(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I am an arbitrage trader at heart. In May 2013 brimming with my experience as a delta one trader, I entered the crypto capital markets. The first trade I ever put on was buying Bitcoin from Mt. Gox, depositing them on ICBIT, then selling BTC/USD June 2013 inverse futures contracts at a premium. My first trade captured a premium of 200% per annum (PA). When the futures expired, and my PNL matched my spreadsheet calculations exactly, I thought to myself, holy shit, “Bitcoin is LIT!”

I am an arbitrage trader at heart. In May 2013 brimming with my experience as a delta one trader, I entered the crypto capital markets. The first trade I ever put on was buying Bitcoin from Mt. Gox, depositing them on ICBIT, then selling BTC/USD June 2013 inverse futures contracts at a premium. My first trade captured a premium of 200% per annum (PA). When the futures expired, and my PNL matched my spreadsheet calculations exactly, I thought to myself, holy shit, “Bitcoin is LIT!”

This type of trade, called “Cash and Carry”, is the bedrock of the crypto capital markets. The futures implied yields on Bitcoin, USD, and other coins affects all aspects of the market. It is one the simplest and highest risk adjusted return trades one can execute. It also does not entail taking any crypto vs. fiat price risk. Remember, the primary goal of trading and investing is for your portfolio to at least match fiat M2 growth. Essentially, the “Cash and Carry” trade allows you to harvest the structural bid speculators have for crypto and its realised volatility.

In various past newsletters and seminars, I harped on about this trade. As there is a lot of new blood in the markets, and my friends who are analogue market professionals still ask about the details of this trade, it is high time for an in-depth, step-by-step guide to “Cash and Carry”. This tome will be filled with amusing stories about my days as a junior sell-side banking trader, the early days of my crypto trading experience, and my thoughts on how to capture yield in the crypto capital markets.

THIS IS NOT FINANCIAL ADVICE … I JUST LIKE THIS STOCK!

Don’t take my word for it — do your own research, and replicate my examples on an exchange’s Testnet or a spreadsheet. I will use the BitMEX trading platform as a reference point when describing these strategies. They will work across most if not all of the major crypto derivatives platforms.

SS Arbitrage

I spent a lot of time in the ICBIT chat room. It was a general room where all users could chat. There was a particular user named “SS Arbitrage”. Every time he signed on, he would say “Honk Honk”. I believe it coincided with him selling futures contracts, as his preferred trade was long cash vs. short future to earn the very high basis I just spoke about.

In subsequent years, I learned that he is one of the most OG crypto traders. Rumour has it he also paid 10,000 BTC for a pizza. The dude is a legend, and I am glad I got to meet him in the default world a while back.

In this bull market, the basis on futures contracts looks extremely high. When my banker friends discover you can make 30% PA doing cash and carry using USD, BTC, and futures their minds melt. If you think 30% is aggressive, imagine 200% back in 2013. I will go into the structural reasons of why basis is highly positive in a flat or bull market later.

The biggest dislocation I ever saw was in December 2013 when Bitcoin hit $1,000. China was pumping, and Bitcoin rocketed from $60 in August to $1,000 in December. The March 2014 Future vs. December 2013 Future basis traded at a 100% premium OUTRIGHT. I sold Mar14’s and bought Dec13’s. The trade was delta neutral, but I picked up the price difference between the two contracts. The calendar spread collapsed to flat during January as Mt. Gox started to wobble, and spot began its multi-year bear market. I remarked to another crypto OG trader and former exchange head that I should have bet the house on that trade – and that individual said he went all in on that spread and made beaucoup moneys.

I provide this historical vignette to illustrate that crypto basis trading is nothing new, and today’s levels speak to a more mature market. This maturity is the result of an increase in arbitrageurs willing to lend synthetic USD to long speculators.

Training Day

When I joined Deutsche Bank as a graduate, you had four rotations to find a job, or you were out. They generally had enough slots on the floor for every graduate, but if no one liked you, bye bye. I rotated through the Asian Equity Index Vol, Research Sales, Convertible Bond Trading, and Absolute Strategies desks. I thankfully found a role on the Absolute Strategies desk, which essentially was an Asian equity index arbitrage desk. We traded the difference between the cash basket of stocks and any futures contract listed on top around the region.

If there was a BSD of the Deutsche Equities trading floor, it was my boss. He drove a white Lambo, spoke very quietly, and his desk made the most money on the floor at my time of arrival.

One day I got him the wrong fruit for breakfast and he pulled me aside and said, “you know why this is important, right?”, I replied, “yes, attention to detail”. I never fucked up the breakfast or lunch order again.

DB was making a big push into Asian ETFs, and his desk acquired the mandate to build out the DB X-Trackers product line. I was the grad hired to grow the business.

I really didn’t have a deep understanding of the basis trading business acutely until an incident occured a bit later down the line (I’ll get to that in a bit). In 2009, traction on ETFs in Asia was a nothingburger. We launched a series of ETFs on the Hong Kong and Singapore stock exchanges. No retail investors bothered buying them and the only trades we saw were the result of my prices getting arbed by other trading houses. Shout out to Su Zhu of Three Arrows. Before he joined crypto, he used to arb my ass when I got sloppy.

In the summer of 2009, I dropped a few hundred thousand USD in a matter of hours because I did not fully grasp the relationship between cash stock baskets and futures contracts. I don’t remember what the political catalyst was, but one morning Taiwan opened strong, and the cash markets traded limit up (7% up over the previous close) within an hour.

I had an ETF listed that tracked the MSCI Taiwan Index. I did my usual morning routine, checked the index constituent file to make sure my quoter would produce the right prices on the exchange, and then opened the market. However, I quickly noticed that I kept getting lifted even after the Taiwanese cash market was limit up. I soon had so much short delta that I began trying to buy cash baskets, but I could not because all the constituents were locked limit up. Instinctively, I just started raising my prices, but I kept getting lifted, which meant I got shorter and shorter. The exposure was in the millions of USD of naked Taiwan risk that I couldn’t hedge in the cash markets. I thought “Fuck Fuck, Fuckity Fuck Fuck” I had way too much Taiwan risk and no ability to hedge. I looked around for my boss. He was nowhere to be found, so I frantically ran around the trading floor looking into all the meeting rooms for him. I located him chilling with a bunch of other swingers, and I interrupted them — telling him how much delta I had, and that I couldn’t hedge. He told me to keep raising my prices. I returned to my desk and kept skewing my prices higher. I kept getting shorter. I got back up, went and found him again, and told him the situation. At that point, he followed me back to my desk and I showed him what I was doing. He asked me if I was buying futures contracts, and I said, “No, why would I do that? My hedge is the cash basket”. WRONG.COM

I don’t remember if he called me a “fucking idiot” or not. I definitely received that feedback on other occasions due to mispricing. But I was scared shitless.

The MSCI Taiwan futures contract in Singapore did not have a 7% limit up provision, so they traded at the true market level. He then instructed me to price my ETF off the fair price of the MSCI Taiwan index as derived from the futures market. The MSCI Taiwan index arb trader gave me his fair every morning, and I would trade my offset in my spreadsheet and adjust my quoter. This chap is also a legend— he is currently one of the head traders of the desk I received a pink slip from at Citi in Hong Kong. Luckily, I instinctively knew that if someone traded against me, I was wrong, not them. After hedging my position in the futures market, the loss was a few hundred thousand USD. I never forgot that painful lesson on the connection between the cash and the futures market.

The NakaDollar

We live in a US Dollar global currency regime. That is equally true for the crypto capital markets. While Bitcoin is the reserve asset of crypto, it is most commonly valued against the USD. To be truly intellectually honest we should value Bitcoin against the representation of the energy it takes to produce blocks every 10 minutes (e.g., Bitcoin vs. Joules, kwH, a barrel of oil, etc.) but we don’t— and the most common way to obtain Bitcoin is not to tender energy, but fiat currency.

Bitcoin miners need fiat to pay electricity bills, and speculators bring fiat to obtain Bitcoin. Both sides meet on the exchange, and magic happens. The big issue is that spot exchanges rely on banking partners to allow fiat into and out of the exchange. Without a reliable bank, the exchange cannot conduct its business.

When ICBIT started the Bitcoin derivatives markets, it made a crucially important decision to settle margin, profit, and loss in Bitcoin only. This is unusual, as most FX derivatives – in order to have a linear payoff curve – will settle in the unit of the foreign currency.

EUR/USD

Home Currency = EUR

Foreign Currency = USD

If I buy 1 EUR at EUR/USD = 1, and then sell 1 EUR at EUR/USD = 2, I make 1 USD. It’s very easy to conceptually understand. I post margin in USD, I receive my profit in USD. Wham, bam, thank you ma’am.

Instead, ICBIT used an inverse structure where the contract settled in units of the home currency. For BTC/USD the home currency is BTC, and this means the contract behaves in a non-linear fashion.

Bitcoin Contract Value = 1 / P

P is the price of BTC/USD

P = $50,000

1 / $50,000 = 0.00002 BTC

So, 1 USD is worth 0.00002 BTC when BTC/USD is $50,000. Or if we take the inverse of 0.00002 BTC, that is 1 / 0.00002 BTC or $50,000. In other words, 0.00002 BTC is worth 1 USD at a Bitcoin / USD price of $50,000.

What happens to the value of the contract if the price goes from $50,000 to $100,000?

1 / $50,000 = 0.00002 BTC

1 / $100,000 = 0.00001 BTC

Value_Last – Value_Initial = Profit or Loss (PNL)

0.00001 BTC – 0.00002 BTC = -0.00001 BTC

The price doubled, but if we use the standard formula to compute PNL, it outputs a negative number when we know we made money. That is because the multiplier is not +1, but is -1 due to the inverse nature of the contract. For anyone constructing a spreadsheet model, please take note, this is the correct way to represent the inverse function.

(Value_Last – Value_Initial) * Multiplier = PNL

What’s the value of 1 USD of Bitcoin when BTC/USD is $1 million?

1 / $1,000,000 = 0.000001 BTC

What’s the value of 1 USD of Bitcoin when BTC/USD is $1?

1 / $1 = 1 BTC

The key takeaway is that as the price of BTC/USD rises, the Bitcoin value gets exponentially smaller; X^-1. As the price of BTC/USD falls the Bitcoin value gets exponentially larger via the same function.

We can create a synthetic USD combining Bitcoin and a short BTC/USD inverse derivative. Regardless of the price of Bitcoin, this portfolio will have a fixed value in USD terms. Let me prove it.

Assume:

Time 0:

BTC/USD = $1

I buy 1 BTC, and sell 1 BTC/USD inverse contract. Each BTC/USD contract is worth $1 of Bitcoin at any BTC/USD price. That means its multiplier is -1. If each BTC/USD contract tracked the value of $10 of Bitcoin, the multiplier would be -10.

1 BTC Value = $1

1 BTC/USD inverse contract BTC value = 1 / $1 = 1 BTC

Time 1a:

BTC/USD = $100,000

1 BTC Value = $100,000

1 BTC/USD inverse contract BTC value = 1 / $100,000 = 0.00001 BTC

What is 0.00001 BTC worth at BTC/USD = $100,000?

0.00001 BTC * $100,000 = $1

What is my unrealised loss in BTC terms on the BTC/USD inverse contract?

(Value_Last – Value_Initial) * Side [+1 for Long, -1 for Short] * Multiplier

(0.00001 BTC – 1 BTC) * -1 * -1 = -0.99999 BTC

What is 0.99999 BTC worth in USD when BTC/USD = $100,000?

0.99999 BTC * $100,000 = $99,999

Therefore in USD terms, the BTC/USD inverse contract lost $99,999, but our 1 BTC is worth $100,000, so the portfolio is still worth $1.

What if instead of BTC/USD going to $100,000 it went to $0.01?

Time 1b:

BTC/USD = $0.01

1 BTC Value = $0.01

1 BTC/USD inverse contract BTC value = 1 / $0.01 = 100 BTC

What is 100 BTC worth at BTC/USD = $0.01?

100 BTC * $0.01 = $1

What is my unrealised loss in BTC terms on the BTC/USD inverse contract?

(Value_Last – Value_Initial) * Side [+1 for Long, -1 for Short] * Multiplier

(100 BTC – 1 BTC) * -1 * -1 = +99 BTC

What is 99 BTC worth in USD when BTC/USD = $0.01?

99 BTC * $0.01 = $0.99

Therefore in USD terms, the BTC/USD inverse contract gained $0.99, but our 1 BTC is worth $0.01, so the portfolio is still worth $1.

NakaDollar Identity = Bitcoin + Short BTC/USD Inverse Derivatives Contract = A constant USD value at any BTC/USD price

Using derivatives, NakaDollars can be created by derivatives platforms without interfacing with the fiat banking system. NakaDollars allow market makers to receive a yield for lending out their dollar synthetically to speculators.

Why do market makers lend dollars? A market maker who goes short derivative must purchase Bitcoin as the hedge. They will purchase Bitcoin with dollars. Therefore, they must be compensated by a positive interest rate on their synthetic dollar to overcome the opportunity cost of lending dollars in other investments.

If I could earn 20% PA depositing USD into a “Too Big To Fail” bank that is fully insured by the government, I would demand at least a 20% premium when selling BTC/USD derivatives. E.g., if spot BTC/USD is $100, I would sell a 1-year BTC/USD inverse futures contract at no less than $120.

As a speculator, I am willing to pay a positive interest rate to obtain leverage if I believe that the price appreciation of BTC/USD will at least outpace the premium over the length of the contract. If I purchase a $120 1-year futures contract when spot BTC is at $100, then I only make money if in a year’s time if the spot price of Bitcoin is greater than or equal to $120.

There are a few factors of Bitcoin that make it very attractive to longs.

- BTC/USD on the upside can go to infinity, but on the downside can only go to 0. The upside returns are asymmetric, which exhibits positive convexity.

- BTC/USD volatility increases as the price increases. That means if we view BTC/USD as a call option on a new digital financial system, it has positive reflexivity. As the price goes up, the volatility goes up, therefore the option value goes up— because an option’s value is heavily determined by the volatility of the underlying asset.

- There is a finite supply of Bitcoin, and its production function has no connection to its market determined value. The coinbase reward is set on a schedule that does not change if the price of BTC goes up or down. Contrast that to gold where if the fiat price of gold rises, certain mines become profitable and these mines can bring more gold supply to the market. The Bitcoin production function acts as a short squeeze as the price goes higher and higher without a counterbalancing increase in supply available to purchase.

A simplistic breakdown of the BTC/USD derivatives open interest is that specs are long, and market makers are short. Market makers supply NakaDollars and create them through the mechanism described above.

NakaDollars = Sum of Open Interest of all BTC/USD Inverse Derivatives Contracts

Much like how the Eurodollar interest rate market is the most important market to pricing all fiat valued assets in the analogue financial ecosystem, the NakaDollar interest rate is the most important to the crypto capital markets. If you ever wondered how BlockFi, Nexo, Celcius etc. can pay 10% if you deposit USDC or USDT, please read on. I will describe how you can earn substantial yields on your dollars by doing the following:

- Sell USD, Buy BTC

- Deposit BTC on a derivatives trading platform like BitMEX

- Sell a BTC/USD inverse futures contract (e.g XBTM21), or the BTC/USD perpetual swap contract (e.g XBTUSD)

This trade has zero BTC/USD price risk. This trade has counterparty risk to the exchange, and counterparty risk to the pool of other traders. The rest of this essay will focus on the mechanics and risks of this trade. It will be done in excruciating detail.

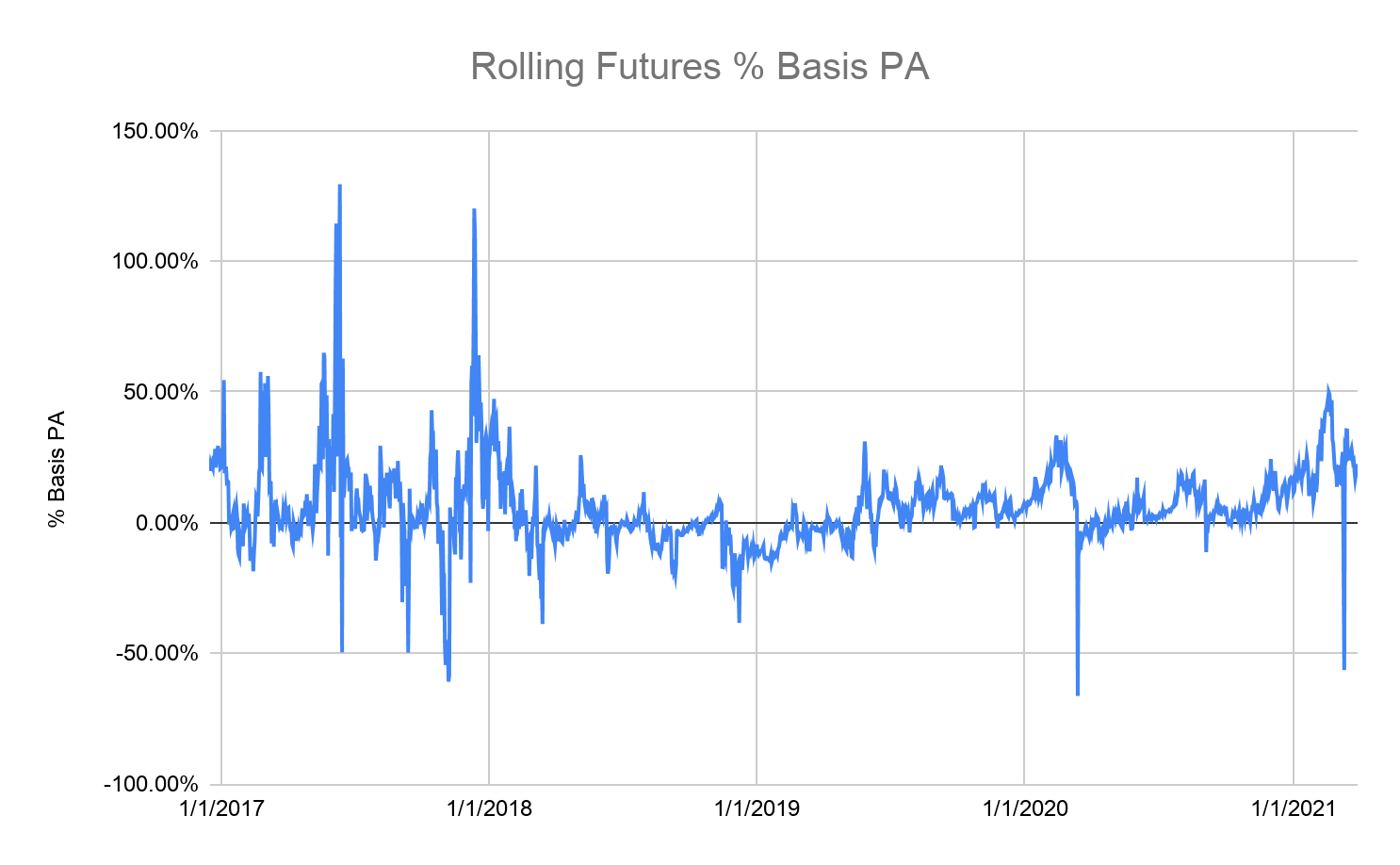

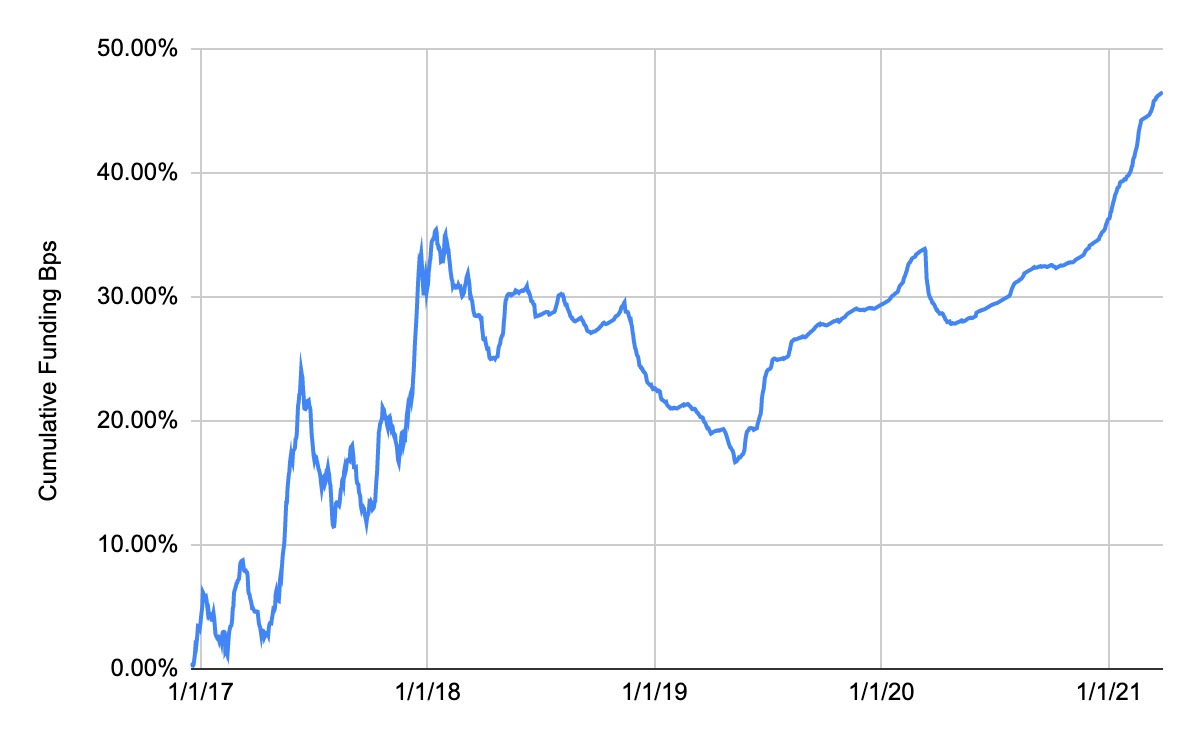

The following charts display historic returns of this strategy from 2017 until the present.

Investing Opportunity Set

How does the return of NakaDollar Fixed and Floating rate bond compare to equities, government bonds, and the balance sheet of the US Federal Reserve?

A Total Return Index aims to mimic reinvestment of dividends and or interest income. We are observing the returns from 16 December 2016 to 29 March 2021.

S&P 500 Total Return Index (Bloomberg Ticker: SPTX): +90.92%

S&P U.S. Treasury Bond Current 10-Year Total Return Index (Bloomberg Ticker: SPBDU1BT): +16.40%

US Federal Reserve Balance Sheet – (Bloomberg Ticker: FARBAST): +72.75%

NakaDollar Floating Rate Total Return: +58.38%

Note: This is different than just summing all funding payments, as we are compounding the funding interest income.

NakaDollar Fixed Rate Total Return: +48.50%

Bitcoin / USD: +7,099.63%

The US equity market barely outperformed the Fed’s balance sheet expansion.

Investing in ten year treasury bonds is the worst performing asset. However, it is the least risky as the US government can never be forced to default on their bonds because they can print infinite amounts of USD to pay off bond holders.

The NakaDollar Floating Rate Bond as I will describe below is a portfolio comprised of Bitcoin and short XBTUSD perpetual swap. That total return is the cumulative funding received by XBTUSD shorts over the time period.

The NakaDollar Fixed Rate Bond as I will describe below is a portfolio comprised of Bitcoin and short XBT/USD quarterly futures contracts. That total return is the cumulative interest income received by shorting the future and rolling every quarter.

Bitcoin is by far the best performing asset when measured against USD. While that is a spectacular return, the volatility experienced from 2016 until now is nothing short of extraordinary. For investors whose mentality is to use lower vol strategies in an attempt to beat central bank monetary inflation, evaluating the NakaDollar fixed income universe is more appropriate.

BitMEX Bitcoin / USD Futures Basis Time Series

The % Basis PA is very volatile. This is great news for those traders who want to level up their basis trading strategies and take term structure curvature positions. This type of trading gives me pleasant goosebumps. I would much rather leverage up my position and trade on a DV01 basis than take naked delta. If you don’t understand what I just said, then you know this trade ain’t for you.

The % Basis PA is very volatile. This is great news for those traders who want to level up their basis trading strategies and take term structure curvature positions. This type of trading gives me pleasant goosebumps. I would much rather leverage up my position and trade on a DV01 basis than take naked delta. If you don’t understand what I just said, then you know this trade ain’t for you.

BitMEX Bitcoin / USD Perpetual Swap Cumulative Funding Time Series

This chart shows the cumulative funding received (+ve value) or paid (-ve value) by a XBTUSD shorts over the relevant time period. Funding is not always positive— there was a painful period for shorts in 2018 to mid-2019 where funding was consistently negative. This also corresponds with the depth of that bear market’s nuclear winter. In a crypto nuclear winter, the price goes down, and stays down, with very low volatility.

This chart shows the cumulative funding received (+ve value) or paid (-ve value) by a XBTUSD shorts over the relevant time period. Funding is not always positive— there was a painful period for shorts in 2018 to mid-2019 where funding was consistently negative. This also corresponds with the depth of that bear market’s nuclear winter. In a crypto nuclear winter, the price goes down, and stays down, with very low volatility.

Futures vs. Swaps % Basis

The big question is, “fixed or floating?” As a basis trader, should you sell a futures contract to lock in a fixed interest rate, or gamble on whether the floating interest rate, i.e. funding, will be in excess of the fixed rate predicted by the futures curve? The above chart is a historical study of this relationship. I took the futures basis exhibited by the roll on the date I rolled from one quarterly contract to another, and then looked at the actual funding paid or received for that 91-day time period.

The big question is, “fixed or floating?” As a basis trader, should you sell a futures contract to lock in a fixed interest rate, or gamble on whether the floating interest rate, i.e. funding, will be in excess of the fixed rate predicted by the futures curve? The above chart is a historical study of this relationship. I took the futures basis exhibited by the roll on the date I rolled from one quarterly contract to another, and then looked at the actual funding paid or received for that 91-day time period.

If the futures performed better than the swap, then the number is positive. If the futures performed worse than the swap, then the number is negative.

Here are the stats:

- The number of quarters where futures overperformed was 8. This overperformance totaled 47.58%.

- The number of quarters where futures underperformed was 9. This underperformance totaled 58.21%.

- In total, the floating rate overperformed by 10.63%. That means that an investor long NakaDollar Floating Rate bonds would overperform and investor long NakaDollar Fixed Rate Bonds.

The NakaDollar Fixed Rate Bond

To lend NakaDollars at a fixed rate, you must:

- Sell USD that you own or borrowed

- Buy BTC for immediate delivery, aka on a spot basis

- Deposit BTC on BitMEX or another derivatives trading platform

- Sell a BTC/USD inverse futures contract

I will always use simple interest and annualised rates.

Cost of USD Capital

Either you have idle USD sitting in your bank account, or you can borrow at a low rate.

A zero yielding savings account has a 0% opportunity cost, and a 0% cost of capital. A 10% yielding savings account has a 10% opportunity cost, and a 10% cost of capital.

If you can borrow USD at 1% from your bank, then your cost of capital is 1%.

Everyone has a different cost of capital; you must evaluate this trade vis-à-vis your personal or firm’s financial position. For the below examples I will use a 0% cost of capital.

Assume the following:

- It’s January 1, 2021

- BTC/USD = $100

- The BitMEX BTC/USD 31 December 2021 Futures Contract (XBTZ21) = $150

- Each XBTZ21 is worth $1 of BTC at any price

- Days to Maturity = 365

- Day count Convention = Actual / 365

What is the fixed 1-year yield offered by XBTZ21?

Basis = Futures Price – Spot Price

% Basis PA = [Basis / Spot Price] * [365 / Days to Maturity]

Basis = $150 – $100 = $50

% Basis PA = $50 / $100 * (365 / 365) = 50%

The NakaDollar 1-year fixed rate bond yields 50%.

If our cost of capital is 0%, does the Nakadollar 1-year bond offer an attractive yield? Yes, because it’s 50 percentage points above our cost of capital. Therefore, we will “buy” this bond by engaging in the behaviour described below.

We would like to purchase $100,000 worth of bonds.

Sell $100,000 and buy 1,000 BTC.

BTC/USD = $100

$100,000 / $100 = 1,000 BTC

Deposit 1,000 BTC onto BitMEX. We will discuss counterparty risk considerations later.

1,000 BTC is currently worth $100,000. Because each XBTZ21 contract is worth $1 of BTC at any price, we will sell 100,000 XBTZ21 contracts.

Let’s double confirm the math.

BTC value of 100,000 XBTZ21 contracts = 100,000 * 1 / $150 = 666.67 BTC

666.67 BTC is less than 1,000 BTC. That is because we did not factor into account the profit due to us in the form of interest income. If the spot price of Bitcoin does not move between now and expiry, we will make $50 per contract. Therefore, the future value of our $100,000 is $150,000. We must sell 150,000 XBTZ21 contracts INSTEAD of 100,000 XBTZ21 contracts.

BTC value of 150,000 XBTZ21 contracts = 150,000 * 1 / $150 = 1,000 BTC.

Double confirming again.

If at expiry BTC/USD is $100, what is our PNL?

At expiry the XBTZ21 price will equal the spot price or $100.

BTC PNL at Expiry = (Value_Last – Value_Initial) * Side Sign * Multiplier * Contracts

(1 / $100 – 1 / $150) * -1 * -1 * 150,000 = 500 BTC

Initial BTC Deposit = 1,000 BTC

XBTZ21 Profit = 500 BTC

Total = 1,500 BTC

USD Value = 1,500 BTC * $100 = $150,000

USD Return = $150,000 / $100,000 – 1 = 50%

We know conceptually that we have the correct portfolio to “buy” $100,000 of a NakaDollar 1-year fixed rate bond.

It is now 1 December 2021, and we need to decide whether to close the trade or to roll it in order to compound our returns.

BTC/USD = $100

XBTZ21 = $110 [the price will decay as theta or the time value declines]

The BitMEX BTC/USD 31 December 2022 Futures Contract (XBTZ22) = $132

XBTZ22 vs. XBTZ21 difference in days to maturity = 365

If we choose to let our bond expire and receive principal plus interest, we must do the following:

The XBTZ21 settlement price will be based on the 2 hour TWAP of the .BXBT index (this is the value across a number of spot BTC/USD exchanges) from 10:00 UTC to 12:00 UTC. In an ideal world, we would sell our deposited BTC plus our unrealised BTC PNL in one minute slices between 10:00 UTC to 12:00 UTC on 31 December 2021 in order to match the TWAP price, but BitMEX will not allow us to withdraw all of our equity and unrealised PNL until the XBTZ21 has settled and we no longer have a position.

Note: When a futures contract settles, we no longer have a position, but unrealised profit is now realised. E.g., if at 11:59 UTC we were short 150,000 XBTZ21 contracts with an unrealised PNL of 500 BTC, at 12:00 UTC we will be short 0 XBTZ21 contracts with a realised PNL of 500 BTC. We can now withdraw the realised 500 BTC PNL.

Therefore, we will just run the risk between TWAP observation period and 13:00 UTC when we are able to withdraw Bitcoin from BitMEX. Once we receive our BTC, we can then sell them on our preferred spot exchange for USD and the trade is finished.

If we want to continue to compound our USD, then we must roll our XBTZ21 position into XBTZ22.

We call this a calendar spread, or the roll. I will refer to it as “The Roll”.

Roll Basis = Far Leg Future Price – Near Leg Future Price

Roll % Basis PA = (Roll Basis / Near Leg Futures Price) * (365 / Roll Days to Maturity)

Roll Basis = $132 – $110 = $22

Roll % Basis PA = ($15 / $110) * (365 / 365) = 20%

If the Roll % Basis PA is greater than our cost of capital, then we should roll.

Long Roll is when we are long the near leg. And this means we will sell the near leg and buy the far leg.

Short Roll is when we are short the near leg. And this means we will buy the near leg and sell the far leg.

We are short rollers because we are short XBTZ21, which is the near leg.

How many XBTZ21 contracts should we buy? Remember, as a short roller we buy the near leg.

We are short 150,000 XBTZ21 contracts, therefore we must buy back 150,000 XBTZ21 contracts. Now we no longer have a XBTZ21 position.

Our Roll % Basis PA is 20% with initial starting capital of $150,000. Therefore, on 31 December 2022, our $150,000 will be worth 20% more ($180,000). We must sell 180,000 XBTZ22 contracts.

If the roll basis compensates for our cost of capital, we can continue to roll and compound our USD. As my fixed income professor used to say, “A one-year bond becomes a one-month bond in eleven months”. Our 1-year NakaDollar bond becomes a 1-month NakaDollar bond by the beginning of December 2021, and now we can roll into another 1-year NakaDollar bond to keep earning income.

Local Risks

We know that at maturity Spot Price = Futures Price. We do not know the futures price during the contract period. If we unwind this trade prior to maturity or are not rolling into another futures contract, we are subject to price and interest rate risk which manifests itself in mark-to-market (MTM) risk.

We are short XBTZ21, if the basis rises the futures contract becomes more expensive relative to spot. We fixed an interest rate of 50%. If immediately after we sold XBTZ21, the futures price shot to $200, but spot stayed at $100, then the % Basis PA rises to 100%. Our XBTZ21 has an MTM unrealised loss even though spot did not move because the NakaDollar interest rate rose. If immediately after we sold XBTZ21, the spot price and the futures price rose 50% in tandem, we still would have an MTM unrealised loss because the BTC/USD price rose.

MTM unrealised losses are not a problem as long as we have sufficient margin deposited on BitMEX in the form of BTC, and we do not unwind the trade early. If we lock up our USD in a 1-year NakaDollar fixed rate bond, we must be confident we will not need those dollars between now and expiry.

There is also execution risk between the time we purchase Bitcoin and sell XBTZ21 contracts. We may observe a market determined 50% NakaDollar 1-year rate, but after buying Bitcoin and selling XBTZ21, the executed prices after fees and slippage mean our true return is 40%. When we expire our XBTZ21 contracts, there will be execution slippage and fees incurred. When we roll our XBTZ21 into XBTZ22 contracts, there will be execution slippage and fees incurred. If we purchase a large quantum of bonds, our skill at fee minimisation and trade execution come into play.

The NakaDollar Floating Rate Bond

To lend NakaDollars at a variable rate, we must:

- Sell USD that we own or borrowed

- Buy BTC for immediate delivery, aka on a spot basis

- Deposit BTC on BitMEX or another derivatives trading platform

- Sell a BTC/USD inverse perpetual swap contract

The BitMEX XBTUSD perpetual swap exchanges a funding rate or interest income between longs and shorts every 8 hours. Therefore, we can say that Long Bitcoin + Short XBTUSD is equal to a floating rate bond with an 8-hour duration.

Theoretically speaking the % Basis PA on a 1-year futures contract should equal the sum of all funding payments for the entire year if we held XBTUSD. If everything behaved as it theoretically should, trading derivatives wouldn’t be very profitable. The floating rates will under and overshoot the theoretical sum exhibited by the 1-year fixed rate observed on the futures contracts.

If you would only like to lend NakaDollars for a short period of time, or you might need access to your dollars before expiry of a futures contract, then buying a NakaDollar floating rate bond might be more suitable.

Assume the following:

- It’s January 1, 2021

- BTC/USD = $100

- The BitMEX BTC/USD 31 December 2021 Futures Contract (XBTUSD) = $100

- Each XBTUSD is worth $1 of BTC at any price

- Funding Interval = 8 hours at 04:00 UTC, 12:00 UTC, and 20:00 UTC

After casually overserving the XBTUSD funding amounts over a few days, we believe that they are likely to continue to be positive. A positive funding rate means that longs pay shorts, as we will be going short XBTUSD. This means we earn BTC interest income proportional to the number of contracts we hold every 8 hours.

We would like to purchase $100,000 worth of floating rate bonds.

Sell $100,000 and buy 1,000 BTC.

BTC/USD = $100

$100,000 / $100 = 1,000 BTC

Deposit 1,000 BTC onto BitMEX.

1,000 BTC is currently worth $100,000. Because each XBTUSD contract is worth $1 of BTC at any price, we will sell 100,000 XBTUSD contracts.

At 12:00 UTC we are short 100,000 XBTUSD contracts, the funding amount is 10bps or 0.10%. This is paid or received in BTC.

XBTUSD BTC Value = 1 / $100 (current price of XBTUSD) * 100,000 = 1,000 BTC

Funding Income = XBTUSD BTC Value * Funding Amount = 1,000 BTC * 0.10% = 1 BTC

Currently the BTC/USD spot price is $100, so our 1 BTC of funding income is worth $100. At this point our NakaDollar floating rate bond has technically expired. We could buy back 100,000 XBTUSD contracts, withdraw the realised XBTUSD PNL and BTC equity (1,001 BTC), then sell the combined amount for $100,100 (1,000 BTC * $100) on a spot exchange. Remember the duration of our floating rate bond is only 8 hours.

However, we want to benefit from the beautiful effects of compounding. Instead of closing out our position, we buy another $100 worth of NakaDollar floating rate bonds by selling another 100 XBTUSD contracts to hedge the 1 BTC of funding income we just received.

It’s now 20:00 UTC and the XBTUSD funding amount is again 0.10%. The XBTUSD price has not changed, it is still $100.

100,100 XBTUSD Contracts have a BTC value of 1,001 BTC. We earn 0.10% on 1,001 BTC, or 1.001 BTC. Now our total equity capital is 1,002.001 BTC and we will sell another 100 XBTUSD contracts for a total of short 100,200 XBTUSD.

We can continue to roll our NakaDollar floating rate bonds and compound our capital until we need our USD capital back or we can decide the trajectory of future funding payments is not ideal.

What happens if funding is negative?

What’s our portfolio at 20:00 UTC:

BTC Equity = 1,002.001 BTC

Swap Position = Short 100,200 XBTUSD

Now it’s 04:00 UTC:

Funding Amount = -0.10%

XBTUSD Price = $100

XBTUSD BTC Value = 1 / $100 * 100,200 = 1,002 BTC

Funding Payment = 1,002 BTC * 0.10% = 1.002 BTC

BTC Equity = 1,002.001 BTC – 1.002 BTC = 1,000.999 BTC

We are exposed to interest rate risk every 8 hours. That can work for or against us. The good thing is that XBTUSD funding rates are published 8 hours in advance. Therefore at 04:00 UTC we know the funding rate to be charged if we hold a XBTUSD position at 12:00 UTC. That is helpful, but the whole market has the same information. That means that the price of the XBTUSD intra-funding periods should reflect the upcoming funding. E.g. if there is a massively positive upcoming funding, longs may attempt to exit their positions right before 12:00 UTC in order to avoid paying funding. This action, if done by enough traders, will depress the market price of XBTUSD. And it could turn out that exiting early would cost the same if not more than holding over the funding timestamp and paying funding.

Local Risks

The duration of the NakaDollar floating rate bond is quite short, 8 hours. Therefore, we have MTM risk for 8-hour periods if we really need to “sell” our bonds to reclaim access to our USD.

The act of buying spot Bitcoin and selling XBTUSD contracts carries execution risk and will incur fees. Similar to the futures example, as the size of the position grows more attention must be paid to how trades are executed.

Global Risks and Other Considerations

Exchange Counterparty Risk

There is no such thing as risk-free. While fixed income instruments in the non-crypto space incur banking system or corporate counterparty risk in the guise of default, the NakaDollar instruments described above have exchange counterparty risk.

If the exchange is unable to return your principal plus interest due to a hack or theft of Bitcoin, then you will suffer near or complete loss of capital. In order to avoid being liquidated on your short futures or swap position if the BTC/USD price rises, you must use zero leverage. I proved this relationship above when I showed that the Bitcoin + Short Inverse Contract will have a constant USD value at any BTC/USD price. That is another way of saying you mathematically cannot be liquidated if you deposit the full BTC value of your short derivatives position at trade inception.

Using zero leverage exposes all of your equity to exchange counterparty risk. If you use leverage you reduce your counterparty risk, but if you do not manage your positions correctly should the price rise high enough your short futures or swap position could get liquidated. That is why at 0% short term USD rates the NakaDollar fixed and floating rates are markedly greater than 0%. The market makers providing synthetic dollars to the market must be compensated for exchange counterparty risk.

Trader Counterparty Risk

Trades in the crypto derivatives ecosystem feature limited liability. That means you are only liable for losses up to the amount of initial margin deposited. If you use 100x leverage, on a 100 BTC position, you deposit 1 BTC. If the position goes against you in excess of 1%, your losses are capped at 1 BTC.

The function 1 / X, as X gets increasingly small explodes in value.

There are only 21 million Bitcoin in existence. Therefore at a certain price relative to the open interest and average entry prices of longs, there could be more Bitcoin owed than will ever exist. That is the existential flow with the inverse contract. That is why down moves are very vicious— because long speculators owe more and more Bitcoin as the price falls and have no way to quickly acquire them.

Creating NakaDollars requires us to always be short an inverse derivative. Therefore, as the price falls, we have unrealised profits that are essential towards maintaining a constant USD value. If the longs do not have enough equity to pay us, we will not be able to maintain a constant USD value.

Exchanges have reserves of Bitcoin by different names that help reduce the risk that one side cannot payout. These reserves are tapped into when the longs or shorts cannot cover their unrealised losses. The larger the fund, the more confidence bond holders have that their NakaDollars will maintain a 1:1 peg.

At the point where there is just no more Bitcoin left to pay the winners, there are various ways contracts are early assigned or taxed in order to bring the system into equilibrium. In the NakaDollar situation, imagine the price fell and our short 150,000 XBTZ21 position became a short 100,000 XBTZ21 position leaving us underhedged by 50,000 contracts.

Re-establishing the hedge would require selling another 50,000 XBTZ21 contracts, but it can be assumed that the % basis PA during this correction would be much less than 50% observed at the outset of the trade. Therefore, we would lock in a loss of interest income in order to reestablish our hedge. All else being equal, market makers will demand a much higher % basis PA to compensate for the risk that if the market falls, given that their position could be forcibly unwound at an inopportune moment.

Extra Income

Bitcoin these days has repo value. Platforms such as BlockFi, Celcius, Nexo, etc. will pay a positive rate if you deposit Bitcoin for a period of time on their platforms. If you have good risk management capabilities, it is optimal to take a portion of the BTC sitting in equity on BitMEX and deploy it elsewhere to earn additional Bitcoin denominated yield.

You must be careful that you do not run too much duration risk. Don’t lock your Bitcoin up for 1 year if you own a 1-year NakaDollar bond. Maybe lock it up for a day or a week.

USD Settled Linear BTC/USD Contracts

Today, there are various platforms that offer linear USD settled BTC/USD derivatives contracts. While these contracts are popular, useful, and have a significant amount of open interest, they cannot be used to create a truly synthetic dollar for the crypto capital markets.

Using just Bitcoin and a Bitcoin-margined derivative we can create a synthetic dollar that is borrowed and lent. Rather than centralising the holdings of physical USD on exchanges, it is spread amongst a global set of market makers willing to lend NakaDollars into existence through their ability to purchase Bitcoin with dollars. This is a more robust market structure than centralising dollar holdings on a small handful of global crypto exchanges.

The biggest problem with USD-settled contracts is margining them. Think like a market maker. If I am supplying dollars by selling a derivative and purchasing Bitcoin as my hedge, I want to minimise capital usage. Using a BTC settled inverse derivative, I can post my hedge as collateral, underpinning my short derivative position with the exchange. If I use a USD-settled linear contract, I cannot post my hedge as collateral; I must obtain additional USD to post as collateral.

I must have additional savings or must borrow USD. In either case I lower my expected return because those dollars cost me something but earn me nothing. I could take my BTC hedge and use it as collateral to obtain USD. But that will not be free, and the USD lender should demand at a minimum the NakaDollar fixed rate yield on their dollars.

This USD funding issue is more acute if the price rises. I owe more and more USD as margin as my MTM loss on the short derivatives position increases. The good thing is that on the downside, the long holders owe dollars, not Bitcoin— so they will not face an exponentially rising margin requirement in BTC terms as with inverse contracts.

Carry On

I have given similar presentations on the mechanics of this trade many times. However, as new players appear in our sandbox, they continuously marvel at the high basis during bull markets — and even sometimes during bear markets. For those who do not wish to take price risk, but want to outperform against broad monetary supply expansion, purchasing NakaDollar fixed and floating rate bonds must be evaluated.

Related

The post appeared first on Blog BitMex