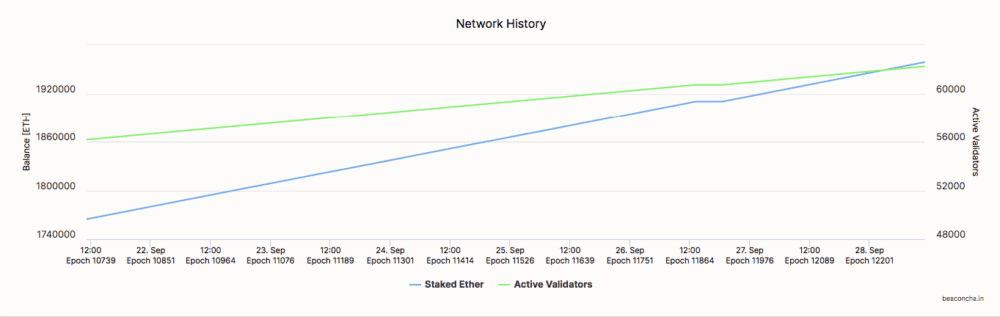

Validator participation in Ethereum 2.0’s Medalla testnet is on the rise. And with the growing number of them, the number of staked test ETH is about to close in on a new high of Almost two million test ETH tokens, that are now staked on Medalla.

This comes amid the launch of the Optimism Layer for Ethereum and DeFi TVL clocking $11 billion.

Ethereum 2.0 Medalla Testnet: The Numbers Say It All

As per the latest update, validators have staked a little close to 2 million Goerli test tokens on the Ethereum 2.0 Medalla test net. Active validators are just above 62,000, with network participation ranging between 72 percent to 80 percent in the last 24 hours.

As of now, close to two million test ETH tokens are eligible for voting whereas only little more than 1.5 million Ethers have actually voted to validate Medalla.

According to the last update on test ETH staking, around 38,000 participants had plugged in more than 1.1 million Goerli Ethereum tokens. Since then validator participation has gone up to 63.2% in a month’s time.

ETH Layer 2 Testnet Launched To Give an ‘Optimistic Shape’ To Scaling

As seen above folks are actively working to make Ethereum 2.0 a roaring success. But besides Medalla, Plasma Group developers have been hard at work to reduce the activity load on the Ethereum main net.

Dubbed as ‘Optimism Layer 2,’ the test net will find deployment over the currently trending projects to test Ethereum’s scaling capabilities.

In its entirety, Optimism is OVM, a fully-featured Ethereum Virtual Machine (EVM) compliant execution environment. It’s objective is to work off the root chain to process data and transactions faster.

Optimism is the only generic L2 solution for Ethereum. This means that it does not need to include specific functionality to support existing L1 protocols.

DeFi protocol Synthetix will take the beginning shot at trialing Optimism. And in the process will offer 200,000 SNX in rewards to their users for participating. Synthetix said that currently, the test net is open to the public, but is not available for public contract deployment.

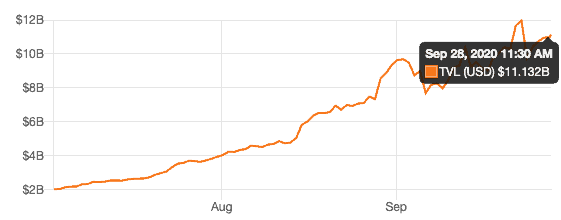

Total Value Locked In DeFi Clocks $11 Billion

Speaking about defi, recent data points to a resurgence in USD deposits in decentralized finance protocols. As per the latest numbers, the total value locked (TVL) has topped $11.13 billion.

The recent rise in activity comes after decentralized exchange Uniswap clocked around $2.3 billion in liquidity, an all-time high for the Ethereum based DEX. This has made it the top DeFi project with an almost 19% dominance.

DeFi lending projects Maker and Aave are also closely trailing behind Uniswap with $1.95 billion and $1.53 billion in USD deposits.

But the current star of the ecosystem is dForce which is designed to be an ecosystem that offers a full-stack solution for DeFi. The project has experienced a near 150% infusion of funds which parabolically pumped its TVL number from $104 million to $257 million in the last 24 hours.

Despite the explosive trend in the DeFi market, ETH has portrayed a lackluster price action. The token is trading sideways $357 a coin.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato