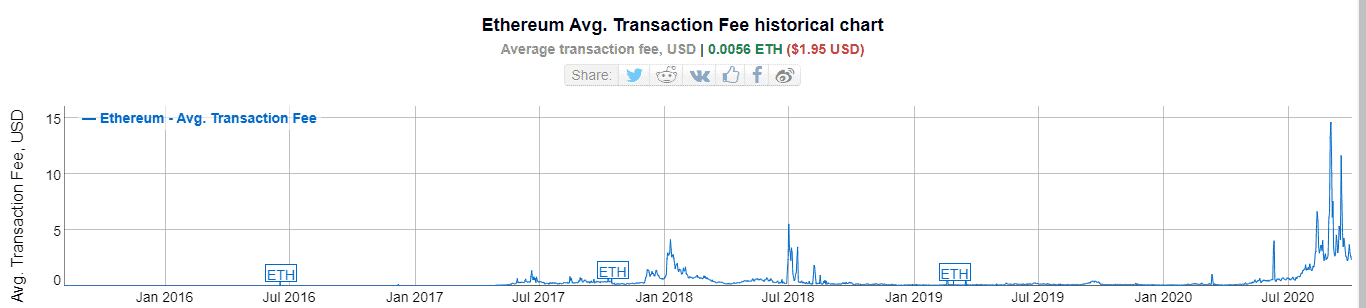

Currently, the average transaction fee is slightly above $2, according to Bitinfocharts. This milestone represents a drop of more than 80% from the peak reached on September 2, 2020.

After spiking to record levels, the network returned to normal. Still, a further rise in mid-September catapulted usage costs back to a new peak that was only beaten by spikes in ATH.

Since that time, fees have returned to normal, and the trend seems to be down to Ethereum users’ delight.

However, despite the talks of a sharp drop, transaction fees are still very high. In January of 2020, they averaged $0.07, and they never surpassed 1 dollar mark in 2019 (except for an unusual peak at the beginning of the year)

Usability: Is it Good, Is it Bad… Or is it Both?

Currently, Ethereum has proven the usability of blockchain technologies. This is thanks to the smart contracts, tokenized assets, and dApps that run on the blockchain.

In addition to this group of innovations, there are the stablecoins and DeFi projects, which have raised Ethereum’s usability to standards never before seen in the industry. Ethereum managed to overtake Bitcoin (in terms of value moved) precisely thanks to the DeFi and stablecoins.

However, fees became the karma of the blockchain enthusiasts, demonstrating that scalability is not merely a theoretical debate but an immediate need to support current standards – not to speak of global adoption.

Even Vitalik Buterin himself recently complained about how high fees make global adoption difficult:

“The $17.76 in fees it took me to make a bet on Augur last week itself makes present-day Augur very much “for the niche people and not for the world.

Ethereum 2.0 for Those Who Dream of Low Fees

However, everything could change with Ethereum 2.0. Although it will be a long time before a complete implementation, the first step of the roadmap – the transition to a PoS algorithm – promises lower fees and higher network efficiency.

Subsequently, other implementations ensure an ability to support thousands of transactions per second, so fees should not be a problem anymore. For Vitalik Buterin, though, L2 solutions are just as important as any other improvement to the blockchain’s hard code.

But, despite the optimism, there is still a long way to go and there seems to be no other solution but to wait. At least, that’s what Vitalik Buterin thinks:

“I do think it’s important to note that at least in the short term, as far as I can tell we have no choice. The L1 is nearly unusable for many classes of applications, and there’s no non-L2 path that can get us to scalability in the short-to-medium term. “

The post appeared first on CryptoPotato