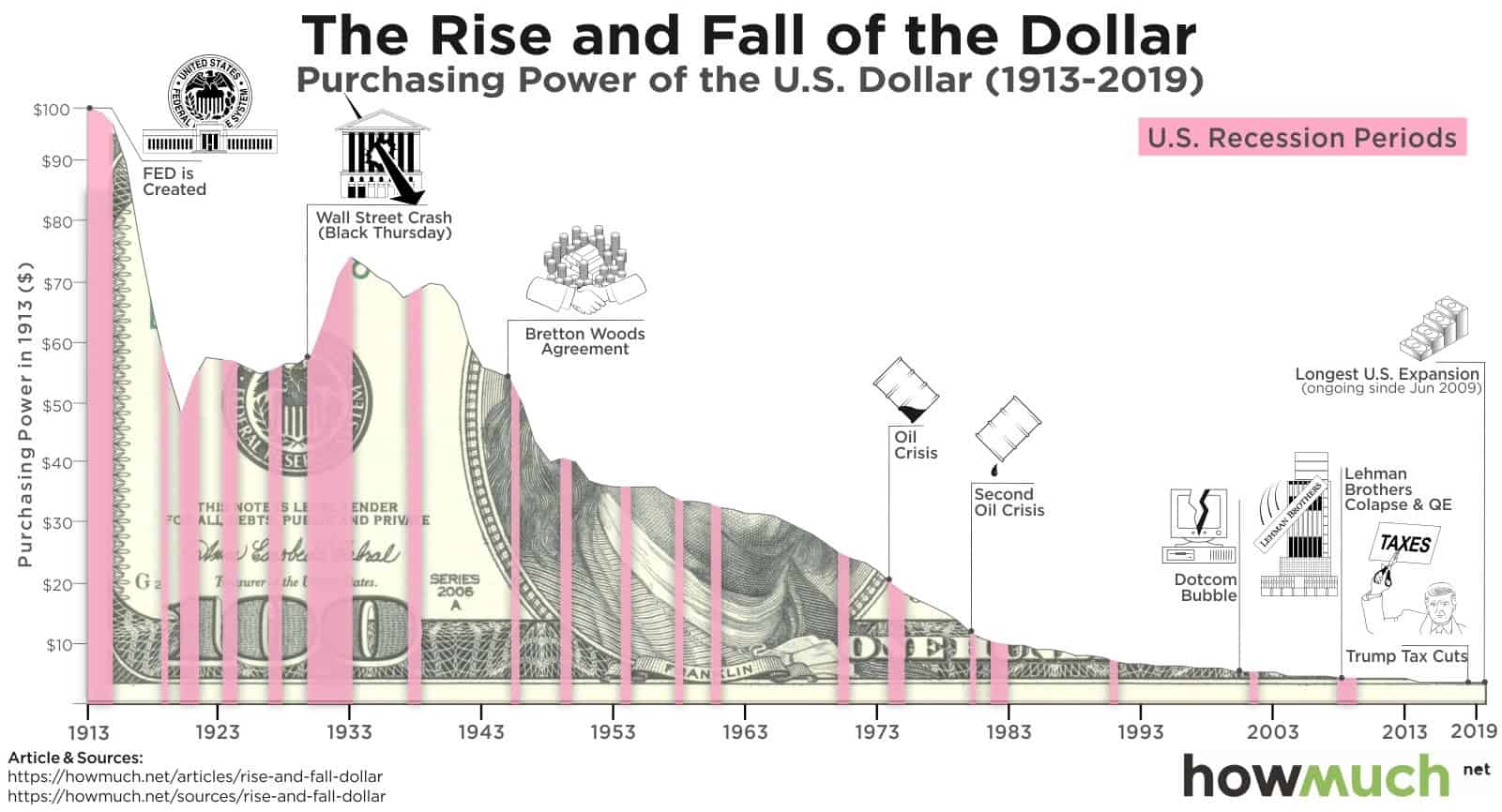

It has long been questioned as to why Bitcoin is priced in U.S. dollars when they are two entirely different entities. One is an inherently weak currency that has been continuously devalued for almost 50 years, and the other is a mathematically finite digital store of value.

In a recent blog post by entrepreneur, Sylvain Saurel pointed out that the purchasing power of $1,000 in August 1971 has lost more than 85% of its value in 2020, and is not even worth $150 today.

“Pricing Bitcoin in the U.S. dollar will, therefore, tend to boost the Bitcoin price more rapidly due to the effects of the monetary inflation,”

Those lofty $1 million Bitcoin price predictions are likely to arrive quicker as the greenback is increasingly devalued. Most are familiar with this now-famous chart (and this does not even include the 2020 economic collapse).

Saurel suggested that gold would be a better alternative to price Bitcoin because it has been a recognized store of value for centuries.

Stores of Value Increasing

According to Goldprice.org, the precious yellow metal hit an all-time high of $2,070/oz on August 6, and some of it must be attributed to a weakening dollar. The Federal Reserve continues to print trillions to keep the sinking economy afloat, and this will ultimately dissolve investor confidence in the USD as a reserve currency.

Gold is not the only store of value increasing as the greenback crumbles. Silver is also trading close to a seven-year high, and Bitcoin is up by around 57% since the beginning of the year.

Bitcoin and gold share several similarities, such as the cost of extraction or mining. Dollars, on the other hand, can be created out of thin air as the Fed has duly demonstrated over the past few months. However, it isn’t easy to estimate the supply of gold, whereas, for Bitcoin, it is a known quantity.

Bitcoin to $50k

Saurel added that pricing Bitcoin in terms of gold would eliminate the inflation associated with fiat currencies, specifically the dollar. It would take in just the prices of the two best stores of value in relation to each other.

He concluded that the next Bitcoin bull run would see prices hit at least $50k by the end of 2021, or even longer if the current cycle is extended as predicted. By then, the ratio of Bitcoin to an ounce of gold should be between 20 and 50. Although pricing in dollars is not likely to change at any time soon, looking at gold as a comparison will provide a much clearer picture of value for both assets.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato