The dimension of DeFis welcomed a new stout project to its league in the year 2020. The project we are referring to here is AMP, which is renowned for operating on the Flexa Network. AMP aims to ensure that the transactions and the underlying data are sped up, whilst being secured. The project also aims at collateralizing transactions as a virtual currency.

Moreover, AMP offers customers the ease of buying and selling in fiat and any other virtual currencies. This is possible because of its construction on the Ethereum platform in compliance with the ERC20 protocol for tokens. Are you someone looking for an in-depth AMP price prediction? Then you have landed at the right place! As we decode the plausible price projections for 2022 and beyond!

Overview

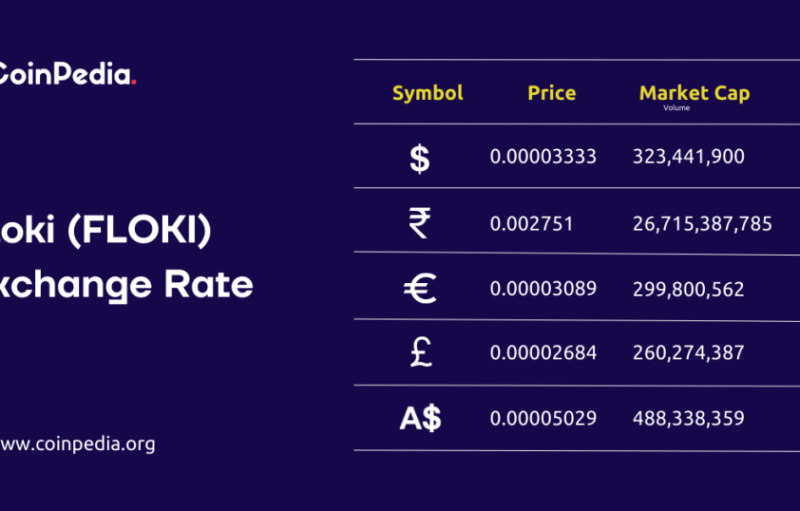

| Cryptocurrency | Amp |

| Token | AMP |

| Price | $0.009 |

| Market Cap | $384,895,992 |

| Circulating Supply | 42,227,702,186 |

| Trading Volume | $6,159,347 |

| All-Time High | $0.121 |

| All-Time Low | $0.0007 |

*The statistics are from the time of publication.

AMP Price Prediction For The Year 2022

| Potential Low | Average Price | Potential High |

| $0.01024 | $0.0121 | $0.0142 |

The token had a bearish start to the year, the coin was down by almost 40% with a price of $0.04. Due to acute build-up in selling pressures, the coin continued its descend to brush $0.02 on the 21st of January. Later in February, AMP’s price rose to $0.03 but failed to retain that price margin.

Circumstances in March were no different, tensions in the market exacerbated the downward trend. Wherefore the price of AMP slipped back to $0.2 again. After that, a steady ascent brought the quarter to a conclusion at $0.02. Moving forward, the coin constantly plummeted to reach the cost of $0.01 on the 1st of May. For the rest of the month, the token did not confront any major price changes.

The price of AMP has followed a rough course since the beginning of July. The cryptocurrency dropped precipitously to $0.008 on the 16th of June. The build-up of bearish pressures and fear amidst the rise of insolvency crisis of major firms led to the second quarter’s closure at $0.0104.

AMP Price Prediction For Q3

A significant benefit of AMP is the ability to trade at higher rates as the network grows. This has helped it to dramatically expand the proportion of miners. It is aiming to address accessibility concerns and entrapping deceitful or spurious transactions which can help AMP hit a maximum of $0.0113.

On the contrary, the token’s price could also end up settling at the low of $0.0085 if the bears continue to rule. That said, a balance in buying and selling pressures could end up its average price at around $0.0101.

Price Forecast Of AMP For Q4

Price Statistics of Amp is being added to DeFi platforms’ goods. This has significantly improved the collateral value of AMP and also broadened its existing and emerging applications. Users can investigate numerous DeFi platforms that are now employing Amp which can close its annual market at its peak of $0.0142.

On the flip side, any possible downfalls like delays in developments can flash its price to attain the low of $0.01024. That said, consistency in trade activities could land the price at $0.0121.

Amp Price Prediction For 2023

AMP functions on Ethereum, and its shift to ETH 2.0, will be imperative for AMP. Successively, the AMP economy would be thrilled to see this shift. As, the worth of the entire ecosystem could rise, landing its highest price at $0.0245.

On the contrary, factors like negative criticism and the fall of the community can hold the token back. That said it could end up at the lowest price of $0.0132. Moreover, the anticipated average trading price is around $0.01887.

AMP Price Forecast For 2024

One of the members of the AMP family is Flexa Pay. The online payments scaled by Flexa Pay will eventually happen in 2024. As a result, the economy as a whole will have more users. Flexa’s rapid expansion would assist AMP in attaining its long-term price goals. This would help its price peak at $0.04014.

However, prolonged bearish dominance and declining volumes may pull the price to $0.02149. That said, its average trading price could be around $0.03016.

Amp Price Prediction For 2025

Since a wide variety of use cases for collateral are supported by AMP. The idea of specified partitioning techniques may allow for the creation of a host of features. Such as collateral systems for staking without anyone ever having to leave one’s home address. It would have an optimistic impact on its user base which would propel its price to $0.06341.

In contrast, if the platform fails in building up its community the price could leap down to $0.034. That said, the anticipated average trading price could still land at $0.05016. As AMP is majorly held by whales at 72.31% with 56.6 B AMP. Followed by investors at 18.13% with 14.2 B AMP. And retailers at 9.56% with 7.48 B AMP.

| Year | Potential Low | Potential High |

| 2023 | $0.0132 | $0.0245 |

| 2024 | $0.02149 | $0.04014 |

| 2025 | $0.034 | $0.06341 |

What Does The Market Say?

Digital Coin Price

According to the AMP price prediction by Digital Coin Price. The altcoin is anticipated to surge to a maximum of $0.0124 by the end of 2022. The analysts believe that a reversal in trends could knock the price down to $0.0109. And that, a balance in buying and selling pressures could land the price at $0.0118.

The firm anticipates the altcoin to surge to a maximum of $0.0152 by the end of 2023. And a maximum of $0.0191 by the end of 2025.

Trading Beasts

As per the AMP forecast by Trading Beasts, the price of AMP could soar to a maximum of $0.0163 by year-end. The analysts from the prediction firm have pinned the minimum and average targets for the year at $0.0111 and $0.0131. Trading Beasts also hosts predictions for the long-term. It foresees the AMP price to brush a high of $0.0229 by the end of 2025.

Long Forecast

According to Long Forecast’s AMP price prediction, the digital token might catapult as high as $0.0123 by the end of 2022. That said, the maximum annual closing targets for 2023 and 2024 are set at $0.0129 and $0.0153.

What Is AMP?

The Flexa payment platform’s native coin is called Amp. With Flexa, businesses can take payments in a variety of digital currencies without having to worry about payment failures. Additionally, it uses collateralized Amp coins to enable quick approvals.

It is the customer’s right and privilege to stake and guarantee any type of value exchange. Including electronic payments, trade of fiat currencies, administration of loans, sale of real estate, and much more.

The platform’s native coin was created by the Flexa network and ConsenSys, it has a devoted league of advisors and traders. An innovation that turned into an ERC20 token, making waves on the AMP cryptocurrency exchange and other comparable platforms.

Fundamental Analysis

The AMP can be pictured as a form of payment insurance. The protocol intervenes to cover losses if a transfer on the Flexa network crashes owing to prolonged processing durations. To enable payment during a regular checkout process, Flexa interacts natively with preexisting point of sale (POS) platforms and digital channels.

According to the co-founder Tyler Spalding, the firm steadily uses its wallet service while offering more centralized solutions for retail partnerships. The fact that this protocol guarantees liquidity and lightning transaction speeds sets it apart from its rivals. Therefore, it would not be wrong to say that AMP coins serve as stimulants for the implementation of smart contracts and financial transactions.

Our AMP Price Prediction

The collateral models for AMP will keep evolving. AMP will eventually offer non-fungible tokens, actual assets, and a variety of digital currencies as collateral. As a result, there will be more AMP users, bringing in volumes. According to CoinPedia’s formulated price AMP price prediction, the altcoin could climb as high as $0.015 by the end of 2022. On the contrary, the price can hit a potential low of $0.01.

Historical Market Sentiments

2020

- The majority of exchanges began listing AMP when it was first launched in September 2020.

- The token’s price quickly increased from $0.009 to $0.01 once it started trading.

- AMP collapsed in the following few weeks, falling to $0.003 by the end of October.

- However, the trend of AMP’s price fluctuations did reverse until the year’s terminal. By the end of the year, it had crept back to $0.006.

2021

- Despite spending most of January at $0.006, it rose to $0.036 in the second week of February.

- AMP failed to trade beyond $0.029 in March, but April revealed a different story, with the price rising to $0.062.

- The next month of May turned out to be even more fruitful for AMP, with the token rising as high as $0.073.

- AMP, however, survived to outperform the general market decline once more, rising to $0.077 in July.

- The digital asset gradually started to fall towards the close of the year, concluding its trade at $0.048.

FAQs

A: AMP was created to serve as collateral for payments made using other cryptocurrencies.

A: AMP has been in the bearish trend for the past few months. However, it has strong fundamentals which make it a good long-term investment.

A: The price of the digital asset could surge to a maximum of $0.0245 by the end of 2023.

A: According to our AMP price prediction, it could attain a maximum price of $0.06341 by the end of 2025.

A: AMP is available for trade across prominent cryptocurrency exchange platforms such as Binance, Bybit, Bitget, and BingX amongst others.

The post appeared first on Coinpedia