Bitcoin started gaining momentum yesterday and saw its price increase above the coveted $10,000 mark. At the same time, gold continued its recent surge by marking a fresh all-time high.

Some altcoins retraced heavily in the past 24 hours, helping Bitcoin’s dominance reclaim some lost ground.

Bitcoin Stands Above $10k

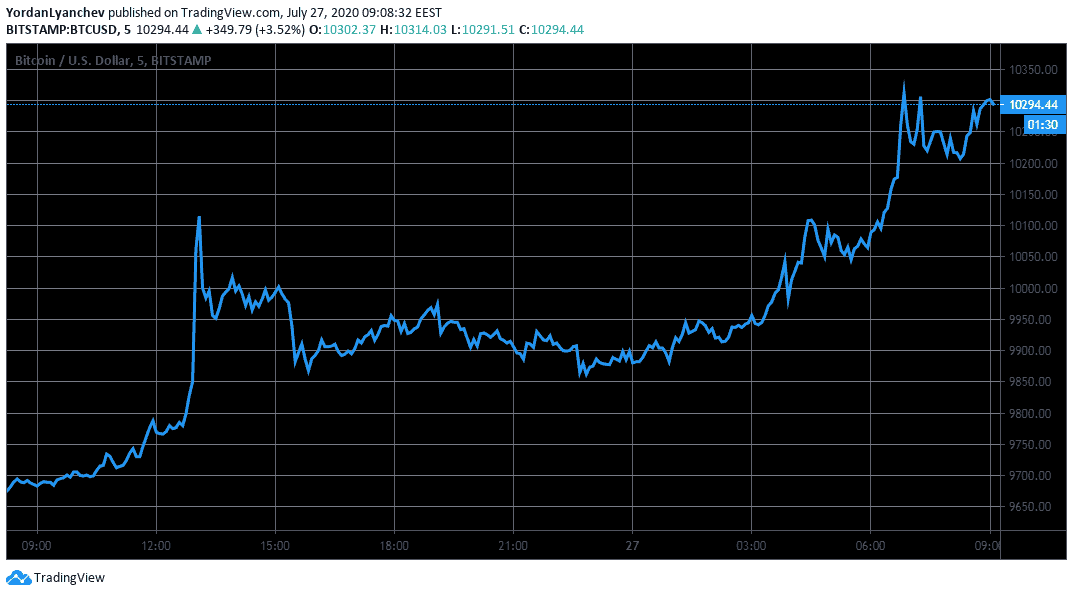

After weeks of trading within a confined range between $9,000 and $9,300, Bitcoin has finally woken up. The past couple of days are particularly action-packed.

Yesterday, in a few decisive candles, BTC surged to $10,100 on some exchanges. Unfortunately, the momentum was for not as it retraced to slightly below $10,000 minutes later. In the early hours of today’s trading session, however, Bitcoin’s price made another leg up, this time more decisively, marking a high of $10,320 on Binance.

This is Bitcoin’s fourth attempt to recapture the $10,000 level this year. However, BTC couldn’t sustain its bull runs during the first three times in February, May, and early June, and it dropped almost immediately.

With its weekly price jump of 12%, BTC showed signs of decoupling from the US stock markets after several months of mimicking their price patterns. This comes after a week of losses for the leading indices such as the Nasdaq Composite, the S&P 500, and the Dow Jones Industrial Average (DJI).

Volatile Altcoins

The altcoin market is fluctuating again. The most notable gainer in the past 24 hours is Elrond, up by nearly 40% to $0.025. Terra has also increased its value by a double-digit percentage – 12%.

ETH’s price increased by 5% since yesterday, pushing to $327 and totaling weekly gains of 38%.

As seen in the above chart, the strong move in Bitcoin’s price had an adverse effect on altcoins trading against it. The entire cryptocurrency market is in the red, which enabled BTC to gain more than 1% of the whole market, seeing its dominance index rise to 61.4%

Against the USD, a few altcoins are also feeling the pressure. Those include Aave (-16.5), Band Protocol (-16.15), Swipe (-15.2), Synthetix Network (-13.8), Loopring (-13%), Aurora (-12.4%), Blockstack (-12.1%), Compound (-11.5%), and Ren (-10).

From the larger-cap coins, Tezos and Stellar are down by approximately 5.4% and Chainlink by 7.5%.

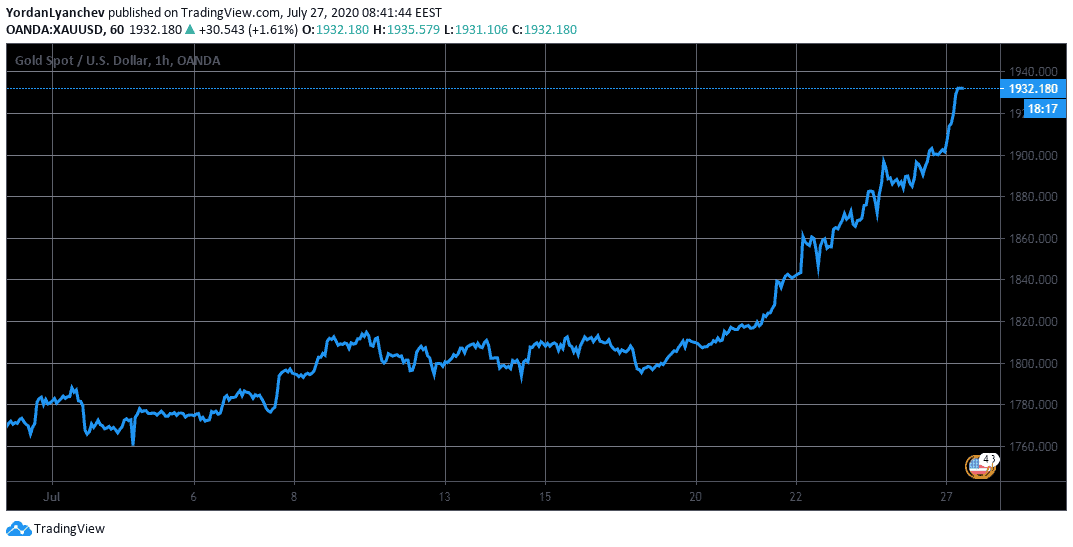

Gold ATH

And while Bitcoin may be decoupling from the stock markets, its performance seems somewhat similar to that of gold. The precious metal has also increased its value – 7% in the past week alone. Moreover, the bullion indeed followed the predictions of Goldman Sachs and Peter Schiff and broke its 2011 all-time high of about $1,920 per ounce.

During the Sunday evening Asian trading session, the spot price first moved above that level, before the August futures followed suit. As of writing these lines, gold trades at $1,933.

Although this surge appears quite impressive, experts foresee an even brighter future for the price of gold. Chief market strategist at Bannockburn Global Forex, Mark Chandler, recently said that the low interest rates and the decreasing dollar could prompt the precious metal towards $2,000 soon and even “$2,500 might not seem unreasonable.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato