The coronavirus outbreak led to new developments and restrictions in the past 24 hours. The 2020 Tokyo Olympic Games could be postponed, while India inserts a lockdown on 75 districts in its borders. The financial markets reacted adversely today, as U.S. futures and Asian stocks nosedived by up to 10% in some cases.

Bitcoin is down by 9% to $5,800 in the same timeframe, hinting again a positive correlation with the stock market.

Stocks and Futures Plunge (Again)

The number of deaths linked to the novel COVID-19 is rapidly approaching 15,000, while confirmed cases are close to 340,000. Months after the outbreak, it’s no secret that the virus is hitting global economies as businesses and countries are shutting down. Consequently, the stock markets are feeling the immense pressure and continue to plunge.

The rising numbers of coronavirus cases in the second-most populated nation in the world, India, led to the lockdown of 75 districts today, including Delhi and Mumbai. As a result, the country’s most popular indexes – Sensex and Nifty – lost up to 10% of their value. The steep declines followed in halting the trading activities for 45 minutes.

Australia’s S&P/ASX 200 and South Korea’s Kospi (KOSPI) also went down today by approximately 5.5%. Hong Kong’s Hang Seng Index (HSI) dropped by over 4%, while China’s Shanghai Composite (SHCOMP) lost 2.4%.

The only silver lining coming today from the East is Japan’s Nikkei 225, which saw an increase of 2%. Less positive news for the country, though, touched upon one of the largest events of the year – the Olympic Games in Tokyo. Originally scheduled to begin on July 24th, the International Olympic Committee’s executive board is contemplating postponing – not canceling – the Summer Olympics.

The U.S. stock futures are in no better shape than most of the Asian markets. S&P 500 and Nasdaq futures are currently down by 3.7% and 3.1%, respectively. Dow (INDU) futures, on the other hand, noted a 900 point fall. The 5% drop triggered the “limit down,” which halted further declines.

Today’s slumps came after U.S. Senate Democrats blocked movement on the $1 trillion stimulus package on Sunday, initiated by Republicans to deliver aid to the citizens and local businesses. It’s also worth noting that last Monday was one of the worst on Wall Street, as indices marked declines not seen since 1987.

Another Positive Correlation By Bitcoin?

The largest digital asset has previously showcased a compelling correlation with the stock markets. In 2019 and early 2020, it was mostly negative. However, it all changed when with the outbreak of the COVID-19. Once the consequences of the virus started to apply pressure on most markets, Bitcoin and stocks were plummeting likewise.

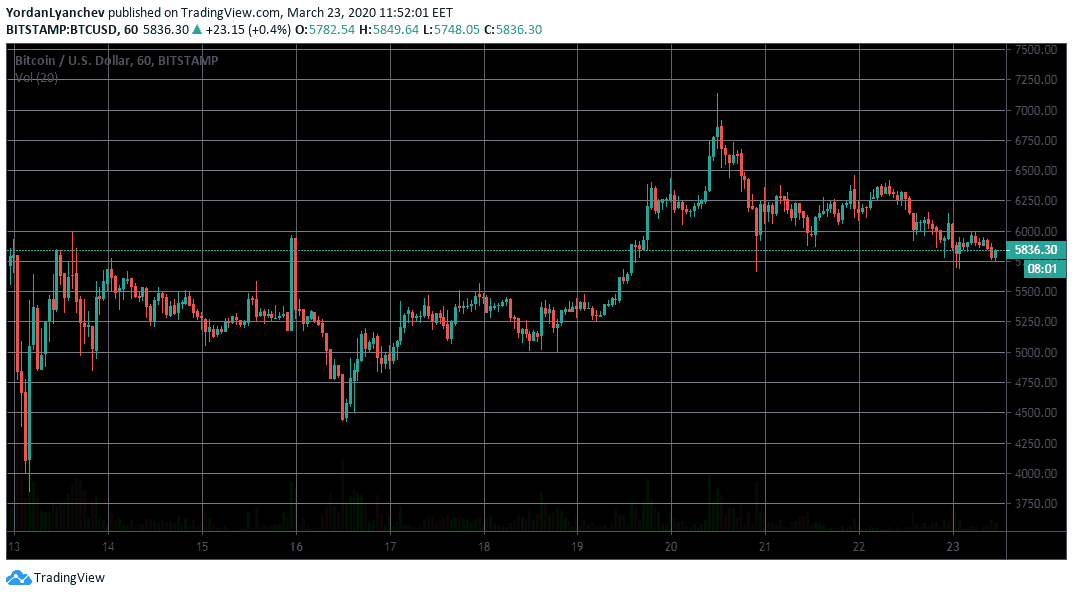

So far, today is no different. The primary cryptocurrency is on the downfall again. Reaching a high of $6,400 yesterday, it has retraced with 9% to the current level of $5,830.

As Cryptopotato reported yesterday, this could be the calm before the storm. Bitcoin is now testing the first support level at $5,800. If it’s to decline even further, the next ones are at $5,650 and $5,500. Alternatively, if BTC moves in the opposite direction, firstly, it would have to break the $6,000 resistance before it reaches the next level at $6,300 – $6,400.

The post Another Black Monday Incoming? Global Markets Crash As Bitcoin Drops Below $6,000 appeared first on CryptoPotato.

The post appeared first on CryptoPotato