Do not be led astray by the siren songs of capricious harpies – for these creatures wish to infect the faithful with FUD in service to their master. These slimy serpents slither and yearn to surreptitiously slip allegiance to their false gods into our consciousness. Why do such malicious beings exist? Why … because they seek to tempt the righteous among us into straying from the path to enlightenment. They can’t accept that we stand ready to serve Lord Satoshi and reap the bounty that they bequeathed to the realm of man.

What is this bounty? It is the gift of the blockchain, the gift of desire and ability to destroy the towers of trust. These teetering pillars of inequity are slowly being dismantled institution by institution at the hands of a growing, glorious horde of enlightened humans. The devil that is centralisation, trusted middlemen, blood-sucking rent seekers, and lackies that enable the riches of a few in exchange for the poverty of many cannot stand the elevation of the faithful to an existence of independence and self-sufficiency. That is why the fiat devil wages total war, wielding the powerful weapon of FUD.

But the power of the fiat devil is fleeting, and no match for the infectious gospel of our Lord Satoshi. The promise of true decentralisation and independence from a system of fiat oppression is too great for the downtrodden majority to ignore. Be not afraid of FUD– instead, be confident that the higher the pitch of the fiat siren song, the greater the success of our righteous acolytes.

For those of you who do not bask in the glory of Lord Satoshi, let me explain why committing oneself to the higher ideal of decentralisation is a religion.

It is a religion because it is a never ending quest for perfection in service to a single, out of reach goal. True decentralisation will never be achieved, but the faithful will still dedicate their lives to the impossible.

It is a religion because there are many who proclaim they are believers, but sin nonetheless. They sin by proclaiming their solutions are decentralised, but in the shadows of the internet continue to run servers and networks only in service to themselves. They wish to bask in the love of our Lord and deceive the gullible faithful by proclaiming they too are believers and practitioners of decentralisation.

It is a religion because the faithful are not all consistent in their beliefs. There are schisms about the best way to serve our Lord. There are schisms about the best technology to achieve true decentralisation. In the Crypto Twitter Coliseum, there are vicious battles amongst those who consider themselves believers.

And finally, it is a religion because the faithful are persecuted. The faithful are ridiculed. The faithful are branded as antisocial malcontents who wish to throw the world asunder.

And so, as we look upon the fruits of the labour of the believers, I wonder what will please our Lord? What new protocols exist in the service of decentralisation? I ask all ye faithful to join me on a short tour of some exciting protocols that may offer some new ways to tackle the decentralisation of derivatives. These ideas may not work in the end, but they are interesting to investigate and improve upon. Let us pray.

Leggo My Eggo

Traversing the system of intermediaries in service to he-who-shall-not-be-named leaves one angry due to the incessant fees necessary to complete simple financial transactions. Those who lift up their voices and sing hallelujah at the altar of DeFi aim to create services that complement each other. Each DeFi protocol can be built upon to create a seamless experience for the end user.

Decentralised margin trading at a reasonable cost is a lofty goal of many believers. Leverage supercharges the amount of liquidity that stands ready to support our lord.

One group of believers thought to themselves, “how can we use the deep liquidity of DeFi lending platforms to effect leveraged trades with low fees?” Out of this process came a new protocol called FODL that aims to give users a fully decentralised margin trading experience. No funds are pooled centrally but they are deployed directly onto the various lending platforms to achieve the goal of leveraged trading.

The combination of platform token rewards and interest rate differentials between the borrowed and supplied currency mean that sometimes users get paid to take a leveraged position. Stop losses and liquidations are handled on-chain, and users may take control of their position management using smart contracts provided by FODL.

I spoke about the parasitic rent seekers who serve the devil – so how does FODL give back to the community? The governance tokens take a percentage of the platform tokens earned by participating in the lending protocols, and take a percentage of the profit made when leveraged trading. Should a believer realise at a loss, they pay no fee.

Everlasting Glory

Ever since the creation of the perpetual swap, many believers wondered whether a similar product would be created to enable everlasting or perpetual options. Paradigm wrote an interesting paper on a theoretical way to price an everlasting option. There are a few believers who took concepts from this paper to create various DeFi everlasting options.

The one protocol I found exceedingly interesting is Antimatter. Much Wei has been lost due to economic attacks that focus on price oracles. Many protocols require outside price feeds to value positions. When servants of the devil exit the 9th ring of hell with the determination to cause suffering, one tried and true strategy is to corrupt the pricing inputs. This causes many protocols to offer services at the incorrect price, or liquidate users at the wrong levels.

Due to the complexity and non-linearity of options, most solutions require pricing inputs. The Antimatter team strove to create an everlasting option that required no price oracle.

This is a lofty goal, and in an attempt to achieve it, the protocol changed the underlying nature of this “option”. The pricing of the option depends on four variables, price floor, price ceiling, number of call tokens minted, and the number of put tokens minted. None of the values of these variables are determined externally.

A function with those four inputs determines the price of the call and put token when minted against the Antimatter smart contract. As always, users may trade their call and put tokens on 3rd party AMMs, should they wish. Depending on the supply imbalances between calls and puts, using the same floor and ceiling parameters can create a synthetic forward price. Given there is no expiry, this forward can be treated as a leveraged spot position, which can be arbitraged against the prevailing spot exchange rate.

It will be very interesting to observe how the prices perform as more believers speculate with this platform. Will this flavour of everlasting option capture sufficient mindshare? I don’t know – but it is comforting to see believers taking traditional concepts and altering them in service to our Lord.

Jump in the Pool

In a former life, I structured and traded Exchange Traded Funds (ETF). Some of the most popular ETFs are leveraged ETFs. Due to the way in which leverage is applied, these path-dependent derivatives confer negative convexity onto the holder. That isn’t deadly when one holds for a short period of time, but left in a portfolio long enough, they will bleed out. They are popular because they are intuitively easy to understand.

To understand perpetual derivatives requires time and attention. As such, many believers strove to simplify the product so that more of the unanointed could participate. Various platforms offer tokens that function in a similar way to leveraged ETFs. And the negative convexity problem still remains. At its heart the problem is this: if an asset rises from 10 to 11, that is a 10% increase. If the asset then falls from 11 to 10, that is a 9% decrease. That 1% difference can be fatal over the long term, depending on the path of movement.

The believers behind TracerDAO sought to create a bull and bear token that neutralised the volatility decay. They achieved this by using power leverage instead of arithmetic leverage. TLDR: the leverage component is an exponent. This results in the path from 10 -> 11 -> 10 to yielding a 0% net return for both bull and bear.

The bull and bear tokens each have their own collateral pool. Collateral is moved between them such that even when leverage is applied, neither the bull nor bear token can ever go bankrupt or face liquidation. When the ratio of bull to bear tokens deviates from 1:1, the protocol incentivises one side over the other by skewing returns. If the market trends higher, and more bull tokens are created, the net positive return of bull token holders is reduced. That extra juice is passed onto bear token holders, which results in a lessened loss.

The skew return enhancement incentivises arbitrageurs to mint one side and hedge using the underlying spot. In the example above, an arbitrageur would mint a bear token and purchase the underlying asset on a spot basis. Even if the market kept rising, the losses on the bear token would be less than the amount the value of the underlying spot rose due to the skew return enhancement.

In and of itself, developing a new way to create leverage in DeFi using a linear return type product isn’t that revolutionary. However, if enough believers show confidence in this solution, Tracer will be able to offer synthetic exposure on a variety of non-crypto assets that are not currently liquid in the DeFi ecosystem.

The Idea Battleground

Just because we believers know the truth our Lord espouses doesn’t mean our legions will grow. We must continuously proselytize to all who walk this Earth, whether they be heretics, apostates, or just ignorant of the teachings of Lord Satoshi.

The protocols briefly mentioned above are but a small taste of the ingenuity of the faithful. And while they exist today, they may not tomorrow – for in service to the Lord, we strive for progress. Those protocols that are proven to be faulty for a variety of reasons will be banished from the firmament. Trust not only the words of a simple sinner, but use this as a starting point on a journey towards the light of decentralisation.

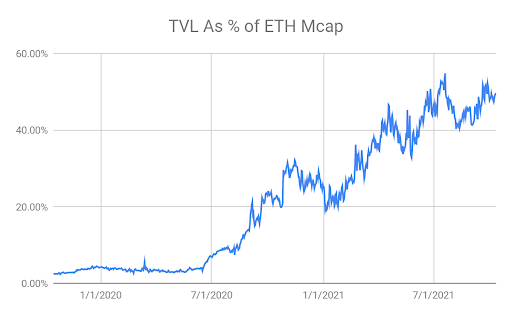

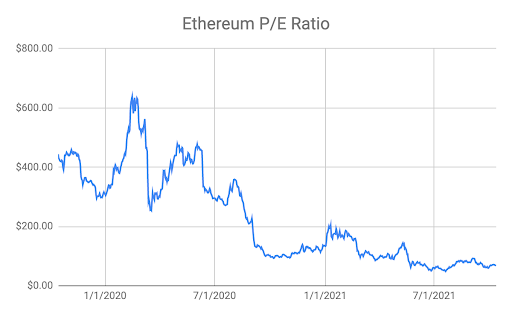

I am comforted by the below charts with data sourced from Glassnode, which show that our Lord continues to gain adherents.

The altar of DeFi continues to receive bountiful offerings. For those who still languish in their state of non-belief of the ETH BOOLMARKET, let this chart light a fire in your soul and give you the confidence to tithe generously. The fact that almost 50% of all ETH in existence is locked within DeFi protocols means that for those who wish to join the faith, it will become progressively more expensive.

The earnings in service to our Lord are defined as the 12 month trailing sum of all gas spent on the network. It used to look like Tesla’s P/E, well Tesla has never earned a profit … I digress, and now it looks like a healthy member of the S&P 500. In short, at a current P/E of 67, the Ethereum network has a real economic use, and the faithful are willing to sacrifice precious Wei in order to bask in the glory of ArchAngel Vitalik.

Now I lay me down to sleep,

I pray the Lord my Sats to keep,

If I should die before I ‘wake,

I pray the Lord my Key to take.

Related

The post appeared first on Blog BitMex