Bitcoin has been one cryptocurrency that has been constantly in demand. Recently, Bakkt Bitcoin futures marked an all-time high in the physically settled Bitcoins, while the tokenized version of Bitcoin has been peaking in decentralized finance [DeFi]. Even though the spot market may appear dull at the moment, major activities were going on in the background.

Tokenization of Bitcoin and rise of DeFi

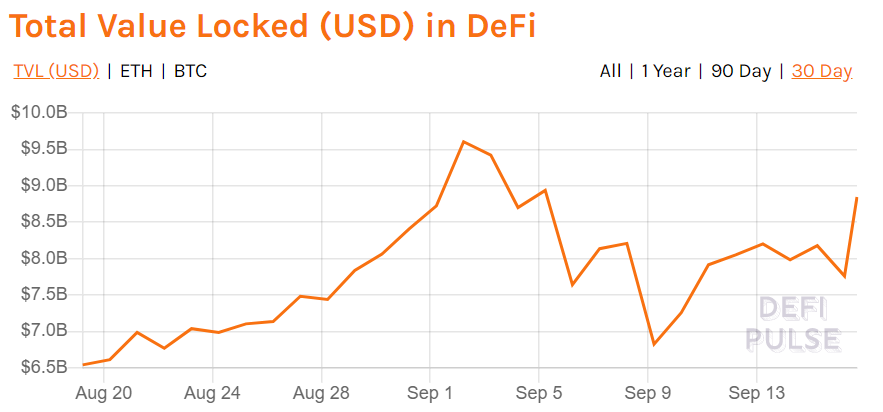

The decentralized finance infrastructure was hurt pretty badly with the sinking spot market. However, the DeFi sector was recovering over the past few days as the total value locked on the platform surpassed $8.5 billion. This was a recovery of 39.5% in six days and the market was still showing strong upward momentum.

Similarly, Bitcoin was being increasingly tokenized to access decentralized finance protocols. According to data, over $1 billion worth of Bitcoin was currently locked in DeFi.

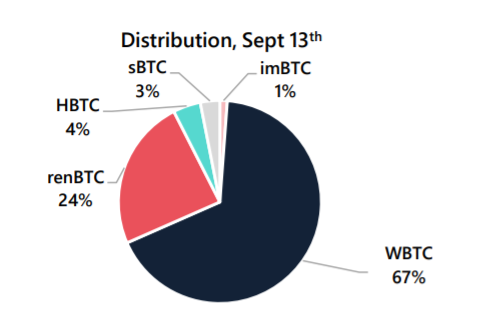

DeFiPulse suggested nearly 99.844k BTC was currently in Defi, but the peak was of 101.655k BTC earlier today. This was over 23x the BTC locked into the Liquid Network [2,593 BTC] and the Lightning Network [1,069 BTC, public channels]. While Wrapped Bitcoin [wBTC] saw the most BTC locked, holding 67% of the total amount of Bitcoin represented on the Ethereum blockchain, as per data collated by Arcane Research.

Source: Arcane Research

Bitcoin accounts for almost 5% of the TVL in DeFi indicating a rise in the share of DeFi capitalization represented by BTC which has increased by 150% in the past three and a half months.

Other factors to have influenced BTC’s expansion into the DeFi ecosystem could be the launch of Ren’s more decentralized Virtual Machine and RenBTC. Even though wBTC was the leading tokenization protocol by total BTC locked, Ren’s Virtual Machine was not far behind as it tokenized 21,500 BTC worth $230 million since its launch in May. Both protocols have managed to more than double the number of locked Bitcoin over 30 days, wBTC was still attracting a larger volume of BTC than Ren.

The post appeared first on AMBCrypto