The total USD value locked in DeFi may have taken a hit after topping at $9.5 billion. But that hasn’t stopped the proliferation of tokenized Bitcoin tokens on the Ethereum blockchain.

Data shows that the ‘BTC on Ethereum’ number has now gone up to a little over 72,000. That implies that around $750 million worth of Bitcoin is doing rounds on Ethereum.

‘BTC on Ethereum’ Number Going up Exponentially

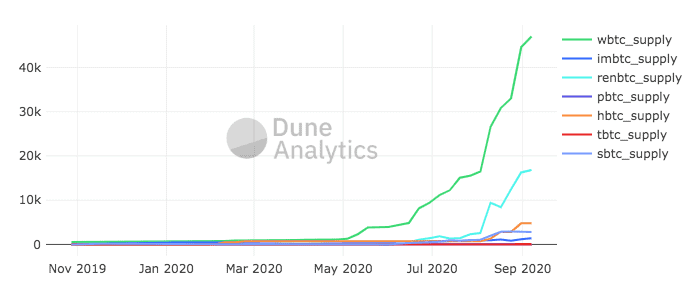

According to data published by Elias Simos on the on-chain analytics platform, Dune Analytics, Bitcoins circulating on Ethereum has surged past the 70,000 mark. The latest statistics, as shared by Simos, show that 72,944 synthetic BTC tokens now exist on the DeFi spawning platform.

Wrapped BTC (WBTC) and RenBTC have the lion’s share of the Bitcoin market on Ethereum with circulations clocking around 47,000 WBTC and 17,000 RenBTC tokens.

Elias first started reporting about the growth of Bitcoin on Ethereum when he launched his tracker dashboard on Dune Analytics back in June this year. Then, there were just around 5550 synthetic BTC tokens, worth $53 million (considering prices then). The Bitcoin supply on Ethereum was only 0.02 percent.

How much $BTC actually lives on Ethereum these days?

I made a dashboard on @DuneAnalytics so you can stop wondering!

As of today:

– $BTC on Ethereum: ~5550 || 53M USD

– % of BTC supply on Ethereum: 0.025%

– $wBTC reps: 75%Dig in here 👇🏻https://t.co/Afnzwf4hyf pic.twitter.com/SwJQ5x3edY

— Elias Simos (@eliasimos) June 16, 2020

More than two months down the line, BTC tokens circulating on Ethereum has jumped 1215 percent with the total Bitcoin supply appreciating almost 1300 percent.

There are a total of seven Bitcoin projects that are actively operating on the Ethereum blockchain. Slowly and gradually, the second-most popular public blockchain platform is turning out to be a dominant off-chain transactional layer for BTC. But why?

Why Is Bitcoin (Tokenized) On Ethereum Gaining Popularity?

Bitcoin, by itself, has become a hugely popular store of value. But compared to other blockchain applications, BTC’s use case other than the investment aspect, is a bit too limited. Also, there was a crying need to make Bitcoin available on other decentralized networks.

Ethereum was the most logical choice for the same. The availability of BTC on Ethereum would expand Bitcoin’s network utility and also its purpose from a ‘peer-to-peer electronic cash system’ to a ‘peer-to-peer electronic finance system’ due to the growth of the DeFi ecosystem on Ethereum.

Bitcoin’s basic features, such as security, fungibility, pseudo-anonymity, etc., would remain conserved with the added benefits of Ethereum’s development ecosystem.

The broader objective for cryptocurrency systems, especially Bitcoin, is adoption. Many think that the growth of BTC on the Ethereum ecosystem will contribute to the cause significantly.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato