Formerly a CoinDesk Contributing Editor, Daniel Cawrey is author of the upcoming “Mastering Blockchain” book to be published by O’Reilly Media.

Earlier this year IBM purchased Red Hat, the oft-referred to model for how open source can thrive, for $34 billion.

Long the consultant to enterprises, IBM is going through a transitional period as a business and needs a boost. Red Hat’s open-source software offers IBM the ability to better compete in cloud services offered by Amazon, Microsoft and Google.

Why is this important? Red Hat is one of the most name-checked examples of how open-source software can be successful. It is often used as an example of how championing open source can lead to business success. This is particularly pertinent to the cryptocurrency ecosystem, where open-source ethos rule the technology.

But, something is being lost in this conversation. Namely, open source requires funding for developers to contribute.

Despite what some may think, open source isn’t free. That’s a problematic proposition in the rollercoaster markets that make up open blockchains.

The Volume Issue

Crypto can enable almost ridiculous levels of transparency and control.

Yet in order for it to move forward, incentives must be aligned. Scaling technologies and design experiences must make cryptocurrency easier to use. However, most cryptocurrencies are used primarily for speculation. And the speculative market is in the doldrums, with low levels of volume.

BTC trading volume is at one of the lowest points it has been over the last two years. Source: Bitcoinity

I wrote about this issue years ago, discussing the existential threat facing bitcoin. This was during the 2015-2016 bear market when Bitcoin Core was really the only group working on the protocol. Not long after my piece was published on CoinDesk, an MIT initiative providing $900,000 worth of funding for bitcoin development was announced.

This isn’t to say markets are the single unifying force in crypto, but it’s important to recognize the significance. Augur seems to be an example of this as news comes out about that project seems to affect price. Augur went up as its 2018 launch approached. Yet as volumes hit $1 million and an assassination market developed the price began to decline.

Augur is an interesting project funded directly by crypto via its own token. But Augur depends on other projects to use its network in an open source fashion. When a trader’s market depends on that, it’s an issue.

Veil, which relied on Augur’s protocol, closed up recently. It is an example of this and how the market perspective can impact things. Less trading means less interest in projects like prediction markets.

Zcash and Litecoin

Zcash and Litecoin are experiencing difficulties funding development and other expenses. Both projects have indicated it is the market causing these issues.

The Litecoin Foundation’s finances are in the red. Founder Charlie Lee seemingly is just funding it at this point. Blame for this has been put on crypto’s bear market, which shows projects are more influenced by trading than most in the ecosystem realize.

“The goal, of course, is to get Litecoin Foundation to be self-sustaining from donations, partnerships and merchandise sales,” Lee said. “Until we get to that point, I have and will continue to support the Litecoin Foundation financially as necessary.”

Litecoin isn’t much different than bitcoin, although they did experiment with things like SegWit before BTC implementation. Yet the litecoin community clearly doesn’t see a reason to put forth money to keep the Litecoin Foundation operational.

Zcash can be considered differentiated from both bitcoin and litecoin with increased privacy features. Zcash’s shielding technology is indeed novel, though only a small number of transactions are shielded.

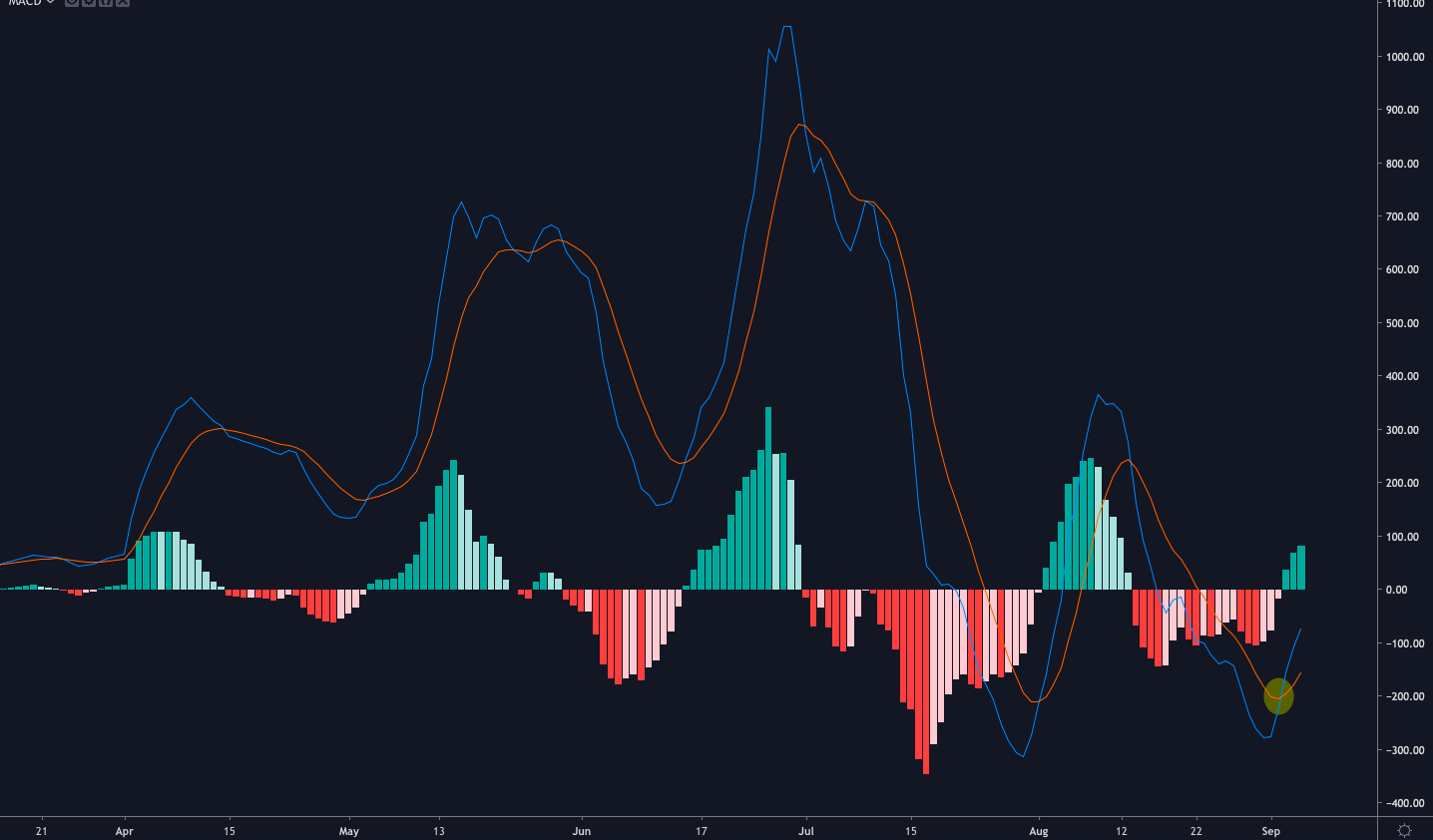

The black line represents unshielded transactions, while the blue line indicates shielded Zcash transactions. Source: Zchain

Is there a community in need of zcash and its privacy protections? Time will tell, although from a trading perspective banks seem to have issues with it. And example of this is when Coinbase UK dropped the asset in Europe likely due to banking pressure.

“I opted for the initial Dev Fund to sunset itself, so that in the future, if Zcash were a success and a community were to grow up to support it, that community would have to collectively decide what to do next,” said Electric Coin Company CEO Zooko Wilcox.

Time will tell how much support Zcash will get.

Where Funding Comes From

“I think things have improved greatly in terms of the breadth of different funders.… We’ve had an explosion in people that want to fund open source work in the space,” Matt Corallo told CoinDesk recently after joining Square Crypto.

If there’s an explosion of funders for open-source crypto, they are keeping it pretty quiet. Coinbase has talked about support for open source, offering $2,500 per month starting in early 2018. However, there hasn’t been any updates since 2018 and the Coinbase Open Source Engineering site no longer works.

Square Crypto is willing to pay its developers salaries in BTC to fund bitcoin development. Jack Dorsey wants to “improve money.” That statement seems to indicate Dorsey’s not really sure what cryptocurrency is. Yes, people did buy $125 million of BTC from the Cash App. But are they using bitcoin for payments?

Why don’t miners help pay for more open source development? Traders? What are the stakeholders providing funding? Square Crypto. Blockstream. Lightning. MIT. The Ethereum Foundation. Who else is putting resources into crypto development?

2019 has been a good year for Gitcoin. Source: Gitcoin

OKCoin just announced a contest where users vote which version of bitcoin (core, cash, SV) to fund development. The exchange is donation up to a whopping 1,000 BTC. Something feels a little bit divisive about a campaign like this, even though the effort is called “Let’s Build Bitcoin Together!”. Sounds more like building very different versions of bitcoin very separately.

In the ethereum and dapp ecosystem, Gitcoin has paid out over $2 million to developers, with ConsenSys apparently leading the way. Maybe other cryptocurrency projects should have a community-based resource like this. Despite low volumes in the trading market, Gitcoin appears to be working.

Developers over Investors

Recently, Binance announced funding for 40 developers to work on open-source projects.

However, the requirements for an “evangelist” to receive funding means building exclusively on the Binance platform. That seems trading related, although with Binance X and Venus, its likely to compete with Facebook’s cryptocurrency project.

Could it be, shocking as it may seem, that Libra, with 28 members, could help move crypto open source forward?

Despite criticism from literally everyone, the project is still expected to become an open network. Endpoint wallets will still need to provide the KYC/AML compliance. Yet there could be a lot of money contributed to open source surrounding the project. This might be true if they follow the Gitcoin playbook.

Markets don’t always go up. Litecoin has had to cut salaries despite Charlie Lee’s salvo. And the Zcash foundation is spending more than it’s bringing in. Ironic for there to be funded bailouts for cryptocurrency development. Or running deficits. In these cases, it’s easy to blame it on the performance of the crypto market. Because one has to wonder: How will open cryptocurrency development do financially in the future if some of these big-name projects can’t find funding?

Market dynamics have never stopped open source outside of crypto.

Look at Red Hat – no market ever stopped it from figuring out open source. It focused on developers, not investors. Crypto projects should pay attention to what has worked in open source over the years. It should not depend on donations correlated with the whims of the market.

Cold money via Shutterstock

As Crypto Markets Go Cold, Who Will Pay for Open-Source Code?

The post appeared first on Crypto Asset Home