ARK Investment Management LLC thinks that bitcoin is an asset with one of the most attractive risk-reward profiles. In a recent analysis, the New-York based investment advisory firm made a pretty optimistic call regarding BTC’s growth. Bitcoin’s network valuation could balloon to $1 – 5 trillion in the next 5-10 years.

From $200 Billion Today To Trillions In 5-10 Years

ARK Invest provides investment consultancy with a sole focus on disruptive and innovative technologies like AI, machine learning, blockchain, etc. The firm thinks that bitcoin’s aggregated market value could soar up to 25 times from where it is currently.

Their basis for this claim? A detailed analysis that outlines how bitcoin can capture a variety of markets, including financial settlement networks:

In the United States alone, deposits totaling $14.7 trillions generate $1.3 quadrillion in settlement volumes between and among banks each year.

If it were to capture 10% of those settlement volumes at a similar deposit velocity, we believe the Bitcoin network would scale more than 7-fold from roughly $200 billion to $1.5 trillion in value.

Speaking of value settlement, Bitcoin has already ascended the status of a valuable money transfer network. As reported by CryptoPotato, since 2017, the total value of BTC transactions have fallen in the $670 to $750 billion range. Bitcoin and Ethereum are on pace to settle a combined $1.3 trillion in transactions in 2020.

Bitcoin Could Take Over The Asset Protection Market

Yassine Elmandjra, ARK Invest’s resident crypto analyst, pointed out that bitcoin could help protect other assets.

Bitcoin could provide protection against the arbitrary seizure of assets

In our view, a sensible allocation to bitcoin would approximate the probability that a misguided regime will confiscate assets – whether by inflation or by outright seizure – during an individual’s lifetime pic.twitter.com/dS5mRtIl5f

— Yassine Elmandjra (@yassineARK) September 17, 2020

And how would this come into being? Yassine says that bitcoin’s scarcity, durability, divisibility, and convenience wrt portability renders it safe from centralization.

How Could BTC Achieve More Than A Trillion Dollars in Valuation?

The ARK Invest analysis finds out that bitcoin trades more like a large-cap stock than a whole asset class. BTC has a higher trading volume than Google and Netflix but lower than Facebook and Amazon.

Nonetheless, Bitcoin capturing 10% of gold’s global market will propel it’s network valuation upwards of $1 trillion. Also, because the world’s first cryptocurrency does a minimum of $200 million in daily trading volumes,

a buy-side institution limited to 10% of the volume could deploy roughly $20 million per day.

Exceeding Trading Volumes Of US Stocks and Bonds

Apart from the above, based on ARK Invest’s Bitcoin market outlook,

At historical growth rates, bitcoin’s daily volume would exceed the volume of the US equity market in fewer than 4 years, and the volume of the US bond market in fewer than 5 years. pic.twitter.com/uqY4SfZZDk

— Yassine Elmandjra (@yassineARK) September 17, 2020

Increased Influx Of Institutional Investment

Bitcoin’s market is also pretty much liquid, the investment advisor said. Since the top cryptocurrency is comparable to a prominent publicly traded equity, this is a favorable aspect for attracting the attention of institutional players.

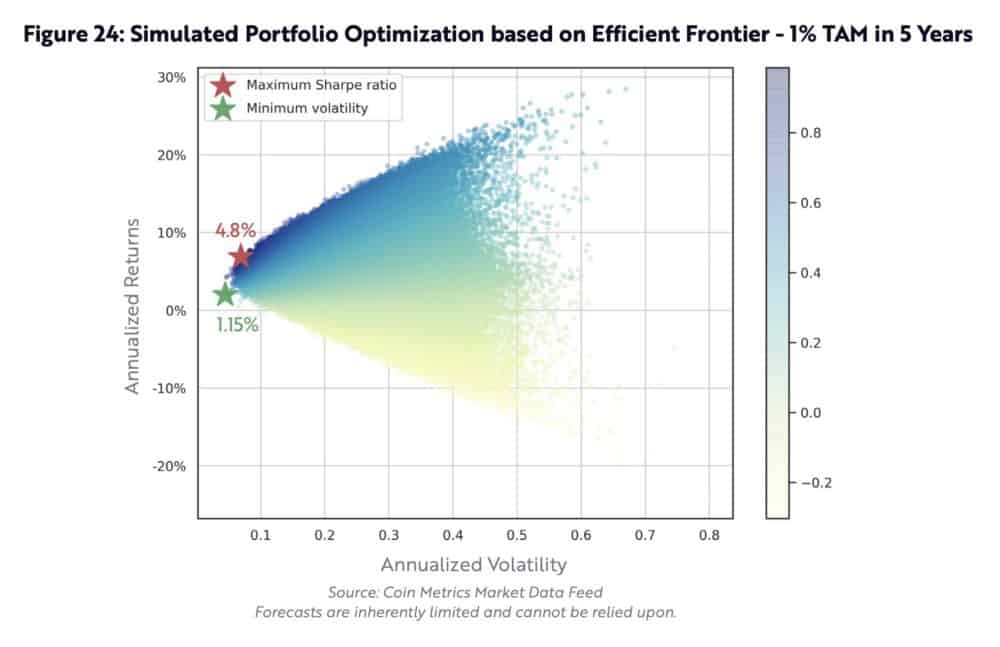

ARK Invest simulated the Bitcoin investment behaviors of these deep-pocketed players based on ‘1,000,000 portfolios composed of various asset classes’.

In the first simulation scenario, with a limit of 1% allocation limit, institutions optimizing for returns compared to volatility would allocate 0.27% ‘while those aiming for the highest Sharpe Ratio would allocate 0.74%.’

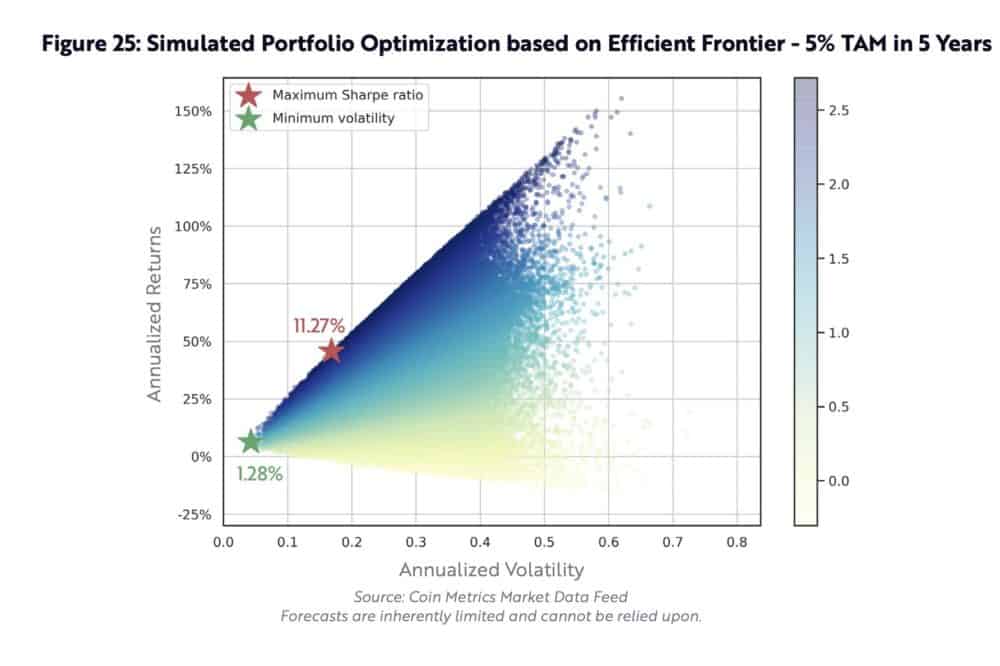

When bitcoin’s trading volumes and liquidity approach other asset classes, institutional players would want to do away with the 1% allocation limit. Now:

allocations to bitcoin would range from 2.55% when maximizing returns and minimizing volatility to 6.55% when maximizing Sharpe Ratios.

Constructing a predictive model which includes our 5-year forecast for bitcoin’s TAM, investors seeking to minimize volatility would allocate between 0.03% and 1.28% to bitcoin. Investors seeking to maximize Sharpe Ratio would allocate between 4.8% and 25.78% to bitcoin.

The firm states that investors and folks who allocate capital in markets should seriously consider becoming a part of the bitcoin market or it may be too late.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato