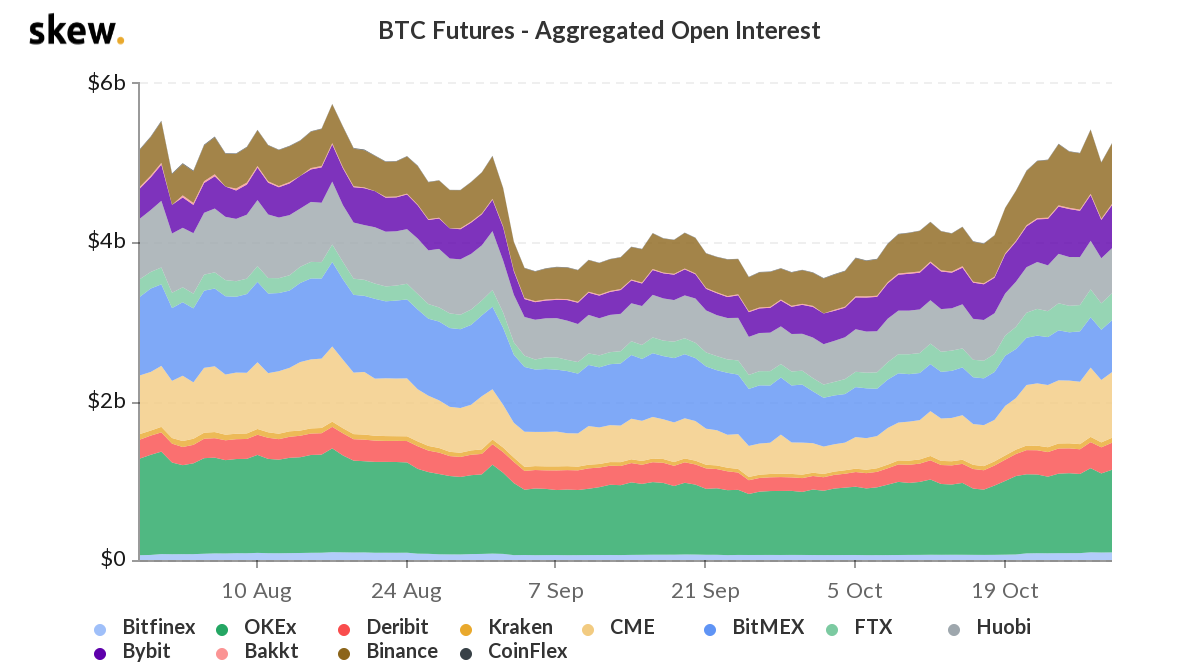

The aggregate open interest in Bitcoin futures is up 43% since the beginning of October. Based on data from Skew, cyclical drops in Bitcoin’s open interest on top derivatives exchanges occur every 45-50 days.

In the past year there were 3 peaks of open interest above $5.5 Billion, a few months apart from each other. The last two peaks were only 30-35 days apart, however, the ATH of open interest in the past year hasn’t crossed $5.8 Billion. This cyclical nature can be attributed to the phases of Bitcoin’s market cycle and the fact that they have been occurring closer than usual. The accumulation phase lasted from the end of May to mid-July and the price has been rallying since then. The price has entered the $13k range only recently, last week and the open interest on top derivatives exchanges like CME and Bakkt is rising in response.

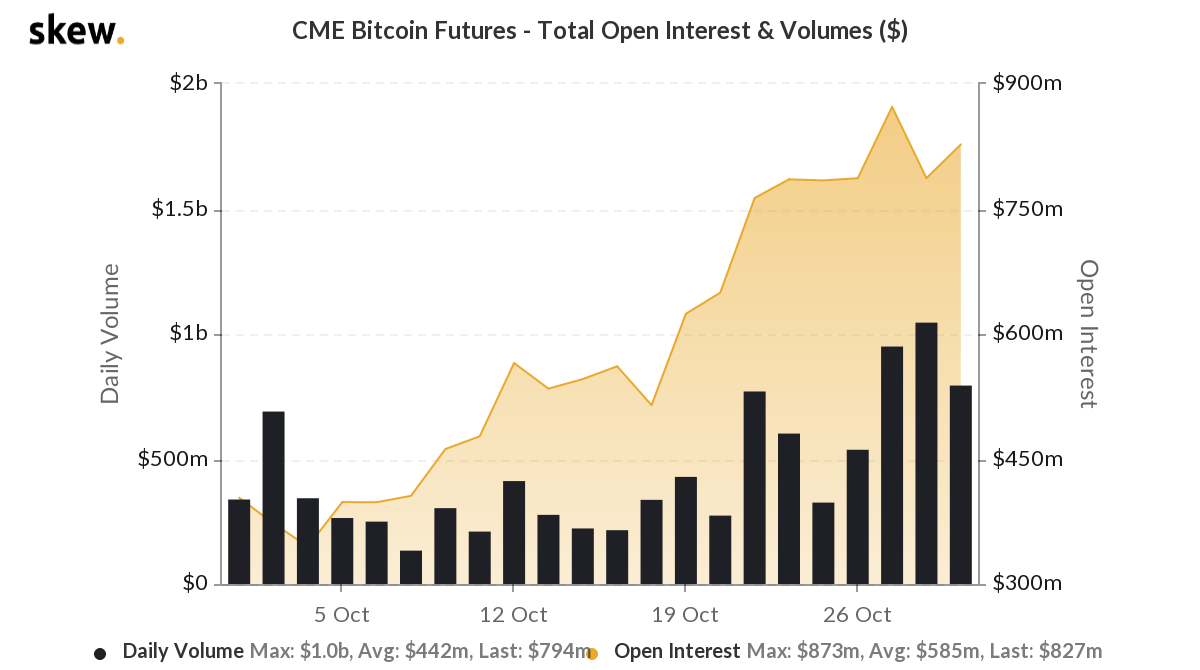

On CME, the past month has been a rally of open interest in Bitcoin futures. The open interest has nearly doubled and the trade volume is higher than the monthly average. Open interest hit a peak of $873 on October 27, 2020, this is when Bitcoin was trading above $13k. The narrative of Bitcoin’s price increasing due to the launch of CBDCs and a conducive regulatory environment, news from Paypal, and further pouring in of institutional investments is driving the open interest to its next peak. However, on Bakkt, the price rally has had a different impact.

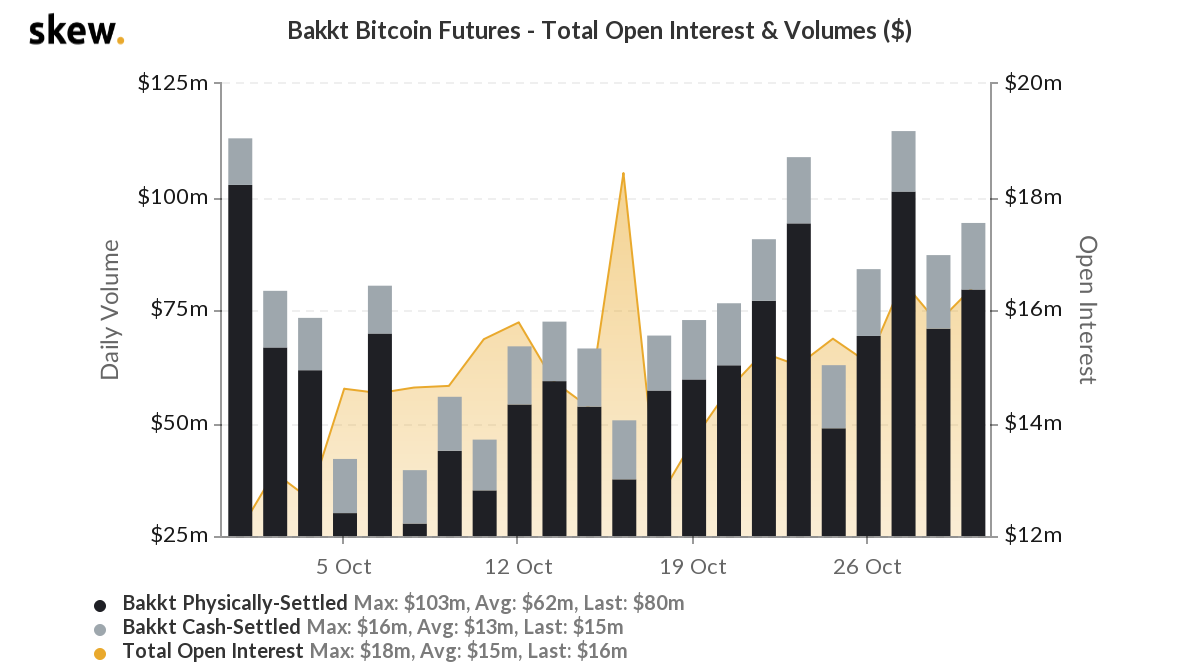

On Bakkt, the open interest hit a peak of $18 Million on October 15, 2020 and it has plummeted since then. The recent price rally had a small impact and the recovery started, however, open interest is still near $16 Million. It was anticipated that there will possibly be a rise in the Physically settled BTC futures trade volume and the open interest, due to bullish sentiment on spot exchanges, however, it hasn’t had a positive impact yet.

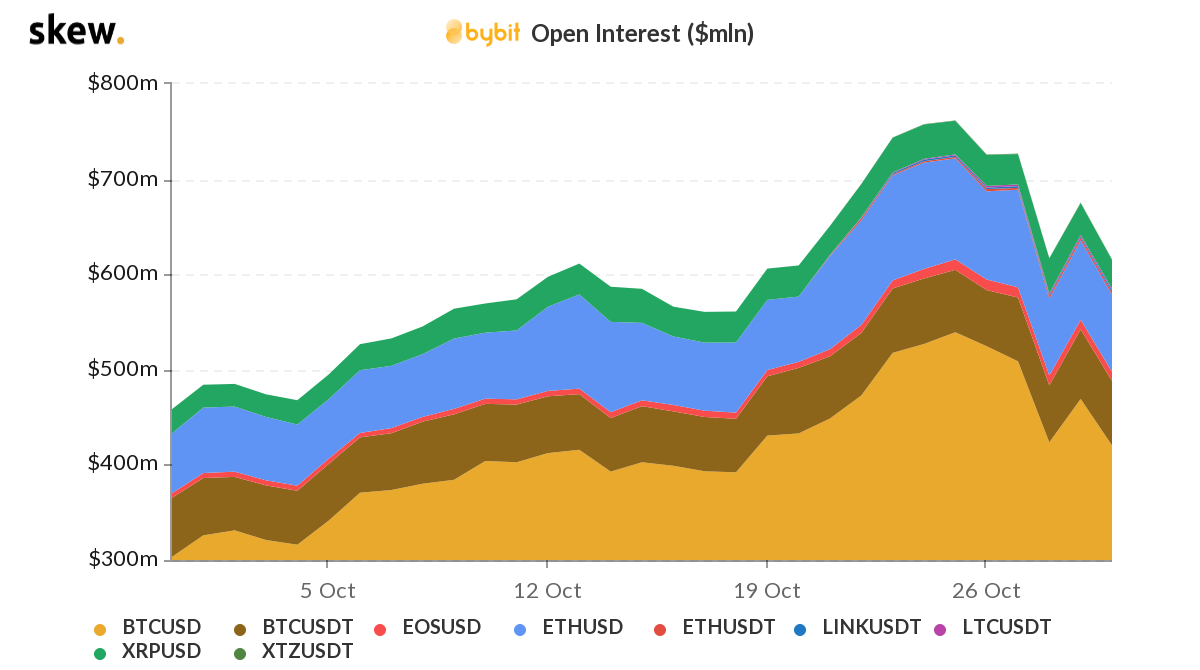

Just as Bakkt’s open interest hasn’t seen much recovery yet, Bybit’s open interest has plummeted. For the past two months, there was a peak and then open interest has trended above the monthly average, with no signs of recovery on charts.

Open interest may recover if the market sentiment moves away from greed. When greed is high, correction is due. If the price gets corrected above $13k there may be a retracement to the fair value level, which is $8.5k and that would hurt the open interest in futures on derivatives exchanges.

The post appeared first on AMBCrypto