- Bitcoin price could drop to $6,000s says Dave the Wave.

- BTC is set for its worst month in 2019.

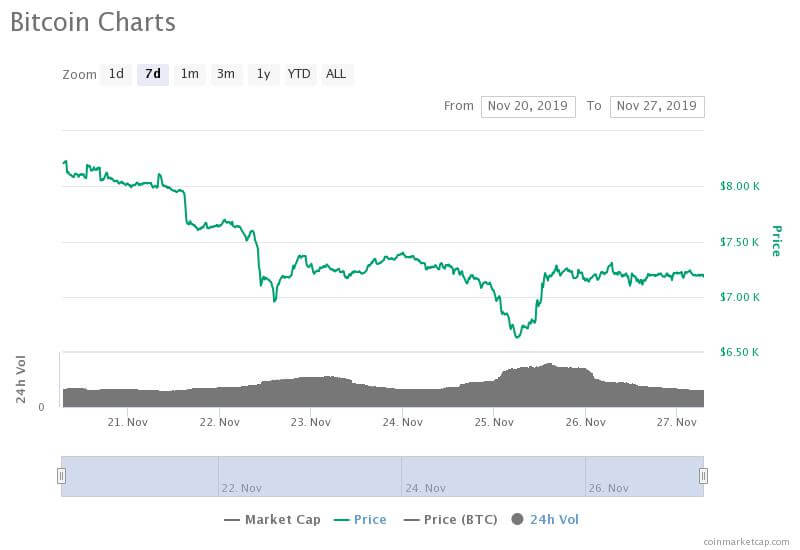

- The cryptocurrency’s recovery was rejected at $7,400.

The bitcoin price could retrace back to the $6,000 region but is unlikely to drop to the $5,000s, according to a prominent cryptocurrency trader.

Technical analyst Dave the Wave, who accurately predicted the bitcoin price to drop to $6,800 since early 2019, said:

A closer look of the comparison. On the basis of this chart, while 6K might be possible, 5K looks unlikely.

One metric to look at besides others. Given the potential to the upside, I reckon you’d be best to slowly average in…. pic.twitter.com/unAbtHXyVH

— dave the wave (@davthewave) November 27, 2019

Bitcoin has shown an extended correction throughout November without a strong reaction to an intense sell-off.

Since November 5, the bitcoin price has fallen from $9,600 to $7,075 by 26% against the U.S. dollar.

Is the relief rally of bitcoin already over?

On November 5, when the bitcoin price dropped to as low as $6,500 on major platforms including BitMEX, Dave the Wave noted that the asset is oversold.

Due to the oversold conditions demonstrated by various technical indicators, the analyst said bitcoin is likely to see a relief rally in the short term.

Bitcoin price begins to fall after recovering to $7,400 (source: coinmarketcap.com)

Bitcoin price begins to fall after recovering to $7,400 (source: coinmarketcap.com)

He said:

“BTC oversold and at the bottom of its medium-term channel. Due a bounce.”

While BTC rebounded to nearly $7,400 from mid-$6,000, it was quickly rejected at a key resistance level, pulling it below $7,100.

Realistic target for BTC

According to cryptocurrency trader Josh Rager, following the relatively weak weekly close of bitcoin, $6,300 remains a realistic short term target.

Rager stated:

18% drop this week and currently trying to hang out to the $6800s. Funding still positive, so not overly bearish at this point as $6300s would be an eventual target here, the only question is does it bounce back up to high $7ks before or after the next drop.

Analysts are considering the capitulation of small miners as the main factor behind the steep sell-off of bitcoin in the past month.

Rising limit sell orders across major spot exchanges including Coinbase, Huobi, and Binance also indicate that individual investors are affecting the market.

Spot exchanges leading the downward movement of BTC shows that the asset’s correction in November is not likely to have been manipulated.

This article was edited by Samburaj Das.

The post appeared first on CCN