Bitcoin’s price has been recovering steadily since the crash in mid-March. With it, most of the altcoins are also growing, charting notable increases altogether. However, BTC is also taking over the market as its dominance has been going up continuously.

Bitcoin Dominance Highest Since January 2020

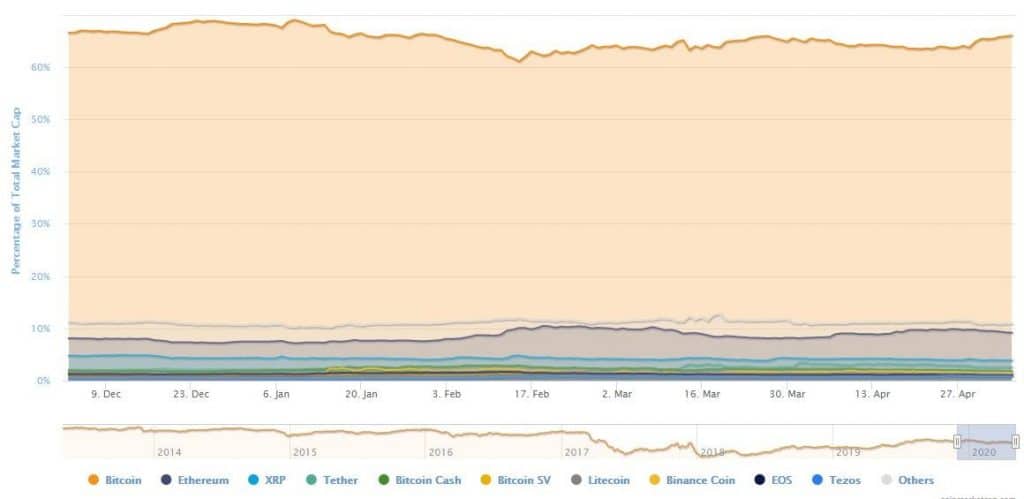

Bitcoin’s dominance is the index that measures the cryptocurrency’s relative share of the entire market. At the time of this writing, it stands at 66.02%, and it hasn’t been higher than this since January 20th this year.

This means that altcoins, despite growing in price against the US Dollar, are failing to claim any solid grounds.

Bitcoin’s dominance dropped substantially in February when it reached 60%. Back then, altcoins were popping as the market was in a state of the so-called alt season. However, ever since then, Bitcoin is taking over the market as the halving inches nearer.

The event which will slash Bitcoin’s block rewards in half is estimated to take place on May 12th, and it has historically been a major bullish catalyst for its price.

Altcoins Are Failing Against Bitcoin

Over the past month, altcoins are tumbling in their value against Bitcoin.

As seen in the chart above, all major cryptocurrencies have decreased against the surging BTC. Ethereum is down just a bit under 4%, XRP is down 12%, while EOS has lost the staggering 20% of its Bitcoin value.

This suggests that there is a serious dislocation of funds coming into the market as investors obviously prefer to put their money in Bitcoin.

That’s perhaps to be expected, given that Bitcoin’s halving is coming up. However, on the positive note, altcoins are also popping up against the US dollar. The entire market is recovering nicely and comparatively quickly following the selloff that came in mid-March.

It remains very interesting to see how the market will turn following the halving, as the majority expect the price to drop in the short-term.

The post Altcoins Are Tumbling BTC-Wise As Bitcoin Dominance At Highest Levels Since January 2020 appeared first on CryptoPotato.

The post appeared first on CryptoPotato